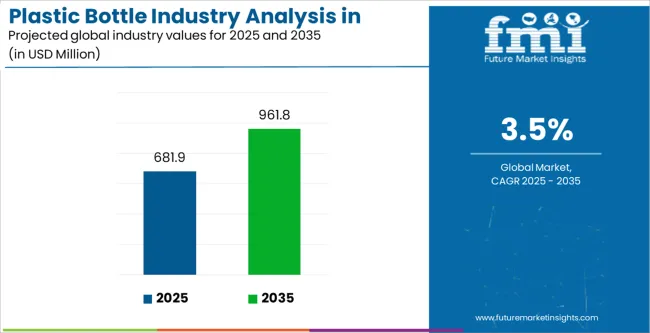

The Plastic Bottle Industry Analysis in Malaysia is estimated to be valued at USD 681.9 million in 2025 and is projected to reach USD 961.8 million by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Bottle Industry Analysis in Malaysia Estimated Value in (2025 E) | USD 681.9 million |

| Plastic Bottle Industry Analysis in Malaysia Forecast Value in (2035 F) | USD 961.8 million |

| Forecast CAGR (2025 to 2035) | 3.5% |

The plastic bottle industry in Malaysia is advancing steadily, supported by rising demand in food and beverage packaging and the country’s evolving consumer lifestyle trends. Industry updates and company reports have emphasized the strong role of plastic bottles in driving packaging efficiency, cost-effectiveness, and durability. PET and HDPE bottles have remained widely used due to their recyclability, lightweight properties, and ability to meet stringent food safety standards.

Growth in Malaysia’s retail sector, coupled with the expansion of convenience stores and e-commerce, has significantly increased the consumption of bottled products across categories such as water, carbonated drinks, sauces, and edible oils. Additionally, government initiatives promoting recycling and the circular economy have encouraged investments in rPET production and collection infrastructure, strengthening sustainable growth.

Looking forward, the industry is expected to benefit from rising consumer demand for smaller and portable packaging formats, continuous innovations in lightweight bottles, and stronger commitments by major beverage brands toward recycled content integration.

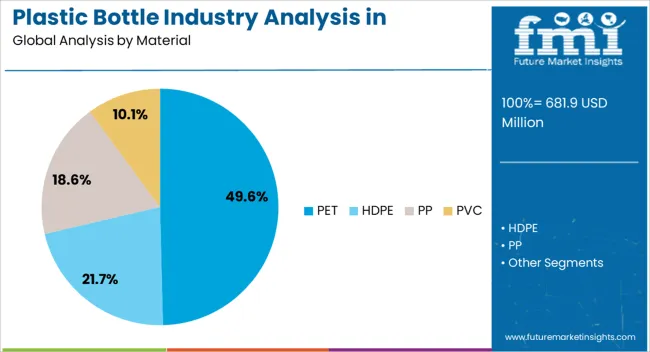

The PET segment is projected to account for 49.6% of the plastic bottle industry revenue in Malaysia in 2025, retaining its leadership due to its superior clarity, strength, and recyclability. Growth in this segment has been supported by PET’s suitability for food and beverage applications, where product visibility and safety are critical. Industry publications have highlighted that PET bottles are highly preferred for their barrier properties against moisture and oxygen, preserving product quality during storage and transport.

Additionally, PET’s lightweight nature has reduced logistics costs, which has been a key factor for beverage manufacturers. Investments in recycled PET (rPET) have further strengthened the material’s dominance, aligning with sustainability goals and consumer demand for eco-friendly packaging.

These combined advantages are expected to sustain PET’s leading position in Malaysia’s plastic bottle market.

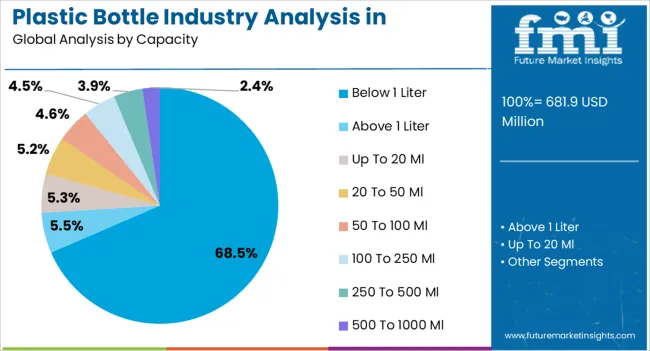

The Below 1 Liter segment is projected to contribute 68.5% of the plastic bottle industry revenue in Malaysia in 2025, making it the dominant capacity category. This growth has been driven by the strong demand for bottled water, juices, and ready-to-drink products packaged in smaller volumes for convenience and portability. Lifestyle trends, particularly among urban consumers, have favored compact packaging that is easy to carry and consume on the go.

Additionally, smaller bottle sizes have been widely adopted in retail environments such as supermarkets, convenience stores, and vending machines, further enhancing their market share. Manufacturers have also focused on lightweight bottle innovations in this capacity segment, reducing material usage while maintaining durability.

With consumer preferences shifting toward affordable, single-serve, and travel-friendly packaging, the Below 1 Liter segment is expected to remain the most widely used capacity in Malaysia’s plastic bottle industry.

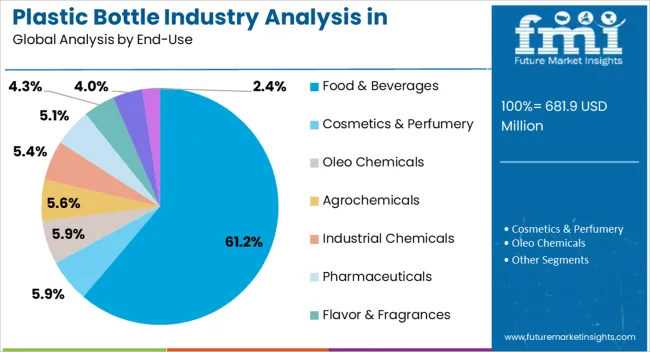

The Food & Beverages segment is projected to hold 61.2% of the plastic bottle industry revenue in Malaysia in 2025, consolidating its role as the largest end-use category. Growth in this segment has been attributed to the increasing consumption of packaged beverages, edible oils, condiments, and dairy products. The expanding foodservice industry, alongside the rapid growth of modern retail and online delivery platforms, has further increased the reliance on plastic bottles for packaging.

PET and HDPE bottles have been widely used to ensure product safety, extended shelf life, and ease of transportation. Furthermore, beverage companies have launched initiatives to incorporate recycled plastics into their packaging, strengthening the alignment of this segment with sustainability goals.

With ongoing innovation in design, light weighting, and barrier technologies, the Food & Beverages segment is expected to sustain its dominant share, supported by both consumer demand and industry-wide commitments to packaging efficiency.

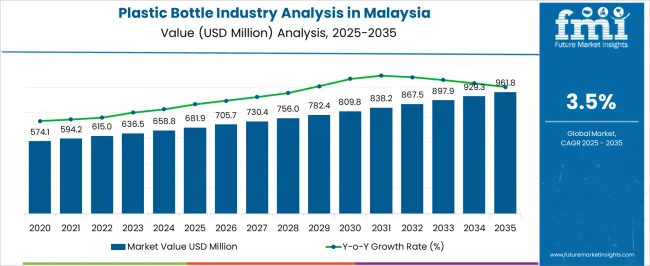

The industry in Malaysia recorded a CAGR of 2.6% from 2020 to 2025, with total revenue reaching USD 681.9 million in 2025. For the next ten years, a CAGR of 3.5% has been estimated for the target industry, indicating an increase of 0.9% from the historical growth rate.

During the historical period, the target industry witnessed sluggish growth. This was mostly due to enforcement of lockdown, low tourist flow, and reduced demand for packaging food products and beverages.

Looking ahead, the target industry is set to grow steadily. The thriving food and beverage industry in Malaysia is anticipated to play a key role in driving demand across the country during the assessment period. It will create lucrative opportunities for plastic bottle suppliers in Kuala Lumpur.

As per Malaysia Investment Performance Report (MIDA), the food sector is projected to grow around 8% annually from 2025 to 2035, reaching USD 961.8 billion by 2035. This growth will elevate the demand for plastic bottles in the country.

The country is witnessing a rise in packaged beverage consumption, which is mostly served in bottles, especially plastic ones. These bottles are easy to carry, portable, and do not break easily, making them popular choices across various end-use sectors.

Growing demand for customization is boosting the demand for custom-molded bottles. The increasing focus on providing appealing packaging by brands is leading to adoption of different printing techniques on bottles, such as decorating silk screen printing, hot stamping, shrink wrap, and labeling. This will help brands to differentiate their products and attract consumers.

The growth of the pharmaceutical industry is also generating demand for plastic packaging bottles in Malaysia. The growing need for healthcare services has led to rising sales of medicines, which are mostly packaged in bottles.

Plastic bottles are also utilized in the beauty and personal care industry because of their lightweight, cost-effective, and convenient features. Growing demand for sustainable packaging solutions and escalating awareness among consumers regarding plastic pollution have led companies to provide fully recycled bottles.

Leading plastic bottle manufacturers in Malaysia are also looking to use biodegradable materials such as bioplastics. Adoption of these materials will help them to reduce their environmental footprint and align with government regulations and consumers' evolving choices.

Enhancing PET Recycling and Halal Certification of Plastic Bottles

Malaysia's government is leading the bottle-to-bottle initiative by increasing the recycling rate of PET to meet the circular economy goals. The Ministry of Environment & Water (KASA), Malaysia, is boosting the need to certify the recycled PET and its material cleansing process for halal so that it can be used for food contact packaging from the Halal Consumable Goods Working Group (WG).

Considering the future need for using recycled resin in the production of food contact packaging, Malaysia is taking necessary steps to push the usage of recycled PET.

For instance, the ongoing development of Halal Consumable Goods-General Requirements provides the halal cleaning requirement. It is anticipated to boost the usage of recycled PET for the domestic, global, and regional industries.

The implementation of these regulations will push the local recyclers and manufacturers to provide a better recycling infrastructure and comply with the halal cleansing requirements.

According to KASA, the demand for recycled PET globally is anticipated to reach USD 961.8 billion by 2035. This push will contribute to the demand for plastic bottles made from recycled materials for various applications, along with halal food and beverages.

Malaysia's Growing Healthcare Landscape

Expenditures on personal healthcare in Malaysia are anticipated to double and reach up to USD 2.8 billion in 2035. The government of Malaysia is focused on strengthening its health service industry for the public sector. This is evident by their budget for 2025, in which they have allocated USD 7.9 billion to the Ministry of Health.

The rising spending on healthcare services and the growth of the medical sector in Malaysia are anticipated to create a demand for packaging solutions like bottles in the country. Since these bottles are used in the pharmaceutical sector, the growth of the target sector in the country will boost the industry.

The elderly population in Malaysia is about 10%, which will contribute to the increased consumption of bottles, especially plastic ones, in the country. Malaysia is experiencing growth in private healthcare services through the adoption of the latest technologies and collaboration with international providers of healthcare services. This upgrade is also strengthening their private health sector.

Pharmaceutical products often require secure and hygienic packaging. As a result, plastic medicine bottles are becoming a preferred choice due to their lightweight, durability, and ability to preserve the integrity of the contents.

The section comprehensively evaluates three interrelated industries: Malaysia plastic bottle sector, the global PCR bottle industry, and the PET bottle industry. It provides distinctive characteristics of each industry, including their CAGRs, while delving into the pivotal factors that influence their growth trajectories.

Among the three industries, the PCR bottle sector is anticipated to lead during the forecast period due to escalating demand for sustainable packaging solutions. On the other hand, Malaysia industry is set to register slower growth compared to the other two. This can be attributed to the ongoing crackdown on plastic packaging usage.

Malaysia Plastic Bottle Industry Analysis:

| Attributes | Malaysia Plastic Bottle Industry Analysis |

|---|---|

| CAGR (2025 to 2035) | 3.5% |

| Growth Drivers for Plastic Bottle Industry | High adoption across industries like food & beverage, pharmaceutical, and cosmetics and increasing pet bottle exports from Malaysia. |

| Exploring Current Trends in Plastic Bottle Sector | Growing focus on using bio-based and recyclable plastics. |

PCR Bottle Industry Analysis:

| Attributes | PCR Bottle Industry Analysis |

|---|---|

| CAGR (2025 to 2035) | 6.1% |

| Growth Factor | Increasing usage of PCR bottles in pharmaceutical, food & beverages, and personal care sectors. |

| Key Trend | Growing demand for sustainable and eco-friendly packaging solutions. |

PET Bottle Industry Analysis:

| Attributes | PET Bottle Industry Analysis |

|---|---|

| CAGR (2025 to 2035) | 4.4% |

| Growth Factor | Surging popularity of PET bottles across diverse sectors. |

| Key Trend | Growing interest in customized PET bottles. |

The section provides detailed information about the sub-regions of Malaysia. Southern Peninsula is anticipated to remain at the forefront by registering a considerable CAGR of 3.6% during the assessment period. However, Central Malaysia is not very far in terms of growth as demand is set to rise with supermarkets selling a wide range of on-the-go beverages.

| Sub-region | Value (CAGR) |

|---|---|

| Southern Peninsula | 3.6% |

| Central Malaysia | 2.4% |

Southern Peninsula is a manufacturing hub for the plastic industry, having a number of manufacturing companies for various products. The region has favorable infrastructure, skilled labor, and a business environment for the plastic packaging bottle industry to grow.

Southern Peninsula is export-oriented, with major shipping routes and ports. The booming food and beverage, personal care & cosmetics, and healthcare industries are creating opportunities for growth in the region.

Central Malaysia is witnessing significant demand for packaging formats like bottles. Urbanization and population growth are highly impacting the consumption patterns of bottles, especially plastic ones, in the region.

Escalating demand for various consumer goods and a high concentration of businesses are influencing the plastic bottle industry's growth. Central Malaysia has a vibrant retail sector with an increasing number of supermarkets, hypermarkets, and convenience stores. Hence, growth of the retail sector in the region will play a key role in boosting sales.

Central Malaysia has a growing food and beverage sector which requires convenient and portable packaging options for on-the-go consumption. This will uplift demand for packaging solutions like PET bottles in the region through 2035.

The section below sheds some light on top segments and their anticipated growth rates. Companies can use this information to invest in popular products and forms to solidify their positions in Malaysia.

Based on material, the PET segment accounts for a prominent value share and is set to register a CAGR of 3.5% through 2035, owing to several advantages offered by this material. By capacity, the below 1-liter segment is poised to advance at 3.8% CAGR between 2025 and 2035.

| Material | Value CAGR |

|---|---|

| HDPE | 3.6% |

| PET | 3.5% |

PET remains the most preferred material among plastic bottle-producing companies. This can be attributed to multiple advantages of PET and growing consumer demand for PET bottles in Malaysia.

PET bottles are mostly used for packaging various beverages and other liquid products. Lightweight, transparency, and high durability of PET bottles are contributing to their adoption in Malaysia.

PET bottles have become an ideal choice for the food and beverage industry because of their impact resistance, shatterproof, and high strength-to-density ratio. These bottles provide transparency which consumers majorly favor.

High adoption of PET bottles for packaging, water, soft drinks, juices, and other carbonated beverages is set to boost segment growth. These bottles are also highly recyclable, which makes them an appropriate choice for eco-conscious customers.

Sales of PET bottles are set to record a CAGR of 3.5% during the forecast period. Thus, plastic bottle players in Malaysia will need to strengthen their PET bottle portfolios to gain profits. On the other hand, the PVC segment is anticipated to exhibit a CAGR of 3.7% over the upcoming decade.

| Capacity | Value CAGR |

|---|---|

| Above 1 Lit | 3.1% |

| Below 1 Lit | 3.8% |

Plastic bottles of capacity below 1 liter are prominently used in Malaysia because of their portability and convenience. Smaller size bottles are preferred as they are easy to carry for consumption, particularly for juices, water, energy drinks and soft drinks.

Small-size bottles are suitable for single-serve purposes and are generally more affordable options. Increasing popularity of single-serve consumption and portion control is augmenting the demand for low-capacity bottles.

The target segment is anticipated to capture more than 58% of the industry share. Further, it will register a steady CAGR of 3.8% throughout the assessment period, prompting plastic bottle companies in Malaysia to offer these products.

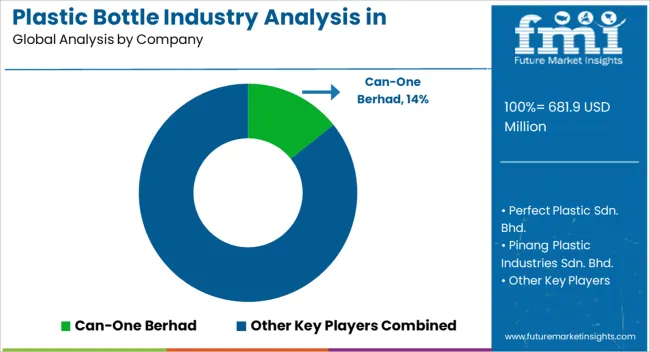

Top plastic bottle players in Malaysia are focusing on reducing the plastic content in their products while maintaining functionality and strength. They are continuously using recycled plastics as well as bioplastics to reduce their environmental footprint.

Several leading plastic bottle distributors and manufacturers are forming partnerships, agreements, and collaborations with end users to boost their revenues. Similarly, they are using advertisement strategies to reach a wider audience.

Recent Developments

| Date and Approach | Description |

|---|---|

| December 2025, New Product Launch | Coca-Cola Malaysia launched new 100% recycled plastic PET bottles in Malaysia. |

| November 2025, New Product Launch | Berry Global, a manufacturer of plastic packaging products, developed a new line of sustainable plastic bottle caps. The company is looking to increase its customer base across nations like the United States, India, the United Kingdom, and Malaysia by launching eco-friendly packaging solutions. |

| Attribute | Details |

|---|---|

| Industry Value in 2025 | USD 658.8 million |

| Revenue in 2035 | USD 928.9 million |

| Growth Rate (2025 to 2035) | 3.5% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Capacity, End-use, Sub-region |

| Key Country Covered | Northern Peninsula, Southern Peninsula, Central, East Coast, East Malaysia |

| Key Companies in Malaysia Plastic Bottle Industry Outlook Report | Can-One Berhad; Perfect Plastic Sdn. Bhd.; Pinang Plastic Industries Sdn. Bhd.; Hon Chuan Malaysia Sdn Bhd; Dynaplast Sdn Bhd.; RENIPLAS SDN. BHD.; A&A Plastic Industries Sdn. Bhd.; MIGHTY SIGNATURE SDN. BHD; KPI Plastic (M) Sdn Bhd; Panwrite Plastic Industries Sdn Bhd; SHS Plastics Industries Sendirian Berhad; U-Lik (M) Sdn Bhd; Medicplas Industries Sdn Bhd; Plasticmate Sdn Bhd; Kembangan Plastik Sdn Bhd |

The industry is divided into HDPE, PET, PP, and PVC.

The report is classified into above 1 liter and below 1 liter. The latter is further classified into up to 20 ml, 20 to 50 ml, 50 to 100 ml, 100 to 250 ml, 250 to 500 ml, and 500 to 1000 ml.

In terms of end-use, the industry is segmented into cosmetics & perfumery, oleo chemicals, agrochemicals, industrial chemicals, pharmaceuticals, food & beverages, flavor & fragrances, petroleum & lubricants, and others (homecare & personal care).

Analysis of the industry has been carried out in key sub-regions of Malaysia, including Northern Peninsula, Southern Peninsula, Central, East Coast, and East Malaysia.

The global plastic bottle industry analysis in Malaysia is estimated to be valued at USD 681.9 million in 2025.

The market size for the plastic bottle industry analysis in Malaysia is projected to reach USD 961.8 million by 2035.

The plastic bottle industry analysis in Malaysia is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in plastic bottle industry analysis in Malaysia are pet, hdpe, pp and pvc.

In terms of capacity, below 1 liter segment to command 68.5% share in the plastic bottle industry analysis in Malaysia in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Malaysia Plastic Jerry Can Market Trends & Forecast 2024-2034

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Plastic Medicine Bottles Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Industry Analysis In Indonesia Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Plastic Medicine Bottles Manufacturers

Vietnam Plastic Jerry Can Market Analysis – Growth & Forecast 2023-2033

Vietnam Plastic Bottle Market Analysis by Capacity, Material, End-use, and Region Forecast Through 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Plastic Bottle in USA Size and Share Forecast Outlook 2025 to 2035

Automotive Plastic Market in BRIC Countries - Size, Share, and Forecast 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Europe Healthcare Rigid Plastic Packaging Market Trends – 2024-2034

Master Recharge API Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA