The USA Barrier Coated Paper Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| USA Barrier Coated Paper Market Estimated Value in (2025 E) | USD 1.8 billion |

| USA Barrier Coated Paper Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The USA barrier coated paper market is gaining traction due to rising demand for sustainable packaging solutions and increasing restrictions on single use plastics. Growing consumer preference for recyclable and compostable alternatives is accelerating the adoption of coated paper in packaging, food service, and retail applications.

Advances in coating technologies, including water based solutions and bio polymers, are improving barrier properties against moisture, grease, and oxygen while maintaining recyclability. Regulatory support and corporate sustainability commitments are further reinforcing investment in eco friendly materials.

The outlook for the market remains positive as brands emphasize environmentally responsible packaging while ensuring product safety and performance across diverse supply chains.

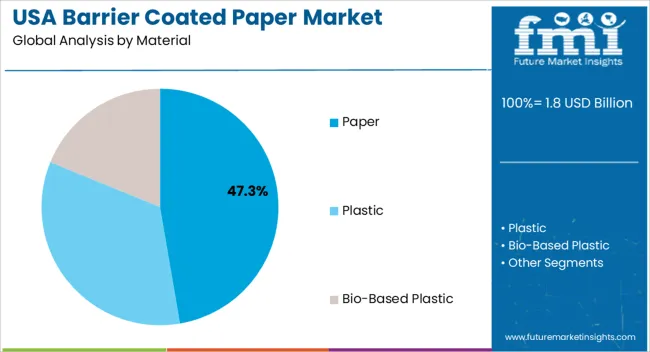

The paper material segment is expected to account for 47.30% of total revenue by 2025 within the material category, making it the leading choice. Its dominance is attributed to its recyclability, biodegradability, and alignment with consumer and regulatory preference for sustainable materials.

Paper based substrates provide an eco friendly alternative to plastic while offering cost effectiveness and versatility across industries.

The rising demand for packaging formats that balance performance with environmental responsibility has strengthened the position of paper as the most widely adopted material in this market.

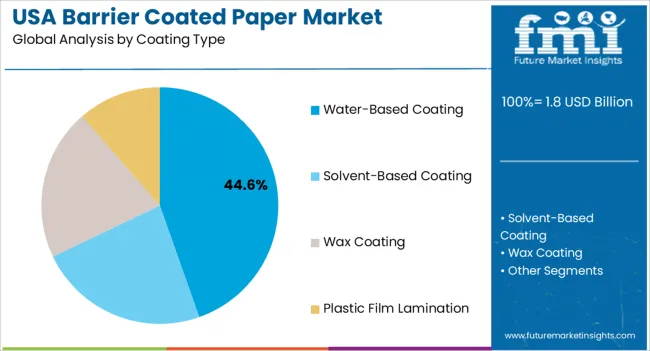

The water based coating type is projected to represent 44.60% of market revenue by 2025 within the coating category. Its growth is supported by its low environmental footprint, reduced volatile organic compound emissions, and compliance with stringent safety standards.

Water based coatings provide strong resistance to oil, grease, and moisture, making them highly suitable for food contact applications. Their ease of application and compatibility with large scale manufacturing processes have further accelerated adoption.

As industries transition toward safer and more sustainable coating technologies, water based coatings have secured a dominant share of the market.

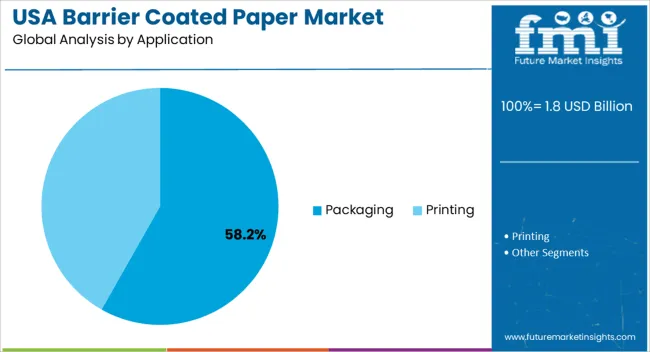

The packaging application segment is anticipated to contribute 58.20% of total market revenue by 2025, establishing it as the largest application area. This leadership is driven by the increasing need for eco friendly packaging solutions in food, beverages, and consumer goods.

Barrier coated paper ensures product protection, extends shelf life, and supports brand positioning with sustainable credentials. Retailers and manufacturers are actively shifting toward recyclable coated paper formats to comply with environmental regulations and meet consumer expectations.

As packaging continues to be the central focus of sustainability strategies, this application segment remains the primary driver of market growth.

The USA barrier coated paper market registered a CAGR of 2.9% from 2020 to 2025. Total market value increased from USD 1,265.9 million in 2020 to USD 1,545.9 billion by 2025.

Between 2025 and 2035, sales of paper coated papers in the USA will rise at 4.5% CAGR. By 2035, the United States barrier coated paper market size will reach USD 2,515.1 million.

Rising applications of barrier coated paper across industries such as food & beverages, electronics, pharmaceutical, etc. will drive the USA market forward.

As an attempt to reduce the use of plastics in packaging, coatings with barrier properties are applied to papers, flexible boards, or paperboards. This is done to inhibit the permeation of air, water, oil, grease, or any kind of moisture.

They can be used on food packaging paper as well as non-food packaging paper which enables them to cater to a wide range of industries.

The barrier coatings can be water-based, solvent-based, or wax-based. These coatings offer exceptional barrier properties. They are applied to the packaging surface (paper, plastic, etc.) to obtain a smooth surface for brightness, printability, and aseptic packaging while extending the shelf life of the packaged product.

Barrier coated papers are ideal for on-the-go consumers. Besides functional attributes such as easy storage, low costs, and hygiene, grab-and-go features of barrier coated paper also contribute to its increasing demand in the USA.

Escalating Demand for Flexible Paper Packaging Driving the USA Barrier Coated Paper Market

In recent years, flexible packaging manufacturers have started to shift from plastic to paper to reduce the impact on the environment. The growing usage of flexible paper packaging has created a need for better barrier protection in various end-use products.

Flexible paper with barrier coating is lightweight, recyclable, and biodegradable. Unlike rigid packaging, flexible barrier coated paper use 70% less paper. It also occupies a smaller space on shelves.

The barrier coated paper also provides an improved aesthetic appearance to the product, which paves the way for better product branding.

This is leading to an increased inclination towards the adoption of barrier coated paper packaging solutions over rigid packaging in primary packaging in the United States.

The extremely customizable nature and versatility of barrier coated paper for packaging will boost the USA market during the projection period.

Robust Growth of Retail Sector in the United States to Fuel Barrier Coated Paper Sales

Changing lifestyles coupled with increasing per-capita disposable incomes of consumers have boosted the growth of the retail sector in the United States. This is leading to a sharp rise in the number of modern retail stores across the country such as supermarkets, convenience stores, and hypermarkets.

In the United States, the sales for retail and food services in December 2025 alone topped USD 677 billion. Even the remote regions in the country have retail outlets which are open 24/7 which is causing an increase in the consumption of packaged foods in the United States. This in turn is bolstering sales of barrier coated papers as it is being used for packaging.

Further, the growing awareness of environmentally friendly packaged food solutions will create growth opportunities for barrier coated paper packaging products.

Cost-effectiveness and Sustainability of Paper Makes it Appealing to Manufacturers

The paper segment is set to maintain its lead in terms of market share through 2035. The same segment will offer an incremental opportunity of USD 563.1 million during the next five years in the United States. This is due to its lightweight but sturdy nature.

Both the bleached and unbleached kraft paper sub-segments combined are set to hold more than 50% of the paper segment share.

Paper is also a greener alternative which encourages manufacturers to use it for making barrier coated paper.

Environmental-friendly Packaging Solutions to Present Significant Growth Opportunity

By application, the packaging segment will retain its dominance in the USA barrier coated paper industry throughout the forecast period. Substantial demand generation for barrier coated paper for a variety of food packaging applications is driving the market growth significantly.

Barrier coated papers also offer superior printing surfaces which allow manufacturers to advertise their brand as well as make their product more appealing to consumers. The target segment is forecast to offer an incremental opportunity of USD 2.7.0 million by the end of 2035.

Leading barrier coated paper manufacturers are enhancing their production capacities to meet the growing demand from several industries. New paper grades are being developed in response to the need for more efficient manufacturing processes and added benefits to the packaging.

Several companies are also focusing on expanding their footprint through mergers and acquisitions. Few recent developments are as follows:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 1.8 billion |

| Projected Market Value (2035) | USD 2.7 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.5% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in ‘000 Tonnes and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Coating Type, Material, Application, End Use, Country |

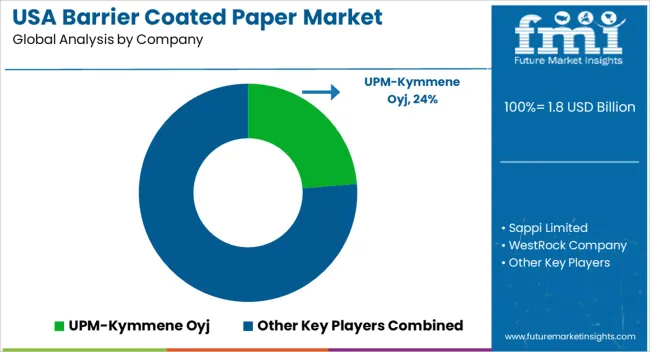

| Key Companies Profiled | UPM-Kymmene Oyj; Sappi Limited; WestRock Company; Ahlstrom-Munksjö Oyj; Atlantic Coated Papers Ltd; Dunn Paper Company; BPM Inc.; Holland Manufacturing Co.; Plastic Coated Papers, Inc.; Billerudkorsnas AB; Cortec Corporation; Gascogne Group; Transcendia; PG Paper Company Ltd; Sierra Coating Technologies LLC; Atlantic Coated Paper; Mondi Group PLC; Toppan Packaging Solutions; Twin Rivers Paper Co. Inc.; DS Smith; The Griff Network; PaperTec Inc.; Robert Wilson Paper Corporation; EMI Specialty Papers; Loparex; Cheever Specialty Paper & Film |

The global USA barrier coated paper market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the USA barrier coated paper market is projected to reach USD 2.7 billion by 2035.

The USA barrier coated paper market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in USA barrier coated paper market are paper, _bleached kraft paper, _unbleached kraft paper, _plastic lamination paper, _coated paper, _uncoated paper (including machine glazed paper), plastic, _polyethylene (pe), _polypropylene (pp), _polyvinylidene dichloride (pvdc), _polyethylene terephthalate (pet), bio-based plastic, _ethylene vinyl alcohol (evoh), _polyamide (pa), wax and aluminum oxides (alox) & silicon oxides (siox).

In terms of coating type, water-based coating segment to command 44.6% share in the USA barrier coated paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Key Players & Market Share in the Barrier Coated Paper Industry

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Market Share Distribution Among Europe Barrier Coated Paper Companies

Western Europe Barrier Coated Paper Market by Material, Coating, Application, End user, and Country 2025 to 2035

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

coated-paper-packaging-box-market-market-value-analysis

Uncoated Paper Market Trends- Growth & Industry Outlook 2025 to 2035

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

Polycoated Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Polycoated Paper Packaging Market Share

Wax-coated Paper Market

Uncoated Fine Papers Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Coated Recycled Paperboard Providers

USA Micro Flute Paper Market Report – Trends, Demand & Industry Outlook 2025-2035

Clay Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA