The USA Food Testing Services Market is projected to reach a value of USD 697.5 Million in 2025, growing at a CAGR of 7.4% over the next decade to an estimated value of USD 1416.4 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 697.5 Million |

| Projected USA Value in 2035 | USD 1416.4 Million |

| Value-based CAGR from 2025 to 2035 | 7.4% |

The USA Food Testing Services market is rapidly expanding as a critical segment of the country’s growing food safety industry. Three primary factors drive the market expansion in food testing namely rising regulatory requirements as well as growing customer interest in transparency along with increased focus on better food quality standards. Food testing services confirm compliance with regulations set by FDA, USDA, and FSMA therefore protecting public health along with industry standards.

The food safety of manufacturers depends on testing methods that combine microbial detection with allergen screening and both chemical analysis and nutritional verification for controlling contamination and authenticating ingredients.

Novel testing procedures must be developed because plant-based products and alternative proteins and functional foods require protocols to validate nutritional labels while stopping cross-contamination. Advances in diagnostic technology receive substantial growth due to escalating foodborne diseases alongside heightened contamination threats.

The food safety protocols get stronger through technological advancements such as AI analysis tools along with blockchain tracking systems and biosensor testing platforms. Food safety in the United States relies heavily on the US food testing services market since the two factors of regulatory changes and manufacturers' investment in advanced safety technologies make it essential.

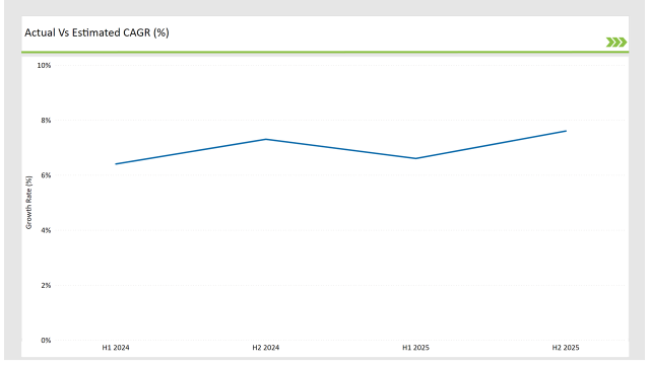

The continuous growth of the USA food testing services market is evident from the semi-annual market update. The key factors for this growth are escalating regulatory oversight and consumers' desire for the transparency of food safety structural changes like AI and blockchain, which are on the front lines of the technological evolution.

H1 signifies period from January to June, H2 Signifies period from July to December.

Introduction of these technologies in the food testing process has significantly increased its efficiency. In addition to these trends, the growing demand for plant-based protein and other alternative protein products is creating a need for the development of additional testing procedures to demonstrate the safety and validate the nutritional claims.

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | SGS: Launched an AI-powered contamination detection platform to improve accuracy and reduce false positives in food safety testing. |

| March 24 | Eurofins Scientific: Expanded its microbiological testing labs to enhance pathogen detection in dairy and meat products. |

| May 24 | Intertek: Introduced a blockchain-based traceability system to verify ingredient authenticity across global supply chains. |

| July 24 | Bureau Veritas: Partnered with leading alternative protein manufacturers to establish new safety guidelines for plant-based foods. |

| September 24 | ALS Global: Developed a next-generation allergen detection assay, reducing cross-contamination risks in processed foods. |

Increasing Demand for Organic and Sustainable Shrimp

Growth of AI and Blockchain-Integrated Food Testing Solutions

When AI and blockchain technology are applied to food traceability studies, contamination identification, and fraud prevention systems, a revolutionary change occurs. AI, together with predictive maintenance, provides a significant tool for preventing potential risks while maintaining control over contamination.

The blockchain-based routing of goods also manifests in the supply chain through the tracing of food, which enhances manufacturers and customers ability to verify the authenticity and safety of products in real time. The rapid acceptance and use of smart packaging with integrated test sensors will be the next solution to make the quality assurance process more efficient.

Rising Demand for Plant-Based and Novel Food Testing Protocols

The marketing of plant-based and alternative protein products has given rise to new difficulties in food safety testing. The special formulation of testing laboratory facilities ensures nutritional accuracy, the presence of no allergens, and microbial safety in lab-grown meats, fermented proteins, and other new food formulations.

New instructions are issued to regulatory bodies for food safety evaluations of alternatives that are prompting testing service providers to build their laboratory facilities. The development of DNA-based testing and enzymatic assays contributes a great deal to the identification and risk assessment of food ingredients.

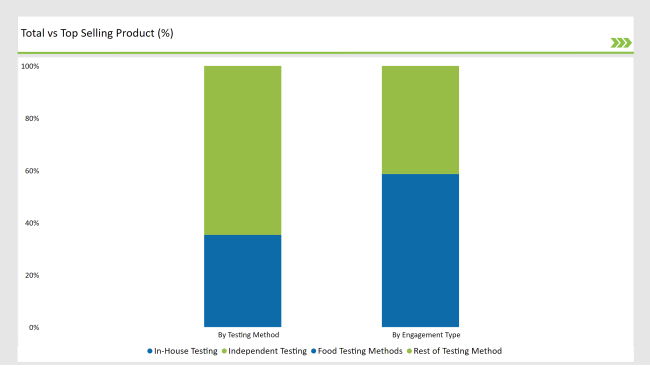

% share of Individual categories by Testing Methods and Engagement Type in 2025

Food testing methods have a market share of 35.3%, and this is attributed to the development of contamination risks, product recalls, and increased regulatory scrutiny. The necessity of fast test kits is increasing in the cases of processed food, ready-to-eat meals, and packaged goods along with the rising food safety regulations. The result of chemicals combined with microbiological and allergen tests confirms that products fulfill licensing prerequisites and allergen labeling standards.

Organic product labeling without harmful additives gained popularity due to increased customer demand for clean-label products hence testing of heavy metals pesticides and mycotoxins became more prevalent. AI data analytics combined with biosensors creates more accurate testing that produces better processing times for laboratory results.

The regulatory authorities are emphasizing boat prevention and traceability improvement, which is why food testing methods are going to be going through the development of automation, real-time diagnostics, and blockchain integration.

The in-house testing segment occupies 58.6% of the market as substantial food producers put money into real-time monitoring and compliance assurances. Firms focus on being cost-effective, producing goods in a faster time frame, and having their own customized testing methods; therefore, they can assure the quality of the product in every manufacturing phase.

The in-house units give the chance to work out respective testing, so they help producers improve food safety and formulation consistency issues. Yet, there are gaps, such as considerable capital investments in infrastructure and the need for specialized skills that lead certain companies to third-party testing.

The introduction of the cloud-based testing model and the IoT-enabled diagnostics movement is the driving force for in-house testing being easier and more accessible to the manufacturers to operate automated systems for real-time risk assessments and compliance reporting for increased efficiency and food safety management.

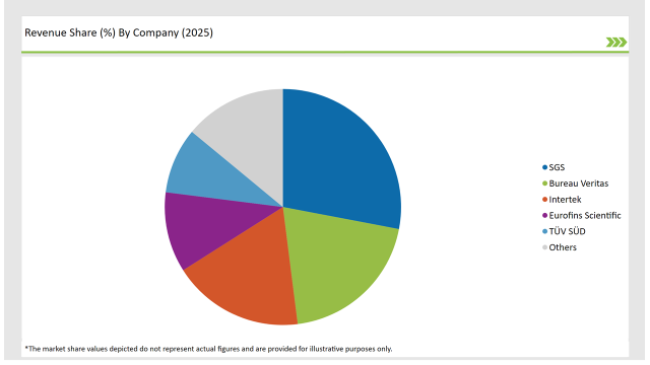

The USA food testing services market is moderately consolidated. The food testing services market in the USA, which is seen as quite competitive by several brands, is a bit more than half consolidated is it not These companies, such as SGS, Bureau Veritas, Intertek, Eurofins Scientific, and TÜV SÜD, bring the majority of the cake to the table, leading the industry with their technological innovations and partnership with regulators.

Testing service providers' main agenda is the expansion of their lab networks and rapid testing kit development. Data analysis driven by an AI is integrated. The independent testing preferred by third most is now opening the door for specialized laboratories to provide niche analytical services.

With food supply chains being globalized, companies are making more and more investments in food authenticity testing, allergen screening, and pathogens detection to be in line with the modern FDA and USDA regulations. Automation and cloud-based reporting platforms are already delivering control over testing workflows, minimizing turnaround times, and enhancing accuracy in the results.

2025 Market share of USA Food Testing Services Market suppliers

By testing method, the market includes food testing, dairy product testing, meat analysis, dietary supplement testing, plant-based and novel food testing, and animal feed testing.

By engagement type, the industry is segmented into in-house/captive testing and independent third-party testing services.

The market is expected to grow at a CAGR of 7.4% from 2025 to 2035.

The USA food testing services market is projected to reach USD 1416.4 Million by 2035.

Key drivers include increasing regulatory compliance, advancements in testing technologies, and rising concerns over food safety and authenticity.

Food testing methods lead by testing type, while in-house testing dominates the engagement segment in 2025.

Top manufacturers include SGS, Bureau Veritas, Intertek, Eurofins Scientific, and TÜV SÜD.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA