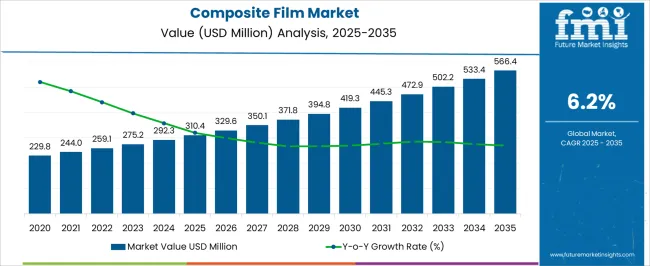

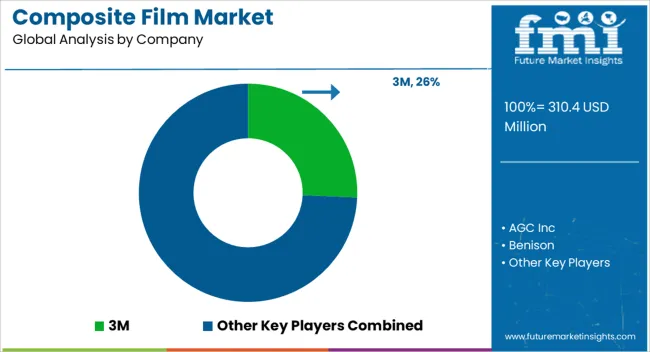

The composite film market is estimated to be valued at USD 310.4 million in 2025 and is projected to reach USD 566.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. A 5-year growth block analysis highlights a steady upward trajectory, with consistent expansion during both the early and later phases. Between 2025 and 2030, the market grows from USD 310.4 million to USD 419.3 million, contributing USD 108.9 million in growth, with a CAGR of 6.5%. This phase is driven by the increasing demand for composite films in industries such as packaging, automotive, and electronics, where lightweight, durable, and versatile materials are increasingly required.

Technological innovations and the rising preference for eco-friendly, sustainable materials in manufacturing further fuel the growth. From 2030 to 2035, the market continues to expand from USD 419.3 million to USD 566.4 million, adding USD 147.1 million in growth, with a slightly lower CAGR of 5.8%. This deceleration is reflective of the market maturing, with widespread adoption of composite films across various sectors. However, continued advancements in composite film applications, such as in flexible electronics, advanced packaging solutions, and renewable energy applications, ensure sustained growth. The 5-year growth block analysis shows strong and stable growth, driven by innovation and increasing market penetration.

| Metric | Value |

|---|---|

| Composite Film Market Estimated Value in (2025 E) | USD 310.4 million |

| Composite Film Market Forecast Value in (2035 F) | USD 566.4 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The need for films that offer superior mechanical strength, thermal stability, and chemical resistance has led to rising adoption across diverse sectors. Innovations in multilayer film technologies and eco-friendly resin blends have improved both the functional properties and sustainability profiles of composite films. Growth is further supported by regulatory emphasis on lightweight recyclable materials and the increasing role of flexible packaging in food safety, shelf life extension, and logistics optimization.

The market outlook remains optimistic as industry stakeholders focus on enhancing product performance, meeting sustainability goals, and improving production efficiency through automation and smart film design.

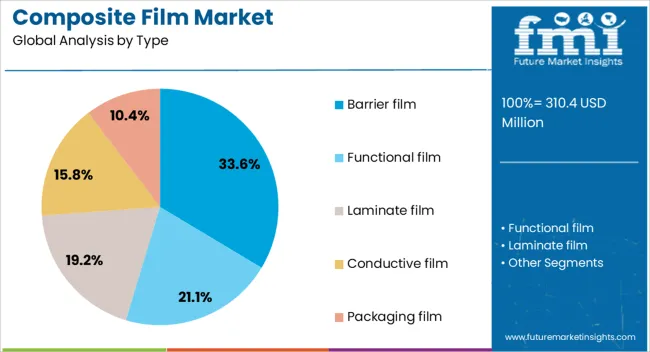

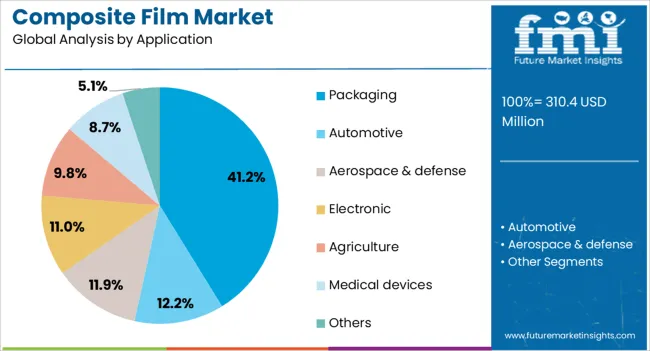

The composite film market is segmented by type, application, end use industry, and geographic regions. By type, the composite film market is divided into Barrier film, Functional film, Laminate film, Conductive film, and Packaging film. In terms of application, the composite film market is classified into Packaging, Automotive, Aerospace & defense, Electronic, Agriculture, Medical devices, and Others.

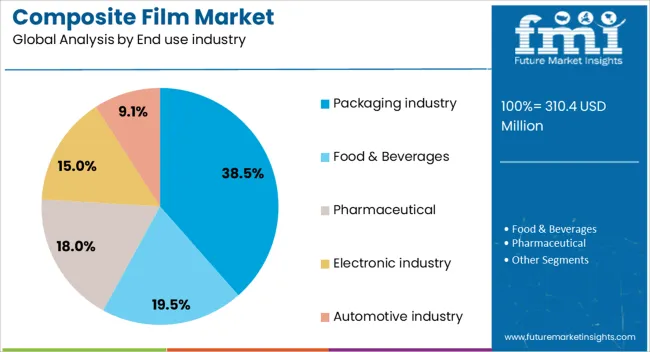

Based on end-use industry, the composite film market is segmented into the Packaging industry, the Food & Beverages industry, the Pharmaceutical industry, the electronics industry, and the Automotive industry. Regionally, the composite film industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The barrier film segment is projected to represent 33.60% of total market revenue by 2025 within the type category, establishing itself as the leading type. This dominance is driven by the critical need for materials that prevent the ingress of moisture, oxygen, and other contaminants.

Barrier films are widely used to enhance product shelf life and preserve material quality across various applications, including food packaging, electronics, and pharmaceuticals. The growth of the segment is further supported by advancements in nanocoating and multilayer barrier technologie,s which offer high protection with minimal material usage.

The ability to maintain integrity under diverse environmental conditions has reinforced the relevance of barrier films, making them an essential component in modern composite film development.

Packaging is expected to hold 41.20% of the total market revenue by 2025 under the application category, securing its position as the dominant segment. The growing demand for flexible, lightweight, and high barrier packaging solutions in food, personal care, and pharmaceutical sectors is fueling this growth.

Composite films are preferred due to their customizable structure which provides superior mechanical strength and aesthetic appeal. As consumer preferences shift toward products with longer shelf lives and minimal environmental impact, the adoption of advanced composite film packaging continues to rise. Additionally, innovations in resealable, tamper evident, and smart packaging formats are expanding the use of composite films in retail and logistics channels.

The packaging industry segment is projected to contribute 38.50% of total market revenue by 2025 within the end use industry category, making it the largest contributor. This is driven by the packaging sector’s emphasis on durability, barrier protection, and visual presentation.

Composite films meet these needs while offering scalability in production and adaptability across product categories. Increased consumer demand for hygienic, transport-resilient, and sustainable packaging formats has accelerated the integration of composite film solutions. Furthermore, global brands are actively replacing conventional packaging with high-performance film alternatives to align with environmental regulations and brand sustainability commitments. This continued push for innovation and compliance is sustaining the packaging industry’s leadership in composite film adoption.

The composite film market is growing rapidly due to the increasing demand for high-performance materials in packaging, electronics, and industrial applications. Composite films, made by combining different materials like polymers, metals, and ceramics, offer superior properties such as strength, flexibility, and barrier resistance. These films are ideal for applications requiring enhanced durability, moisture resistance, and electrical conductivity. With industries increasingly adopting composite films for packaging, automotive, and medical devices, the market is set to expand. Technological advancements in film manufacturing and customization are further driving growth, offering tailored solutions for diverse applications.

The growing demand for advanced packaging solutions is a major driver for the composite film market. Composite films offer enhanced protective qualities such as moisture resistance, oxygen barrier properties, and improved durability compared to traditional packaging materials. As industries such as food and beverage, pharmaceuticals, and consumer goods look to extend product shelf life and improve packaging functionality, composite films are becoming an essential part of the packaging supply chain. The increasing focus on reducing waste and improving packaging efficiency further accelerates the adoption of composite films, particularly in food packaging, where their ability to protect contents from environmental factors is highly valued.

Despite their advantages, the composite film market faces challenges related to high production costs and material compatibility. The manufacturing process for composite films can be expensive due to the use of multiple materials, specialized equipment, and advanced techniques. These higher production costs can make composite films less competitive compared to conventional films in price-sensitive markets. Furthermore, achieving compatibility between different materials to create films with the desired properties can be technically complex. Ensuring proper adhesion, flexibility, and functionality while maintaining film strength and resistance to environmental factors can be challenging. Overcoming these challenges is essential for expanding the market reach of composite films.

The composite film market presents significant opportunities, particularly with innovations in multi-layer film technologies and electronics applications. The ability to combine various materials into multi-layer composite films offers enhanced properties such as improved barrier performance, greater strength, and better electrical conductivity. In the electronics sector, composite films are increasingly being used in flexible displays, batteries, and printed circuit boards, where their lightweight and high-performance properties are highly valued. Advancements in composite film technologies are enabling the development of more customizable solutions for industries such as automotive, medical devices, and textiles. As industries continue to prioritize functionality and performance, composite films are expected to see growing adoption, creating new market opportunities.

A major trend in the composite film market is the increasing use of composite films in flexible electronics and smart packaging solutions. Flexible electronics, which require films that can withstand bending and stretching without compromising performance, are driving the demand for composite films with superior flexibility and electrical properties. In smart packaging, composite films are being integrated with sensors, RFID technology, and other smart features to monitor product conditions in real-time. These films can help track temperature, humidity, and other factors, providing valuable data for manufacturers and consumers. As these trends continue, composite films will play an increasingly important role in the development of innovative products across industries like electronics, packaging, and automotive.

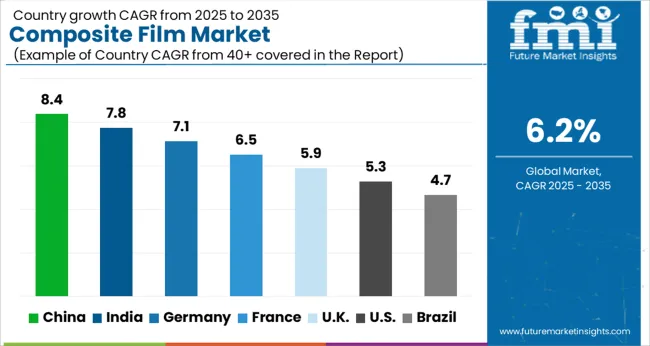

The global composite film market is projected to grow at a global CAGR of 6.2% from 2025 to 2035. China leads the market with a growth rate of 8.4%, followed by India at 7.8%. Germany records a growth rate of 7.1%, while the UK shows 5.9% and the USA. follows at 5.3%. The market is primarily driven by increasing demand for lightweight, high-performance films in packaging, electronics, and automotive industries. China and India are leading the growth, supported by rapid industrialization and rising demand for composite films in manufacturing sectors. Developed markets like Germany, the UK, and the USA are witnessing steady growth driven by technological advancements and high demand for packaging solutions. The analysis spans over 40+ countries, with the leading markets shown below.

The composite film market in China is expanding at a CAGR of 8.4% through 2035,driven by the growing demand for packaging, automotive, and electronics applications. China’s manufacturing industry, one of the largest in the world, is a key driver of the demand for composite films. As urbanization continues and consumer demand for high-quality packaging and electronics rises, the need for lightweight, durable, and high-performance composite films is increasing. The automotive industry, seeking materials that enhance fuel efficiency and reduce vehicle weight, is further contributing to the adoption of composite films. With the government’s emphasis on improving infrastructure and promoting industrial growth, China’s market for composite films is poised for significant expansion.

Demand for composite film in India is expected to grow at a CAGR of 7.8% through 2035, fueled by the country’s expanding industrial base and growing demand for eco-friendly, lightweight materials. The country’s rapid urbanization and development of infrastructure are key factors driving the adoption of composite films in packaging and construction. As the demand for consumer electronics and automotive solutions increases, so does the need for high-quality, durable films. The growing focus on sustainable alternatives in packaging is also contributing to the rise in demand for composite films in India. With government support for infrastructure and manufacturing, the adoption of composite films is set to rise significantly.

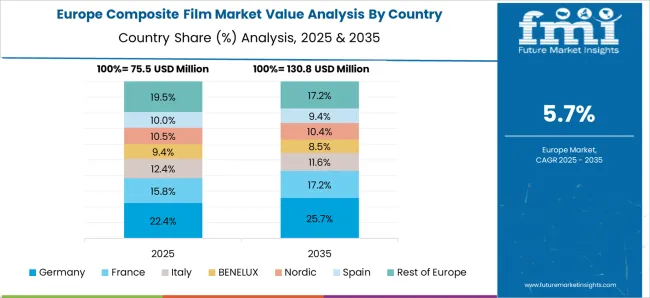

Sale of composite film in Germany is projected to grow at a CAGR of 7.1% through 2035, driven by the country’s robust demand for packaging, automotive, and industrial applications. Germany’s well-established manufacturing sector, particularly in the automotive and electronics industries, is pushing the need for lightweight, durable, and cost-efficient composite films. In addition, Germany’s focus on eco-friendly solutions and reducing environmental impacts in packaging materials is contributing to the growing use of composite films. As the automotive sector in Germany seeks lightweight solutions to improve fuel efficiency, the market for composite films continues to expand, making Germany one of the key regions for growth in Europe.

The composite film market in the UK is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by rising demand for packaging solutions and increasing adoption of lightweight materials in various industries. The UK market benefits from the growing consumer demand for high-quality packaging in food, beverages, and pharmaceuticals. As industries shift towards more efficient, energy-saving materials, the adoption of composite films is growing across the packaging and automotive sectors. The UK government’s emphasis on reducing waste and improving packaging standards also supports the market, leading to a rise in demand for lightweight alternatives like composite films.

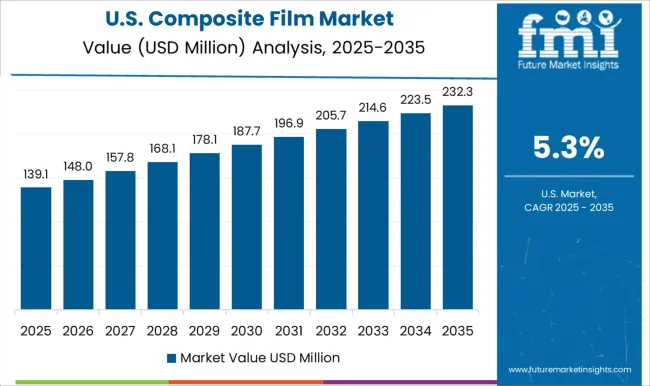

The USA composite film market is expected to grow at a CAGR of 5.3% through 2035, fueled by the increasing need for high-performance materials in the packaging, automotive, and electronics sectors. As USA industries focus on improving product quality and reducing environmental impact, composite films are becoming a preferred choice due to their lightweight, durable, and cost-effective properties. The automotive sector, aiming to reduce vehicle weight and improve efficiency, is a significant driver of this market. The growing e-commerce industry and increasing demand for packaged goods are boosting the adoption of composite films for packaging solutions.

Composite film adoption has been driven by major suppliers across packaging, electronics, automotive, and construction. 3M supplies specialty and optical films used in electronic displays, automotive paint protection, and medical packaging laminates. AGC Inc. provides Fluon ETFE fluoropolymer film used in electronics, solar modules, and architectural membranes, valued for UV resistance, clarity, and mechanical strength. Benison focuses on shrink and laminated packaging films rather than electronics or automotive. Fengchen Group supplies PVC, PE, and PVC PVDC PE composite films for pharmaceutical and food packaging. Guangdong Chaowei manufactures PE and PP protective films and multilayer co-extruded barrier films for flexible packaging. Henkel is best described as a supplier of laminating and adhesive films and functional coatings for flexible packaging and electronics assembly, not a producer of commodity packaging films.

Huizhou Yangrui produces flexible packaging films and laminates for food and consumer goods. HySum offers multilayer composite films for packaging and medical device packaging with high barrier options. Krus manufactures multilayer composite films for flexible packaging, mainly for food, pet food, and hygiene applications. Mondi develops laminating and high-barrier films and mono material options for food and industrial packaging. Park Aerospace supplies aerospace-grade surfacing films and structural film adhesives for composite structures. Shandong Top Leader manufactures PVC, PET, PP, and composite plastic films, including PET PE laminates for packaging.

| Item | Value |

|---|---|

| Quantitative Units | USD 310.4 Million |

| Type | Barrier film, Functional film, Laminate film, Conductive film, and Packaging film |

| Application | Packaging, Automotive, Aerospace & defense, Electronic, Agriculture, Medical devices, and Others |

| End use industry | Packaging industry, Food & Beverages, Pharmaceutical, Electronic industry, and Automotive industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, AGC Inc, Benison, Fengchen Group Co.,Ltd, Guangdong Chaowei Plastic Film Co., Ltd, Henkel AG, Huizhou Yangrui Printing & Packaging Co.,Ltd, Hysum, Krus company, Mondi Group, Park Aerospace Corp., and Shandong Top Leader Plastic Packing Co.,Ltd |

| Additional Attributes | Dollar sales by product type (protective films, packaging films, barrier films, electrical films, specialty films) and end-use segments (packaging, electronics, automotive, construction, food and beverage). Demand dynamics are influenced by increasing consumer demand for sustainable packaging, the rise of electronic and automotive applications requiring specialized films, and the growing need for high-performance films in protective coatings. Regional trends show strong growth in North America and Europe, where advanced technology applications drive demand, while Asia-Pacific is expanding rapidly due to growing industrialization, urbanization, and packaging needs. Innovation trends focus on improving film properties like barrier resistance, flexibility, and eco-friendliness, while environmental considerations include reducing plastic waste and optimizing the recyclability of composite films. |

The global composite film market is estimated to be valued at USD 310.4 million in 2025.

The market size for the composite film market is projected to reach USD 566.4 million by 2035.

The composite film market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in composite film market are barrier film, functional film, laminate film, conductive film and packaging film.

In terms of application, packaging segment to command 41.2% share in the composite film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Breaking Down Market Share in Composite Cardboard Tube Packaging

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Biocomposite Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA