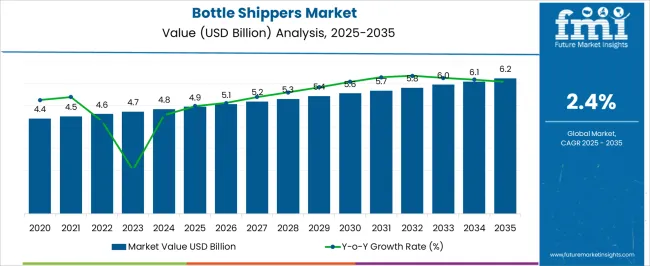

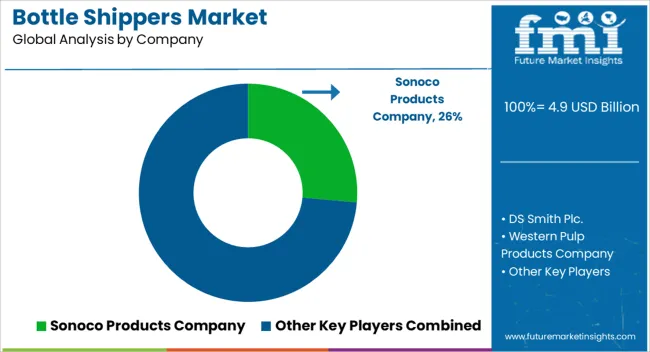

The Bottle Shippers Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 6.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.4% over the forecast period.

| Metric | Value |

|---|---|

| Bottle Shippers Market Estimated Value in (2025 E) | USD 4.9 billion |

| Bottle Shippers Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 2.4% |

The Bottle Shippers market is experiencing steady growth due to increasing demand for secure and efficient packaging solutions in the beverage, dairy, and pharmaceutical sectors. Current market dynamics are shaped by the need for lightweight, cost-effective, and environmentally friendly shipping options that ensure product safety during transit. Growth is being driven by the rising adoption of e-commerce platforms and direct-to-consumer distribution models, which require reliable packaging to prevent damage and contamination.

The shift toward sustainability is encouraging the use of recyclable and biodegradable materials, while manufacturers are focusing on enhancing structural strength and ease of handling. Investments in automation and supply chain optimization are facilitating faster production and deployment of bottle shippers, enabling businesses to meet increasing consumer demand efficiently.

With global consumption of beverages and dairy products rising, coupled with stricter logistics and safety regulations, the market is expected to witness continued growth Future opportunities lie in developing innovative designs that maximize load capacity, minimize material usage, and integrate tracking or anti-tamper features to enhance security and traceability across the supply chain.

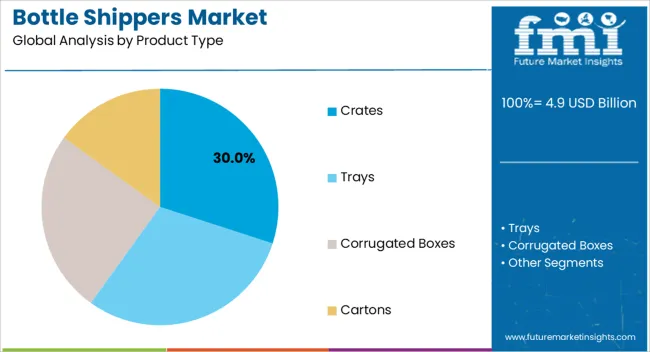

The Crates product type is projected to hold 30.0% of the Bottle Shippers market revenue in 2025, making it the leading product type. This position is being attributed to the inherent durability and reusability of crates, which provide superior protection for bottles during storage and transport. Adoption has been reinforced by their ability to accommodate multiple bottle sizes and designs without compromising stability, allowing for flexible packaging solutions across various industries.

Crates are preferred in commercial distribution and logistics operations due to their stackability, ease of handling, and compatibility with automated handling systems. Additionally, the ability to clean and reuse crates contributes to cost efficiency and sustainability goals, making them an attractive choice for environmentally conscious manufacturers.

The demand is further supported by growing regulatory emphasis on minimizing product damage and ensuring hygiene in the supply chain As companies continue to prioritize operational efficiency and sustainability, crates are expected to maintain their leadership within the product type segment.

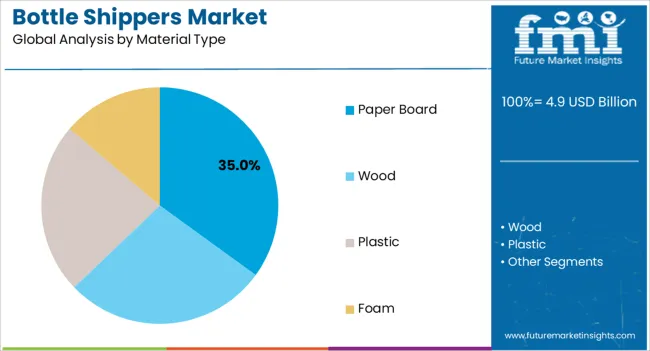

The Paper Board material segment is expected to capture 35.0% of the Bottle Shippers market revenue in 2025, reflecting its dominant role in the packaging landscape. This growth is being driven by the material’s recyclability, lightweight nature, and cost-effectiveness, which align with both environmental sustainability and logistical efficiency requirements. Paper board provides adequate strength and cushioning for bottle protection, particularly for short to medium-distance transportation, while allowing customization in printing and branding for marketing purposes.

The adoption of paper board has been facilitated by the increasing focus on eco-friendly packaging initiatives, where companies are under pressure to reduce plastic usage and carbon footprint. Additionally, manufacturing processes for paper board shippers have become more scalable and automated, enabling high-volume production with consistent quality.

The segment’s expansion is further reinforced by increasing demand in commercial distribution channels and retail sectors, where lightweight and easily recyclable packaging solutions are favored Continued innovation in reinforced paper board designs and coatings is expected to enhance its competitiveness and support ongoing market growth.

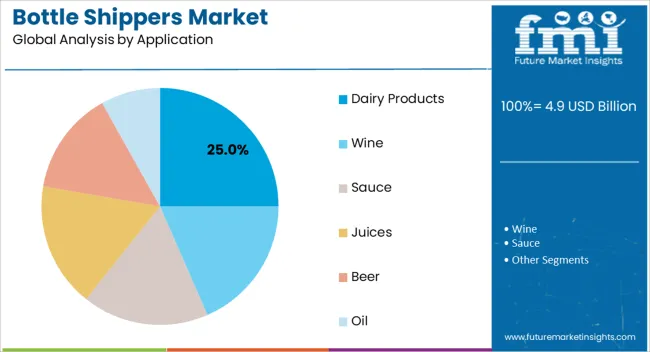

The Dairy Products application segment is anticipated to hold 25.0% of the Bottle Shippers market revenue in 2025, positioning it as the leading end-use segment. This growth is being driven by the need for safe and hygienic transport of perishable liquids such as milk, yogurt, and other dairy beverages. The segment has benefited from the rising consumption of packaged dairy products globally, as well as the expansion of refrigerated logistics networks that require reliable and sturdy packaging solutions.

Software-defined crate and paper board systems have enabled precise protection against temperature fluctuations, leakage, and breakage during transit. Additionally, increasing consumer preference for convenience and ready-to-use packaging formats has reinforced the adoption of specialized bottle shippers in this sector.

Regulatory requirements for food safety and traceability further support the use of standardized packaging solutions that can be easily sanitized and monitored As dairy production scales up to meet global demand, the reliance on robust, cost-efficient, and sustainable shipping solutions is expected to drive continued growth of this application segment.

The global demand for bottle shippers is projected to increase at a CAGR of 1.2% during the forecast period between 2020 and 2025, reaching a total of USD 6.2.0 billion in 2035.

According to Future Market Insights, a market research and competitive intelligence provider, the bottle shippers market was valued at USD 4.9.2 billion in 2025.

The focus on sustainable packaging has emerged as a significant driver in the beverage industry, including the demand for environmentally friendly bottle shippers. Consumers are increasingly aware of the environmental impact of packaging materials, leading them to seek products from brands that prioritize sustainability and take proactive steps to reduce their carbon footprint. The growing awareness has created a shift in consumer preferences, and businesses are responding by adopting sustainable practices in their packaging choices.

Consumers are demanding products that align with their values, with greater access to information and heightened awareness of environmental issues. Sustainable packaging, including recyclable and biodegradable bottle shippers, resonates with eco-conscious consumers who seek to minimize their ecological footprint.

Companies are increasingly incorporating sustainability into their corporate social responsibility initiatives. Businesses can showcase their commitment to environmental stewardship and contribute to a positive brand image, by choosing sustainable packaging materials.

Governments worldwide are implementing stricter regulations on packaging materials to address the growing plastic waste problem. Sustainable packaging solutions, such as recyclable and biodegradable bottle shippers, enable companies to comply with these regulations and demonstrate their dedication to responsible practices.

Advancements in Packaging Technology is Likely to be Beneficial for Market Growth

Advancements in packaging technology have significantly impacted the design and functionality of bottle shippers, resulting in more efficient, protective, and reliable packaging solutions. Innovations in cushioning materials, design elements, and closures have been instrumental in ensuring safer transportation of bottles and minimizing product damage during transit.

Packaging technology has introduced advanced cushioning materials that provide better protection to bottles during transit. Materials such as foam inserts, air pillows, molded pulp, and corrugated dividers are designed to absorb shocks and vibrations, reducing the risk of breakage or leakage.

Packaging engineers have developed impact-resistant bottle shipper designs that take into account the fragile nature of glass and other bottle materials. Bottle shippers can withstand external forces and maintain the integrity of the bottles inside, by incorporating specific structural features and reinforcements.

Advanced packaging technology allows for customization based on the specific shape and size of bottles. The flexibility ensures that the bottle shippers provide a snug fit and minimize movement during transit, thereby reducing the potential for collision and breakage.

Growth of Craft Beverages to Fuel the Market Growth

The growth of craft beverages, including craft beers, artisanal spirits, and small-batch wines, has been a significant trend in the beverage industry in recent years. Craft beverages are characterized by their high-quality ingredients, unique flavors, and the artistry of their production, which appeals to a niche and discerning consumer base. The demand for specialized bottle shippers has also risen to cater to the unique packaging requirements of these premium products, as these craft beverages gain popularity.

Craft beverages often come in unique bottle sizes and shapes that differ from standard commercial bottles. Specialized bottle shippers are designed to accommodate these non-traditional dimensions, ensuring a snug fit and optimal protection during transit.

Craft beverages typically feature artistic labeling and branding that reflects the creativity and individuality of the product. Specialized bottle shippers may incorporate clear windows or custom printing to showcase the label artwork, enhancing the presentation and brand identity during transportation.

Craft beverages are often packaged in premium bottles with unique finishes, such as embossing or etching, that require extra protection during shipping. Specialized bottle shippers use high-quality materials and cushioning to safeguard these premium bottles from damage.

Craft beverages are often produced in small batches, making them limited-edition products with a higher perceived value. Specialized bottle shippers may be designed to cater to smaller production volumes, offering more flexible packaging solutions.

Corrugated Boxes to Take the Lion’s Share

The corrugated boxes are expected to be the major segment that will boost the growth of the market. Corrugated boxes offer high flexibility and customization in design, size, and shape, making them suitable for packaging bottles of various types and dimensions. The versatility attracts beverage manufacturers and retailers seeking tailored packaging solutions.

The boxes are relatively cost-effective compared to other packaging materials. They provide a cost-efficient option for transporting bottles in bulk, making them appealing to businesses aiming to optimize their supply chain costs. The corrugated boxes are designed with multiple layers of durable corrugated material, providing excellent protection and cushioning for bottles during transit. The protective feature is crucial in ensuring that fragile bottles remain intact and undamaged during shipping. The segment is expected to hold a CAGR of 2.4% during the forecast period.

Wine to Take the Lion’s Share

The wine segment under the application generates heavy demand for bottle shippers. The global wine industry has been experiencing steady growth, with an increasing number of consumers enjoying wines from various regions. The demand for reliable and secure bottle shippers to transport wine bottles safely to consumers is expected to rise, as the wine market expands.

There is a growing trend of premiumization in the wine market, with consumers willing to pay more for high-quality and unique wines. Premium wines often come in delicate and aesthetically pleasing bottles, requiring specialized bottle shippers to ensure their protection during transportation. The rise of e-commerce and direct-to-consumer sales of wine has created a need for robust packaging solutions. Wine bottles shipped directly to consumers must be well-protected to avoid damage and leaks during transit, making the use of secure bottle shippers essential. The segment is expected to hold a CAGR of 2.4% during the forecast period.

Increasing Demand for Spirits to Boost the Market Growth

Asia Pacific is set to remain at the forefront in the assessment period in terms of the bottle shippers' market share. The growth is mainly attributed to China, which is considered to be one of the most significant consumers of alcoholic beverages.

The high demand for spirits, imported beer, wine, and the Chinese rice liquor ‘Baijiu’ is expected to bode well for the market. The rising consumption of alcohol in Asia Pacific, on the other hand, backed by the need to facilitate social interaction and relieve stress is anticipated to drive the market. The region is expected to hold a CAGR of 2.4% over the analysis period.

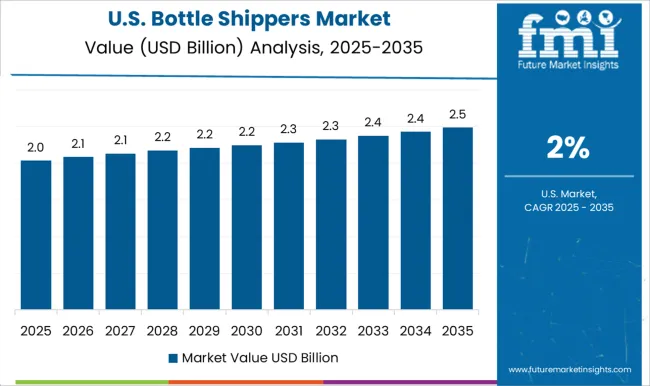

Increasing Awareness About Alcoholic Products to Boost the Market Growth

The increasing awareness about differentiating various alcoholic products among manufacturers based on their packaging is likely to boost the North American bottle shippers' market growth in the future years. The increasing focus of several United States-based manufacturers on the development of state-of-the-art, as well as relatively low-cost packaging solutions, such as bottle shippers is another crucial factor that is anticipated to fuel the regional market. The region is expected to hold a CAGR of 2.3% over the analysis period.

The increasing usage of shippers for the efficient transportation of non-alcoholic and alcoholic beverages is set to surge across North America, even though these shippers take more storage space, as compared to other packaging solutions. The easy availability of numerous customizable solutions for brand owners is likely to help in expanding the market foothold of United States-based companies.

Bottle shippers market startup players are adopting various marketing strategies such as new product launches, geographical expansion, merger and acquisitions, partnerships and collaboration to create a larger customer base. For instance,

Key players in the bottle shippers market are strongly focusing on profit generation from their existing product portfolios along while exploring potential new applications. The players are emphasizing on increasing their bottle shippers production capacities, to cater to the demand from numerous end use industries. Prominent players are also pushing for geographical expansion to decrease the dependency on imported bottle shippers.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for value and Tons for Volume |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; and Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel. |

| Key Segments Covered | Product Type, Material Type, Application, and Region |

| Key Companies Profiled | Sonoco Products Company; DS Smith Plc.; Western Pulp Products Company; RADVA Corporation; Packaging Services Industries; Saxon Packaging Limited |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global bottle shippers market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the bottle shippers market is projected to reach USD 6.2 billion by 2035.

The bottle shippers market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in bottle shippers market are crates, trays, corrugated boxes and cartons.

In terms of material type, paper board segment to command 35.0% share in the bottle shippers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Bottle Pourers Market

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA