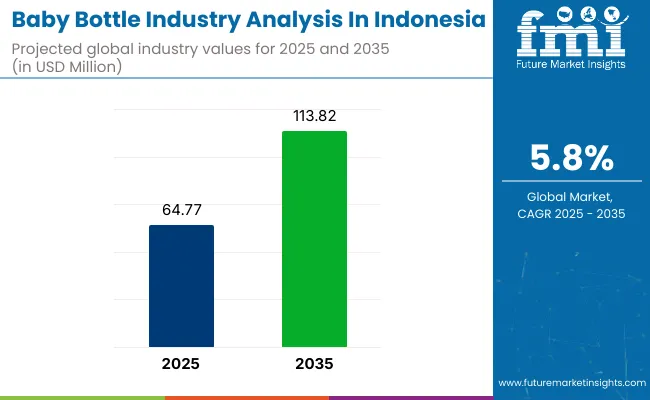

The baby bottle market in Indonesia is valued at USD 64.77 million in 2025 and is projected to reach USD 113.82 million by 2035, which shows a CAGR of 5.8% over the forecast period. This steady growth is driven by rising birth rates, growing awareness of infant nutrition, and changing consumer lifestyles.

Indonesia Baby Bottle Sales Statistics 2025

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 64.77 million |

| Industry Value (2035F) | USD 113.82 million |

| CAGR (2025 to 2035) | 5.8% |

As more women enter the workforce and dual-income households increase, the demand for convenient, safe, and hygienic baby feeding solutions continues to rise. Baby bottles are becoming essential childcare items in both urban and semi-urban households, supported by better healthcare access and growing parental focus on infant well-being. The trend is especially prominent among middle- and upper-income families who are more likely to invest in high-quality baby care products.

Product innovation plays a central role in driving market growth. Manufacturers are offering bottles made from BPA-free plastics, borosilicate glass, silicone, and stainless steel to meet safety, durability, and sustainability expectations. Features like anti-colic vents, temperature indicators, and compatibility with breast pumps are increasingly popular among health-conscious parents. Global and local brands are focusing on ergonomic bottle designs that mimic natural breastfeeding to ease the transition for infants.

The rise of e-commerce has made it easier for Indonesian consumers to access a wide range of baby bottles, compare specifications, and read customer reviews, leading to more informed purchasing decisions. Online platforms, along with growing retail penetration, are expanding the market reach even in secondary cities.

Government-led campaigns promoting maternal and infant health are also encouraging the adoption of safe feeding practices. Increasing pediatric care services and education around infant hygiene are raising consumer awareness, especially in developing areas.

At the same time, rising disposable incomes and broader access to premium baby care products are strengthening market momentum. As consumer preferences evolve and innovation continues, Indonesia’s baby bottle market is set to expand steadily from 2025 to 2035.

The market is segmented based on material type, capacity, sales channels, price range, and sub-region. By material type, the market includes polycarbonate, polypropylene, stainless steel, glass, and silicone. Based on capacity, it is categorized into up to 90 ml, 91 ml to 180 ml, 181 ml to 270 ml, 271 ml to 360 ml, and 361 ml and above.

By sales channels, the product is distributed through modern trade, departmental stores, convenience stores, specialty stores, mono brand store, online retailers (direct to customer, indirect to customer), drug stores, and other sales channels (pop-up stores, vending machines, maternity boutiques, mobile retail units). In terms of price range, the segments include low (below 5 USD), mid (between 5 to 10 USD), and high (above 10 USD). Regionally, the market is segmented into Sumatra, Java, Kalimantan, Nusa Tenggara, Sulawesi, Maluka Islands, and Papua (Western New Guinea).

The silicone segment is expected to grow at the highest CAGR of 9% from 2025 to 2035 in the Indonesia baby bottle market. Silicone bottles are gaining favor among modern parents due to their non-toxic, BPA-free properties, lightweight build, and high durability. They withstand temperature variations, making them ideal for sterilization and everyday use. As awareness grows around product safety and sustainability, Indonesian parents are shifting from traditional plastic bottles to silicone alternatives.

Brands are actively promoting silicone bottles through parenting forums, digital platforms, and eco-friendly campaigns, accelerating market adoption. Additionally, the material’s long lifespan and resistance to odor or staining add long-term value for users. With disposable incomes rising in urban areas such as Jakarta and Surabaya, demand for high-quality, safe, and visually appealing baby products is rapidly increasing.

Many products in this category now include added features such as anti-colic designs and wide-neck bottles for easier cleaning. With these innovations, silicone bottles are positioned to dominate future consumer preferences in Indonesia. The silicone bottles segment holds 38.5% share.

| Material Segment | CAGR (2025 to 2035) |

|---|---|

| Silicone Bottles | 9% |

The 361 ml and above capacity segment is forecasted to grow at the CAGR of 7% from 2025 to 2035, reflecting a shift in demand among parents of older infants and toddlers. These larger bottles offer convenience by reducing the frequency of refills, which is particularly important for working parents and caregivers. The increasing number of dual-income households in Indonesia has made practicality a priority when purchasing baby feeding products.

Manufacturers are tapping into this trend by launching ergonomically designed, high-volume bottles with features such as spill-proof caps, thermal sleeves, and built-in measurement indicators. Retailers especially online and specialty baby stores are expanding their product assortments to include more of these high-capacity options.

With consumer preference shifting toward value-for-money and multipurpose products, this segment is set to benefit from both functional necessity and premium add-ons. The availability of accessories tailored for larger bottles like insulated carriers and fast flow nipples also strengthens this segment’s appeal. This category is expected to attract both new and returning buyers seeking efficient feeding solutions for their growing children.

| Capacity Segment | CAGR (2025 to 2035) |

|---|---|

| 361 ml and Above | 7% |

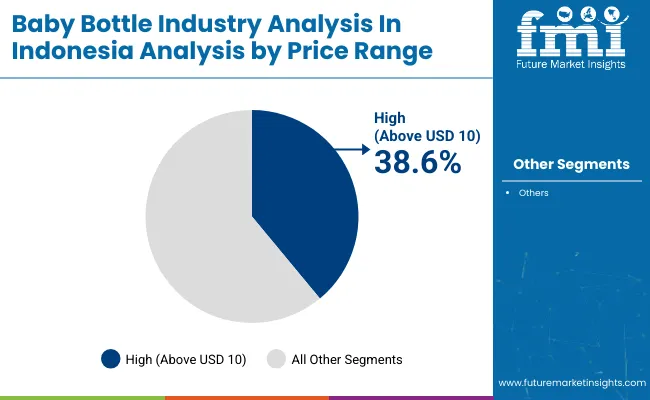

The high-price segment (above USD 10) is projected to capture a notable market share of 38.6% in 2025, reflecting the strong shift toward premiumization in Indonesia’s baby care market. Urban parents are increasingly investing in high-end baby bottles made from superior materials like medical-grade silicone, glass, and stainless steel. These bottles are often equipped with smart features such as anti-colic systems, heat sensors, and ergonomic designs, which appeal to health-conscious and convenience-driven consumers.

| Price Range Segment | Market Share (2025 to 2035) |

|---|---|

| High (Above USD 10) | 38.6% |

Premium baby bottles are perceived not only as feeding tools but also as an extension of parental care and safety assurance. Brands are capitalizing on this trend by offering premium packaging, branded accessories, and product bundles via e-commerce platforms.

Rising disposable incomes and the influence of international parenting standards are further boosting demand in this segment, especially in metro cities like Jakarta and Bandung. Additionally, marketing campaigns focused on product safety, environmental sustainability, and durability are reinforcing consumer loyalty toward premium options. As long as urbanization and income growth persist, the high-end baby bottle market will remain a key focus area for manufacturers and retailers alike.

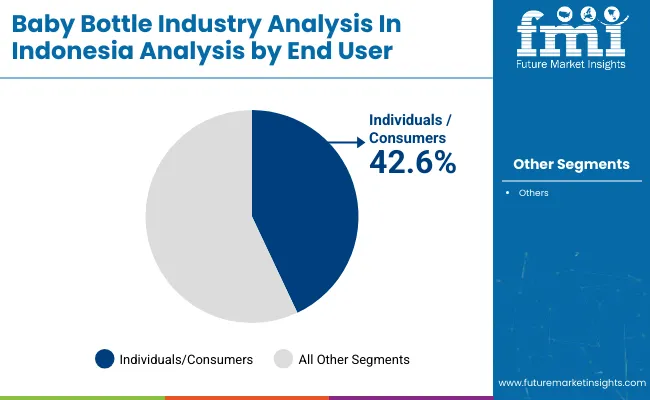

The individuals/consumers segment is expected to dominate the Indonesia baby bottle market by end user, accounting for 42.6% of the total market share in 2025. This group consists of parents and caregivers purchasing for personal or family use often making buying decisions based on safety, convenience, and affordability.

| End User Segment | Market Share (2025) |

|---|---|

| Individuals/Consumers | 42.6% |

As smartphone penetration and digital access rise across the country, individual consumers increasingly prefer online platforms to compare features, prices, and reviews. Parents are particularly drawn to bottles that are easy to clean, travel-friendly, and compatible with accessories such as warmers and sterilizers.

In both urban and semi-urban areas, consumers are prioritizing high-quality feeding solutions, especially for first-time parents and health-conscious households. This segment is further bolstered by targeted social media marketing, parenting communities, and product recommendations shared through influencer networks.

Whether shopping in-store or online, individual consumers remain the primary driver of baby bottle sales volume in Indonesia. With higher birth rates in suburban areas and increased digital literacy among new parents, this end-user segment is expected to retain its leadership throughout the forecast period.

To ensure sustained growth in the Indonesian baby bottle industry, executives should prioritize research and development (R&D) focused on eco-friendly, BPA-free bottle designs and sustainable packaging. The shift toward safe, non-toxic, and recyclable materials will be a key differentiator as consumer awareness about product safety and environmental impact increases. Proactively adopting these innovations will help companies meet evolving consumer expectations and regulatory standards.

Strategic partnerships with e-commerce platforms and retailers will be essential for expanding industry reach, especially as online sales continue to rise. Companies should focus on enhancing their distribution networks in key regions.

This is particularly important in urban centres, where disposable incomes are rising and demand for premium products is growing.Strengthening collaborations with environmental advocacy groups will also bolster brand credibility and appeal to environmentally conscious consumers.

Key risks to address include regulatory pressures surrounding plastic waste management and product safety, which may impact production costs and industry entry. Fluctuations in raw material prices, especially for eco-friendly materials, pose another medium-to-high impact risk.

Additionally, supply chain disruptions, particularly in sourcing sustainable materials, can lead to delays in production and increased costs. To mitigate these, companies should invest in sustainable supply chain solutions, conduct thorough industry research to adapt to shifting trends, and forge strong relationships with regulatory bodies to stay ahead of compliance changes.

FMI’s survey of stakeholders in the Indonesian baby bottle industry revealed that 68% of industry professionals believe consumer demand for eco-friendly and BPA-free bottles will continue to grow in the coming years. A significant 75% of manufacturers are prioritizing sustainable materials, with a strong emphasis on recyclable plastics and bio-based alternatives.

This trend reflects growing awareness among parents about the safety of baby products and their environmental impact. Additionally, 55% of surveyed retailers noted an increase in online baby product sales, with e-commerce platforms becoming the dominant distribution channel, particularly in urban regions where disposable incomes are higher.

Looking ahead, 62% of stakeholders expressed confidence in the industry's growth, anticipating a steady rise in demand for innovative designs such as spill-proof and ergonomic bottles. However, 48% raised concerns about potential regulatory changes around plastic waste management, which could lead to higher production costs and tighter compliance requirements.

Despite this, 54% of manufacturers are investing in R&D to address these challenges and stay competitive. As for future industry expansion, 67% of respondents see opportunities in emerging regions, particularly in smaller cities and towns where awareness of product safety is rising, and urbanization is contributing to growing demand for baby care products. Overall, the survey found that stakeholders are focused on innovation, sustainability, and adapting to evolving consumer preferences.

| Region | Impact of Policies and Government Regulations |

|---|---|

| Sumatra | Strict environmental regulations on plastic waste management are being enforced. Companies must comply with national standards for safety and non-toxic materials in baby products. BPA-free certification is required for certain products. (Source: Indonesian Ministry of Environment and Forestry) |

| Java | Java sees stringent regulations regarding child safety and product standards. Companies need certifications like SNI (Indonesian National Standard) for product safety and compliance with environmentally friendly packaging laws. (Source: Indonesian National Standardization Agency) |

| Kalimantan | Similar to Java, stricter rules on material safety, especially with BPA-free bottles, are enforced. Companies must comply with eco- labeling regulations and undergo periodic inspections to ensure compliance. |

| Nusa Tenggara | Regulatory focus is on the safety of baby products in this region. Compliance with the Indonesian Ministry of Health's standards is mandatory. Companies may also need eco-friendly certification to meet local industry preferences. |

| Sulawesi | Companies are required to meet SNI and health and safety regulations. There is growing demand for BPA-free products due to heightened awareness, and companies must meet these demands through proper certifications. |

| Maluku Islands | Regulatory oversight is increasing with an emphasis on the environmental impact of plastic products. Companies must have eco-friendly product certifications, along with ensuring safety standards under Indonesian law. |

| Papua (Western New Guinea) | Although less regulated, there is increasing pressure for companies to adopt BPA-free products. Local certifications for health and safety must be obtained to sell in Papua, in line with national p olicies for baby care products. |

The industry in Sumatra is anticipated to grow at a CAGR of 5.8% from 2025 to 2035. As the second-largest island in Indonesia, Sumatra offers a relatively steady industry for baby bottle sales. While not as economically developed as Java, Sumatra benefits from a growing population and improving healthcare infrastructure.

Urban centres like Medan are expected to drive the growth of baby product demand, especially among the rising middle class. However, compared to Java, the industry growth might be slightly slower due to a less dense population and fewer large urban centres. Still, steady improvements in living standards will support ongoing demand.

Sales in Java is anticipated to grow at a CAGR of 6.0% from 2025 to 2035. As the economic and population hub of Indonesia, Java remains the most lucrative region for baby bottle sales. With Jakarta being a metropolitan centre and the largest consumer base in the country, the demand for baby products will continue to rise rapidly.

The increasing number of working parents and high urbanization rates will continue to drive the industry. Additionally, higher purchasing power and a more extensive distribution network will support the growth of baby bottle sales in this region.

The industry in Kalimantan is anticipated to grow at a CAGR of 5.5% from 2025 to 2035. As a region with significant natural resources, Kalimantan’s economy is gradually diversifying. However, the industry for baby products is expected to grow more moderately compared to Java and Sumatra.

The slower urbanization rate and relatively low population density in certain parts of the region are factors that could limit faster industry expansion. That said, economic development, especially in cities like Balikpapan, will drive demand for baby products in the long term. Continued infrastructural improvements will also support this industry's gradual growth.

Sales in Nusa Tenggara are anticipated to grow at a CAGR of 5.3% from 2025 to 2035. Nusa Tenggara, with its relatively smaller population and agriculture-focused economy, is expected to experience moderate growth in the baby bottle industry. The region's demand for baby products will likely increase as living standards improve, especially in more developed areas.

However, the slower pace of urbanization and the rural character of many areas may limit the industry’s overall potential. Despite this, growing healthcare access and a higher standard of living in urban centres will provide consistent industry opportunities for baby products.

In Sulawesi sales are anticipated to grow at a CAGR of 5.7% from 2025 to 2035. Sulawesi is expected to see solid growth in the baby bottle industry as the region is experiencing gradual urbanization, with an expanding middle class. The economic growth in cities like Makassar and Manado will contribute to increasing demand for baby products.

Furthermore, the region is seeing more access to modern healthcare services, which will likely increase the demand for quality baby care products. While not as rapid as Java, Sulawesi’s growth potential is significant due to rising incomes and changing consumer preferences.

The industry in Maluku Islands is anticipated to grow at a CAGR of 5.2% from 2025 to 2035. As a less developed region with lower population density, the Maluku Islands will see slower growth compared to other parts of Indonesia. However, improvements in healthcare, access to baby products, and rising consumer awareness will lead to steady demand for baby bottles.

The small but growing middle-class population in the urban areas of Ambon will support the industry. Despite the challenges posed by geographic isolation and slower economic development, the demand for baby products will see gradual but consistent growth.

Sales in Papua (Western New Guinea) are anticipated to grow at a CAGR of 4.8% from 2025 to 2035. Papua faces significant challenges in terms of infrastructure and accessibility, which limits the growth of consumer industries such as baby products. The relatively low population density and slower pace of economic development also contribute to slower industry growth.

However, as the region slowly improves its healthcare access and living standards, there will be some gradual growth in the baby bottle industry. Government and NGO initiatives aimed at improving maternal and child health may drive demand for baby products in the long run.

The Indonesian baby bottle industry is experiencing notable developments in 2024. Philips Avent introduced a new line of eco-friendly silicone bottles, responding to growing consumer demand for sustainable products.

Pigeon Indonesia formed a strategic partnership with Tokopedia to strengthen its online distribution network, aligning with the 15% year-on-year growth in e-commerce sales of baby products. New BPOM regulations enforcing stricter BPA-free certification are accelerating the shift toward glass and stainless-steel materials. Industry analysts project sustained industry growth exceeding 6%, fueled by premium product trends and expanding digital retail channels.

In 2024, Pigeon Corporation (16-20% industry share) maintains its leadership in the Indonesian baby bottle industry, leveraging its strong brand presence and innovative products, such as BPA-free and anti-colic bottles, to cater to the growing demand for safe and sustainable baby products.

Phillips Avent (14-18%) continues to capture industry share with its advanced, ergonomic baby bottles and strong distribution network, especially in urban centres like Jakarta. Tupperware (12-15%) is focusing on expanding its presence through direct-to-consumer channels and partnerships with retail stores, capitalizing on the increasing consumer preference for durable and environmentally-friendly materials.

Cussons Baby (10-13%) benefits from its reputation for affordable, high-quality baby products and is focused on gaining industry share in both urban and rural areas by offering budget-friendly options. Medela AG (8-10%) continues to focus on premium, medically designed products, appealing to a growing segment of health-conscious parents, especially in high-income areas. Farlin (7-9%) is poised to capture a larger industry share, particularly through increasing distribution in specialty baby stores and online channels.

PT. Dodorindo Jaya Abadi (6-8%) targets local industries with cost-effective and locally manufactured baby bottles. Lustybunny Baby (5-7%) is gaining traction in the Southeast Asian region by offering budget-friendly, high-quality alternatives.

Baby Huki Corporation (4-6%) continues to expand its presence through strong regional distribution and localized product development. Baby Safe (3-5%) focuses on enhancing its industry share by introducing bottles with advanced safety features, responding to the growing safety concerns among parents.Top of Form

the industry is segmented into Up to 90 ml, 91 ml to 180 ml, 181 ml to 270 ml, 271 ml to 360 ml, 361 ml and Above

the industry is divided into polycarbonate, polypropylene, stainless steel, glass and silicone

the industry modern trade, departmental stores, convenience stores, specialty stores, mono brand store, online retailers, direct to customer, indirect to customer, drug stores and other sales channel

the industry is segmented into low (Below 5 USD), mid (Between 5 to 10 USD) and high (Above 10 USD)

the industry is studied across Sumatra, Java, Kalimantan, Nusa Tenggara, Sulawesi, Maluka Islands and Papua (Western New Guinea)

The Indonesia baby bottle market is expected to reach USD 113.82 million by 2035, growing from USD 64.77 million in 2025, at a CAGR of 5.8% during the forecast period.

Silicone bottles are projected to grow at the fastest CAGR of 9.0% from 2025 to 2035, due to their safety, durability, and rising popularity among health-conscious parents.

The 361 ml and above segment is expected to grow at a CAGR of 7% from 2025 to 2035, driven by demand from working parents seeking high-volume, time-saving feeding solutions.

High-end baby bottles priced above USD 10 are expected to hold the largest market share of 38.6% in 2025, fueled by premiumization trends in urban centers and demand for advanced features.

Individuals and consumers are projected to lead demand, accounting for 42.6% of the market share in 2025, supported by rising digital access, product awareness, and first-time parenting needs.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Indonesia Baby Bottle Market

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Indonesia Consumer Packaging Market Trends & Forecast 2024-2034

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Indonesia Pet Care Market Size and Share Forecast Outlook 2025 to 2035

Indonesia Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indonesia Pet Care Market

Indonesia Surfing Tourism Market Insights – Size, Growth & Forecast 2025–2035

Industry 4.0 Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA