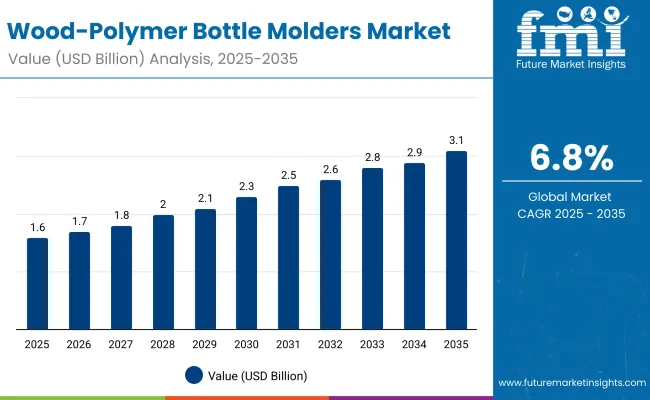

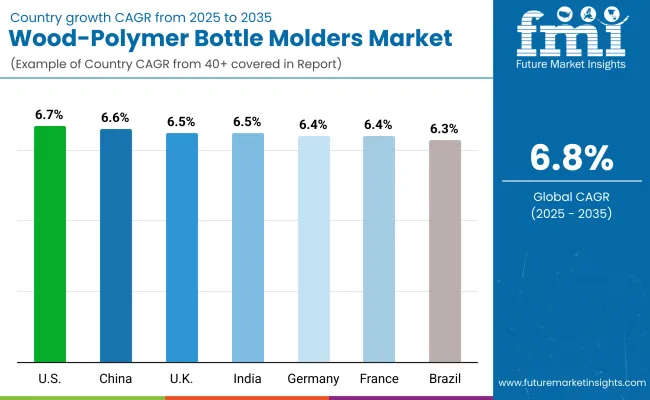

The global Wood-Polymer Bottle Molders Market will expand from USD 1.6 billion in 2025 to USD 3.1 billion by 2035 at a CAGR of 6.8%. Market growth is driven by the shift toward bio-based materials in bottle manufacturing and advances in molding technologies. Wood-polyethylene (Wood-PE) remains the primary material due to its high strength and recyclability. Between 2025 and 2030, Asia-Pacific’s adoption of renewable feedstocks and lightweight bottle production will add nearly USD 1 billion to market value. By 2035, integrated wood-fiber composites will redefine eco-packaging for drinks and personal care.

Between 2020 and 2024, wood-polymer composite technology advanced rapidly, reducing production costs and increasing durability. Sustainable packaging mandates from food and personal-care sectors accelerated adoption of wood-fiber bottles.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.6 billion |

| Forecast Value in (2035F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

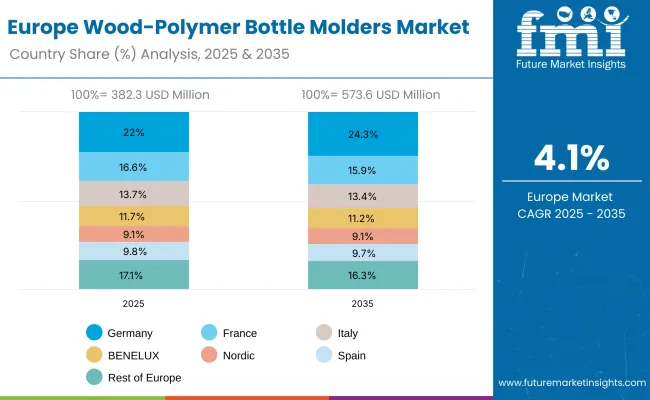

By 2035, the market will reach USD 3.1 billion, driven by bio-PE integration, automated molding lines, and lightweight composite formulations. Asia-Pacific leads with robust R&D in fiber reinforcement, while Europe focuses on regulatory compliance and closed-loop bottle recycling.

Growth is propelled by eco-conscious packaging policies and consumer shift toward biocomposites. Wood-polymer bottles offer durability with reduced carbon footprint. Advancements in blow molding and hybrid molding systems improve precision and production efficiency. Manufacturers increasingly invest in bio-based polymers for beverages and personal care, driving steady adoption globally.

The market is segmented by material, molding technology, bottle type, end-use industry, and region. Core materials include Wood-PE, Wood-PP, Wood-PLA, and Wood-PC. Primary molding methods cover blow, injection, and extrusion molding. Applications range from beverage and pharmaceutical bottles to industrial chemical containers across key regions worldwide.

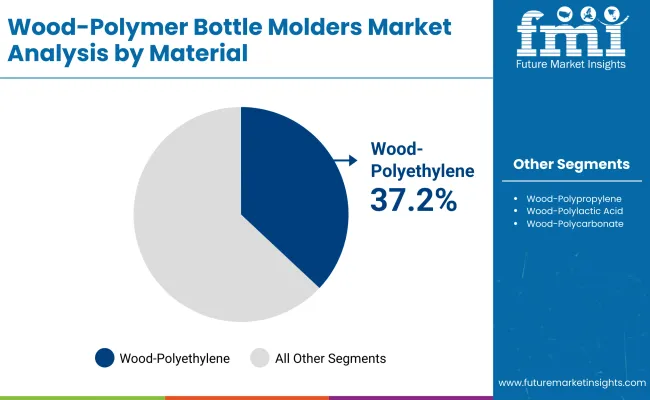

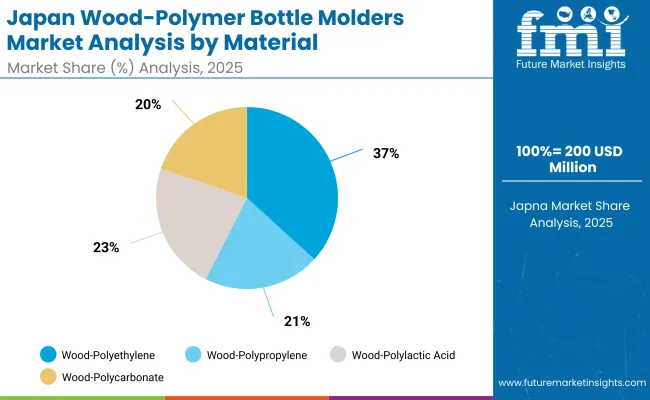

Wood-polyethylene (Wood-PE) is projected to hold 37.2% of the market in 2025, owing to its unique combination of flexibility, strength, and lightweight structure. This composite enables durable bottle molding while maintaining environmental benefits through partial bio-based content. It offers improved impact resistance and processability compared to conventional plastics.

By 2035, advancements in wood-fiber compounding and bio-PE resin technology will drive broader adoption across recyclable packaging applications. Its ability to support reduced carbon footprints and full recyclability aligns with global sustainability targets. As consumer brands accelerate eco-friendly packaging transitions, Wood-PE remains central to material innovation.

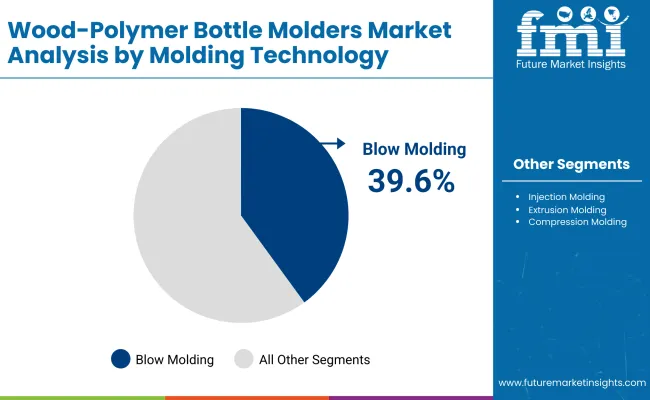

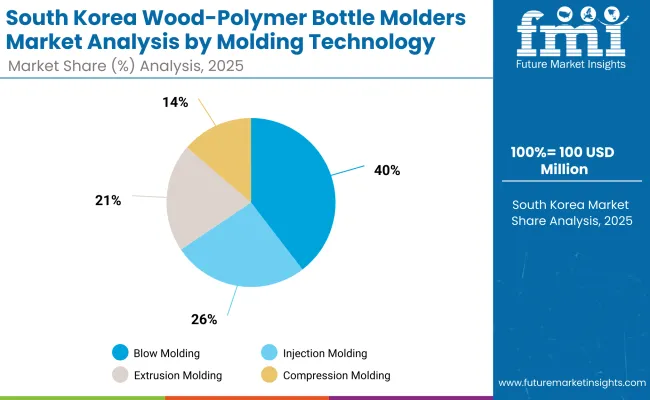

Blow molding is expected to represent 39.6% of the market in 2025, as it enables scalable, high-precision manufacturing of hollow wood-polymer bottles. This technology supports complex geometries and seamless surface finishes, making it ideal for food and beverage applications.

Future advancements in multi-layer extrusion and controlled temperature molding will further enhance barrier performance and visual appeal. As hybrid polymer technologies evolve, blow molding continues to provide cost-efficient and automated production solutions for eco-conscious bottle manufacturing.

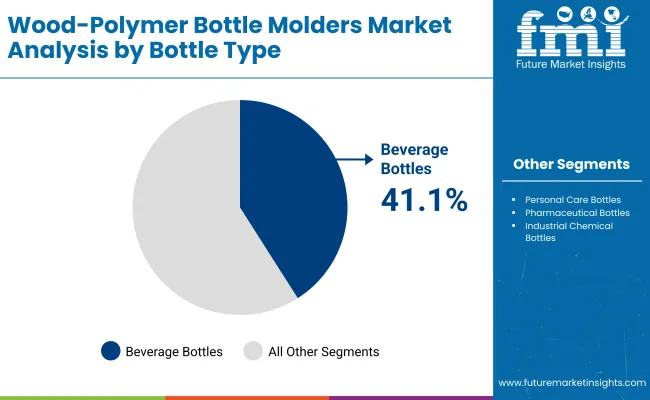

Beverage bottles are forecast to account for 41.1% of the market in 2025, reflecting rapid substitution of traditional plastics with wood-polymer alternatives. These bottles meet the beverage industry’s sustainability objectives while maintaining strength and shelf appeal.

By 2035, major global beverage brands are expected to shift toward wood-polymer formats that comply with eco-label and recyclability standards. Their ability to deliver lightweight, shatter-resistant designs makes them an attractive solution for carbon reduction across drink packaging lines.

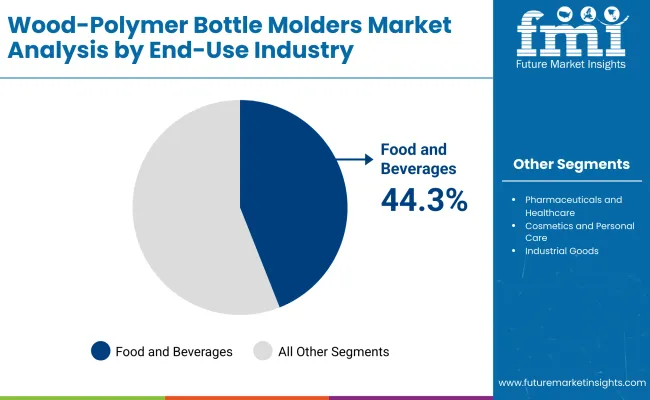

The food and beverage industry is projected to hold 44.3% of the market in 2025, driven by growing regulatory and consumer preference for recyclable, bio-composite packaging. Manufacturers are investing in wood-polymer bottle lines to replace single-use plastics in drink and condiment packaging.

By 2035, automated wood-fibermolding facilities will support large-scale commercialization across Asia and Europe. Rising adoption of renewable feedstocks and low-emission processes strengthens the sector’s commitment to sustainable packaging. This industry remains the principal driver of long-term market growth for wood-polymer bottle molding.

Sustainability mandates and consumer eco-awareness accelerate adoption of wood-polymer composites in bottle production.High material costs and limited supply of refined wood fibers may restrict scaling in developing markets.Innovation in bio-fillers, hybrid resins, and smart molding systems opens new growth avenues.Circular economy integration, energy-efficient molding equipment, and multi-layer bio-bottle design dominate R&D focus.

The global wood-polymer bottle molders market is expanding as sustainability, recyclability, and eco-packaging trends redefine the beverage and personal care industries. Asia-Pacific leads with large-scale production and technological advancements in bio-composites, while Europe focuses on circular material innovation and strict regulatory compliance. North America is increasingly investing in automation and premium sustainable designs. The combination of biopolymer engineering, precision molding, and renewable fiber sourcing is transforming global packaging toward a low-carbon future.

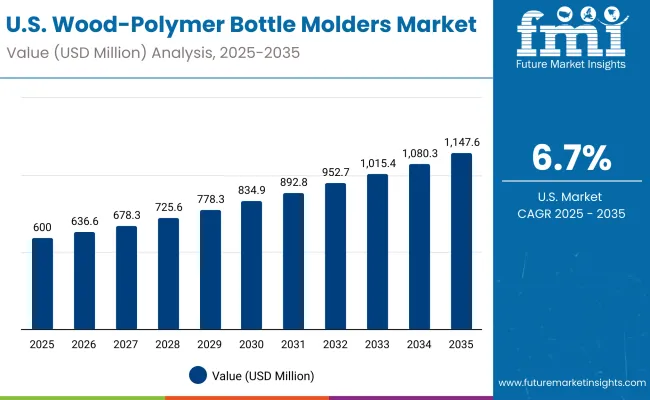

The USA will grow at 6.7% CAGR, driven by rising adoption of wood-polymer materials in premium beverage, cosmetic, and personal care packaging. Investments in biopolymer R&D are expanding as companies focus on sustainable alternatives to PET and glass. Luxury and niche brands are leading the transition to eco-conscious bottle designs with high aesthetic value. Increased automation and advanced extrusion molding are boosting domestic manufacturing efficiency and competitiveness.

Germany will expand at 6.4% CAGR, emphasizing circular material systems and closed-loop wood fiber recycling. Energy-efficient molding lines are being deployed across beverage and household packaging industries. EU-driven packaging reforms are encouraging bio-material adoption and innovation in fiber-based composites. The beverage sector is spearheading pilot projects to replace conventional polymers with hybrid, recyclable wood-polymer materials.

The UK will grow at 6.5% CAGR, supported by strong regulatory backing for recyclability and extended producer responsibility initiatives. Personal care and cosmetic brands are adopting wood-polymer bottles to align with plastic reduction goals. Entry of small manufacturers into the bio-bottle segment is enhancing local market diversity. Premium eco-packaging exports are rising, reinforcing the country’s presence in sustainable product manufacturing.

China will grow at 6.6% CAGR, driven by large-scale automation and domestic infrastructure for fiber processing. National efforts toward reducing plastic waste are encouraging beverage brands to adopt bio-based bottle designs. Localized production of wood-polymer blends is minimizing cost and improving scalability. Advanced molding automation is reducing material waste, enhancing precision, and supporting China’s leadership in global eco-packaging exports.

India will grow at 6.5% CAGR, supported by expanding FMCG and personal care packaging sectors. Government initiatives promoting eco-alternatives and biodegradable materials are stimulating demand for wood-polymer packaging. Small and medium enterprises are adopting affordable molding technologies to cater to regional markets. The utilization of locally sourced wood fibers is lowering material costs and decreasing dependency on imported biopolymers.

Japan will grow at 7.2% CAGR, leading innovation in high-precision molding and recyclable bio-composite materials. Collaborative R&D projects are advancing carbon-neutral bottle production using advanced fiber-polymer integration. Cosmetic and beverage brands are accelerating adoption of lightweight, durable bio-bottles. With strong environmental policies and material technology leadership, Japan remains a pioneer in sustainable packaging development.

South Korea will lead with 7.3% CAGR, emerging as a hub for premium and smart wood-polymer bottle solutions. Advanced automation and high-speed molding integration are elevating production quality and output. The country’s export-oriented manufacturers are scaling regional supply of eco-packaging technologies. Circular recycling frameworks are being implemented to recover and reuse wood-polymer bottle materials efficiently.

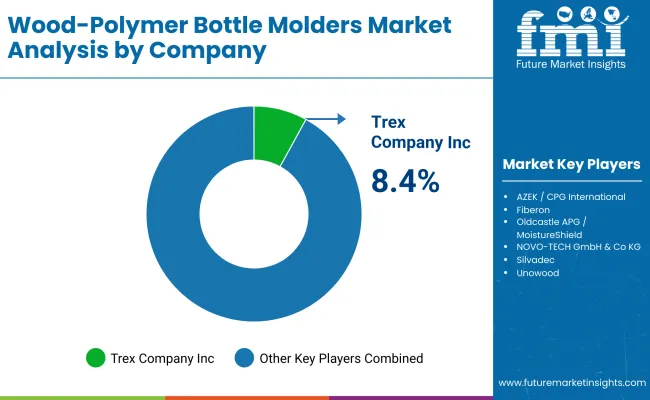

The market is moderately consolidated with Trex Company, AZEK/CPD, UFP Industries, Fiberon, Oldcastle Innovations, NOVO-TECH, Silvadec, Unowood, Eurodeck, and Green Dot Bioplastics as key participants. Trex and AZEK lead with advanced molding lines for bio-composite packaging. Asian players such as Silvadec and Unowood expand low-cost production for regional markets.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| By Material | Wood-PE, Wood-PP, Wood-PLA, Wood-PC, Composite Biomaterials |

| By Molding Technology | Blow, Injection, Extrusion, Compression |

| By Bottle Type | Beverage, Personal Care, Pharmaceutical, Industrial |

| By End-Use Industry | Food & Beverages, Pharmaceuticals, Cosmetics, Industrial |

| Key Companies Profiled | Trex, AZEK/CPD, UFP Industries, Fiberon, Oldcastle, NOVO-TECH, Silvadec, Unowood, Eurodeck, Green Dot Bioplastics |

| Additional Attributes | Growth driven by bio-composite integration, automation in bottle molding, and eco-regulatory advances. |

The Wood-Polymer Bottle Molders Market is valued at USD 1.6 billion in 2025.

The Wood-Polymer Bottle Molders Market will reach USD 3.1 billion by 2035.

The market is expected to grow at a CAGR of 6.8%.

Wood-Polyethylene (Wood-PE) leads with a 37.2% share in 2025.

Blow Molding dominates with a 39.6% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Bottle Pourers Market

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA