According to the report, the USA food service industry which was valued at USD 1,121.4 billion in 2025 is expected to register a compound annual growth rate (CAGR) of 7.3% from 2025 to 2035 and reach USD 2,226.6 billion in 2035 These trends are backed by increasing disposable income, demand for on-the-go meals, and technology development in ordering platforms along with a consumer move toward convenient, experience-led dining.

| Attributes | Values |

|---|---|

| Estimated Industry Size in 2025 | USD 1,121.4 billion |

| Projected Industry Size in 2035 | USD 2,226.6 billion |

| Value-based CAGR from 2025 to 2035 | 7.3% |

In fact, several transformative trends shaping the USA food service landscape to drive the industry’s strong growth. At the forefront is digital transformation, as mobile ordering, AI-based personalization, and on-demand delivery platforms radically transform the way consumers interact with food service providers.

There’s also a marked trend toward health and sustainability within restaurants, as customers demand more organic, local and plant-based options, which have led to a flurry of menu innovations across restaurant chains.

Franchising expansion is still a prominent area for growth, as quick-service heavy hitters, like McDonald’s, Chick-fil-A and Subway, implement the same aggressive scaling strategies domestically and abroad. Added to this, the experience economy is also shaping people’s dining decisions, with hybrid businesses, those combining food and entertainment like Hard Rock Cafe and Dave & Buster’s, driving more consumer attention.

Finally, the rise of ghost kitchens and delivery-only concepts is reshaping operational modelsfor example, by reducing overhead costs and meeting demand for off-premise dining in an increasingly convenience-driven world. These dynamic changes are driving the positive outlook in USA food service demand growth through 2035.

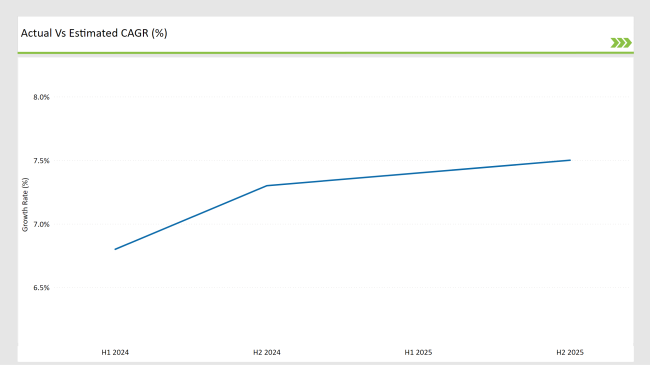

In the table below, a comprehensive comparative analysis of six-month CAGR change in the base year (2024) and year on year (2025) for the USA food service market has been provided. This bi-annual direction gives a fair idea of the trending and the revenue patterns which help stakeholders understand the growth path at least on a yearly basis. H1 (first half of the year) refers to January-June and H2 (second half) is July-December.

H1 signifies period from January to June, H2 Signifies period from July to December

Industry analysts expect food and service industry growth in the first half of 2024 for the USA market will hit a CAGR of 6.8%, while step up in the second half of 2024 to 7.3%. In 2025, growth will accelerate to 7.4% in H1 and 7.5% in H2. The trend demonstrates a 60bp rise from H1 2024 to H1 2025 and a 20bp rise from H2 2025 compared to H2 2024.

These statistics reflect the fast-changing and transformative story of the USA food service system, driven by changing consumer preferences, the growth of digital technologies, ongoing innovation in delivery and off-premise formats, and other trends toward healthier and sustainable menus. This bi-annual dissection serves as a must-read for all players in the industry, as they seek to recreate their strategies based on growth patterns and capitalize on emerging opportunities in a dynamic competitive landscape.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | McDonald’s Introduces AI Drive-Thru Nationwide : McDonald’s completed rollout of AI-enabled voice ordering systems across 85% of its USA drive-thru locations to improve speed and personalization. |

| Nov-24 | Yum! Brands Invests in Ghost Kitchen Expansion : Yum! Brands announced plans to double its USA ghost kitchen presence by 2026 to meet rising off-premise demand. |

| Aug-24 | Chipotle Launches Fully Plant-Based Menu Pilot : Chipotle began piloting a fully plant-based menu in select California and New York stores to cater to sustainability-driven consumers. |

| May-24 | Panera Bread Partners with Amazon for Smart Ordering : Panera integrated Amazon’s palm-recognition payment system for frictionless, personalized ordering at high-traffic urban stores. |

| Mar-24 | Chick-fil-A Opens First Fully Digital Storefront : Chick-fil-A unveiled its first cashier-less digital-only location in Atlanta, focused solely on app and kiosk orders for efficiency. |

Digital Transformation Revolutionizing Customer Experience

USA food service industry is going digital with heavy investments from corporations such as Starbucks, Wendy’s, and McDonald’s in AI-powered ordering and payment systems, mobile apps, and loyalty platforms. These innovations enhance operational efficiency and provide more tailored experiences. Automated kitchens and robotics are also coming into play more broadly, specifically within high-volume QSRs.

Emergence of Healthy Menus and Sustainable Methods

Increasing attention to health and sustainability is spurring restaurants around the country to reinvent their menus. Panera Bread and Sweet green, brands that put an emphasis on organic, plant-based and locally sourced ingredients. There’s also more transparency around nutrition labeling and sourcing practices, a response to growing consumer awareness around wellness and environmental impact.

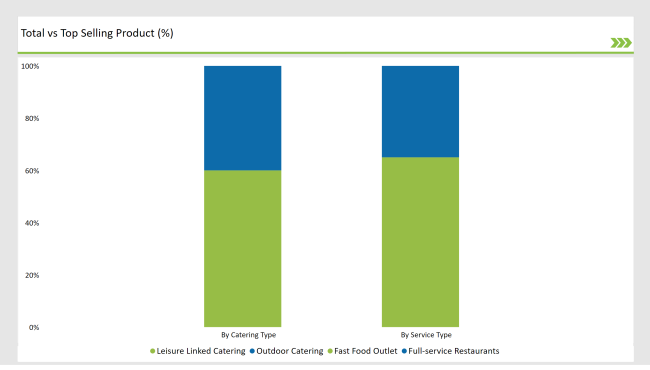

% share of Individual categories by Service Type and Catering Type in 2025

Drive Thru services: The USA market is experiencing a considerable surge in plant-based creamer purchases. Driven towards convenience-led living, consumers are increasingly choosing the Drive Thru model as a go-to format for plant-based beverages, particularly coffee and tea with dairy alternatives, such as almond, oat and soy creamers.

Drive Thru channels have a projected 22% value share of the USA plant-based creamers market by 2035. The latest study provides a detailed summary of the growth of plant-based creamer market during 2023-2030, and the various reasons behind the growth such as increasing penetration of quick-service restaurants (QSRs) and coffee chains that are incorporating a large number of plant-based creamer varieties to meet the dietary preferences of vegan, lactose-intolerant, and clean-label consumers.

Moreover, the high convenience, quick service, and customized orders with plant-based offerings have relatively increased customer retention and repeat purchases in this segment. The Drive Thru trend is part of a bigger change in the USA toward better, more accessible, and more sustainable food and beverage solutions.

The plant-based creamers market in USA is witnessing steady growth in healthcare sector due to increasing adoption of plant-based products in curb hospitals, rehabilitation centers and wellness facilities to improve the patients' and staff dietary preferences.

USA Plant-Based Creamers Market by Healthcare, by 2035 -Figure 41: USA Plant-Based Creamers Market by Healthcare, by 2035, Opportunity Analysis and Recommendation In 2035, healthcare segment is predicted to register a value share of 19% of the USA plant-based creamers market.

This is also a result of the increasing focus on nutrition-sensitive menus in health care institutions, with lactose-free, low-cholesterol and allergen-free alternatives at the forefront of offerings. Clean label features and functional health benefits enable plant-based creamers particularly oat, almond, and soy-derived drinks to become the default in hospital cafeterias and staff lounges. And as institutions strive for more sustainable and ethical food sourcing, plant-based creamers hit home with their environmental targets and wellness protocols.

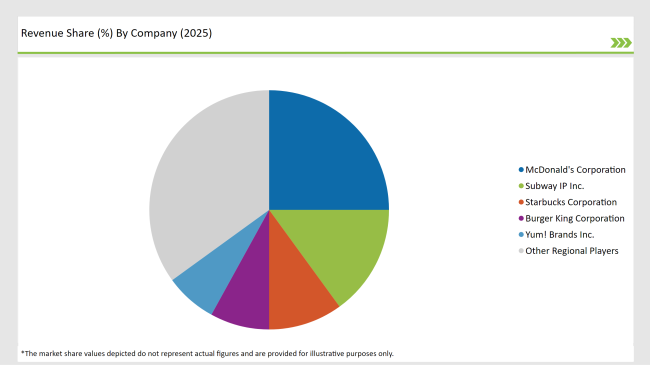

The landscape of the USA food service industry is largely defined by both multinational chains and smaller regional entities. The sector is dominated by fast-food giants like McDonald's, Subway and Starbucks, but smaller and independent operators keep expanding by serving niche markets and local tastes. This industry has high brand loyalty, has innovation in menus, and focuses more on delivery services and convenience.

But big companies have all the tools they need to keep their competitive advantage through advanced supply chain networks, extensive marketing campaigns, and technological integration (think mobile ordering and AI-driven personalization). The former are responding with consolidation, while the latter are striking to cash in on consumer trends around plant-based eating, sustainability and the popularity of food delivery platforms.

But it’s the delivery/takeaway services that have exploded in the past few years due to consumers’ desire for convenience. Moreover, growing focus on healthy alternatives and novel dining experiences add another layer of complexity to the competition.

The market is segmented into Full-service Restaurants, Street/Kiosks, Cafes and Bars, Self-service Restaurants, Fast Food Outlets, Delivery/Takeaway, andRecreational Places.

The industry is classified into Dine-in, Delivery, Online, Drive-Thru, and Takeout.

The industry includes Outdoor Catering (Away-from-home), Industrial Catering (Canteen, Cafeteria), Club Catering (Turf Clubs, Polo Clubs, Golf Clubs), Welfare Catering (NGO, Charity), Leisure Linked Catering (Kiosks, Zoos, Parks, Stadiums), Retail Store Catering, and Transport Catering (Airline, Railway, Cruise, Surface).

The market is categorized into Corporate, Education, Healthcare, Defense & Offshore, Mining & EPC, Sports & Leisure, Event Management, and Others(including Retail, Manufacturing, and Aviation).

The USA Food Service Industry is estimated to be worth USD 1,121.4 billion in 2025.

By 2035, the market is expected to reach USD 2,226.6 billion.

The industry is projected to expand at a CAGR of 7.3% over the ten-year period.

Key players include McDonald’s Corporation, Yum! Brands (KFC, Taco Bell, Pizza Hut), Restaurant Brands International, Starbucks Corporation, Darden Restaurants (Olive Garden, etc.), and Other Chains and Independent Operators.

Mc Donald’s Corporation is projected to lead with a 16% market share in 2025.

Table 1: USA Historical Market Value (US$ billion) Analysis, by Service Type, 2018 to 2022

Table 2: USA Value (US$ billion) Forecast, by Service Type, 2023 to 2033

Table 3: USA Historical Market Value (US$ billion) Analysis, by Delivery Method, 2018 to 2022

Table 4: USA Value (US$ billion) Forecast, by Delivery Method, 2023 to 2033

Table 5: USA Historical Market Value (US$ billion) Analysis, by Region, 2018 to 2022

Table 6: Table: USA Value (US$ billion) Forecast, by Region, 2023 to 2033

Table 7: USA Catering Service Industry Historical Market Value (US$ billion) Analysis, by Catering Type, 2018 to 2022

Table 8: USA Catering Service Industry Value (US$ billion) Forecast, by Catering Type, 2023 to 2033

Table 9: USA Catering Service Industry Historical Market Value (US$ billion) Analysis, by End User, 2018 to 2022

Table 10: USA Catering Service Industry Value (US$ billion) Forecast, by End User, 2023 to 2033

Table 11: USA Catering Service Industry Historical Market Value (US$ billion) Analysis, by Region, 2018 to 2022

Table 12: USA Catering Service Industry Value (US$ billion) Forecast, by Region, 2023 to 2033

Figure 1: USA Value (US$ billion) by Service Type, 2023 to 2033

Figure 2: USA Value (US$ billion) by Delivery Method, 2023 to 2033

Figure 3: USA Value (US$ billion) Analysis by Service Type, 2018 to 2033

Figure 4: USA Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 5: USA t Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 6: USA Value (US$ billion) Analysis by Delivery Method, 2018 to 2033

Figure 7: USA Attractiveness by Service Type, 2023 to 2033

Figure 8: USA Attractiveness by Delivery Method, 2023 to 2033

Figure 9: USA Catering Service Industry Value (US$ billion) by Catering Type, 2023 to 2033

Figure 10: USA Catering Service Industry Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 11: USA Catering Service Industry Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 12: USA Catering Service Industry Value (US$ billion) Analysis by Catering Type, 2018 to 2033

Figure 13: USA Catering Service Industry Value Share (%) and BPS Analysis by Catering Type, 2023 to 2033

Figure 14: USA Catering Service Industry Y-o-Y Growth (%) Projections by Catering Type, 2023 to 2033

Figure 15: USA Catering Service Industry Attractiveness by End User, 2023 to 2033

Figure 16: USA Catering Service Industry Attractiveness by Catering Type, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Food Service Industry - Size, Share, and Forecast 2025 to 2035

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Food Premix Industry Analysis in USA Growth & Demand Forecast 2025 to 2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

USA Food Hydrocolloids Market Trends – Size, Share & Growth 2025-2035

Competitive Overview of Foodservice Paper Bag Companies

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Market Share Distribution Among Food Service Equipment Companies

Food Service Coffee Market Analysis by Type and End User Through 2035

USA Bird Food Market Insights - Trends & Demand 2025 to 2035

USA Superfood Powder Market Report – Trends, Demand & Outlook 2025-2035

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

USA Frozen Food Market Analysis – Demand, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA