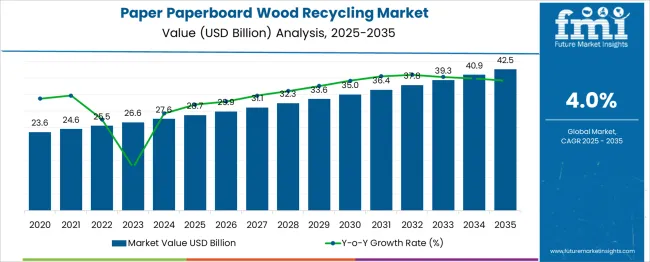

The Paper Paperboard Wood Recycling Market is estimated to be valued at USD 28.7 billion in 2025 and is projected to reach USD 42.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. The year-on-year (YoY) growth data reveal a steady and consistent expansion throughout the forecast period, reflecting stable demand within recycling and sustainable material sourcing.

Annual increases start at USD 1.2 billion between 2025 and 2026 and gradually rise to USD 1.6 billion in the final year between 2034 and 2035. This progression indicates incremental growth in the market’s value, averaging approximately 4.0% annually. The steady pace suggests that the market is characterized by gradual adoption of recycling processes and incremental capacity additions rather than sudden shifts or disruptions.

Between 2025 and 2030, the market grows from USD 28.7 billion to USD 35.0 billion, adding USD 6.3 billion in value. The yearly increments during this period range from USD 1.2 billion to USD 1.4 billion, indicating steady expansion supported by established recycling infrastructure and regulatory compliance in major markets.

From 2030 to 2035, the market adds USD 7.5 billion, with annual growth increasing slightly to between USD 1.5 billion and USD 1.6 billion. This reflects ongoing improvements in recycling technologies and expanding adoption in emerging regions. The consistent YoY growth suggests a stable market environment with predictable value creation, driven by steady advancements in recycling capabilities and material demand.

| Metric | Value |

|---|---|

| Paper Paperboard Wood Recycling Market Estimated Value in (2025 E) | USD 28.7 billion |

| Paper Paperboard Wood Recycling Market Forecast Value in (2035 F) | USD 42.5 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The paper, paperboard, and wood recycling market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.8% of the global waste management and recycling market, supported by efforts to recover valuable raw materials. Within the pulp and paper manufacturing industry, a share of approximately 3.5% is assessed as recycled fiber is increasingly used to reduce reliance on virgin pulp.

In the wood products and timber industry, around 2.6% is observed reflecting use of reclaimed wood in panels, furniture, and construction materials. Within the circular economy and resource recovery segment, about 3.1% is evaluated due to recycling’s role in reducing landfill volumes. In the packaging materials market, a contribution of roughly 2.9% is calculated given rising use of recycled paperboard in consumer goods and shipping applications.

Market development has been driven by regulatory measures, corporate sustainability commitments, and cost advantages of recycled inputs. Advancements have included improved sorting and de inking processes for paper, enhanced pulping technology for higher fiber yield, and wood treatment methods to extend usability of reclaimed material. Interest has been increasing in closed loop systems where packaging and construction waste is collected and reprocessed into new products.

The Asia Pacific region has been observed to lead growth in recycling capacity, while Europe maintains high collection rates supported by established infrastructure. Strategic initiatives have included collaborations between recyclers, packaging manufacturers, and retailers to secure supply chains for recovered fiber and wood, improve material quality, and expand use in high performance applications.

The paper paperboard wood recycling market is witnessing sustained expansion, driven by the global push for circular economy models and rising material recovery rates in industrial and packaging sectors. Regulatory mandates for landfill diversion, extended producer responsibility (EPR), and recycled content targets have accelerated the development of efficient collection and sorting systems.

Supply chain disruptions and rising costs of virgin pulp and timber are fueling demand for secondary raw materials. Technological advancements in de-inking, fiber separation, and contamination control have improved the commercial viability of recycling processes.

Additionally, industries are increasingly integrating recycled inputs into packaging, construction, and paperboard manufacturing to meet environmental commitments. Future growth is expected to be shaped by innovations in composite recovery, cross-sector partnerships, and digitized waste traceability.

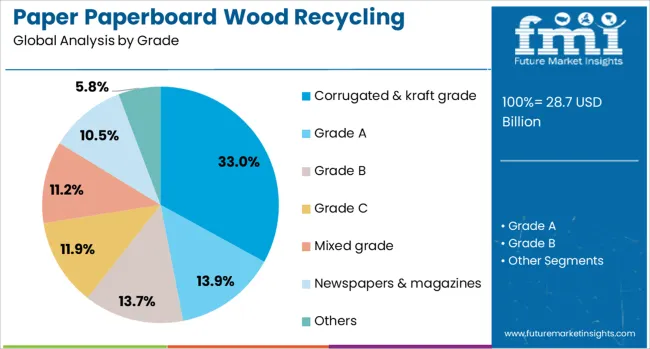

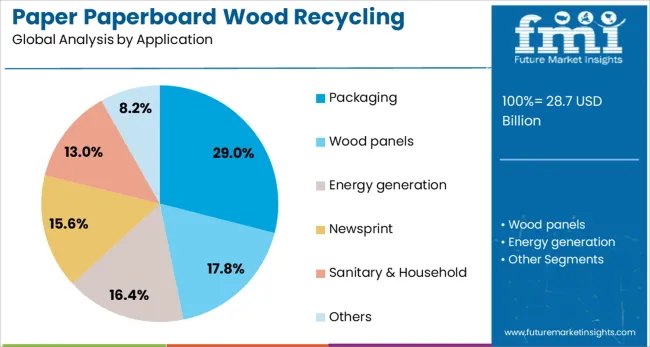

The paper paperboard wood recycling market is segmented by grade, application, and geographic regions. By grade of the paper, the paperboard wood recycling market is divided into Corrugated & Kraft grade, Grade A, Grade B, Grade C, Mixed grade, Newspapers & magazines, and Others. In terms of application of the paperboard wood recycling market, it is classified into Packaging, Wood panels, Energy generation, Newsprint, Sanitary & Household, and Others. Regionally, the paper paperboard wood recycling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Corrugated & kraft grade is projected to hold 33.0% of the market share in 2025, making it the dominant grade segment in the paper paperboard wood recycling industry. The segment’s growth is underpinned by surging demand for e-commerce packaging, retail logistics, and industrial shipping cartons, all of which rely heavily on corrugated board.

High fiber yield, ease of sorting, and strong resale value have made kraft and corrugated grades a priority for recovery operators. Their consistent availability through commercial waste streams and favorable mechanical properties for reprocessing have further enhanced their recycling attractiveness.

Strategic investments in baling, compression, and automation systems are optimizing throughput and profitability in this segment.

Packaging is expected to account for 29.0% of total revenue in 2025, making it the largest application area for paper paperboard wood recycling. Increased focus on sustainable packaging by brand owners, retailers, and regulators has elevated the role of recycled materials in primary and secondary packaging solutions.

Legislative pressures to reduce plastic content and incorporate recycled inputs are accelerating the substitution of virgin board with recycled paperboard. Packaging's high volume and standardized specifications make it ideal for large-scale recycled content integration.

Additionally, consumer preference for eco-friendly packaging is strengthening procurement pipelines for recycled feedstock, particularly in the FMCG, food, and industrial goods sectors.

The recycling of paper, paperboard, and wood has been an essential part of waste management and raw material recovery in packaging, printing, furniture, and construction industries. These processes have allowed used products to be reprocessed into pulp, particleboard, or other reusable materials, reducing dependence on virgin resources. Demand has been driven by the expansion of packaging production, rising waste generation, and the need to optimize material use in manufacturing. Recycling companies have invested in advanced sorting, cleaning, and processing technologies to improve recovery rates and product quality.

The packaging sector has been a major driver for recycled paper and paperboard due to its high consumption of raw fiber. Cardboard boxes, corrugated sheets, and folding cartons have been widely produced using recycled pulp to reduce manufacturing costs and meet regulatory requirements. E-commerce growth has increased packaging demand, leading to higher collection volumes of post-consumer cardboard. Many packaging manufacturers have entered long-term supply agreements with recycling plants to secure consistent material flow. The ability to blend recycled pulp with virgin fibers has allowed producers to maintain strength and print quality standards. In parallel, wood recycling has supplied particleboard and pallet manufacturing, meeting the needs of the logistics and construction industries.

Advances in pulping, fiber recovery, and contaminant removal have enhanced the quality and efficiency of recycling processes for paper, paperboard, and wood. Automated sorting systems using optical sensors and AI-based recognition have increased throughput while reducing manual labor requirements. Water-saving technologies in paper pulping have lowered operational costs and improved environmental performance. In wood recycling, shredding and screening equipment have been refined to produce cleaner feedstock for composite panel manufacturing. Chemical treatments have been developed to improve fiber strength in recycled paper, enabling broader application in high-performance packaging. These technological improvements have made recycled materials more competitive with virgin resources in both quality and cost-effectiveness.

The construction and furniture industries have been significant consumers of recycled wood for particleboard, medium-density fiberboard (MDF), and other engineered wood products. Demolition waste, offcuts from manufacturing, and end-of-life furniture have been collected and processed into usable feedstock. Recycled wood has been preferred for interior applications where surface finishes can hide imperfections. In addition to cost savings, consistent supply from recycling operations has supported large-scale manufacturing needs. The use of recycled wood in temporary site structures, pallets, and packaging crates has also expanded its demand base. These sectors have maintained steady consumption patterns, ensuring that wood recycling remains a critical part of the overall material recovery market.

Despite advancements, the paper, paperboard, and wood recycling market has faced challenges from inefficient collection systems, contamination, and fluctuating demand for recycled products. Mixed waste streams and poor sorting practices have reduced recovery yields and increased processing costs. In some regions, limited recycling infrastructure has resulted in low collection rates, particularly for wood waste. Contamination from adhesives, coatings, or food residues has lowered the quality of recovered fibers, restricting their use in premium applications. Additionally, price volatility for recycled materials has discouraged investment in new facilities. Without improved waste segregation, infrastructure expansion, and stable market incentives, recycling rates may remain below their potential.

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

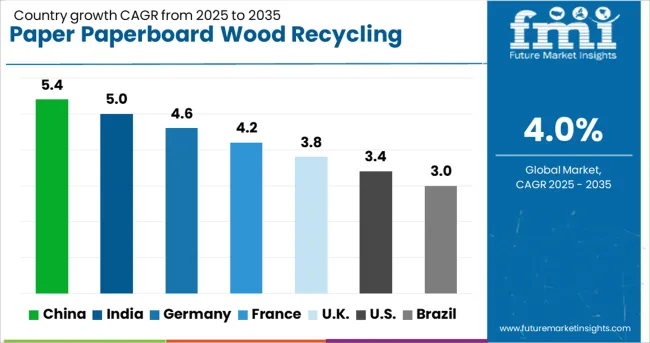

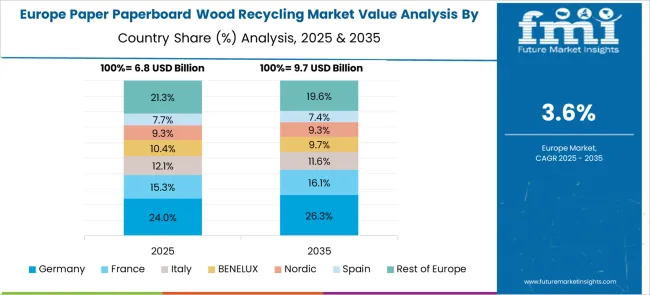

The paper, paperboard, and wood recycling market is expected to grow at a global CAGR of 4.0% between 2025 and 2035, driven by increasing demand for sustainable raw materials, waste reduction initiatives, and growth in packaging and construction sectors. China leads with a 5.4% CAGR, supported by large-scale recycling infrastructure and demand from paper manufacturing.

India follows at 5.0%, fueled by expanding packaging industries and government-led waste management programs. Germany, at 4.6%, benefits from advanced recycling technologies and strong circular economy policies. The UK, projected at 3.8%, sees steady adoption in sustainable construction and packaging sectors. The USA, at 3.4%, reflects stable demand from manufacturing and wood product recovery. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to register a CAGR of 5.4% from 2025 to 2035, driven by expanding packaging production and construction activities. Domestic recycling companies such as Nine Dragons Paper and Lee & Man Paper are investing in advanced sorting and pulping technologies to improve recovery rates from mixed waste streams. The push for higher recycled fiber content in packaging products has increased demand for both paperboard and recovered wood fiber. Partnerships with municipal waste management authorities are ensuring stable raw material supply for large-scale recycling facilities. Growth in e-commerce packaging waste has also added to the availability of recyclable paper-based materials in urban and industrial zones.

India is projected to grow at a CAGR of 5.0% from 2025 to 2035, supported by increasing recovery of packaging materials and construction sector wood waste. Major recyclers such as ITC Limited and West Coast Paper are upgrading plants with automated sorting lines to boost efficiency. Rising paperboard demand from the food service and FMCG sectors is driving higher collection rates of post-consumer packaging. Wood recycling from dismantled structures and furniture manufacturing waste is also gaining traction. Local government initiatives for waste segregation are improving the quality of collected materials, allowing manufacturers to produce higher-grade recycled products.

Germany is anticipated to post a CAGR of 4.6% from 2025 to 2035, with high recycling efficiency supported by advanced waste management infrastructure. Companies such as Stora Enso and DS Smith are enhancing their paperboard recycling operations through closed-loop systems that minimize fiber loss. Demand for recycled paperboard in premium packaging has remained strong, while recovered wood is increasingly used in engineered wood products. Municipal collection systems ensure high purity levels in recovered paper streams, reducing processing costs for recyclers. Integration of digital tracking systems in waste collection is further improving supply chain transparency.

The United Kingdom is projected to grow at a CAGR of 3.8% from 2025 to 2035, supported by rising demand for recycled packaging materials and sustainable construction practices. Recyclers like Smurfit Kappa UK and DS Smith are expanding capacities for paperboard recovery and processing. Wood recycling from demolition and refurbishment projects is feeding into particleboard and biomass fuel production. E-commerce-driven packaging waste continues to provide a steady supply of recyclable materials, while corporate procurement policies are increasingly specifying recycled content requirements.

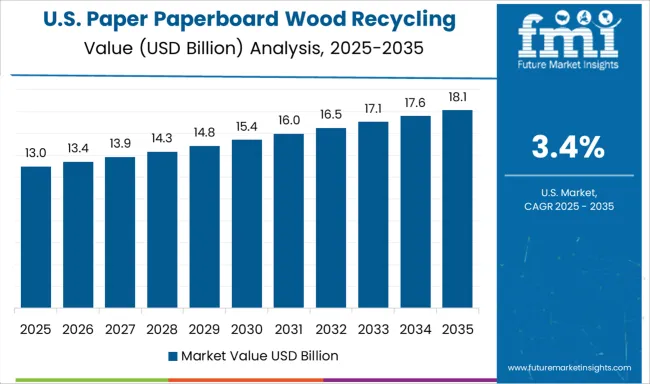

The United States is forecasted to achieve a CAGR of 3.4% from 2025 to 2035, with growth led by packaging, printing, and construction industries. Companies such as International Paper, WestRock, and Georgia-Pacific are expanding regional recycling networks to secure consistent feedstock supply. Innovations in pulping and deinking technologies are enabling higher recovery rates of post-consumer materials. Recovered wood from residential and commercial construction is increasingly processed into composite materials and bioenergy products. Demand from packaging producers for recycled paperboard is rising, particularly in food-grade applications where safe and clean recovered fiber is essential.

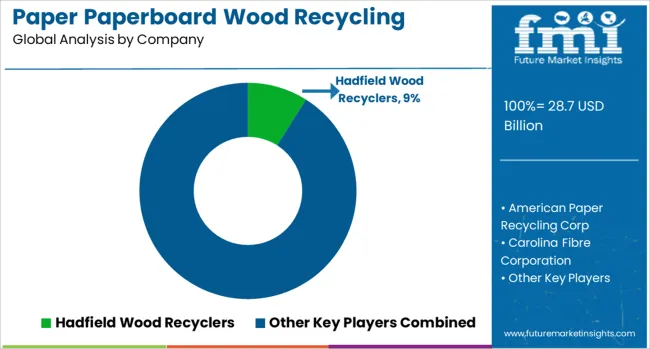

The paper, paperboard, and wood recycling market is driven by regional recycling specialists and waste management companies that collect, process, and supply recovered materials to paper mills, panel board manufacturers, and biomass energy producers. Hadfield Wood Recyclers leads in processing waste wood into panel board feedstock, animal bedding, and biofuel materials, serving both domestic and export markets. American Paper Recycling Corp focuses on large-scale collection and processing of recovered paper grades, supplying pulp and paper manufacturers across North America.

Carolina Fibre Corporation specializes in recycling corrugated containers, office paper, and mixed paper, maintaining strong supply relationships with regional mills. Evergreen Paper Recycling operates in both commercial and municipal collection, offering tailored recycling programs for businesses and institutions. Global Waste Recyclers Ltd provides integrated paper and wood recycling services, emphasizing material recovery efficiency and landfill diversion. Hanna Paper Recycling maintains a strong presence in the wholesale recovered fiber market, trading and processing high-volume paper grades.

Huron Paper Stock supplies both domestic and export markets with sorted and baled recovered fiber, supporting packaging and tissue manufacturing. Key strategies in this sector include expanding material recovery facilities, securing long-term supply contracts with industrial and municipal clients, and investing in sorting and shredding technologies to improve quality and consistency. Entry barriers include high transportation costs, commodity price fluctuations, and the need for strong relationships with downstream manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.7 Billion |

| Grade | Corrugated & kraft grade, Grade A, Grade B, Grade C, Mixed grade, Newspapers & magazines, and Others |

| Application | Packaging, Wood panels, Energy generation, Newsprint, Sanitary & Household, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hadfield Wood Recyclers, American Paper Recycling Corp, Carolina Fibre Corporation, Evergreen Paper Recycling, Global Waste Recyclers Ltd, Hanna Paper Recycling, and Huron Paper Stock |

| Additional Attributes | Dollar sales by recycled material type and end-use application, demand dynamics across packaging, newsprint/printing, sanitary household, wood panels, and energy-generation segments, regional trends in paper & paperboard vs wood recycling across North America, Europe, Asia-Pacific, and Latin America/Africa, innovation in AI/IoT-enabled sorting, advanced de-inking and fiber recovery systems, blockchain traceability and automated material recovery facilities, environmental impact of landfill diversion, energy & water savings, emissions reductions, and deforestation mitigation, and emerging use cases in circular packaging, recycled-content furniture & panels, bio-based insulation, and decentralized energy-from-waste systems. |

The global paper paperboard wood recycling market is estimated to be valued at USD 28.7 billion in 2025.

The market size for the paper paperboard wood recycling market is projected to reach USD 42.5 billion by 2035.

The paper paperboard wood recycling market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in paper paperboard wood recycling market are corrugated & kraft grade, grade a, grade b, grade c, mixed grade, newspapers & magazines and others.

In terms of application, packaging segment to command 29.0% share in the paper paperboard wood recycling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Paper Honeycomb Market Size and Share Forecast Outlook 2025 to 2035

Paper Goods Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA