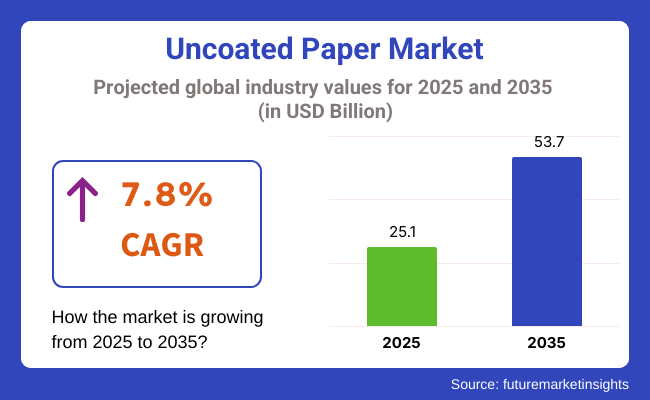

The industry is expected to grow significantly from 2025 to 2035 due to increasing concern for sustainability and the need for recyclable and biodegradable products. Expected to be around USD 25.1 billion in 2025, the market will grow consistently and touch more than USD 53.7 billion by 2035, with a very high CAGR of approximately 7.8% during the forecast period.

There is a transition to recyclable and sustainable materials in industrial and consumer markets. With companies and brands wanting to cut down their carbon footprint, uncoated paper products, particularly consisting of certified sustainable fibers and post-consumer materials, are increasingly being demanded in place of coated products. This is most apparent in packaging, where plastic-free and compostable alternatives are being increasingly demanded.

Corporate and educational industries also exhibit consistent demand for uncoated paper in the shape of notebooks, writing pads, and office print paper. Although digitalization has impacted paper consumption to some extent, the resurgence of print media in niche industries combined with the consistent demand for printed educational content in emerging economies supports maintaining stability.

In addition, the expansion of on-demand and digital printing technologies is expanding opportunities for manufacturers. Expansion in print technology is making high-quality color and grayscale printing on uncoated substrates possible and more versatile than ever. Meanwhile, expansion in paper production-i.e., smoother textures and improved levels of brightness-is supporting performance growth and greater utilization in creative and commercial industries. However, there are certain challenges.

Fluctuating raw material prices, specifically pulp, may impact production costs and earnings margins. Further, the global push towards digitalization can restrain growth in certain segments, primarily those dealing with documentation and publication.

Despite these constraints, the future is promising. Organizations are increasingly focusing on sustainable innovation, product differentiation, and strategic alliances in order to be competitive and benefit from evolving requirements. With increasingly stringent environmental rules and efforts at circular economy gathering momentum, the uncoated paper will lead the way to support global sustainability targets.

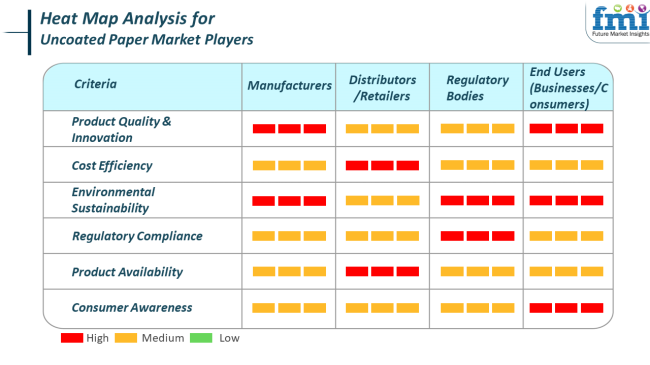

The demand is growing in various industries like printing, packaging, and stationery. The manufacturers concentrate on product quality improvement while incorporating sustainability initiatives to stay in line with consumer demands and environmental laws.

They are making high-performance, sustainable paper products a priority to meet the growing concerns of sustainability. Distributors and retailers, however, are focusing on cost-effectiveness and availability to meet the increasing demand for paper products.

Regulators have persistently maintained high standards to ensure environmental sustainability, encouraging the development and use of recycled materials and low-environmental-impact production processes. For the end-users, who are firms and households, purchase decisions are guided by print quality, durability over the long term, and sustainability of the product itself.

There was a growth between 2020 and 2024 due to the rising demand within industries like publishing, printing, and packaging. An important catalyst was the growth in e-commerce, which caused a boost in demand for packaging products.

Throughout this time, there was also a significant move towards sustainability, as businesses and consumers switched to environmentally friendly and recyclable paper products. Moreover, new digital printing technologies caused greater adoption of this paper as a result of its use for digital purposes, which enhanced print quality and lowered costs for small print runs.

From 2025 to 2035, the industry will keep on growing with support from more innovation in papermaking and rising ecological consciousness. The sustainability trend is likely to continue with more focus on biodegradable and recyclable paper products.

With advancements in digital printing technology, the use of uncoated paper will expand, and it will find application even in packaging eco-friendly consumer goods. In addition, increased uptake of sustainable solutions in both consumer and industrial markets will propel demand, especially in North America and Europe.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| ecommerce expansion, sustainable packaging demand, digital printing | Sustained e-commerce expansion, paper manufacturing innovations, sustainability emphasis, and digital printing |

| Digital printing development and sustainable paper production | Additional innovations in sustainable paper, intelligent packaging solutions, and digital printing advancements |

| Robust growth in North America, steady demand in Europe, growth in Asia-Pacific | Sustained robust demand in North America and Asia-Pacific, with an increasing interest in Europe's sustainable offerings |

| Growing demand for recyclable and sustainable paper, digital printing uptake | Growing consumers' preference for sustainable and recyclable packaging, growing digital printing uptake |

| Increased emphasis on recyclable and biodegradable paper products | Sustained focus on sustainable and green paper production and use in packaging |

The global uncoated paper industry is vulnerable to various risks that can influence its growth trend in the coming years. Economic sensitivity is the most significant risk among them. The demand greatly relies on consumer spending, particularly in publishing, stationery, and printing.

Economies experience recessions or financial crises when they proceed to lower discretionary paper items by companies and consumers. This may lead to a drop in demand, particularly in developed economies, thus decreasing growth in the long term. Another key threat is supply chain vulnerabilities.

The sector has an international supply chain for raw materials such as wood pulp and chemicals. Any uncertainty-geopolitical tensions, pandemics, or natural disasters-can affect the supply of materials, prolong manufacturing time, make it costlier, and even cause shortages. Such disruptions pose a serious concern for manufacturers because they would affect not only the production timeline but also the pricing stability and, thus, profitability. Technological breakthroughs are also posing threats.

With more development towards digital media and communication, the need for traditional paper products may decrease within a period. With more businesses and consumers embracing digital alternatives, physical paper products may reduce in demand, and the company will have to innovate and redefine itself according to the altered reality. Companies would have to seek digital printing technologies or sustainable paper options in an attempt to remain competitive.

The second threat facing the industry is environmental regulations. Mounting pressures on sustainability and the green issue in paper production are fueling stricter legislation. Suppliers are being compelled to adopt green practices, such as waste minimization and recycled content. Compliance with these standards can be costly in terms of cleaner technology and processes, which can drive up the cost of doing business for companies.

Small enterprises might not be able to differentiate their products from already established big brands. Moreover, the pressure to maintain low prices could end in poor product quality, thus further increasing market competition.Businesses can diversify their products, targeting a wide variety of paper types to prevent reliance on one segment.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 2.9% |

| UK | 2.3% |

| France | 1.9% |

| Germany | 2.1% |

| Italy | 1.7% |

| South Korea | 2.2% |

| Japan | 1.6% |

| China | 3.6% |

| Australia-New Zealand | 2.0% |

The USA is anticipated to register a growth of 2.9% CAGR throughout the research period. The USA remains one of the leading regions because of the consistent demand from the education, legal, and government sectors. Despite digitalization impacting the traditional consumption of paper, the industry continues to play a central role in documentation, printing, and office use. Additionally, the increasing popularity of recyclable and sustainable products supports demand, particularly from institutions and environmentally responsive businesses.

Big-ticket operations and government and private sector procurement deals stabilize market balances further. Internal paper mills' increased production efficiency and technological improvements provide cost-saving supply and conform to changing standards of quality. The packaging market's gradual replacement of plastic-based materials with paper-based products also benefits the uncoated segment.

With sustainability mandates gaining more ground, rising investment in recycled or tree-free paper sources underpins future development. Strong domestic production and import-export balance drive a healthy backdrop that supports long-term industry traction in the USA, notwithstanding modest volume oscillations induced by digital shifts in certain verticals.

The UK will grow at 2.3% CAGR over the study period. The UK is experiencing moderate growth in this sector, led by steady institutional and business use. Government institutions and educational facilities have a steady customer base despite the fact that digital forms are increasingly gaining entry into communications and record-keeping.

The UK sustainability agenda highly promotes the use of paper products with recycling content and reduced environmental footprint, making uncoated paper an attractive option for environmentally conscious companies. Demand is also stimulated by specialist printing uses, like legal documents and creative applications in the design and publishing industries, where uncoated finishes are used to meet texture and quality standards.

UK paper manufacturing is increasingly agile and responsive, meeting niche demands while accommodating lower bulk orders. As part of the larger sustainable materials drive, innovations in packaging using uncoated kraft paper are on the rise, particularly among small and medium-sized firms. Although development is incremental instead of meteoric, sustained policy backing and knowledge among consumers regarding environmentally friendly substitutes should drive long-term demand.

France is anticipated to develop at 1.9% CAGR throughout the research period. France is registering controlled growth, affected by the digitalization of administrative and educational processes. There has been a steady demand within governmental, academic, and legal industries, where physical documentation is still the norm. Uncoated paper is also important in premium printing and publishing uses owing to its natural touch and professional finish. French laws facilitating the circular economy and green purchasing continue to urge recyclable and biodegradable paper products.

This is quite favorable to positioning uncoated paper as a green alternative, especially when manufactured using recycled fibers. Additionally, France's art and culture sectors, which frequently demand premium and tactile paper due to its aesthetics, drive niche demand.Supply-side dynamics are influenced by initiatives from domestic mills to minimize energy consumption and emissions. Steady institutional usage and cultural uses underpin a positive outlook during the forecast period.

Germany will grow at 2.1% CAGR during the forecast period. Germany is a region with consistent growth in uncoated paper, with significant demand coming from corporations and industries. Even as digitalization has stifled overall paper usage, specialized printing, legal papers, and official correspondence continue to rely on uncoated versions because of their readability, print quality, and sustainability factor.

The paper-based packaging inclination in Germany also adds diversified usage in secondary packaging and labels. Germany's focus on sustainability and innovation is reflected in domestic production practices that prioritize energy efficiency and closed-loop recycling.

Uncoated paper products made from post-consumer fibers have gained visibility in procurement processes. Small and medium-sized enterprises across publishing, design, and education continue to utilize uncoated formats for both functional and creative needs. In addition, the nation's export-driven economy facilitates stable production by domestic paper mills that serve both home and surrounding EU markets.

Italy is likely to expand by 1.7% CAGR over the study period. Italy is characterized by moderate growth, driven by the persistent digital shift and changing consumer patterns. Nevertheless, conventional uses in education, bureaucracy, and art continue to dominate.

Specifically, Italy's design and luxury packaging industries tend to prefer uncoated paper for its touch and visuality, maintaining demand within creative sectors. Environmental awareness is increasing gradually in Italy, leading to government institutions and companies embracing paper products that meet green procurement policies.

Uncoated paper and recycled, as well as FSC-certified uncoated paper, are increasing in demand, particularly in government tenders and environmentally labeled product offerings. Local manufacturing continues to be operational, though supply chains are vulnerable to changes in the cost of raw materials and energy. Even with overall demand decline in some bulk-use areas, steady niche applications in publishing, official papers, and visual arts provide a supportive foundation for stability throughout the forecast period.

South Korea will grow at 2.2% CAGR over the study period. There is a combination of established demand and new eco-friendly trends. The uncoated paper continues to play critical functions in schools, law firms, and official documents. Even with high digital uptake, physical documents remain significant in most procedural environments, providing a stable floor of demand.

Paper processing innovation and focus on sustainability are the keys to the industry's success in South Korea. Domestic producers are investing in recycling technologies and low-carbon manufacturing processes while conforming to national legislation as well as consumer demands.

The packaging sector is slowly embracing uncoated options, particularly in food and cosmetics, where a natural, matte finish tracks branding direction. In addition, public education efforts advocating lower plastic usage indirectly support uncoated paper by framing it as an environmentally friendly option. As green consumerism continues to grow, consistent growth is anticipated throughout institutional and commercial uses.

Japan is anticipated to expand at 1.6% CAGR through the analysis period. The country shows a mature and conservative expansion. The transition to digital media slowed down demand across legacy print industries, although a fundamental requirement persists in government, legal, and education areas. In addition, Japan's appreciation of quality materials underpins continued demand in artistic, stationery, and publishing applications, in which uncoated finishes are desired.

Local paper manufacturers are known for quality and attention to detail, providing differentiated, uncoated offerings that attract high-end customers. Japanese environmental policy is moving slowly but surely, with more pressure towards recycled content and lower carbon footprints in production.

Specialized uses like specialty printing, branding materials, and cultural products sustain industry liveliness in the face of volume pressures. Furthermore, aging populations and administrative conservatism prolong the use of physical documentation in some industries, which results in a relatively stable, though slow-growing, industry.

China will grow at 3.6% CAGR over the study period. China is the fastest-growing industry, fueled by a mix of scale, industrial use, and increasing domestic consumption. As digital transformation continues to progress, uncoated paper still has high usage in education, government records, and emerging e-commerce and lightweight packaging industries. With China stepping up its drive for environmental sustainability, there is increasing demand for biodegradable and recyclable packaging material.

Uncoated paper, which does not have any chemical coating, supports national agendas in reducing plastic waste and shrinking ecological footprints.Local production has economies of scale and a strong supply chain to support competitive pricing and fast adaptation to changes. In addition, regional differences in digital uptake enable physical formats to continue in rural and semi-urban areas, further enhancing demand. Sustained urbanization, coupled with policy-supported environmental shifts, is likely to maintain momentum high over the forecast period.

The Australia-New Zealand regions will grow at 2.0% CAGR throughout the study. Australia and New Zealand offer a moderately expanding industry driven by consistent institutional demand and increasing interest in sustainable packaging. Notwithstanding high digital penetration, print documentation is still rooted in legal, educational, and governmental purposes.

Moreover, small businesses and creative industries throughout the region continue to prefer uncoated formats for marketing and design applications. Sustainability is a prominent concern in local paper procurement. Consumer demand for environment-friendly products and government-backed efforts have popularized more usage of recycled and tree-free uncoated papers.

The two nations both have an advanced recycling capacity and aggressive green laws supporting the use of paper-based substitutes in lieu of petro-based packaging. Regional supply bases and local mills also focus on low-carbon footprint manufacturing techniques and credentials that are in vogue with mindful consumers. Although not a growth area, stable baseline consumption and convergence with sustainability objectives ensure a positive trend for the next decade.

In 2025, the industry is projected to be led by uncoated woodfree paper, accounting for approximately 52% of the total share, while uncoated groundwood paper is expected to hold around 38%.Uncoated woodfree paper dominates because it is of high quality and has many different uses in professional and commercial printing applications. With superior brightness, better print quality, and a smoother surface compared to groundwood varieties, it finds extensive applications in office printing, books, as well as premium stationery and publishing.

Heavy investments are also being made in producing sustainably sourced, high-brightness, uncoated woodfree paper that can meet the demand of corporate clients and publishing houses. Products such as those being manufactured by Mondi Group and Stora Enso are usually most preferred in cases where documents need to appear professional or where print permanence is required.

Despite having significantly lower revenue shares, uncoated groundwood paper remains generally important in its low-price characteristics and suitability for various high-volume prints for short periods, like newspapers, flyers, and advertising inserts. Typically, more lignin content is available and is produced mainly through mechanical pulping; therefore, it is usually less bright and more easily yellowed.

However, it is cost-sufficient and not heavy; thus, most consumers prefer it for content that will be widely propagated. Major manufacturers, Norske Skog and UPM, focus on the innovative development of this segment, including improving recyclability and reducing the environmental footprint of groundwood papers.

Although global paper consumption is reduced by digitization, the particular application areas of use for uncoated woodfree and groundwood papers still experience maintenance. Such a split reflects the promise of changing industry needs, where quality, cost, and environmental factors govern purchasing behavior.

The uncoated paper market in 2025 is expected to be driven chiefly by the commercial application, accounting for a projected 27% of the share, and the advertising segment accounts for 22%. The continuing demand for office printing, corporate communication material, legal documents, and forms renders the commercial application segment the largest application segment. Uncoated woodfree paper is favored for this application due to its superior printability, readability, and professional finish.

Large manufacturers such as International Paper and Domtar Corporation cater to a large spectrum of commercial clientele with certified environmentally friendly paper that supports high-speed printing and archival standards. The increasing number of SMEs and the continued demand for printed matter, irrespective of digitization, cement the relevance of this segment.

The advertising application segment still holds its own, driven by the demand for flyers, brochures, inserts, and direct mail. Uncoated groundwood paper is the option for these applications usually because uncoated groundwood is economical and lightweight for high-volume print runs of short duration.

Companies like UPM and Sappi are innovating in this space by introducing environmentally friendly advertising paper solutions that minimize carbon emissions and enhance their recyclability, which is in line with the marketing sector's aspiration for eco-friendly promotional materials.

Both applications reflect a balance between costs and quality, whereby businesses are looking for value for money and performance while still maintaining environmental standards. In a changing corporate world along with advertising space, the demand within these segments is expected to remain stable. At the same time, growth opportunities are linked to sustainability initiatives and premium print needs.

The Uncoated Paper Market is highly competitive and mature, with global paper giants like International Paper, Domtar, Mondi, and The Navigator Company among the key players. These companies have developed extensive supply chains, stewardship towards the environment, and strong networks of customers across continents, which put them at an advantage.

International Paper dominates vertically integrated operations in North and Latin America, with a very strong product mix addressing the commercial printing and education sectors. In so doing, it complies with sustainable forestry while focusing on digital-ready grades, with which it will get itself into strong positions in both developed and emerging industries.

Domtar operates even further in North America, especially in the cut-size and digital printing paper segments, realizing significant benefits from conversions in mill strategies and initiatives that are circular. Of course, Mondi falls under the trend in leading Europe-think not-so-lightweight, uncoated, but package-style paper with an emphasis on very low environmental impact.

With regard to premium segmentation, the Navigator Company has made progress, developing a branded, high-performancepaper on which quality and consistency have been focused, with eco-certification as a guiding principle.

Asia Pulp and Paper (APP) are overall star players in the Asia Pacific, the cost-sensitive parts of the world, supplying cost-effective and scalable offerings. Companies such as Finch Paper, Glatfelter, and Appleton Coated invest through regional and niche products, increasing competition by addressing specific formats and sustainability preferences, which are largely meant for digital printing, special formats, and eco-labeled needs. Innovation, operational efficiency, and green manufacturing practices constitute the basis for competitive differentiation.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| International Paper | 20-25% |

| Domtar | 15-18% |

| Mondi | 12-15% |

| The Navigator Company | 10-13% |

| Asia Pulp & Paper | 8-11% |

| Other Key Players (Combined) | 18-22% |

| Company Name | Offerings & Activities |

|---|---|

| International Paper | Offers a broad portfolio of uncoated freesheet papers for commercial and educational use; focuses on sustainable forestry and global logistics. |

| Domtar | Produces uncoated office and printing papers with strong regional supply in North America; emphasizes recycled content and innovation in digital formats. |

| Mondi | Specializes in environmentally responsible lightweight uncoated grades for printing and sustainable packaging applications in Europe. |

| The Navigator Company | High-performance premium product s with strong brand equity and ecolabels such as EU Ecolabel and FSC®. |

| Asia Pulp & Paper | Produc es high-volume, cost-effective products for the Asian and export industrie s; focuses on supply scale and emerging demand. |

Key Company Insights

International Paper (20-25%)

Global leader with a vast product range, focusing on sustainability, digital compatibility, and long-term supply chain investments. Its scale enables it to serve institutional, commercial, and educational demand globally.

Domtar (15-18%)

A key player in North America with cut-sheet and digital printing formats, leveraging its regional mills and converting facilities. Strong focus on recycled and environmentally responsible products.

Mondi (12-15%)

European powerhouse advancing lightweight and packaging-grade papers, backed by sustainability-driven R&D and innovation in low-footprint manufacturing.

The Navigator Company (10-13%)

Premium provider with branded products and eco-certification leadership, catering to office, professional, and digital print users worldwide.

Asia Pulp & Paper (8-11%)

High-capacity manufacturer serving price-sensitive and emerging industries, balancing cost leadership with increasing investment in green supply chains.

The segmentation is into Uncoated Groundwood Paper, Uncoated WoodfreeWoodfree Paper, and Others.

The segmentation is into Advertising, Commercial, Directories, Security and Brand Protection, Transactional, and Packaging applications.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry is slated to reach USD 25.1 billion in 2025.

The industry is predicted to reach a size of USD 53.7 billion by 2035.

Key companies include International Paper, Domtar, Mondi, The Navigator Company, Asia Pulp & Paper, Finch Paper, Glatfelter, Sonoco, Lecta, Appleton Coated, and Case Paper.

China, slated to grow at 3.6% CAGR during the forecast period, is poised for the fastest growth.

Uncoated woodfree paper is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Uncoated Fine Papers Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA