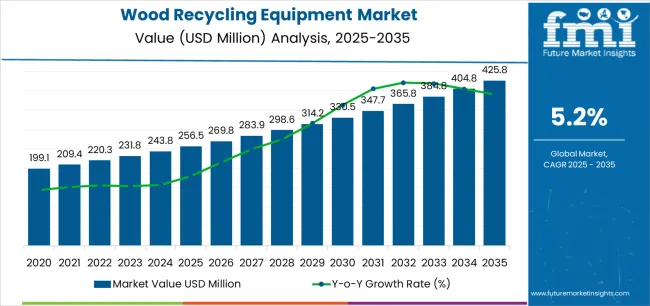

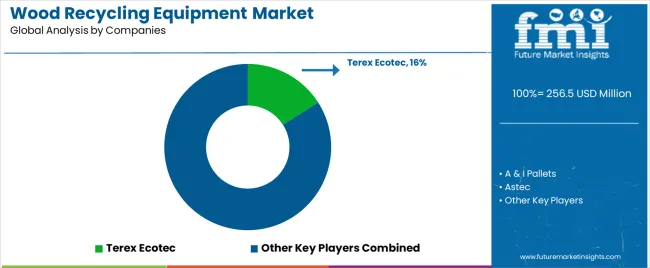

The global wood recycling equipment market is forecasted to reach USD 425.8 million by 2035, recording an absolute increase of USD 169.3 million over the forecast period. The market is valued at USD 256.5 million in 2025 and is set to rise at a CAGR of 5.2% during the assessment period. The overall market size is expected to grow by nearly 1.7 times during the same period, supported by increasing demand for waste management solutions and construction material recovery systems worldwide, driving demand for advanced shredding equipment and increasing investments in building materials processing and recycling applications globally. Limited processing capacity in developing markets and regulatory compliance challenges may pose obstacles to market expansion.

Wood recycling equipment encompasses specialized machinery designed for processing post-consumer and post-industrial wood waste into reusable materials through mechanical size reduction, contamination removal, and material separation technologies. These systems incorporate shredding, grinding, and chipping mechanisms that transform construction debris, furniture waste, and packaging materials into wood chips, biomass fuel, and raw materials for manufactured wood products. Modern equipment features advanced sorting capabilities utilizing magnetic separation, air classification, and optical detection systems to remove metal fasteners, plastic components, and other contaminants from wood waste streams.

Manufacturing processes require robust machinery capable of handling diverse wood waste compositions while maintaining consistent particle size distribution and quality specifications. Primary processing equipment includes waste wood shredders designed for high-volume throughput of construction and demolition materials, featuring hardened steel cutting chambers and replaceable wear components for extended operational life. Secondary processing systems incorporate waste wood grinders that produce specific particle sizes for biomass applications or engineered wood manufacturing, utilizing precision screening systems to achieve target size classifications.

Advanced equipment configurations integrate automated feeding systems, dust collection networks, and conveyor technologies that streamline material handling throughout processing operations. Variable speed drives enable operators to adjust processing parameters for different wood species and contamination levels while maintaining optimal energy efficiency. Safety systems incorporate emergency stop mechanisms, access interlocks, and fire suppression capabilities to protect personnel and equipment during hazardous material processing operations.

Quality control systems monitor particle size distribution, moisture content, and contamination levels throughout processing workflows to ensure end products meet specifications for biomass fuel production, particleboard manufacturing, or landscaping applications. Maintenance protocols focus on cutting edge replacement schedules, bearing lubrication programs, and wear component monitoring to minimize unplanned downtime and optimize equipment productivity across diverse processing environments.

Environmental considerations drive equipment design toward enclosed processing chambers, dust collection systems, and noise reduction technologies that enable installation in urban and industrial environments without violating local emission standards. Energy recovery systems capture waste heat from processing operations while integrated material handling reduces manual labor requirements and improves workplace safety standards across processing facilities.

Between 2025 and 2030, the market is projected to expand from USD 256.5 million to USD 334.7 million, resulting in a value increase of USD 78.2 million, which represents 46.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for construction waste processing and material recovery systems, product innovation in shredding technologies and separation equipment, as well as expanding integration with building materials manufacturing and biomass processing applications. Companies are establishing competitive positions through investment in advanced processing capabilities, automated handling technologies, and strategic market expansion across construction, furniture, and biomass applications.

From 2030 to 2035, the market is forecast to grow from USD 334.7 million to USD 425.8 million, adding another USD 91.1 million, which constitutes 53.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of automated processing applications, including advanced separation systems and integrated processing lines tailored for specific waste stream requirements, strategic collaborations between equipment manufacturers and waste management companies, and an enhanced focus on contamination removal capabilities and energy-efficient processing protocols. The growing focus on circular economy principles and material recovery technologies will drive demand for comprehensive wood recycling solutions across diverse processing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 256.5 million |

| Market Forecast Value (2035) | USD 425.8 million |

| Forecast CAGR (2025-2035) | 5.2% |

The wood recycling equipment market grows by enabling waste management companies and material processing facilities to optimize recovery operations while accessing specialized processing machinery without substantial in-house engineering infrastructure investment. Manufacturing companies and waste processing operators face mounting pressure to develop advanced material recovery systems and efficient processing solutions while managing complex contamination requirements, with high-performance shredding equipment typically providing 40-60% throughput enhancement compared to conventional processing alternatives, making advanced waste wood shredders essential for competitive market positioning. The waste management industry's need for contamination removal capabilities and application-specific processing technologies creates demand for comprehensive equipment solutions that can provide superior material recovery, maintain consistent quality standards, and ensure reliable operation without compromising processing efficiency or regulatory compliance.

Government initiatives promoting circular economy principles and construction waste diversion drive adoption in material recovery facilities, biomass processing operations, and manufacturing applications, where equipment performance has a direct impact on processing economics and long-term operational effectiveness. Complex contamination challenges during large-scale processing projects and the expertise requirements for equipment optimization may limit accessibility among smaller waste management companies and developing regions with limited technical infrastructure for advanced processing systems.

How do waste wood shredders by product and building materials applications by use contribute to the leading market share in the wood recycling equipment market?

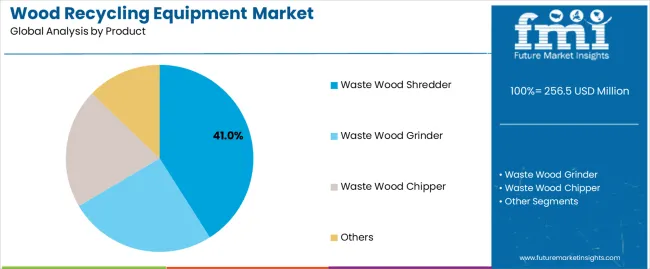

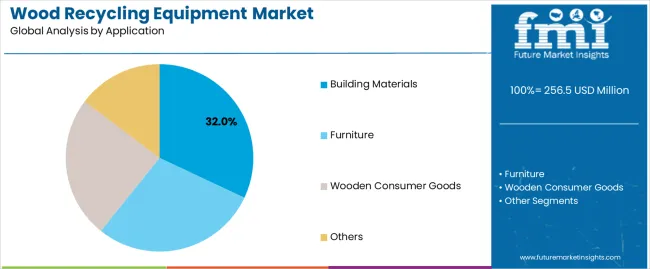

The market is segmented by product, application, and region. By product, the market is divided into waste wood shredder, waste wood grinder, waste wood chipper, and others. Based on application, the market is categorized into building materials, furniture, wooden consumer goods, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, and other key regions.

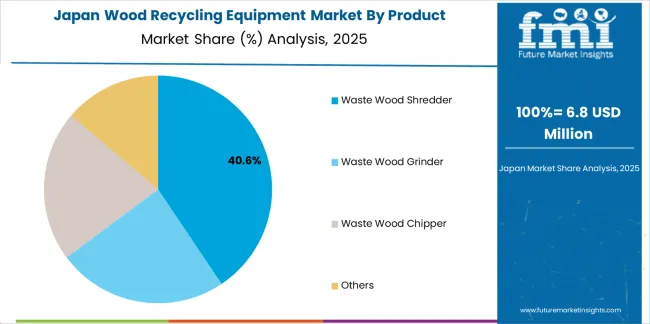

The waste wood shredder segment represents the dominant force in the market, capturing approximately 41.0% of total market share in 2025. This established product category encompasses solutions featuring advanced size reduction capabilities and specialized contamination removal applications, including high-performance cutting systems and enhanced durability characteristics that enable superior processing benefits and operational outcomes across all waste management applications. The waste wood shredder segment's market leadership stems from its proven processing capabilities, with solutions capable of addressing diverse material requirements while maintaining consistent quality standards and processing effectiveness across all operational environments.

Other product segments including waste wood grinders, waste wood chippers, and specialized processing equipment maintain substantial combined market share, serving applications that require specific processing characteristics with particular size reduction properties for targeted material recovery applications. These solutions offer advanced processing capabilities for complex waste streams while providing sufficient throughput capacity to meet demanding operational and quality requirements.

Key product advantages driving the waste wood shredder segment include:

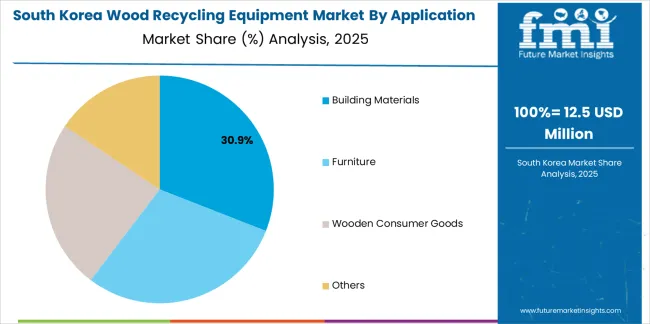

Building materials applications dominate the market with approximately 32.0% market share in 2025, reflecting the critical role of construction waste processing in supporting material recovery requirements and circular economy applications worldwide. The building materials segment's market leadership is reinforced by increasing construction activity trends, demolition waste complexity requirements, and rising needs for material recovery capabilities in construction applications across developed and emerging markets.

Furniture applications represent a significant segment, serving specialized requirements for post-consumer furniture processing, refurbishment operations, and material recovery purposes. This segment benefits from growing furniture replacement demand that requires specific processing requirements, quality standards, and material recovery optimization protocols in furniture markets.

The wooden consumer goods segment accounts for substantial market share, serving packaging waste processing, consumer product recovery, and specialized material applications across various processing sectors. Other applications capture remaining market share through diverse processing and specialty applications.

Key market dynamics supporting application growth include:

The market is driven by three concrete demand factors tied to waste management outcomes. First, construction waste generation and material recovery requirements create increasing demand for wood recycling equipment systems, with processing capacity demand growing 15-25% annually in major construction markets worldwide, requiring comprehensive processing infrastructure. Second, government initiatives promoting circular economy principles and waste diversion targets drive increased adoption of specialized wood processing equipment, with many countries implementing material recovery regulations and regulatory frameworks for waste management advancement by 2030. Third, technological advancements in contamination removal and automated processing enable more efficient and effective material recovery solutions that improve processing quality while reducing operational costs and handling complexity.

Market restraints include complex contamination handling requirements and validation costs for specialized processing platforms that can challenge market participants in developing compliant processing capabilities, particularly in regions where regulatory pathways for wood waste processing remain evolving and uncertain. Technical complexity of contamination removal systems and quality requirements pose another significant challenge, as wood recycling demands sophisticated separation methods and material controls, potentially affecting equipment costs and operational efficiency. Equipment capacity constraints from limited processing infrastructure across different regions create additional operational challenges for waste managers, demanding ongoing investment in facility development and equipment maintenance programs.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where construction activity expansion and waste generation drive comprehensive equipment adoption. Technology integration trends toward automated processing systems with enhanced contamination removal characteristics, advanced separation applications, and integrated handling solutions enable effective processing approaches that optimize material recovery and minimize quality risks. The market thesis could face disruption if significant advances in alternative processing technologies or major changes in waste management frameworks reduce reliance on traditional wood recycling equipment applications.

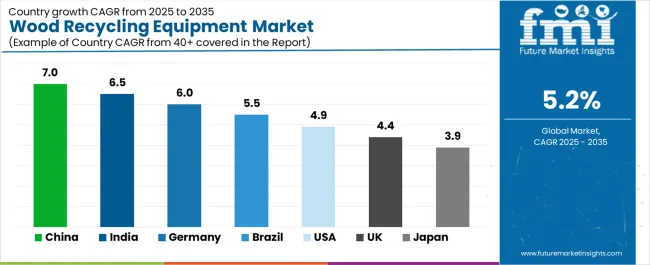

| Country | CAGR (%) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5 |

| U.S. | 4.9 |

| U.K. | 4.4 |

| Japan | 3.9 |

The global market is expanding steadily, with China leading at a 7.0% CAGR through 2035, driven by construction boom growth, infrastructure development programs, and expanding waste management platforms. India follows at 6.5%, supported by urbanization acceleration, large-scale construction projects, and material recovery initiatives. Germany records 6.0%, reflecting advanced waste management landscape with growing integration in circular economy and material processing systems. Brazil advances at 5.5%, leveraging construction sector growth. The U.S. grows at 4.9%, anchored by waste management regulations and material recovery awareness. The U.K. posts 4.4%, focusing on processing technology integration, while Japan grows at 3.9%, focusing equipment precision and processing excellence.

China demonstrates the strongest growth potential in the wood recycling equipment market with a CAGR of 7.0% through 2035. The country's leadership position stems from construction industry expansion, infrastructure development programs, and comprehensive waste management regulations driving the adoption of advanced wood processing solutions. Growth is concentrated in major construction and industrial centers, including Beijing, Shanghai, Guangzhou, and Shenzhen, where waste management companies and construction firms are implementing wood recycling systems for enhanced processing capabilities and material recovery performance. Distribution channels through equipment manufacturers and processing technology providers expand deployment across construction projects and industrial processing initiatives. The country's Ministry of Housing and Urban-Rural Development provides policy support for waste management modernization, including comprehensive processing capability development.

The Chinese market demonstrates significant processing demand across construction sectors, with building materials applications commanding dominant market share due to extensive construction and demolition activities. Equipment deployment focuses on high-capacity shredding systems capable of handling diverse construction waste streams while meeting environmental compliance requirements. Technology partnerships between international equipment manufacturers and domestic construction companies expand market reach through localized technical support and maintenance services.

Key market factors:

In major construction and industrial centers including Mumbai, Delhi, Bangalore, and Chennai, the adoption of comprehensive wood recycling solutions is accelerating across processing projects and waste management development initiatives, driven by urbanization scaling and government infrastructure programs. The market demonstrates strong growth momentum with a CAGR of 6.5% through 2035, linked to comprehensive construction sector modernization and increasing focus on material recovery solutions. Indian companies are implementing advanced processing equipment and handling platforms to enhance operational performance while meeting growing demand in expanding construction and furniture manufacturing sectors. The country's waste management development initiatives create continued demand for recycling equipment, while increasing focus on circular economy drives adoption of advanced processing systems.

Equipment requirements focus on versatile processing capabilities that can handle diverse wood waste compositions from construction, furniture, and packaging sectors. Market development emphasizes cost-effective solutions that provide reliable processing performance while meeting local operational and maintenance requirements. Technical support networks expand through partnerships between international manufacturers and domestic engineering companies.

Key development areas:

Germany's market expansion is driven by diverse waste management demand, including circular economy development in major cities and comprehensive processing projects across multiple regions. The country demonstrates strong growth potential with a CAGR of 6.0% through 2035, supported by established environmental regulations and industry-level processing development initiatives. German companies face implementation challenges related to technology complexity and integration requirements, requiring strategic development approaches and support from specialized equipment partners. Growing environmental consciousness and advanced processing requirements create compelling business cases for equipment adoption, particularly in material recovery areas where processing technologies have a direct impact on operational success and regulatory positioning.

The German market emphasizes precision processing technologies with advanced contamination removal capabilities and energy-efficient operation characteristics. Equipment integration focuses on automated systems that comply with strict environmental regulations while achieving high material recovery rates across diverse waste streams.

Market characteristics:

The Brazil market leads in South American processing innovation based on integration with construction systems and material recovery technologies for enhanced operational performance. The country shows strong potential with a CAGR of 5.5% through 2035, driven by the modernization of existing construction infrastructure and the expansion of advanced processing facilities in major industrial areas, including São Paulo, Rio de Janeiro, Minas Gerais, and Rio Grande do Sul. Brazilian companies are adopting intelligent processing systems for efficiency improvement and material recovery enhancement, particularly in regions with advanced construction requirements and applications demanding comprehensive technology upgrades. Technology deployment channels through established construction institutions and waste management operators expand coverage across processing facilities and development-focused applications.

Market development emphasizes equipment solutions that can handle tropical wood species and diverse construction materials common in Brazilian construction practices. Processing requirements focus on high-capacity systems capable of managing seasonal construction activity variations while maintaining consistent material quality output.

Leading market segments:

In major metropolitan and industrial areas, including California, Texas, Florida, and New York, processing facilities are implementing comprehensive wood recycling solutions to modernize existing waste management infrastructure and improve material recovery capabilities, with documented case studies showing a 50% improvement in processing efficiency through advanced equipment integration. The market shows strong growth potential with a CAGR of 4.9% through 2035, linked to the ongoing modernization of waste management facilities, processing networks, and emerging biomass projects in major regions. American companies are adopting intelligent processing and handling platforms to enhance facility reliability while maintaining standards demanded by the waste management and construction industries. The country's established technology infrastructure creates continued demand for equipment development and modernization solutions that integrate with existing processing systems.

Equipment deployment emphasizes advanced automation technologies with integrated contamination removal capabilities and predictive maintenance systems. Market development focuses on high-efficiency processing solutions that meet stringent environmental regulations while providing reliable operation across diverse operational environments.

Market development factors:

The U.K.'s wood recycling equipment market demonstrates advanced implementation focused on processing efficiency and waste management performance optimization, with documented integration of specialized equipment systems, achieving 40% improvement in material recovery across processing and construction facilities. The country maintains steady growth momentum with a CAGR of 4.4% through 2035, driven by processing facilities' focus on regulatory excellence and continuous operational methodologies that align with British environmental standards applied to equipment operations. Major processing areas, including England, Scotland, Wales, and Northern Ireland, showcase advanced deployment of recycling platforms where equipment systems integrate seamlessly with existing waste management infrastructure and comprehensive quality management programs.

The U.K. market demonstrates particular strength in contamination removal technologies, with processing facilities requiring advanced separation capabilities to meet stringent material quality standards. Regulatory compliance focuses on equipment systems that minimize environmental impact while maximizing material recovery rates across diverse waste streams.

Key market characteristics:

Japan's wood recycling equipment market demonstrates established and precision-focused landscape, characterized by growing integration of processing technology with existing waste management infrastructure across industrial projects, processing networks, and modernization initiatives. Japan's focus on quality excellence and processing precision drives demand for advanced equipment solutions that support comprehensive waste management initiatives and operational requirements in processing operations. The market benefits from partnerships between international equipment providers and domestic waste management leaders, creating service ecosystems that prioritize processing excellence and quality programs. Processing centers in major regions showcase developing equipment implementations where systems achieve efficiency improvements through integrated monitoring programs.

The Japanese market emphasizes compact, high-efficiency equipment designs suitable for space-constrained processing facilities while maintaining precise material separation capabilities. Technology development focuses on equipment systems that integrate seamlessly with existing processing infrastructure while meeting strict quality and environmental standards.

Key market characteristics:

The wood recycling equipment market in Europe is projected to grow from USD 51.3 million in 2025 to USD 85.2 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, projected to reach 29.2% by 2035, supported by its extensive waste management infrastructure, advanced processing facilities, and comprehensive equipment networks serving major European markets.

The United Kingdom follows with a 22.0% share in 2025, projected to reach 22.5% by 2035, driven by comprehensive processing programs in major industrial regions implementing advanced recycling systems. France holds an 18.5% share in 2025, expected to maintain 18.8% by 2035 through the ongoing development of processing facilities and waste management networks. Italy commands a 15.0% share, while Spain accounts for 12.0% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.0% to 4.0% by 2035, attributed to increasing equipment adoption in Nordic countries and emerging Eastern European processing facilities implementing waste management programs.

The Japanese market demonstrates a mature and precision-focused landscape, characterized by advanced integration of shredding technology with existing construction infrastructure across processing facilities, demolition networks, and material recovery initiatives. Japan's focus on quality excellence and precision manufacturing drives demand for high-reliability equipment solutions that support comprehensive construction waste initiatives and regulatory requirements in processing operations.

The market benefits from strong partnerships between international equipment providers and domestic construction leaders, including established waste management and demolition companies, creating comprehensive service ecosystems that prioritize equipment quality and technical precision programs. Processing centers in major industrial regions showcase advanced equipment implementations where shredding systems achieve contamination removal improvements through integrated monitoring programs.

The South Korean market is characterized by strong international equipment manufacturer presence, with companies maintaining dominant positions through comprehensive system integration and technical services capabilities for construction and waste management applications. The market is demonstrating a growing focus on localized technical support and rapid deployment capabilities, as Korean companies increasingly demand customized solutions that integrate with domestic construction infrastructure and advanced processing systems deployed across major industrial centers and waste management facilities.

Local construction companies and regional waste management integrators are gaining market share through strategic partnerships with global providers, offering specialized services including technical training programs and certification services for equipment specialists. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean construction specialists, creating hybrid service models that combine international processing expertise with local market knowledge and construction waste relationship management.

The market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 35-45% of global market share through established equipment portfolios and extensive waste management industry relationships. Competition centers on processing capability, equipment reliability, and technical expertise rather than price competition alone.

Market leaders include Terex Ecotec, A & I Pallets, and Astec, which maintain competitive advantages through comprehensive equipment portfolios, advanced processing capabilities, and deep expertise in the waste management and construction sectors, creating high switching costs for customers. These companies leverage established industry relationships and ongoing development partnerships to defend market positions while expanding into adjacent material recovery and biomass processing applications.

Challengers encompass TOMRA and Vecoplan, which compete through specialized sorting technologies and strong regional presence in key processing markets. Technology specialists, including Zhejiang Haigong Machinery, ThoYu, and Cresswood, focus on specific equipment applications or vertical markets, offering differentiated capabilities in processing systems, contamination removal applications, and application-specific handling.

Regional players and emerging equipment companies create competitive pressure through innovative processing approaches and rapid development capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in cost optimization and regulatory compliance. Market dynamics favor companies that combine advanced processing technologies with comprehensive waste management services that address the complete operational lifecycle from equipment installation through ongoing performance assurance and technical support.

Wood recycling equipment solutions represent critical processing machinery that enables waste management companies, construction firms, and material recovery facilities to enhance operational efficiency and material recovery without substantial ongoing equipment investment, typically providing 40-60% processing enhancement compared to conventional alternatives while ensuring unprecedented reliability and operational compliance. With the market projected to grow from USD 256.5 million in 2025 to USD 425.8 million by 2035 at a 5.2% CAGR, these solutions offer compelling advantages - superior processing capability, enhanced efficiency, and contamination removal capabilities - making them essential for building materials applications (32.0% market share), furniture processing operations, and diverse waste management applications seeking reliable equipment solutions. Scaling market penetration and processing capabilities requires coordinated action across waste management policy, processing standards, equipment providers, waste management companies, and construction institutions.

How Governments Could Spur Local Development and Adoption?

How Industry Bodies Could Support Market Development?

How Service Providers and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 256.5 million |

| Product | Waste Wood Shredder, Waste Wood Grinder, Waste Wood Chipper, Others |

| Application | Building Materials, Furniture, Wooden Consumer Goods, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Terex Ecotec, A & I Pallets, Astec, TOMRA, Vecoplan, Zhejiang Haigong Machinery, ThoYu, Cresswood, WEIMA, Chang Woen, Rawlings Manufacturing, HAAS Recycling-Systems, FOR REC, NM Heilig, Shred-Tech, Frontline Machinery, Dragon Machinery |

| Additional Attributes | Dollar sales by product and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with equipment providers and waste management companies, processing facility requirements and specifications, integration with construction initiatives and material recovery platforms. |

The global wood recycling equipment market is estimated to be valued at USD 256.5 million in 2025.

The market size for the wood recycling equipment market is projected to reach USD 425.8 million by 2035.

The wood recycling equipment market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in wood recycling equipment market are waste wood shredder, waste wood grinder, waste wood chipper and others.

In terms of application, building materials segment to command 32.0% share in the wood recycling equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood Plastic Composite Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Wood Pallets Market Trends – Innovations & Growth 2025 to 2035

Wood Based Panel Market Size and Share Forecast Outlook 2025 to 2035

Wood Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA