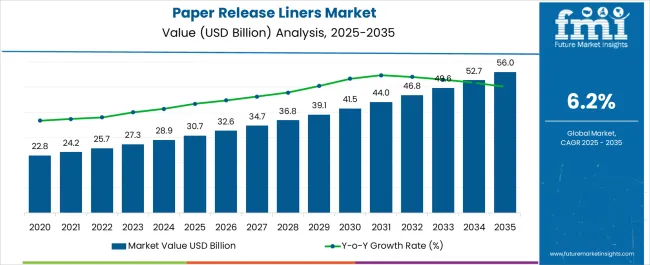

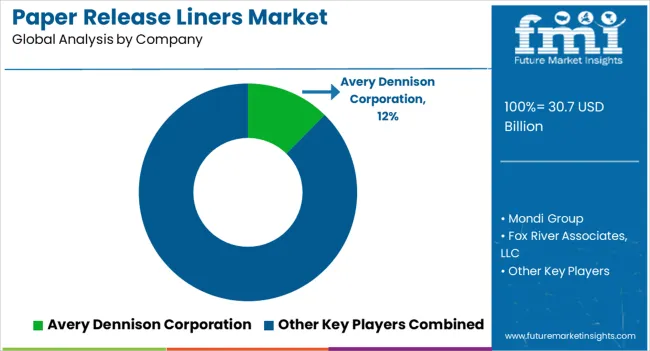

The Paper Release Liners Market is estimated to be valued at USD 30.7 billion in 2025 and is projected to reach USD 56.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Paper Release Liners Market Estimated Value in (2025 E) | USD 30.7 billion |

| Paper Release Liners Market Forecast Value in (2035 F) | USD 56.2 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

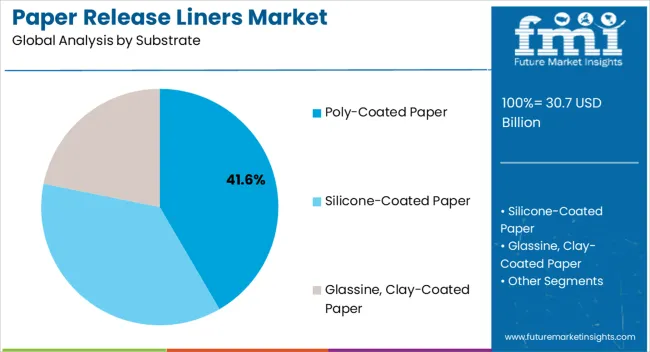

The paper release liners market is expanding steadily, influenced by rising demand across packaging, labeling, and industrial applications. Industry publications and company announcements have highlighted that the growing adoption of pressure-sensitive labeling solutions, particularly in food, beverages, and consumer goods, is a key factor shaping market demand. Poly-coated substrates have been widely preferred due to their durability, smoothness, and compatibility with multiple adhesives, making them an important component in labeling and packaging workflows.

The expansion of e-commerce and retail industries has further accelerated the use of labels, fueling consistent consumption of release liners. Additionally, sustainability initiatives and investments in recyclable and biodegradable liner technologies are reshaping the competitive landscape, with producers exploring eco-friendly coatings and fiber-based substrates.

Future growth is expected to be driven by advances in coating techniques, improved cost efficiency, and wider adoption of automated labeling systems across manufacturing facilities. Segmental leadership is projected to remain with poly-coated paper substrates, pressure-sensitive technologies, and label applications, reflecting their broad utility and strong alignment with evolving industry needs.

The poly-coated paper segment is projected to contribute 41.6% of the paper release liners market revenue in 2025, maintaining its dominant position in the substrate category. Growth in this segment has been underpinned by the superior performance of poly-coatings in providing moisture resistance, dimensional stability, and release uniformity. Manufacturers have preferred poly-coated substrates for their ability to enhance printability and adhesive compatibility, ensuring reliable performance in labeling processes.

Industry reports have indicated that poly-coated paper liners also support faster application speeds on automated labeling equipment, reducing downtime and increasing operational efficiency.

In addition, the balance of affordability and performance has made poly-coated paper a practical choice for high-volume applications across diverse end-use sectors. With ongoing innovations in recyclable coating formulations, the segment is expected to sustain growth while aligning with sustainability demands in global supply chains.

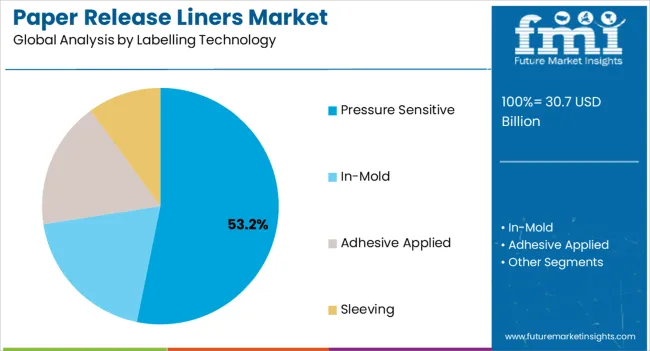

The pressure sensitive segment is projected to account for 53.2% of the paper release liners market revenue in 2025, representing the leading labeling technology. This segment’s growth has been driven by the versatility and ease of use of pressure-sensitive labels, which require no heat, solvent, or water for application. Market adoption has been particularly strong across consumer goods, logistics, and pharmaceuticals, where reliable adhesion and clean removability are critical.

Company reports and labeling industry updates have noted that pressure-sensitive technology supports high-speed production lines, offering flexibility across a range of substrates and packaging formats.

Furthermore, advancements in adhesives, including repositionable and biodegradable options, have expanded the appeal of pressure-sensitive labeling. The widespread acceptance of this technology in global packaging standards has ensured its continued dominance, making it the preferred choice for both large-scale industrial labeling and retail packaging solutions.

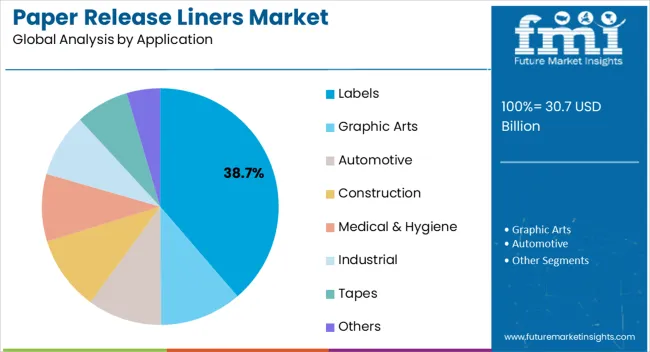

The labels segment is projected to hold 38.7% of the paper release liners market revenue in 2025, leading the application spectrum. Growth in this segment has been fueled by the expansion of consumer goods, pharmaceuticals, and e-commerce industries, all of which rely heavily on product identification and branding. Labels have remained essential for regulatory compliance, traceability, and marketing, driving consistent demand for release liners that ensure precision in adhesive performance.

Press releases and trade updates have highlighted increased investments in digital printing and variable data labeling, which have further raised the demand for high-quality release liners.

In addition, the growth of smart packaging and the integration of RFID and QR-coded labels have increased the technical requirements for reliable release liner substrates. The scalability of labels across multiple industries and the surge in packaging volumes have secured the application’s leading share, with future demand likely to be reinforced by automation and sustainability-driven label innovations.

The global demand for paper release liners increased at a CAGR of 3.1% during the forecast period between 2020 and 2025, reaching a total of USD 56.2 billion in 2035.

According to Future Market Insights, a market research and competitive intelligence provider, the paper release liners market was valued at USD 30.7 billion in 2025.

The rapid expansion of e-commerce has brought about significant changes in the way products are packaged, shipped, and received by consumers. In this evolving landscape, the role of packaging materials, including paper release liners, has become increasingly crucial in ensuring that products are well-protected, visually appealing, and capable of providing a positive unboxing experience for customers.

One of the challenges in e-commerce packaging is preventing adhesive labels, such as shipping labels or barcodes, from adhering to the actual product or its packaging. Paper release liners play a vital role in acting as a barrier between adhesive labels and the product itself. The liners have a special coating that prevents labels from sticking directly to the product or the package, thereby maintaining the product's integrity and aesthetics.

The unboxing experience is a critical touchpoint in the customer journey, especially for e-commerce customers who may not have the opportunity to physically interact with products before purchase. Paper release liners ensure that when customers receive their orders and open the packages, they can do so without any frustration or difficulty caused by labels sticking to the product. The seamless unboxing experience enhances customer satisfaction and contributes to positive brand perception.

In the digital age, where social media and online reviews can quickly amplify customer experiences, brands are increasingly focused on delivering memorable and share-worthy unboxing moments. Packaging that is easy to open, visually appealing, and free from adhesive label residue contributes to a positive and memorable unboxing experience, enhancing the brand's image and fostering customer loyalty.

Innovation in Labelling Technology is Likely to be Beneficial for Market Growth

In recent years, the field of labeling technology has experienced significant innovation, driven by the need for more efficient, sustainable, and cost-effective packaging solutions. The innovations have led to the development of thinner and more efficient release liners, which play a critical role in optimizing the labeling process, improving product performance, and reducing environmental impact.

Innovations in materials science and manufacturing processes have enabled the creation of thinner yet highly functional release liners. The advanced materials offer the same or even improved performance compared to traditional thicker liners. Thinner release liners retain their ability to prevent labels from sticking to the product, ensuring smooth label application and a seamless unboxing experience for consumers.

Thinner release liners are easier to handle and apply during the labeling process. Their reduced thickness allows for more precise and consistent label placement on products, resulting in a higher efficiency rate during labeling operations. The improved efficiency contributes to increased productivity in manufacturing and packaging facilities, ultimately reducing labor costs and production time.

Thinner release liners require fewer raw materials for production, resulting in reduced material usage and waste generation, which is particularly significant in the context of sustainability and environmental responsibility. Manufacturers, by using less material, can minimize their ecological footprint and contribute to the reduction of waste in landfills.

Shift to Digital Printing to Fuel the Market Growth

The advent of digital printing has significantly transformed the landscape of label production and packaging customization. The technological revolution has not only streamlined the label manufacturing process but also opened up a realm of possibilities for brands seeking highly customized, vibrant, and short-run label solutions. Paper release liners, in particular, have seamlessly integrated into this digital printing ecosystem, offering a range of benefits that cater to the evolving needs of modern packaging and labeling requirements.

Digital printing allows brands to create labels that are uniquely tailored to their products, promotions, or even individual consumers. The level of customization can include variable data printing, such as QR codes, barcodes, serialization, and personalized messages. Paper release liners enable this degree of flexibility by providing a stable and reliable substrate that interacts seamlessly with digital printing technologies.

Traditional printing methods often entail longer setup times and higher costs for short print runs. Digital printing eliminates these barriers, enabling on-demand label production with rapid turnaround times. Paper release liners complement this feature by accommodating the quick and efficient printing of labels for small batches, limited-time promotions, seasonal offerings, and special events.

Digital printing eliminates the need for expensive plates or cylinders required in conventional printing methods. The cost-saving advantage is particularly beneficial for small and medium-sized businesses that may have budget constraints. Paper release liners contribute to the overall cost-effectiveness of digital printing by providing a reliable and economical substrate.

By substrate, silicone-coated paper segment is estimated to be the leading segment at a CAGR of 6.4% during the forecast period.

Silicone-coated paper release liners are highly versatile and find applications in various industries such as labels, tapes, medical products, graphic arts, and industrial applications. Their ability to provide a consistent and controlled release of adhesives makes them a preferred choice for many packaging and labeling needs.

The label industry is a significant driver of the silicone-coated paper release liners market. The demand for high-quality and reliable release liners is on the rise, as labels continue to play a crucial role in branding, information dissemination, and consumer engagement. Silicone-coated paper meets these requirements by ensuring easy label release, even for intricate and detailed designs.

Pressure-sensitive adhesives (PSAs) are widely used in various industries due to their convenience and ease of use. Silicone-coated paper release liners are essential components in PSA applications as they allow for efficient and consistent release of adhesives, making them indispensable for industries like packaging, medical devices, automotive, and more.

The growth of e-commerce and online retail has led to increased demand for packaging materials, including labels and tapes. Silicone-coated paper release liners play a critical role in ensuring that labels and tapes can be easily applied and removed without any residue, enhancing the consumer experience.

By application, labels segment is estimated to be the leading segment at a CAGR of 6.4% during the forecast period.

The labeling industry is a significant driver of the paper release liners market, with labels being used extensively in various sectors such as consumer goods, pharmaceuticals, food and beverages, and logistics. The increasing demand for product identification, branding, and information dissemination is fueling the need for high-quality release liners to ensure smooth label application.

The consumer goods sector relies heavily on labels for product differentiation, information communication, and branding. Labels play a critical role in attracting consumers and providing essential details, whether it's food packaging, personal care products, household items, or electronics. Paper release liners are essential components in label production to ensure precise and residue-free application.

The booming e-commerce industry has led to an uptick in demand for labels used in shipping, logistics, and packaging. Labels help in tracking and identifying packages, ensuring efficient handling and delivery. The demand for labels and, consequently, paper release liners is on the rise, as e-commerce continues to expand globally.

In the pharmaceutical and healthcare sectors, labels are crucial for accurately conveying dosage instructions, safety information, and regulatory compliance. Paper release liners facilitate the precise application of these critical labels on various medical products, ensuring readability and adherence to industry standards.

As per FMI, Asia Pacific excluding Japan is estimated to continue dominating the global paper release liners during the forecast period 2025 to 2035

The demand for packaged and ready-to-eat food products is rapidly surging, with increasing working population and surging trend of single living across the Asia Pacific. Increasing availability of ready-to-cook packed and rising consumption of thermoformed container packed fresh products such as fruits and vegetables are augmenting the demand for labels and food quality stickers, which is, in turn, bolstering the sales of paper release liners in the market.

Automotive vehicle manufacturers are increasingly inclining toward using automotive adhesive tapes from conventional mechanical fasteners to cut down the production time, and costs, and reduce automobile weight. Accelerating demand for light-weight and fuel-efficient automotive vehicles, due to the growing fuel price, is anticipated to favor the paper release liners sales in the Asia Pacific excluding Japan market. The region is expected to hold a CAGR of 6.4% over the analysis period.

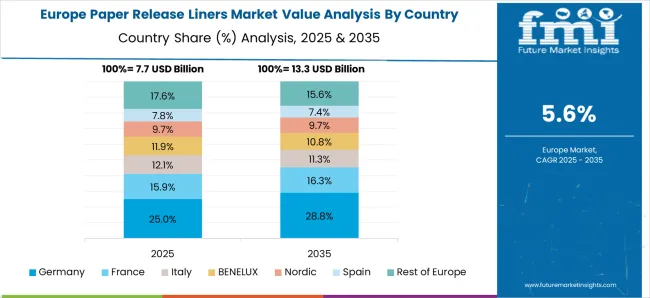

Future Market Insights reveals that Western Europe is projected to account for a significant share in the global paper release liners market between 2025 and 2035.

Demand for labels, tapes, and stickers is increasing at a rapid pace, owing to the increasing application across various industries such as medical, pharmaceuticals, personal care & cosmetics, construction, and automobiles among others, which, in addition to the ban on toxic plastics films such as PVC film across the European Union countries, is creating strong demand for paper release liners.

Leading players in the global market are emphasizing on launches novel products to cater to this increasing demand. For instance, in 2024, Mondi, a multinational packaging and paper group based in the United Kingdom announced introducing a new range of sustainable paper-based release liners, EverLiner, comprising liners manufactured from light-weight solutions and recycled paper.

A slew of such new product launches is expected to elevate the sales paper release liners in the Western Europe market. The region is expected to hold a CAGR of 6.3% over the analysis period.

Key players in the paper release liners market are strongly focusing on profit generation from their existing product portfolios along while exploring potential new applications. The players are emphasizing on increasing their paper release liners production capacities, to cater to the demand from numerous end use industries. Prominent players are also pushing for geographical expansion to decrease the dependency on imported paper release liners.

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for value and Tons for Volume |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; and Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel. |

| Key Segments Covered | Substrate, Labelling Technology, Application, and Region |

| Key Companies Profiled | Avery Dennison Corporation; Mondi Group; Fox River Associates, LLC; 3M; Loparex Holding B.V.; Gascogne Group; UPM; Rayven Inc.; Quanjiao Guangtai Adhesive Products Co. Ltd.; Elkem Silicones |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global paper release liners market is estimated to be valued at USD 30.7 billion in 2025.

The market size for the paper release liners market is projected to reach USD 56.2 billion by 2035.

The paper release liners market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in paper release liners market are poly-coated paper, silicone-coated paper and glassine, clay-coated paper.

In terms of labelling technology, pressure sensitive segment to command 53.2% share in the paper release liners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Silicone Release Liners Market Insights - Growth & Demand 2025 to 2035

PU Artificial Leather Release Paper Market Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA