The USA non-dairy creamer market is projected to reach a value of USD 1,150.2 Million in 2025, growing at a CAGR of 7.4% over the next decade to an estimated value of USD 2,358.8 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 1,150.2 million |

| Projected Global Value in 2035 | USD 2,358.8 million |

| Value-based CAGR from 2025 to 2035 | 7.4% |

This strong growth path is driven by changing consumer tastes, especially the increasing popularity of plant-based items as healthier and more sustainable options. The growing occurrence of lactose intolerance, dietary limitations, and lifestyle changes leaning towards veganism have additionally driven the market's growth.

Non-dairy creamers are widely utilized in the foodservice and retail industries due to their long shelf life, flexibility, and compatibility with various dietary needs. These products create convenience benefits, such as enhancing the taste and texture of beverages, which meets rising demands for convenience. The growth of the market is also furthered by innovation in flavor concepts and packaging configurations, which continuously attract a diverse population of consumers.

Due to further developments in the product formulations and also with the launch of new plant-based sources, this market is expected to grow even higher in the USA for non-dairy creamer. In addition, the market benefits from increased investment in research and development by major stakeholders.

Investments made to improve nutritional content and sensory appeal for non-dairy creamers ensure its place as a highly acceptable alternative for dairy products. Emphasis on innovation ensures constant growth and use within all fields of application.

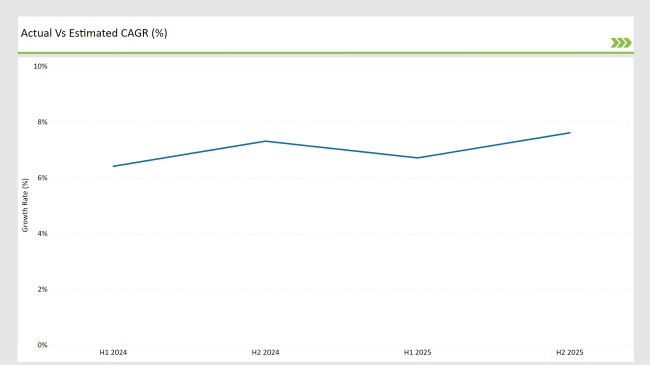

The table demonstrates that the USA non-dairy Creamer market experienced continuous growth through annual Compound Annual Growth Rate increases over successive years. The data reveals how effectively the non-dairy Creamer market responds to shifts in consumer behavior as well as technological improvements and product evolution.

H1 signifies period from January to June, H2 Signifies period from July to December

The semi-annual trends demonstrate growing consumer preference for online retail platforms alongside a rising demand for both health-conscious shopping and technological convenience. The combination of digital marketing tools alongside e-commerce solutions creates expanded product accessibility which drives market growth.

| Date | Development/M&A Activity & Details |

|---|---|

| February 25 | New Non-Dairy Creamer Line by Nestlé : Nestlé launched a new line of plant-based non-dairy Creamer, featuring oat and almond bases, targeting health-conscious consumers seeking dairy alternatives. |

| March 24 | Danone 's Acquisition of a Vegan Brand : Danone acquired a popular vegan brand to expand its non-dairy creamer portfolio, enhancing its offerings in the growing plant-based market segment. |

| April 24 | Califia Farms Introduces Functional Creamer : Califia Farms introduced a new range of functional non-dairy Creamer infused with adaptogens and superfoods, catering to wellness-focused consumers looking for health benefits. |

| May 24 | Nutpods Expands Flavor Options : Nutpods expanded its product line by launching new seasonal flavors of non-dairy Creamer, appealing to consumers seeking unique taste experiences in their beverages. |

| June 24 | Laird Superfood's New Creamer Blend : Laird Superfood launched a new non-dairy creamer blend featuring coconut milk and functional ingredients, targeting the health-conscious coffee drinker market. |

Move Towards Plant-Based and Clean-Label Creamer

Shoppers increasingly are trending towards plant-based non-dairy Creamer developed from natural, minimally processed ingredients. Clean-label products with reduced sugar, no artificial preservatives, and increased nutritional benefits are revolutionizing the expectation of the consumer and driving market growth. This trend illustrates an increasing focus on health-oriented selections, sustainability, and ethical buying behaviors.

The interest in clean-label Creamer is in harmony with larger global trends that emphasize transparency in food manufacturing. Shoppers are proactively looking for items featuring straightforward, familiar ingredients, prompting producers to create and emphasize transparency in their labels.

Advancements in Taste Compositions and Packaging Options

The brands of non-dairy Creamer are broadening their flavor options to reach out to more consumers; they are adding special and seasonal types that turn on those who are trendy and adventurous. Alongside the common flavors like hazelnut, French vanilla, and coconut, the introduction of brilliant alternatives such as pumpkin spice and salted caramel has also played a role in strengthening the market's value.

At the same time, the improvements in green and user-friendly packing are changing the whole industry. The enterprises are presently making use of biodegradable pouches, resealable bags, and compact canisters that not only facilitate the use of the product but also lessen the environmental footprint. These advancements are not just the solutions to the consumer's worries concerning sustainability but they also enhance the product's shelf life and user-friendliness, thus fortifying their market stance.

% share of Individual categories by Form and Distribution Channel in 2025

The non-dairy creamer market remains predominantly dominated by powdered and granular products, which account for approximately 65% of the overall market share. These types of materials possess several key characteristics: they offer an extended shelf life, reduced costs and enhanced transportability.

This combination renders them an optimal selection for both the industrial and foodservice sectors. Powdered Creamer are mainly chosen for their outstanding property of being able to keep the original taste while being easily soluble in drinks. As factories create variants that are enriched with extra nutrients including vitamins and minerals, powdered Creamer are increasingly perceived as a primary option for health-conscious individuals who want both convenience and nutritional advantages.

Foodservice channels are projected to be the top distribution channel, capturing 47% market share by the year 2025. This is attributed to the increasing demand from consumers for plant-derived coffee Creamer in cafes, restaurants, and catering services. These companies typically make large orders to guarantee a consistent supply and satisfy the rising demand for non-dairy Creamer in various hot and cold drinks.

This segment is also benefiting from collaborations with prominent manufacturers, who provide customized products that address both operational requirements and consumer preferences. However, the competitive landscape is evolving and businesses must adapt. Although challenges exist, the potential for growth remains substantial because of shifting consumer behaviors.

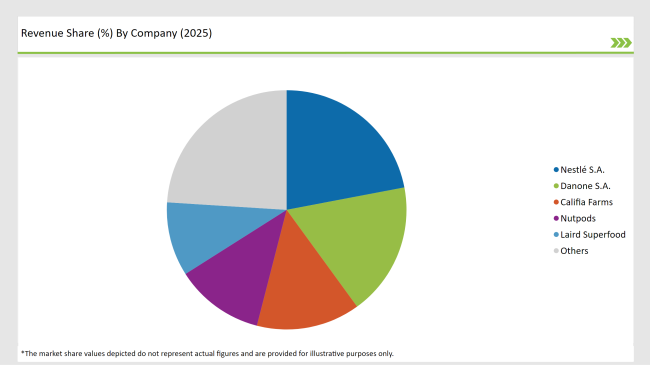

The USA non-dairy creamer market stands out with a mix of global leaders, local manufacturers, and new players each of whom is the driving force behind the growth of this rapidly changing sector. Major companies like Nestlé S.A. and Danone S.A. are strong competitors and command substantial market shares due to their well-known names and varied products.

By focusing on research and development these companies can be fast on the new flavors, better nutritional standards, and fulfilling market demand for clean label plant-based goods. Regional and niche manufacturers also have a crucial role, such as they can able to meet the needs of the area and they can offer formulations that are preferred by the consumer.

By way of example, small firms typically project organic certifications and unique flavors. Yet, this not only promotes healthy competition but can also be a source of a large number of innovations in the industry.

The strategic associations have significantly consolidated market power. Such affiliations allow producers to come up with products specifically designed for certain uses: for example, barista-grade Creamer for coffee houses, which ensures their product use in a lot of places and consumers' loyalty.

However, as sustainability and transparency gain importance, companies are also investing in eco-friendly packaging and ethically sourced ingredients-this is essential to maintain their competitive edge. Although these efforts require substantial resources, they are crucial because they align with consumer expectations.

2025 Market share of USA Non-Dairy Creamer Market suppliers

By form/type, the industry has been categorized into powder/granules and liquid.

By source type, the industry has been categorized into coconut, almond, soy, corn, and others.

By packaging type, the industry has been categorized into sachets/pouches, bags, canisters, and bottles.

By distribution channel, the industry has been categorized into food service channels, hypermarkets/supermarkets, convenience stores, grocery stores, specialty stores, and online retail.

By flavor type, the industry has been categorized into unflavored, French vanilla, chocolate, coconut, hazelnut, and others.

The market is expected to grow at a CAGR of 7.4% from 2025 to 2035.

The USA non-dairy creamer market is projected to reach USD 1,358.8 Million by 2035.

Key drivers include rising demand for plant-based alternatives, advancements in flavor and packaging innovations, and the expanding presence of non-dairy creamer in food service and retail channels.

Powder/granules dominate by form, while food service channels lead the distribution segment in 2025.

Top manufacturers include Nestlé S.A., Danone S.A., Califia Farms, Nutpods, and Laird Superfood.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA