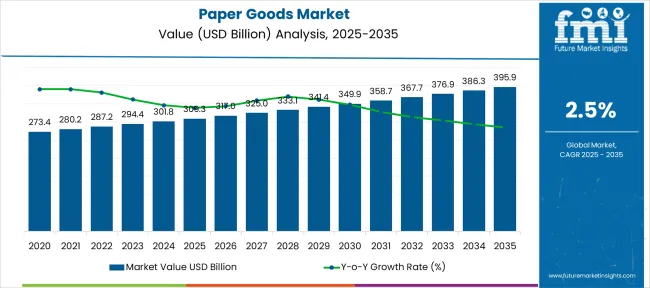

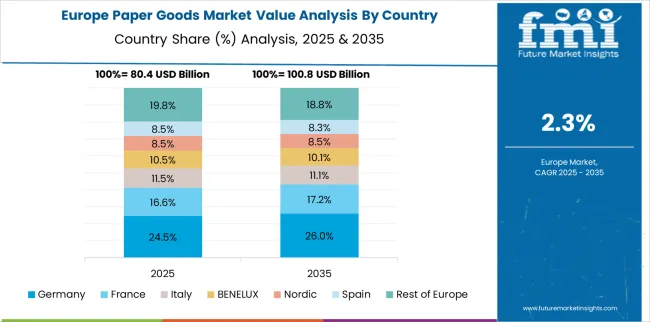

The Paper Goods Market is estimated to be valued at USD 309.3 billion in 2025 and is projected to reach USD 395.9 billion by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period. Regional growth imbalance in the paper goods industry is shaped by varying levels of consumption, production capacity, and regulatory landscapes. North America and Europe are projected to experience slower expansion due to mature demand patterns, recycling mandates, and digital substitution that reduces paper usage. In contrast, the Asia Pacific is set to record higher growth rates, driven by surging packaging requirements, rising hygiene awareness, and expanding e-commerce penetration. Latin America and parts of Africa will post moderate gains, constrained by infrastructure and affordability challenges. This imbalance reflects diverging consumer behavior, industrial expansion, and policy approaches, where emerging markets contribute disproportionately to volume growth while developed economies remain stable but relatively stagnant.

| Metric | Value |

|---|---|

| Paper Goods Market Estimated Value in (2025 E) | USD 309.3 billion |

| Paper Goods Market Forecast Value in (2035 F) | USD 395.9 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

The paper goods market is growing steadily, fueled by increasing consumer focus on hygiene and convenience. Rising awareness about personal and household cleanliness has driven demand for hygienic paper products. Product innovations offering enhanced softness, absorbency, and eco-friendly materials have attracted consumers seeking quality and sustainability.

Retail expansion and organized distribution networks have improved product availability, supporting wider adoption. Additionally, rising urbanization and changing lifestyles have contributed to increased consumption of disposable paper goods.

The market outlook remains positive as companies continue to introduce mid-priced options that balance affordability and quality, making products accessible to a broad consumer base. Segment growth is expected to be led by hygienic paper products, mid-range price offerings, and household end-use driven by daily consumer needs.

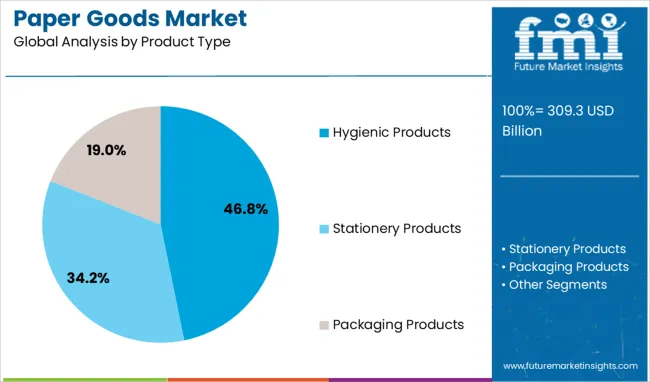

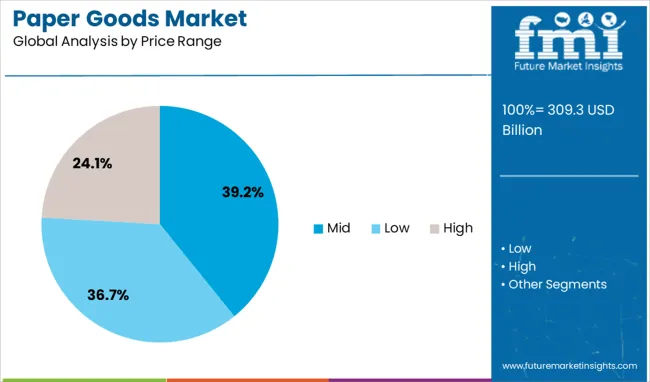

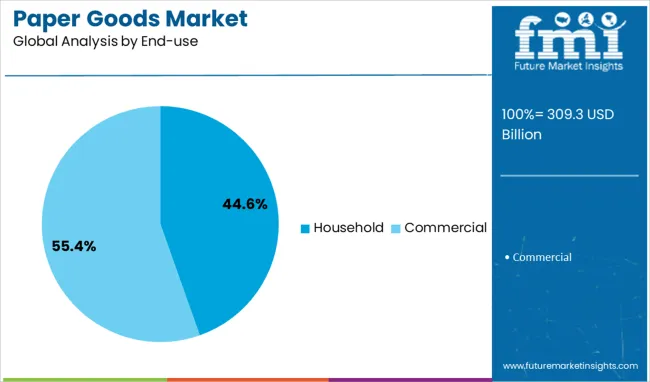

The paper goods market is segmented by product type, price range, end-use, distribution channel, and geographic regions. The paper goods market is divided by product type into Hygienic Products, Stationery Products, Packaging Products, and Others (Paper bags, etc.). The paper goods market is classified into Mid, Low, and High price ranges. The end-use of the paper goods market is segmented into Household and Commercial. The distribution channel of the paper goods market is segmented into Offline and Online. Regionally, the paper goods industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hygienic products segment is projected to hold 46.8% of the paper goods market revenue in 2025, establishing itself as the leading product category. This segment’s growth is attributed to the essential role these products play in personal and domestic hygiene. Consumer preference for tissue papers, napkins, and sanitary products that offer comfort and safety has driven sustained demand.

Product improvements in texture, strength, and biodegradability have enhanced their appeal. Increased focus on health and hygiene has made these products household staples, contributing to consistent consumption patterns.

As hygiene awareness continues to rise globally, the hygienic products segment is expected to maintain its leading position.

The mid-price range segment is expected to account for 39.2% of the paper goods market revenue in 2025, positioning itself as the preferred price category. This segment balances quality and affordability, making it attractive to a wide range of consumers. Mid-priced products often offer better materials and features compared to economy options without commanding premium prices.

Consumer purchasing behavior indicates strong acceptance of products in this price band, especially in emerging markets where price sensitivity coexists with quality demands.

Retailers have expanded shelf space for mid-range items, reflecting consumer demand. This price segment is likely to continue its growth as consumers seek value-driven choices.

The household segment is projected to contribute 44.6% of the paper goods market revenue in 2025, sustaining its dominance in end-use. Growth in this segment is driven by everyday consumer reliance on paper products for cleaning, hygiene, and convenience. Rising disposable incomes and growing urban populations have increased household spending on these products.

Additionally, the convenience offered by disposable paper goods aligns well with busy lifestyles and heightened cleanliness awareness.

Household consumers have shown a preference for reliable brands and mid-priced products that meet their daily needs effectively. The ongoing demand for hygienic and convenient paper goods ensures that the household segment remains central to market growth.

The paper goods market is gaining momentum as demand increases across e‑commerce packaging, hygiene paper, and stationery segments. Expansion is supported by higher consumption in Asia‑Pacific and recovery in packaging post‑2024 declines. Innovation in flexible formats for retail and disposable products is being seen. Yet cost pressures from pulp tariffs and recycling rate fluctuations remain challenging. Manufacturers focusing on scalable production lines and diverse supply chains are believed to be poised for competitive advantage through 2025 as demand for paper goods evolves globally with rising consumer and industrial use.

The market is being propelled by expanding e-commerce channels and increasing consumption of hygiene-grade paper. In 2024, corrugated boxes and protective mailer envelopes saw strong uptake across North America and Asia-Pacific, supporting last-mile logistics. Simultaneously, the tissue paper segment grew significantly as healthcare and hospitality sectors prioritized hygiene compliance. It is widely believed that these combined forces will continue to influence procurement, creating long-term opportunities for producers who offer high-strength packaging solutions and premium-quality hygiene paper suitable for industrial and residential end-use applications globally.

New opportunities are appearing in specialty and synthetic paper segments designed for durability and moisture resistance. In 2025, manufacturers introduced specialty grades for labeling, graphic media, and industrial liners targeting food packaging and healthcare applications. Synthetic paper, valued for tear resistance and extended usability, gained traction in outdoor signage and high-performance packaging. It is considered that producers capable of delivering customized, application-specific paper solutions will benefit from expanding demand in consumer goods and industrial supply chains, as premium functional characteristics become increasingly prioritized by end-users.

The market is moving toward integrated recycling systems to address environmental mandates and reduce dependency on virgin pulp sourcing. In 2024, manufacturers scaled investment in closed-loop fiber recovery programs to meet rising consumer preference for recycled-content packaging and tissue products. Automation in sorting and pulping facilities improved material quality and operational efficiency, reinforcing the value proposition of recycled formats. It is strongly believed that manufacturers aligning production strategies with high-recovery processes and cost-optimized circular systems will achieve superior market positioning in an increasingly competitive environment.

The paper goods market faces persistent challenges from pulp price volatility, tariff disputes, and transportation bottlenecks. In 2024, multiple producers reported margin erosion due to increased input costs linked to restricted fiber availability and fluctuating energy expenses. Trade-related disruptions further compounded the complexity of raw material procurement for large-scale converters. It is widely considered that companies lacking diversified sourcing arrangements or regional production footprints will encounter profitability constraints, particularly during periods of cyclical downturn in packaging demand and shifting global trade policies affecting supply chain reliability.

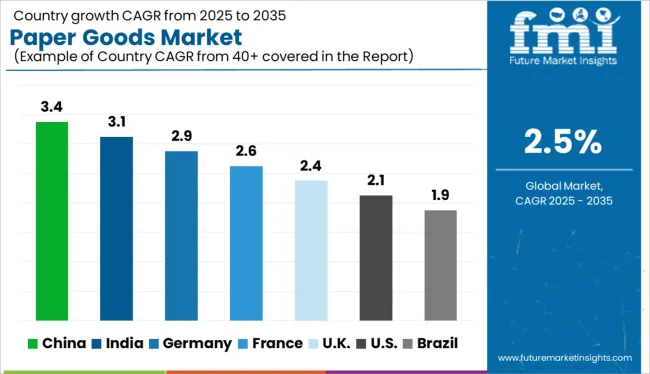

| Country | CAGR |

|---|---|

| China | 3.4% |

| India | 3.1% |

| Germany | 2.9% |

| France | 2.6% |

| UK | 2.4% |

| USA | 2.1% |

| Brazil | 1.9% |

The global paper goods market is projected to grow at a CAGR of 2.5% from 2025 to 2035. China leads with 3.4%, followed by India at 3.1% and Germany at 2.9%. France records 2.6%, while the United Kingdom posts 2.4%. Growth is supported by demand for eco-friendly packaging, tissue products, and specialty papers. China and India dominate due to large-scale packaging exports and rising hygiene product consumption, while Germany emphasizes high-quality paper for industrial and printing applications. France and the UK prioritize recyclable and biodegradable paper solutions aligned with green packaging regulations.

The paper goods market in China is projected to grow at 3.4%, driven by strong demand for consumer tissue products and sustainable packaging materials. Corrugated packaging dominates adoption in e-commerce and logistics sectors. Manufacturers invest in automation and recycling processes to meet environmental targets. Growing exports of paper-based packaging support the market’s expansion globally.

The paper goods market in India is forecast to grow at 3.1%, supported by growing demand for hygiene products and flexible packaging solutions. Kraft paper products dominate packaging for FMCG and retail sectors. Manufacturers introduce lightweight paperboard to reduce shipping costs. Government initiatives promoting sustainable materials drive industry transition toward eco-friendly paper products.

The paper goods market in Germany is expected to grow at 2.9%, driven by strong adoption of specialty paper for printing, industrial packaging, and premium stationery. Coated paper dominates usage in commercial printing and advertising. Manufacturers invest in digital printing compatibility to meet demand for customized designs. EU recycling directives further encourage production of recyclable paper-based goods.

The paper goods market in France is projected to grow at 2.6%, supported by strong adoption of biodegradable packaging for food and beverage sectors. Paperboard trays dominate usage in food retail and takeaway services. Manufacturers invest in water-resistant coatings for packaging durability. National policies to phase out single-use plastics accelerate transition to paper-based alternatives.

The paper goods market in the UK is projected to grow at 2.4%, driven by increased use of recycled paper in packaging and hygiene segments. Folding cartons dominate premium consumer goods packaging. Manufacturers develop high-strength paperboard for heavy-load applications. Demand for luxury and personalized packaging in e-commerce reinforces market growth in the country.

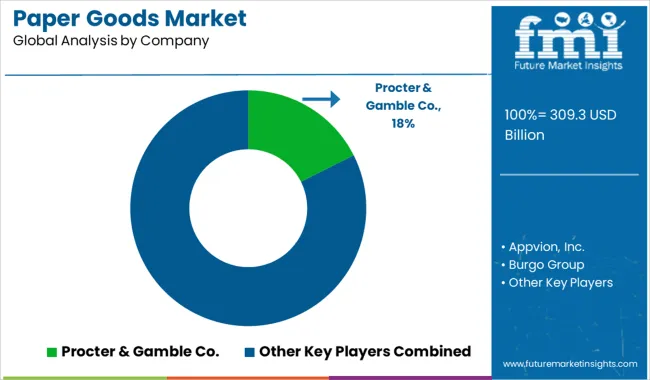

The paper goods market is moderately consolidated, with Procter & Gamble Co. recognized as a leading player due to its dominance in consumer paper products such as tissues, paper towels, and hygiene-focused items. The company’s emphasis on product innovation, strong brand equity, and extensive global distribution network reinforces its market leadership in both retail and institutional segments.

Key players include Appvion, Inc., Burgo Group, Essity AB, Fujifilm Holdings Corporation, Georgia-Pacific LLC, International Paper Company, Kimberly-Clark Corporation, Kruger Inc., Mondi Group, Renova, Sappi Limited, Smurfit Kappa Group, Stora Enso Oyj, and UPM-Kymmene Corporation. These companies offer a wide portfolio that spans tissue products, packaging materials, printing and writing papers, and specialty paper solutions for industrial and consumer needs.

Market growth is driven by the expanding demand for sustainable packaging, premium hygiene products, and high-performance specialty papers. Leading manufacturers are investing in fiber-based alternatives to plastics, water-resistant coatings, and recycled-content papers to address environmental concerns and regulatory compliance.

Digitalization in paper production and automated converting lines are improving operational efficiency and cost competitiveness. North America and Europe remain major markets due to established packaging and hygiene sectors, while Asia-Pacific shows the highest growth potential fueled by e-commerce expansion and increasing disposable incomes.

In April 2024, International Paper announced the acquisition of DS Smith for about £5.8 billion (~USD 7.2 billion) to strengthen its global leadership in sustainable packaging solutions. The transaction secured EU approval in early 2025, marking a major consolidation in the international paper and packaging industry landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 309.3 Billion |

| Product Type | Hygienic Products, Stationery Products, Packaging Products, and Others(Paper bags, etc.) |

| Price Range | Mid, Low, and High |

| End-use | Household and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble Co., Appvion, Inc., Burgo Group, Essity AB, Fujifilm Holdings Corporation, Georgia-Pacific LLC, International Paper Company, Kimberly-Clark Corporation, Kruger Inc., Mondi Group, Renova, Sappi Limited, Smurfit Kappa Group, Stora Enso Oyj, and UPM-Kymmene Corporation |

| Additional Attributes | Dollar sales segmented by product type (hygienic, stationery, packaging), distribution channel (offline, e-commerce), and material (virgin vs recycled). Regional demand strong in North America and Europe, with Asia-Pacific fastest growth. Innovations include biodegradable papers, specialty finishes, customizable designs, and integration with sustainable packaging and digital printing for industrial and consumer applications. |

The global paper goods market is estimated to be valued at USD 309.3 billion in 2025.

The market size for the paper goods market is projected to reach USD 395.9 billion by 2035.

The paper goods market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in paper goods market are hygienic products, toilet paper, facial tissues, paper towels, napkins, others, stationery products, news print, decorative paper, notebooks and books, others, packaging products, kraft paper, corrugated paper, coated paper, others and others(paper bags, etc.).

In terms of price range, mid segment to command 39.2% share in the paper goods market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA