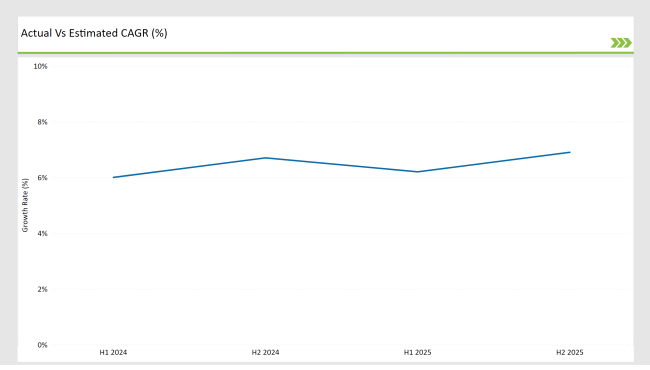

The USA animal feed additives market is projected to reach USD 16,097.3 Million in 2025, growing at a CAGR of 6.8% over the next decade to an estimated value of USD 31,169.3 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated Size 2025 | USD 16097.3 Million |

| Projected Value 2035 | USD 31169.3 Million |

| Value-based CAGR from 2025 to 2035 | 6.8% |

Misuse of sentence structure and inclusion of irrelevant ideas. The USA animal feed additives market is steadily growing as there is an increasing need for better nutrition for livestock, prevention of diseases, and the effective feeding of animals. More and more livestock producers are on the lookout for nutrient-enriched functional feed additives as consumer awareness about high-quality meat and dairy products is boosting.

Animal feed additives help solve a wide array of problems, for instance, they may improve digestion, increase immune function, or even prevent spoilage. The market is determined by the technical improvements in nutritional solutions, the legislative structures that stand in favor of green farming, and the technological breakthroughs in feed blending.

Advances in functional and bio-based feed solutions combined with the trend towards organic, and non-antibiotic alternatives have stimulated investment on the part of manufacturers. The USA's razor-sharp focus on food safety rules brings new ideas to the table and guarantees that animal-derived products are of the highest quality and safety. Market drivers launch sustainability along with successful solutions thus these profits lead to animal health and productivity enhancements.

The semi-annual market update shows that the USA animal feed additives market has undergone continuous growth, which is chiefly accounted for by the increasing consumption of high-quality animal nutrition and health products. The market is simultaneously reaping the benefits of discoveries in feed formulation technologies, the increasing attention dedicated to animal health and welfare, and the surging consumer knowledge about food safety and quality.

H1 signifies period from January to June, H2 Signifies period from July to December.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Cargill: Introduced a fermented probiotic additive to improve digestion and nutrient absorption in poultry feed. |

| March 2024 | ADM Animal Nutrition: Expanded its organic plant-based feed additive line, enhancing sustainability in dairy and swine farming. |

| May 2024 | BASF: Launched a next-generation mycotoxin binder, designed to improve feed safety and enhance livestock performance. |

| July 2024 | Kemin Industries: Developed a precision enzyme solution to optimize feed efficiency in broiler and cattle farms. |

| September 2024 | Nutreco: Partnered with local farms to provide customized feed additives for sustainable aquaculture nutrition. |

Sustainable and Antibiotic-Free Feed Additives Getting Overemphasis

The trend towards sustainable and non-antibiotic livestock production has resulted in the direct development of new probiotic, prebiotic, and enzyme-based feed additive products. The rising number of bans on AGPs is forcing manufacturers to search for naturally occurring solutions to provide animal health benefits, improve feed efficiency, and reduce enteric diseases.

Fermentation-based feed additives are among the products being developed by companies to allow the increase of livestock immunity and the decrease of the environmental impact. The time will come when the manufacture of feed from environmentally sustainable materials will become widespread as consumers, allowing for hormone-treated and antibiotic-fed-free livestock.

Upgrades of Functional Additives for Livestock Performance

The manufacturing of functional feed additives is on the increase due to the need for more efficient farming of poultry, pigs, and cattle. Sensory and technological additives also play an important role in feeding, as they promote better feed texture, more stable formulations and improve nutrient uptake.

The manufacture of high-performance emulsifiers and sweeteners for animal feed makes it more palatable, but the nutrients, such as enzymes, and amino acids, are also important in the optimization of digestion and metabolism. Farmers of livestock want functional additives as a method of differentiation in the market, so they will, therefore, continue to be the driving force in the market.

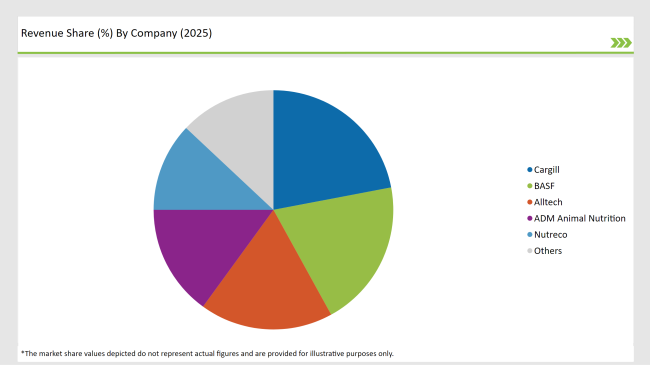

The USA animal feed additives market is very much a seller's market, with the major manufacturers placing their priorities on new technology, unique products, and sustainable feeds. Giant competitors like Cargill, BASF, Alltech, ADM Animal Nutrition, and Nutreco prevail through massive R&D, worldwide distribution channels, and partnerships in the industry.

As the trend catches up with organic and antibiotic-free livestock nutrition, the firms are following by allocating their investments in specialty feed additives which will be the basis for the production of easily digestible, disease-resistant, and productive animals. On top of that, mergers, and acquisitions are the force shaping the markets' dynamics, thus enabling companies to broaden their product spectrum and influence.

New horizons are being explored by pancreatic acid derivatives and algae products that are being used to enrich animal foods feed while probiotic feeds are nowadays easily accessible to farmers. Besides boosting competitiveness, these endeavors will also entail a feed company's adhesion to the changing legal framework and fulfillment of their customer's demands.

2025 Market share of USA Animal Feed AdditivesMarket suppliers

Note: above chart is indicative in nature

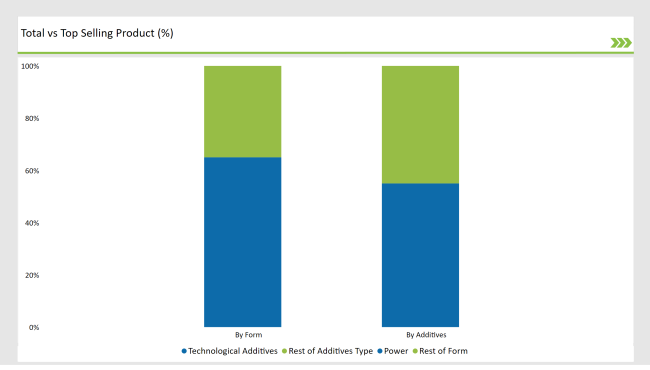

Technological Additives are the Leaders in the Market

Technological additives are the giants of the market holding 55% of the share due to their indispensable use in feed preservation, stabilization, and efficiency improvement. Such additives are preservatives, emulsifiers, and binders that help with the texture of the feed, stability of the nutrients, and shelf life. Moreover, the use of binders as additives reduces the risk of separation of the ingredients in the mixed feed thereby maintaining the quality.

The search for high-performance, economically feasible alternatives has led to the rapid development of enzyme-modified and organic technological additives. As farmers are gearing towards more environmentally friendly and antibiotic-free methods, the addition of technological additives will still be the main factor driving both feed and animal performance forward.

Powder-Based Additives Dominate the Market

Powder-based feed additives take the lion's share of the market at 65% mainly because of their long shelf life, convenient handling, and exceptional stability. The powder form of these additives ensures good mixing which means that the distribution of the nutrients in the feed will be even. These additives are prevalent in poultry, aquaculture, and ruminant feeds with increased digestibility and controlled nutrient release.

Innovation in nutrition is the reason for the invention of products such as microencapsulated and precision-mixed powders which are used to maximize livestock performance and growth. On the other hand, the powder-based form not only helps you to reduce your feed processing cost but also allows you to improve nutrient bioavailability. When the feed manufacturers adopt precise nutrition strategies, the powdered form will continue to dominate through the provision of cost-effective and high-performance feed alternatives for modern livestock breeding.

By additive type, the market includes technological additives, sensory additives, and nutritional additives.

By form, the industry is segmented into powder, granules, and liquid formulations.

The market is expected to grow at a CAGR of 6.8% from 2025 to 2035.

The USA animal feed additives market is projected to reach USD 31,169.3 Million by 2035.

Key drivers include demand for high-quality feed, regulatory push for antibiotic alternatives, and advancements in sustainable feed formulations.

Technological additives lead by additive type, while powder-based additives dominate the form segment in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

United States Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA