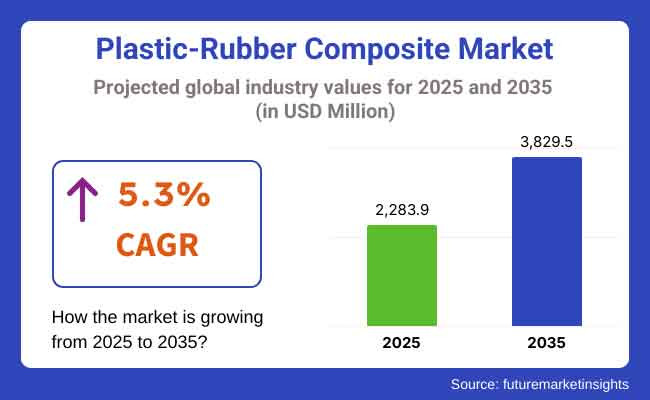

The industry is predictive to be worth USD 2,283.9 million in 2025 and is expected to grow to USD 3,829.5 million by 2035, expanding at a CAGR of 5.3% over the forecast period. The increasing need for plastic-rubber composite is boosted by their multi-functional characteristics and wide-ranging applications in various industries such as automotive and aerospace, consumer goods, construction and infrastructure, electrical and electronics, healthcare and medical devices, and industrial equipment.

Plastic-rubber composites are man-made materials that incorporate rubber and plastic properties, improving flexibility, durability, and resistance to harsh conditions. These composites are created through mixing rubber and plastic polymers to achieve optimum performance characteristics for various industrial applications.

In 2024, the plastic-rubber composite sector progressed with technological developments in polymer technology to serve the automotive, construction, and health sectors. The need for light, strong, and high-performance materials increased as industries pursued affordable and environmentally friendly options. Increased environmental regulations spurred research into bio-based and recyclable polymers, fueling product diversification.

By 2025, increasing urban infrastructure, transportation electrification, and medical technology will boost adoption. Advanced material engineering methods will optimize product efficiency, enhancing thermal resistance and mechanical strength. Emerging economies will drive demand, using industrial automation and smart manufacturing.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustained growth fueled by automotive and construction industries. Demand picked up as industries gave emphasis to lightweight, cost-effective materials. | Technologically-driven growth is expected to accelerate. Bio-based and smart materials will become increasingly popular in various applications. |

| Regulatory pressure for sustainability shaped material innovation. Firms aimed at minimizing environmental footprint through recyclable blends. | Circular economy models to dominate production practices. Recycling, reusability, and low-carbon footprints will set industry standards. |

| Material properties were enhanced with improved polymer blending methods. Durability and thermal resistance improvements were investigated by manufacturers. | Advances in hybrid materials and nanocomposites. Improved manufacturing will result in better mechanical strength and multi-functionality. |

| Asia-Pacific became a leading manufacturing center. Increasing industrialization and low-cost production fueled regional supremacy. | Production diversification into international markets. Expansion into Europe and North America will harmonize supply chains. |

| R&D expenditure grew, but commercialization was slow. High expenses capped large-scale use. | Mass commercialization with cost-efficiency maximization. Scalability and automation will increase affordability and market reach. |

The plastic-rubber composite sector is based in the specialty materials and polymer composites industry, influencing manufacturing, construction, automotive, and healthcare markets. Economic transformation, technological advancements, and policies toward sustainability motivate its development.

Advanced countries emphasize high-performance materials and regulatory compliance, driving innovation in durable, lightweight composites. In contrast, emerging economies undergo mass adoption through industrial growth, infrastructure development, and increasing consumer demand.

Global trade policies, raw material costs, and geopolitical events shape cost structures and supply chain resilience. Pressure towards a circular economy propels investment in recyclable and bio-based polymers to minimize the use of fossil-based ones. As automation and intelligent manufacturing maximize efficiency, industries become more reliant on advanced polymer blends to enhance product performance.

Thermoplastic Elastomers (TPE) will lead the industry during 2025 to 2035 on account of wear resistance, durability, and recyclability. The segment is anticipated to maintain high grip with a CAGR of 4.8% on account of increased applications in automotive, healthcare, and consumer products. Because of their wear and environmental conditions resistance, they are apt for seals, gaskets, and soft-touch applications, which stimulate extended industrial usage.

Ethylene Propylene Diene Monomer (EPDM) thermoplastics will remain very much in demand due to their weatherability and electrical insulation properties. They will remain essential in construction, automotive sealing systems, and electrical components. Rubber-plastic blends will see continued expansion with impact-resistance gaining more importance for businesses.

Over-molded or insert-molded composites will gain more acceptance with advances in precision engineering. They will find increasing applications in medical devices, electronics, and structural parts as industries increasingly appreciate design efficiency and material strength.

The automotive and aerospace sectors will continue to lead the industry from 2025 to 2035, growing at a CAGR of 5.1%. The demand for fuel-efficient, lightweight material from the industry will drive plastic-rubber composite utilization in seals, interiors, and structural parts. The aerospace sector will adopt the materials for aircraft component weight savings and durability.

Consumer products will be the driver of consistent demand, with companies prioritizing looks and sustainability. Construction and infrastructure will keep growing, capitalizing on weather-resistant, flexible materials. Urbanization and smart city initiatives will drive the uptake of advanced polymer-based insulation, piping, and sealing solutions, further fueling the industry's consistent growth. Electrical and electronic uses will be on the increase as a result of demand for heat-resistant, high-performance insulation materials.

Medical devices and healthcare will see more integration of sterilizable, biocompatible materials. The growth in wearable medical devices, prosthetics, and surgical tools will create demand for high-performance, durable, and safe polymer blends in the healthcare industry. Industrial machinery will take advantage of plastic-rubber composite for shock resistance, sound attenuation, and heat stability.

The United States will experience consistent growth in the plastic-rubber composite industry, primarily fueled by innovation in sustainable material technologies and strict environmental regulations. Growing use of 3D printing and intelligent manufacturing will spur demand for tailored polymer composites across various industries.

The USA will also witness more investments in automated recycling technologies for polymers and plastics, lowering virgin material dependence and increasing sustainability initiatives. The administration's clean energy and emission reduction policies will also further accelerate the transition to green blends.

FMI analysis found that the United States will register a CAGR of 5.1% from 2025 to 2035.

India's growing middle class and industrialization will drive demand for cost-effective, long-lasting polymer solutions. The Smart Cities Mission of the government will propel widespread adoption of weather-resistant and flexible building materials in infrastructure development, metro rail networks, and green buildings.

Domestic electronics manufacturing growth will open up opportunities for heat-resistant and lightweight composites. Renewable energy projects, especially in wind and solar energy, will create greater usage of specialty polymer parts for higher durability. Increased attention to green packaging materials by the food and beverages industry will also drive biodegradable polymer solutions demand higher.

FMI opines that India will experience the fastest growth in the industry, with a projected CAGR of 5.7% from 2025 to 2035.

China will continue its leadership in polymer production globally, driven by its supremacy in EV production, high-speed rail development, and industrial automation. The new hydrogen fuel cell industry will grow the need for advanced polymer components in fuel systems and storage tanks. Its rapid progress in 5G infrastructure and next-generation semiconductors will drive demand for miniaturized, heat-resistant polymer blends.

Investments in circular economy and high-tech materials through the government's Five-Year Plan will focus on strengthening bio-based and fully recyclable polymer innovations. China's burgeoning space exploration agenda and satellite manufacturing will further strengthen the demand for high-durability polymers.

FMI analysis found that China will sustain strong industry growth with a projected CAGR of 5.5% from 2025 to 2035.

The United Kingdom will see strong investments in green materials because of stringent sustainability regulations and waste reduction mandates. The increased demand for antimicrobial and self-healing polymers in healthcare applications will redefine the industry. Expansion in offshore wind farms and renewable energy grids will fuel use of weather-resistant, corrosion-resistant polymer parts.

The luxury automotive industry's transition to high-performance, lightweight interiors will propel the use of sophisticated polymer composites. Plastic tax policies of the government will provoke industries to go for recyclable and biodegradable blends of polymers.

FMI opines that the UK will maintain a stable expansion rate, registering a CAGR of 5.2% from 2025 to 2035.

Germany's mechanical manufacturing prowess and precision engineering will drive the nation's need for high performance plastic-rubber composite. Hydrogen fuel cell cars and industrial robots will expand demands for high-durability, heat-resistance polymers. Industry 5.0 transition will bring in AI-based material selection systems to make production more efficient.

Increasing use of biodegradable composite polymers will reinforce the nation's emphasis on circular economy drives. Also, Germany's renewable energy industry, especially for solar panel and wind turbine production, will embrace advanced polymer solutions for durability and efficiency.

FMI analysis found that Germany will grow in alignment with the global average, with a projected CAGR of 5.3% from 2025 to 2035.

South Korea's dominance in next-generation electronics, artificial intelligence-based automation, and semiconductor manufacturing will propel the demand for advanced rubber-plastic composites. The development of electric vertical take-off and landing (eVTOL) aircraft will boost the demand for light, impact-resistant polymers.

Expansion in digital health and robot-assisted surgeries will drive the demand for biocompatible, sterilizable polymers. The nation's growing gaming and augmented reality (AR) industry will drive the need for flexible, long-lasting polymer parts in gaming peripherals and VR wearables.

FMI opines that South Korea will register a CAGR of 5.4% from 2025 to 2035, supported by continued technological innovation.

Japan's industry will be shaped by its aging population and medical innovations, boosting demand for flexible, high-performance, and skin-friendly polymers in prosthetics, assistive devices, and wearables. Growth in high-speed maglev transportation will spur demand for quick-absorbing and lightweight composites.

Growing investments in disaster-resistant building materials will drive use of fire-retardant, high-durability polymer solutions. Japan's robotics and automation sector will adopt flexible, highly durable elastomers to improve machine life.

FMI analysis found that Japan will achieve a CAGR of 5.2% from 2025 to 2035, driven by innovation in healthcare and transportation.

France's emphasis on luxury, aerospace, and green mobility will define the plastic-rubber composite industry. The cosmetic and personal care industry will propel demand for biodegradable, soft-touch polymer packaging solutions. Growth in urban vertical farming and Agri-tech will boost the application of UV-resistant, flexible materials for sustainable agriculture.

The e-bike and micro-mobility boom will drive innovation in lightweight, shock-absorbing polymer components. Further, France's nuclear power industry will need high-performance polymer-based insulation products to increase reactor safety. The low-carbon effort by the government will push industries to utilize bio-based elastomers for lower environmental footprints.

FMI opines that France will experience a CAGR of 5.3% from 2025 to 2035, aligned with global trends.

Italy's economy will be defined by its dominance in fashion, automotive styling, and luxury furniture. The industry for beauty, strength, and lightness of polymer-based textiles in high-end fashion will grow. The rise of smart home automation will drive usage of heat-resistance and customizable polymer parts in appliances and home furnishings.

The yacht and marine sector's growing emphasis on environmentally friendly materials will further propel demand for water-resistant polymer composites. In addition, Italy's emphasis on circular economy programs will propel recycled rubber-plastic composites in consumer goods production.

FMI opines that Italy will maintain a CAGR of 5.2% from 2025 to 2035, driven by innovation in lifestyle and luxury segments.

Australia and New Zealand will witness consistent growth in the plastic-rubber composite industry, led by increasing construction activities, renewable energy initiatives, and developments in sustainable packaging. The thriving electric vehicle (EV) industry in Australia will fuel demand for lightweight, heat-resistant polymer composites for automotive interiors and battery parts.

The growth of marine and offshore industries in both nations will drive the use of UV-stable, corrosion-resistant materials. The agriculture and food packaging industry in New Zealand will depend more on flexible, compostable materials to achieve sustainability objectives.

FMI opines that Australia and New Zealand will witness a CAGR of 5.3% from 2025 to 2035, aligning with global industry growth trends.

(Surveyed Q4 2024, n=500 stakeholder participants, including manufacturers, suppliers, automotive companies, construction firms, electronics manufacturers, and healthcare product developers across North America, Europe, and Asia-Pacific)

Regional Variance

Significant Variance in Technology Implementation

ROI Views on Innovation

Consensus on Material Performance

Regional Variance

Industry-Wide Challenges

Regional Differences

Manufacturers

End-Users

Industry Alignment

Regional Priorities

Regulatory & Policy Impact

High Consensus: Durability, sustainability, and cost-effectiveness remain top of mind.

Regional Key Regional Differences

Strategic Insight

The rubber-plastic composite sector needs to respond with a region-specific strategy-high-performance solution for North America, sustainable compliance material in Europe, and cost-effective, scalable material for Asia-Pacific.

| Countries | Government Regulations and Certifications |

|---|---|

| United States | EPA, TSCA, ASTM, and FDA standards govern polymer safety, emissions, and recyclability. Polymers used in packaging and medical applications must strictly adhere. |

| India | Plastic Waste Management Rules, BIS certification, and EPR mandates push recyclability. Government initiatives like ‘Make in India’ fosters local sustainable manufacturing. |

| China | China RoHS, Green Manufacturing Standard, and GB/T certification dictate material safety and emissions control in the Five-Year Plan. |

| United Kingdom | Plastic Packaging Tax, REACH compliance, and BSI guidelines enforce recyclable material and net-zero production. |

| Germany | Packaging Act, DIN, EU REACH, and VDA standards govern recyclability and car polymer usage under climate-neutral legislation. |

| South Korea | Korean Green New Deal, KC certification, and K-REACH implement polymer safety, sustainability, and chemical conformity. |

| Japan | Plastic Resource Circulation Act, JIS, and Chemical Substances Control Law encourage biodegradable products and limit dangerous chemicals. |

| France | Anti-Waste Law, REACH, and French EPR regulations require recyclability and restrict single-use plastics. |

| Italy | EU Packaging Directive, UNI certification, Circular Economy Action Plan require recyclability and low-emission polymer production. |

| Australia-NZ | APCO Packaging Targets, AS/NZS Standards, Waste Reduction Act promote biodegradable materials and rigorous recycling policies. |

The industry for plastic-rubber composite is undergoing a rapid revolution with catalysts of sustainability requirements, technological developments in materials, and global policy changes. The industry for bio-based polymer blends is growing in Europe and North America, where strict low-emission standards are transforming the use of materials.

The area of concentration in Asia-Pacific is cost-effective hybrid solutions, especially in automotive, consumer electronics, and industrial applications. To remain competitive, businesses will need to focus on cutting-edge R&D partnerships to create high-strength, sustainable polymer products.

Increasing recycling capacity and closed-loop production systems will meet Extended Producer Responsibility (EPR) legislation requirements, minimize waste, and enhance sustainability. Strategic purchases of specialty polymer companies can enhance industry position, and traceability systems based on blockchain technology will guarantee regulatory compliance and transparency.

The plastic-rubber composite industry is relatively fragmented, with major players competing on the basis of pricing, innovation, strategic alliances, and international expansions. Top players emphasize acquisitions to consolidate industry positions, while others emphasize sustainable product innovations and regional expansions to tap increasing demand.

In 2024, significant acquisitions redefined the industry landscape. ADNOC purchased Covestro A.G. for USD 12.9 billion, one of the biggest deals of the year. Likewise, Amcor merged with Berry Global Group in an USD 8.4 billion transaction, cementing its status as the world's largest plastic packaging firm. Innovation was also at the forefront, with Freudenberg Performance Materials launching sophisticated technical textile innovations at JEC World in Paris to advance composite production.

Strategic collaborations of Mutares SE & Co. KGaA acquiring Cikautxo China to further consolidate its automotive business also accelerated the industry growth. These advancements point to the aggressive move of the industry towards expansion, technology integration, and eco-friendly production.

Dow Chemical Company: ~15-20%

A global leader in advanced materials and hybrid composites.

Arkema SA: ~10-15%

Known for innovative plastic-rubber composites and specialty polymers.

Mitsubishi Chemical Corporation: ~8-12%

A major player in high-performance rubber-plastic blends.

SABIC: ~8-12%

Provides advanced hybrid composites for automotive and industrial applications.

DuPont de Nemours, Inc.: ~7-10%

Specializes in high-performance materials for diverse industries.

Covestro AG: ~5-8%

Known for polycarbonates and hybrid composite materials.

Lanxess AG: ~5-8%

Focuses on rubber and plastic composites for automotive and industrial uses.

Increasing need for lightweight, long-lasting materials in automotive, electronics, and construction, as well as sustainability laws, is stimulating industry growth.

Companies are investing in bio-based polymers, 3D printing, and AI-based material design to improve performance, recyclability, and cost-effectiveness.

Large transactions such as ADNOC's takeover of Covestro and Amcor's merger with Berry Global are streamlining industry leadership and broadening product portfolios.

Stringent green policies, including extended producer responsibility (EPR) legislation, are compelling companies to implement sustainable manufacturing and recycling practices.

Automotive, healthcare, aerospace, and consumer electronics are leading adoption, driven by demand for high-performance, flexible, and lightweight materials.

Table 01: Global Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 02: Global Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Table 03: Global Market Volume (Tons) and Value (US$ Million) by Region, 2018 to 2033

Table 04: North America Market Volume (Tons) and Value (US$ Million) by Country, 2018 to 2033

Table 05: North America Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 06: North America Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Table 07: Latin America Market Volume (Tons) and Value (US$ Million) by Country, 2018 to 2033

Table 08: Latin America Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 09: Latin America Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Table 10: Western Europe Market Volume (Tons) and Value (US$ Million) by Country, 2018 to 2033

Table 11: Western Europe Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 12: Western Europe Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Table 13: Eastern Europe Market Volume (Tons) and Value (US$ Million) by Country, 2018 to 2033

Table 14: Eastern Europe Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Table 16: East Asia Market Volume (Tons) and Value (US$ Million) by Country, 2018 to 2033

Table 17: East Asia Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 18: East Asia Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Table 19: South Asia Pacific Market Volume (Tons) and Value (US$ Million) by Country, 2018 to 2033

Table 20: South Asia Pacific Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 21: South Asia Pacific Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Table 22: Middle East and Africa Market Volume (Tons) and Value (US$ Million) by Country, 2018 to 2033

Table 23: Middle East and Africa Market Volume (Tons) and Value (US$ Million) by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Volume (Tons) and Value (US$ Million) by Application, 2018 to 2033

Figure 01: Global Market Volume (Tons) Market Volume, 2018 to 2022

Figure 02: Global Market Volume (Tons) Forecast, 2018 to 2033

Figure 03: Global Market Value (US$ Million) Forecast, 2018 to 2033

Figure 04: Global Market Absolute US$ Opportunity, 2018 to 2033

Figure 05: Global Market Value BPS Analysis by Product Type– 2023 and 2033

Figure 06: Global Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 07: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 08: Market Absolute $ Opportunity by Thermoplastic Elastomers (TPE), 2018 to 2033

Figure 09: Market Absolute $ Opportunity by Ethylene Propylene Diene Monomer (EPDM) Thermoplastics, 2018 to 2033

Figure 10: Market Absolute $ Opportunity by Rubber-Modified Plastics, 2018 to 2033

Figure 11: Market Absolute $ Opportunity by Overmolded or Insert-Molded Composites, 2018 to 2033

Figure 12: Market Absolute $ Opportunity by Others, 2018 to 2033

Figure 13: Global Market Value BPS Analysis by Application– 2023 and 2033

Figure 14: Global Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Market Absolute $ Opportunity by Automotive Industry, 2018 to 2033

Figure 16: Market Absolute $ Opportunity by Consumer Goods, 2018 to 2033

Figure 17: Market Absolute $ Opportunity by Construction and Infrastructure, 2018 to 2033

Figure 18: Market Absolute $ Opportunity by Electrical and Electronics, 2018 to 2033

Figure 19: Market Absolute $ Opportunity by Healthcare and Medical Devices, 2018 to 2033

Figure 20: Market Absolute $ Opportunity by Industrial Equipment, 2018 to 2033

Figure 21: Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 22: Global Market Value BPS Analysis by Region– 2023 and 2033

Figure 23: Global Market Y-o-Y Growth (%) by Region, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 26: Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 27: Market Absolute $ Opportunity by Europe Segment, 2018 to 2033

Figure 28: Market Absolute $ Opportunity by Asia-Pacific Segment, 2018 to 2033

Figure 29: Market Absolute $ Opportunity by Middle East and Africa Segment, 2018 to 2033

Figure 30: North America Market Value BPS Analysis by Country – 2023 and 2033

Figure 31: North America Market Y-o-Y Growth (%) by Country, 2023 to 2033

Figure 32: North America Market Attractiveness by Country, 2023 to 2033

Figure 33: Market Absolute $ Opportunity by U.S. Segment, 2018 to 2033

Figure 34: Market Absolute $ Opportunity by Canada Segment, 2018 to 2033

Figure 35: North America Market Value BPS Analysis by Product Type, 2023 and 2033

Figure 36: North America Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Value BPS Analysis by Application, 2023 and 2033

Figure 39: North America Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 40: North America Market Attractiveness by Application, 2023 to 2033

Figure 41: Latin America Market Value BPS Analysis by Country – 2023 and 2033

Figure 42: Latin America Market Y-o-Y Growth (%) by Country, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 44: Market Absolute $ Opportunity by Brazil Segment, 2018 to 2033

Figure 45: Market Absolute $ Opportunity by Mexico Segment, 2018 to 2033

Figure 46: Market Absolute $ Opportunity by Rest of Latin America Segment, 2018 to 2033

Figure 47: Latin America Market Value BPS Analysis by Product Type, 2023 and 2033

Figure 48: Latin America Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 49: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 50: Latin America Market Value BPS Analysis by Application– 2023 and 2033

Figure 51: Latin America Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 53: Western Europe Market Value BPS Analysis by Country – 2023 and 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) by Country, 2023 to 2033

Figure 55: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 56: Market Absolute $ Opportunity by Germany Segment, 2018 to 2033

Figure 57: Market Absolute $ Opportunity by Italy Segment, 2018 to 2033

Figure 58: Market Absolute $ Opportunity by France Segment, 2018 to 2033

Figure 59: Market Absolute $ Opportunity by U.K. Segment, 2018 to 2033

Figure 60: Market Absolute $ Opportunity by Spain Segment, 2018 to 2033

Figure 61: Market Absolute $ Opportunity by BENELUX Segment, 2018 to 2033

Figure 62: Market Absolute $ Opportunity by Nordics Segment, 2018 to 2033

Figure 63: Market Absolute $ Opportunity by Rest of Europe Segment, 2018 to 2033

Figure 64: Western Europe Market Value BPS Analysis by Product Type, 2023 and 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 66: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 67: Western Europe Market Value BPS Analysis by Application, 2023 and 2033

Figure 68: Western Europe Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 69: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 70: Eastern Europe Market Value BPS Analysis by Country – 2023 and 2033

Figure 71: Eastern Europe Market Y-o-Y Growth (%) by Country, 2023 to 2033

Figure 72: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Market Absolute $ Opportunity by Poland Segment, 2018 to 2033

Figure 74: Market Absolute $ Opportunity by Hungry Segment, 2018 to 2033

Figure 75: Market Absolute $ Opportunity by Romania Segment, 2018 to 2033

Figure 76: Market Absolute $ Opportunity by Czech Republic Segment, 2018 to 2033

Figure 77: Market Absolute $ Opportunity by Rest of Eastern Europe Segment, 2018 to 2033

Figure 78: Eastern Europe Market Value BPS Analysis by Product Type, 2023 and 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 80: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 81: Eastern Europe Market Value BPS Analysis by Application, 2023 and 2033

Figure 82: Eastern Europe Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 83: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 84: East Asia Market Value BPS Analysis by Country – 2023 and 2033

Figure 85: East Asia Market Y-o-Y Growth (%) by Country, 2023 to 2033

Figure 86: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 87: Market Absolute $ Opportunity by China Segment, 2018 to 2033

Figure 88: Market Absolute $ Opportunity by Japan Segment, 2018 to 2033

Figure 89: Market Absolute $ Opportunity by South Korea Segment, 2018 to 2033

Figure 90: East Asia Market Value BPS Analysis by Product Type, 2023 and 2033

Figure 91: East Asia Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 92: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 93: East Asia Market Value BPS Analysis by Application, 2023 and 2033

Figure 94: East Asia Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 95: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 96: South Asia Pacific Market Value BPS Analysis by Country – 2023 and 2033

Figure 97: South Asia Pacific Market Y-o-Y Growth (%) by Country, 2023 to 2033

Figure 98: South Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 99: Market Absolute $ Opportunity by India Segment, 2018 to 2033

Figure 100: Market Absolute $ Opportunity by ASEAN Segment, 2018 to 2033

Figure 101: Market Absolute $ Opportunity by Australia and New Zealand Segment, 2018 to 2033

Figure 102: Market Absolute $ Opportunity by Rest of South Asia Pacific Segment, 2018 to 2033

Figure 103: South Asia Pacific Market Value BPS Analysis by Product Type, 2023 and 2033

Figure 104: South Asia Pacific Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 105: South Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 106: South Asia Pacific Market Value BPS Analysis by Application, 2023 and 2033

Figure 107: South Asia Pacific Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 108: South Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 109: Middle East and Africa Market Value BPS Analysis by Country, 2023 and 2033

Figure 110: Middle East and Africa Market Y-o-Y Growth (%) by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Figure 112: Market Absolute $ Opportunity by Gulf Co-operation Council Countries Segment, 2018 to 2033

Figure 113: Market Absolute $ Opportunity by Northern Africa Segment, 2018 to 2033

Figure 114: Market Absolute $ Opportunity by Türkiye Segment, 2018 to 2033

Figure 115: Market Absolute $ Opportunity by South Africa Segment, 2018 to 2033

Figure 116: Market Absolute $ Opportunity by Rest of Middle East and Africa Segment, 2018 to 2033

Figure 117: Middle East and Africa Market Value BPS Analysis by Product Type, 2023 and 2033

Figure 118: Middle East and Africa Market Y-o-Y Growth (%) by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 120: Middle East and Africa Market Value BPS Analysis by Application, 2023 and 2033

Figure 121: Middle East and Africa Market Y-o-Y Growth (%) by Application, 2023 to 2033

Figure 122: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Key Players & Market Share in Composite Cylinder Production

Breaking Down Market Share in Composite Cardboard Tube Packaging

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA