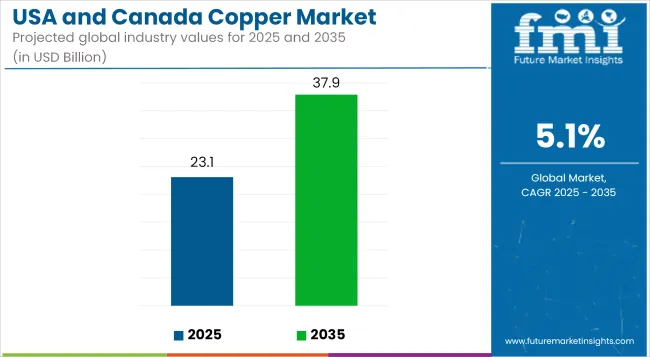

The copper market in the USA and Canada is reported to account for a valuation of USD 23.09 billion in 2025 and is forecast to reach USD 37.88 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1%.

| Metrics | Key Values |

|---|---|

| Industry Size (2025E) | USD 23.09 billion |

| Industry Value (2035F) | USD 37.88 billion |

| CAGR (2025 to 2035) | 5.1% |

Growth is expected to be driven by the increasing use of copper as an electrical conductor, construction material, and alloy component across expanding infrastructure, energy, and automotive sectors.

The copper market in both countries experienced significant shifts driven by economic uncertainty and evolving industrial dynamics. Reports regarding potential USA tariffs on imported copper contributed to a surge in domestic copper prices, creating a premium over international benchmarks.

In anticipation of trade policy adjustments, importers expedited deliveries, which resulted in a short-term buildup of physical inventories in key warehousing and processing hubs.

Domestic copper demand continued to strengthen, supported by accelerating deployment of renewable energy systems, electric vehicle manufacturing, and data center construction. The electrification of transportation networks and grid modernization projects further contributed to elevated copper usage in wire, cable, and component manufacturing.

On the supply side, limited investment in new mining projects, coupled with ongoing disruptions in global production regions such as Chile and Peru, constrained availability. This imbalance between supply and demand contributed to tightening market conditions and reinforced concerns about structural deficits in global copper supply chains.

Market expansion is projected to continue, although trade policy developments may introduce cost volatility. If U.S. tariffs on copper imports are enacted, higher domestic prices are expected to benefit local producers while placing cost pressures on downstream users reliant on imported material. Sectors such as electronics, machinery, and automotive components may face input cost increases unless substitution strategies or supply diversification efforts are implemented.

Copper’s role in the energy transition is expected to remain central, with continued demand growth anticipated from solar and wind installations, EV infrastructure, and smart grid systems.

Canadian operations may benefit from stable regulatory frameworks and proximity to North American manufacturers, positioning the region as a reliable source of refined and semi-finished copper products. Investments in recycling infrastructure and secondary copper recovery are likely to increase as manufacturers seek to secure supply and reduce emissions associated with primary extraction.

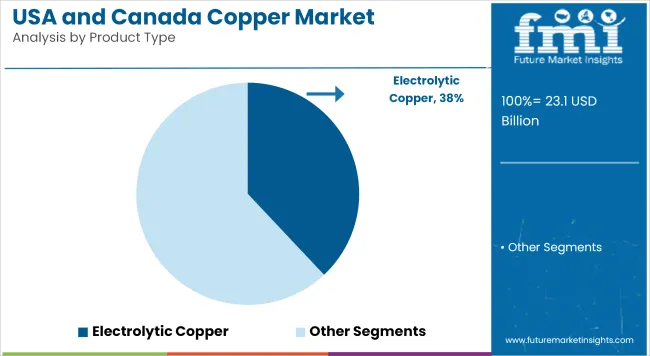

The electrolytic copper segment is projected to account for approximately 38% of the U.S. and Canada copper market share in 2025 and is expected to grow at a CAGR of 5.2% through 2035. Known for its exceptional purity and electrical conductivity, electrolytic copper is a critical material for power transmission lines, switchgear, circuit breakers, and electric vehicle (EV) components.

As North America accelerates its transition to electrification-including EV charging infrastructure, grid modernization, and renewable energy deployment-demand for high-performance copper products continues to increase. Regional producers are also investing in refining and recycling capabilities to ensure reliable domestic supply.

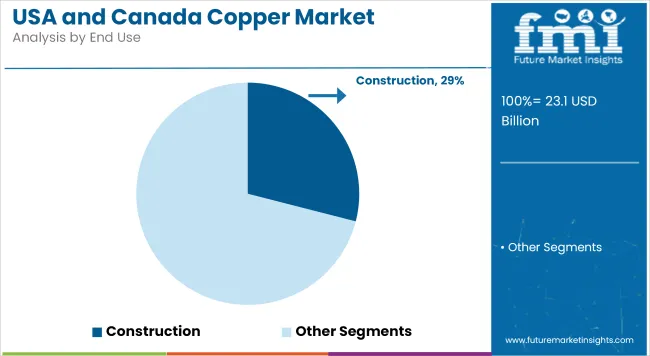

The construction segment is projected to account for approximately 29% of the copper market share in the region in 2025 and is expected to grow at a CAGR of 4.9% through 2035. Copper is used extensively in residential and commercial buildings for piping, roof flashing, heating and cooling coils, and electrical systems.

Urban development projects, along with housing retrofits and green building initiatives, continue to sustain demand. The U.S. Infrastructure Investment and Jobs Act (IIJA) and Canada’s National Housing Strategy are expected to stimulate public and private construction activity, reinforcing medium-term copper consumption across building systems and utility installations.

The USA copper industry is dominated by growing demand for renewable energy infrastructure, electric vehicles (EVs), and local industrial uses.

Robust government policies, such as clean energy investment and manufacturing incentives under initiatives such as the Inflation Reduction Act, are driving significant growth.

Domestic copper production represents some of the industries, but the USA is significantly import-dependent, mostly from nations such as Chile and Canada.

Continued expansion of USA copper mines is prompted by security considerations, while trade is under potential tariff pressures. Industry demand also stems from smart grid extension and low-carbon technology advocacy. Focusing on extending domestic supply chains, the sector challenges lie in the realms of permitting, environmental, and volatile worldwide prices.

FMI opines that the United States Copper sales are likely to expand at a CAGR of 5.1% between 2025 and 2035.

The industry for copper in Canada is driven by immense investments in copper-extraction technology as well as concentration on environmentally friendly methods of doing things. Its abundant deposits, especially found in Ontario and British Columbia, have made the nation's output greater, yet Canadian producers confront stiff competition in an international industryplace.

Stronger concerns about sustainable production from the government in Canada translate to stronger impulses towards using environmentally friendly technologies. In addition, Canada has the advantage of being close to the USA., which guarantees high export volumes to the world's largest copper consumer.

The country's increasing involvement in the electric vehicle and clean energy industries is placing its copper sector at the forefront of North American supply chains. Environmental practices and indigenous peoples' land rights can influence the timing of emerging developments. As global demand for copper picks up, Canada's exports to the emerging economies and dependence on the USA industry remain in control of its industry dynamics.

FMI opines that Canada’s Copper sales are likely to expand at a CAGR of 5.1% between 2025 and 2035.

The USA and Canada copper market is poised for shifts if U.S. tariffs on copper imports are implemented. Higher domestic prices could benefit local producers, though downstream users relying on imported copper may face cost pressures. As a result, investments in recycling infrastructure and secondary copper recovery are expected to rise, as manufacturers look to secure a stable supply and reduce emissions linked to primary copper extraction.

Copper demand is driven by construction, electrical infrastructure, renewable energy, and electric vehicles.

Recycling reduces reliance on mining, providing a sustainable source of copper and minimizing environmental impacts.

The top producers include Chile, Peru, the United States, China, and Australia.

Copper extraction causes water consumption, habitat disruption, and pollution, raising environmental sustainability concerns.

Copper is essential in wind turbines, solar panels, and electric vehicles due to its high conductivity and efficiency.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

United States Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

United States Non-Dairy Creamer Market Insights – Size, Demand & Forecast 2025–2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

United States Fish Protein Market Report – Demand, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA