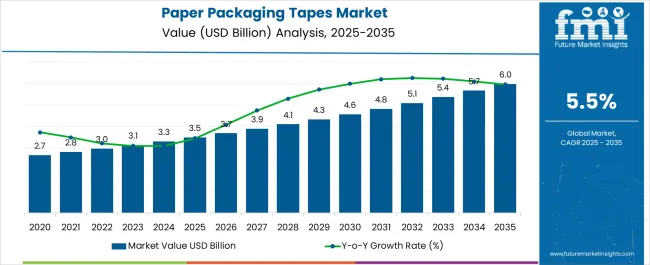

The Paper Packaging Tapes Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Paper Packaging Tapes Market Estimated Value in (2025 E) | USD 3.5 billion |

| Paper Packaging Tapes Market Forecast Value in (2035 F) | USD 6.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Paper Packaging Tapes market is experiencing sustained growth, driven by the rising demand for sustainable and environmentally friendly packaging solutions across multiple industries. Increasing global e-commerce activities, particularly in retail and logistics, are boosting the need for reliable, durable, and recyclable packaging materials. Paper packaging tapes are being favored for their eco-friendly characteristics, recyclability, and compatibility with various packaging surfaces.

The shift towards sustainability and stricter regulations against single-use plastics are further encouraging adoption. Innovations in adhesive formulations, water-based coatings, and easy-to-apply tape designs are enhancing performance while maintaining environmental compliance. Businesses are leveraging paper packaging tapes to improve brand perception and demonstrate commitment to sustainable practices.

Rising demand for lightweight, strong, and tamper-evident packaging solutions is driving integration into supply chains, particularly in e-commerce and retail sectors As companies prioritize operational efficiency, sustainability, and compliance, the paper packaging tapes market is expected to maintain steady expansion over the next decade, with continued focus on product innovation and eco-conscious materials shaping future growth opportunities.

The paper packaging tapes market is segmented by adhesive type, end use, and geographic regions. By adhesive type, paper packaging tapes market is divided into Adhesive Paper Tape and Non-Adhesive Paper Tape. In terms of end use, paper packaging tapes market is classified into E-Commerce Packaging, Food & Beverages Packaging, Building & Construction, Cosmetics & Personal Care, Homecare And Toiletries, Automotive & Mechanical Parts, Aviation And Shipping, and Others.

Regionally, the paper packaging tapes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adhesive paper tape segment is projected to hold 58.3% of the market revenue in 2025, establishing it as the leading adhesive type. Growth in this segment is being driven by its strong adhesive performance, recyclability, and suitability for a wide range of packaging applications. Adhesive paper tapes offer a balance between durability and environmental sustainability, making them the preferred choice for companies seeking to reduce plastic use while ensuring secure parcel sealing.

The compatibility of these tapes with automated packing lines and manual operations enhances operational efficiency. Innovations in adhesive formulations and paper substrates have improved resistance to tearing, moisture, and temperature variations, which further strengthens their appeal.

Adoption is particularly strong in industries such as logistics, retail, and consumer goods, where packaging integrity and sustainability are critical As regulatory pressure to reduce environmental impact increases, and as businesses continue to prioritize sustainable supply chains, the adhesive paper tape segment is expected to maintain its leading position, supported by technological innovation and growing awareness of eco-friendly packaging solutions.

The e-commerce packaging end-use segment is anticipated to account for 21.6% of the market revenue in 2025, making it the leading application area. Growth in this segment is being driven by the rapid expansion of online retail and direct-to-consumer business models, which require reliable, durable, and tamper-evident packaging solutions. Paper packaging tapes are increasingly used to seal parcels, protect shipments, and provide a sustainable alternative to conventional plastic tapes.

The ability of these tapes to integrate with automated packaging systems and withstand logistical handling makes them particularly suitable for high-volume e-commerce operations. Sustainability considerations, including recyclability and reduced carbon footprint, further enhance their appeal to environmentally conscious retailers and consumers.

Rising consumer expectations for secure, visually appealing, and eco-friendly packaging are accelerating adoption As e-commerce volumes continue to grow globally, demand for sustainable packaging solutions like paper packaging tapes is expected to rise, reinforcing the dominance of this segment and supporting overall market expansion through innovative and scalable applications.

The rapidly expanding e-Commerce business is affecting the need for packaging materials, particularly lightweight and long-lasting packaging. Paper and paperboard packaging goods are widely used in the business. The problem is that packing items must travel vast distances in severe weather.

Paper packing tapes are essential under these settings. Tamperproof and better product safety is provided by paper packaging tapes. Thus, the need for paper packaging goods is being driven by the ease and high quality of printability, which is boosting the paper packaging tapes market.

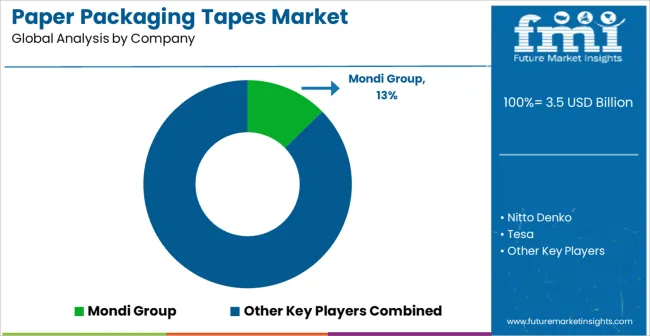

According to Future Market Insights, recent developments in the paper packaging tapes market indicate that this market will experience increased consolidation as well as vertical integration. The market is now controlled by converters, who are responsible for sourcing bulk paper packaging rolls and then converting them to meet the needs of end users.

Papers have numerous appealing properties such as being waterproof, UV resistant, linerless, and so on. The rising middle-class population, increasing disposable income per capita, and expanding infrastructure development are also driving growth in the paper packaging tapes market.

The market is experiencing a new trend of transferring manufacturing bases to low-cost nations with low production and labor expenses. Paper packaging tape companies are embracing flexible and efficient production methods as well as integrating them with global manufacturing standards.

Shifting customer purchasing habits, such as home shopping and online retail, are further pushing demand for paper packaging tapes. Some of the attractive features of the paper packaging tapes such as easy recyclability, reduced carbon footprint, environmental friendliness, and low cost are propelling the paper packaging tapes market expansion and the same trends are expected from this market during the forecast period.

A renowned company in this industry is expanding its operations by investing around USD 210 million in the construction of a new, cutting-edge sawmill facility in southern Alabama. Using cutting-edge technology, this new sawmill will feature a two-shift yearly production capability of 250 million linear feet and will create a new, contemporary working atmosphere for the almost 130 people who will be currently employed, along with considerable indirect jobs.

This facility design includes expenditure in a biomass-fueled timber drying system, which is in line with their decarbonization and sustainability aims. The facility is expected to open in the 3rd quarter of the year 2025. With such developments, the market for paper packaging tapes market will boom during 2025-2035.

Rapidly growing e-Commerce industry is influencing the demand for packaging products, especially lightweight and durable packaging products. Paper & paperboard packaging products are highly preferred across the industry. The challenge is, packaging products has to travel long distances in extreme weather conditions. Paper packaging tapes play a vital role in these conditions.

Paper packaging tapes provides tamperproof and enhanced product safety to packaging contents. Easy and high degree of printability is driving the demand for paper packaging products, which in turn is driving the paper packaging tapes market.

Recent trends in paper packaging tapes market shows that, the market is going to witness rising consolidation and vertical integration. In the present scenario the market is highly dominated by converters, who source the bulk paper packaging roles and convert them according to end user convenience.

Papers comes with many attractive features like UV resistant, waterproof, liner less etc. Rising middle class population, increase in per capita disposable income and growing infrastructure developments are leading to growth in paper packaging tapes market.

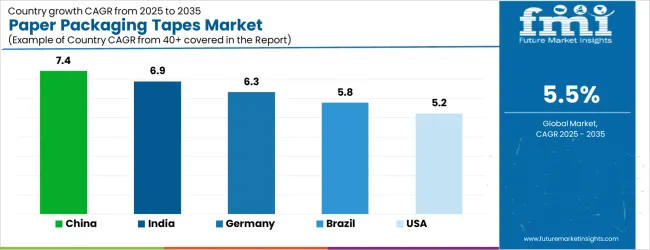

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The Paper Packaging Tapes Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Paper Packaging Tapes Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%.

The USA Paper Packaging Tapes Market is estimated to be valued at USD 1.3 billion in 2025 and is anticipated to reach a valuation of USD 1.3 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 174.9 million and USD 93.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Adhesive Type | Adhesive Paper Tape and Non-Adhesive Paper Tape |

| End Use | E-Commerce Packaging, Food & Beverages Packaging, Building & Construction, Cosmetics & Personal Care, Homecare And Toiletries, Automotive & Mechanical Parts, Aviation And Shipping, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mondi Group, Nitto Denko, Tesa, Shurtape Technologies, Sekisui Chemical, NICHIBAN, Scapa Industrial, Jialong Adhesive Tape, Pro Tapes, Can-Do Tape, EcoEnclose, and Mexim Adhesive Tapes |

The global paper packaging tapes market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the paper packaging tapes market is projected to reach USD 6.0 billion by 2035.

The paper packaging tapes market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in paper packaging tapes market are adhesive paper tape and non-adhesive paper tape.

In terms of end use, e-commerce packaging segment to command 21.6% share in the paper packaging tapes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Paper Honeycomb Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA