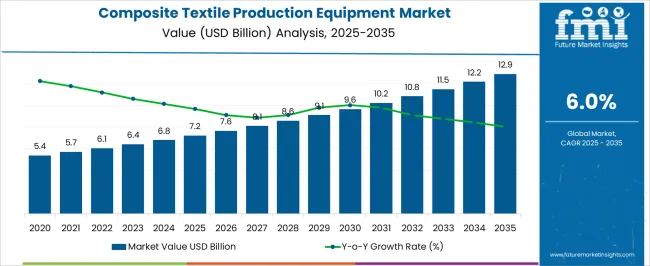

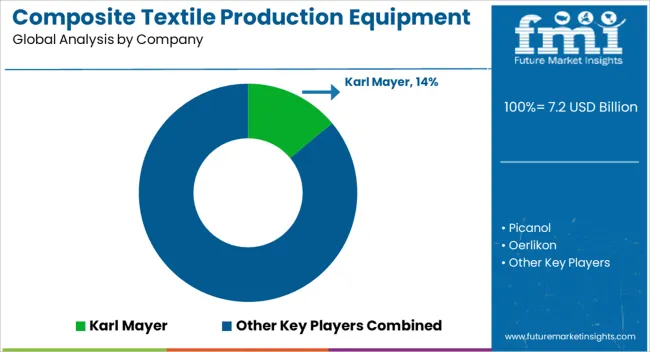

The composite textile production equipment market is projected to grow from USD 7.2 billion in 2025 to USD 12.9 billion by 2035, exhibiting a CAGR of 6.0%. From 2021 to 2025, the market demonstrates steady year-on-year (YoY) growth, moving from USD 5.4 billion in 2021 to USD 7.2 billion in 2025. This growth is driven by increasing demand in industries such as automotive, aerospace, and construction, where composite textiles are integral to advanced manufacturing processes. Between 2021 and 2025, the market grows consistently, reaching USD 5.7 billion in 2022, USD 6.1 billion in 2023, and USD 6.4 billion in 2024.

The increase from USD 5.4 billion to USD 7.2 billion reflects the compounded effect of both incremental market adoption and technological advancements in production techniques. From 2025 to 2030, the market continues to expand, reaching USD 7.6 billion in 2026, followed by USD 8.1 billion in 2027, and USD 8.6 billion in 2028. By 2030, the market value will be USD 9.1 billion, continuing its upward trajectory.

The period from 2030 to 2035 sees the market approaching USD 12.9 billion, with incremental increases from USD 9.6 billion in 2031, USD 10.2 billion in 2032, USD 10.8 billion in 2033, and reaching USD 12.2 billion in 2034. This steady YoY growth highlights the increasing application of composite textiles in high-performance industries.

| Metric | Value |

|---|---|

| Composite Textile Production Equipment Market Estimated Value in (2025 E) | USD 7.2 billion |

| Composite Textile Production Equipment Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The composite textile production equipment market is influenced by several parent markets that drive its growth across different industries. Within the textile machinery market, composite textile production equipment accounts for around 8-10% of the market share. These machines are crucial in manufacturing advanced textiles used in high-performance applications such as automotive, aerospace, and sportswear. The composites market also plays a significant role, contributing approximately 7-9% of the share.

The increasing demand for fiber-reinforced composite materials in industries like aerospace, automotive, and construction fuels the need for specialized equipment designed for composite textile production. The automotive manufacturing market contributes about 5-7% to the composite textile production equipment market. As the automotive industry adopts lightweight, high-strength materials like carbon fiber and other composite textiles for vehicle components, the demand for advanced textile production equipment rises.

Similarly, the aerospace industry market holds around 6-8% of the share, driven by the growing use of composite materials in aircraft construction. Components like wings and fuselages require specialized textile manufacturing equipment to meet performance and safety standards. Lastly, the sports and leisure equipment market accounts for approximately 4-6% of the market share. Composite textiles are increasingly used in the production of high-performance sporting goods, including golf clubs, bicycles, and ski equipment, driving the demand for advanced production equipment.

The Composite Textile Production Equipment market is experiencing steady expansion as industries increasingly adopt advanced machinery to produce high-performance textile materials. Growth is being driven by rising demand for lightweight, durable, and high-strength composites in sectors such as aerospace, automotive, defense, and renewable energy. The integration of automation, precision engineering, and digital monitoring systems in textile equipment has enhanced production efficiency, reduced waste, and improved product quality.

Sustainability initiatives and the shift toward eco-friendly manufacturing processes are also prompting investments in modern equipment that supports recyclable and bio-based fiber processing. Moreover, the rising complexity of composite structures used in engineering applications has created a need for machinery capable of producing intricate and consistent weaves.

The market outlook remains positive, supported by continuous research and development efforts, increasing capital expenditure in manufacturing facilities, and expanding applications of composite textiles in emerging industries These factors collectively position the market for sustained growth over the coming years.

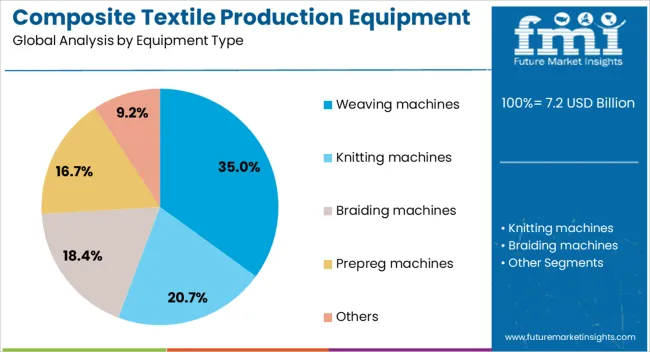

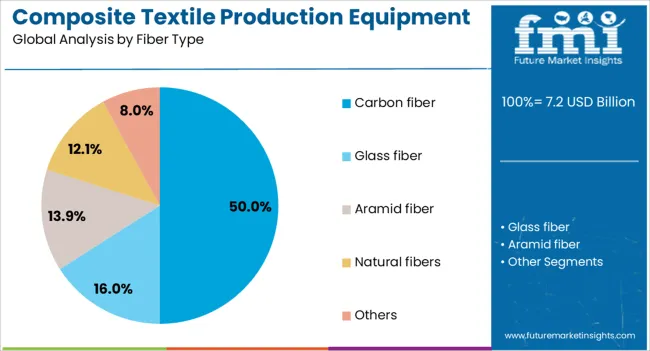

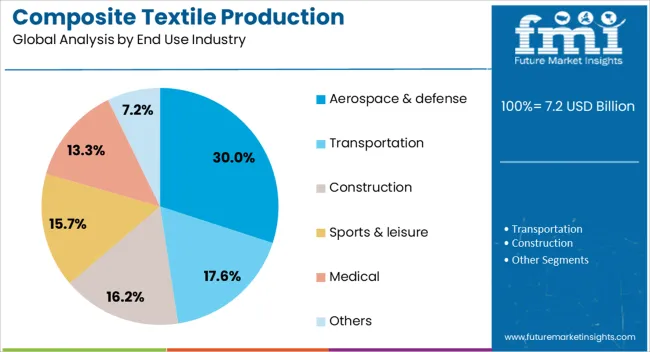

The composite textile production equipment market is segmented by equipment type, fiber type, end use industry, technology level, distribution channel, and geographic regions. By equipment type, composite textile production equipment market is divided into Weaving machines, Knitting machines, Braiding machines, Prepreg machines, and Others. In terms of fiber type, composite textile production equipment market is classified into Carbon fiber, Glass fiber, Aramid fiber, Natural fibers, and Others. Based on end use industry, composite textile production equipment market is segmented into Aerospace & defense, Transportation, Construction, Sports & leisure, Medical, and Others. By technology level, composite textile production equipment market is segmented into Fully automated equipment, Semi-automated systems, and Manual equipment. By distribution channel, composite textile production equipment market is segmented into Direct and Indirect. Regionally, the composite textile production equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The weaving machines segment is projected to hold 35% of the Composite Textile Production Equipment market revenue share in 2025, making it the leading equipment type. Growth in this segment has been supported by the ability of weaving machines to produce highly precise and complex fabric structures that meet stringent performance requirements in composite applications. These machines have been favored for their adaptability to various fiber types, enabling the production of both traditional and advanced composite fabrics.

Advancements in automation and computerized control systems have increased production speeds while maintaining consistency in weave quality. The durability and scalability of weaving machines have further reinforced their adoption in high-volume manufacturing environments.

Manufacturers have increasingly opted for weaving equipment that allows integration with software-driven design systems, enabling quick customization of patterns and properties The combination of efficiency, flexibility, and precision has positioned weaving machines as a preferred choice for composite textile production.

The carbon fiber segment is anticipated to account for 50% of the Composite Textile Production Equipment market revenue share in 2025, positioning it as the leading fiber type. Growth in this segment has been driven by the exceptional strength-to-weight ratio, rigidity, and thermal resistance offered by carbon fibers. These properties make them ideal for applications requiring high performance and durability in demanding environments.

The increasing use of carbon fiber in aerospace, automotive, wind energy, and sporting goods has created sustained demand for production equipment capable of handling its specific manufacturing requirements. Equipment designed for carbon fiber processing has been engineered to ensure precision alignment, minimal material wastage, and consistent tensile properties.

Additionally, advancements in textile machinery have enabled efficient handling of carbon fiber's brittle structure, improving yield and quality The growing push for lightweight materials to enhance energy efficiency and performance in multiple industries has reinforced the segment's dominant position.

The aerospace and defense segment is expected to hold 30% of the Composite Textile Production Equipment market revenue share in 2025, making it the leading end-use industry. Growth in this segment has been propelled by the rising need for advanced composite materials in aircraft, spacecraft, and defense systems to reduce weight, improve fuel efficiency, and enhance structural performance.

Composite textiles produced for this sector must meet stringent quality, safety, and regulatory standards, which has driven investments in state-of-the-art production equipment. The ability of modern machinery to deliver high precision, uniformity, and repeatability has been crucial in meeting aerospace-grade specifications.

Furthermore, ongoing defense modernization programs and the increasing adoption of lightweight armor and protective gear have fueled demand for advanced composite fabrics With continuous technological innovation in aerospace design and materials engineering, the need for specialized textile equipment capable of processing high-performance fibers such as carbon and aramid has further solidified this segment’s leadership in the market.

The composite textile production equipment market is experiencing steady growth, driven by the increasing demand for lightweight and high-performance materials across industries like automotive, aerospace, and renewable energy. These materials, made using advanced textile production techniques, are crucial for applications that require durability and weight reduction. In the automotive industry there is a strong push for fuel-efficient vehicles, which has driven the use of composite materials in various components.

The aerospace sector is focused on improving fuel efficiency and payload capacity, leading to increased adoption of composites. Technological advancements, such as automation and high-precision weaving and braiding techniques, are enhancing the efficiency and scalability of composite textile production.

One of the key challenges is the high cost associated with advanced equipment. The initial investment required for automated production systems and precision machinery can be a significant barrier, especially for smaller manufacturers or startups.Integrating these systems into existing production lines can be complex and resource-intensive, requiring specialized expertise and training. The development of composite textiles also requires the use of specialized raw materials, which can be expensive and difficult to source, especially for emerging industries. Another challenge is the competition from alternative materials and production techniques that offer lower costs or simpler manufacturing processes. Furthermore, fluctuations in demand across industries such as automotive or aerospace can lead to production volatility, affecting profitability. Overcoming these challenges requires continuous innovation, cost optimization, and improvements in the supply chain to remain competitive.

The composite textile production equipment market is primarily driven by the increasing demand for lightweight and durable materials in sectors like automotive, aerospace, and energy. In the automotive industry, the push for energy-efficient vehicles and lighter components has spurred the use of composite materials. Similarly, the aerospace sector is focused on reducing weight for fuel efficiency, making composites an ideal solution. The growing demand for wind energy is driving the adoption of composite textiles in turbine blades, further boosting market growth. Technological advancements in the production process, such as the integration of automation, precision weaving, and braiding machines, have significantly enhanced production speed and material quality. These advancements not only improve the efficiency of the manufacturing process but also expand the range of composite materials that can be produced.

The composite textile production equipment market presents significant opportunities for innovation and expansion. One key opportunity lies in the development of new composite materials, such as hybrid composites that combine different fibers to improve strength and performance. The growing trend toward lightweight, high-performance materials in industries like automotive, aerospace, and construction offers ample growth opportunities. Innovations in production techniques, such as 3D weaving and braiding, are enabling the creation of more complex and customized composite structures. The increasing focus on energy efficiency and reducing material waste presents another growth avenue for manufacturers to develop eco-friendly production processes. Expanding into emerging markets, particularly in Asia-Pacific and Latin America, where industrialization is rapidly progressing, offers significant growth potential for composite textile production equipment manufacturers.

The integration of advanced technologies, such as automation and artificial intelligence (AI), is making the production process more efficient and precise. These technologies allow for improved material handling, real-time performance monitoring, and predictive maintenance, enhancing overall production reliability. Another key trend is the growing demand for lightweight and energy-efficient materials, particularly in the automotive, aerospace, and energy sectors. The development of new materials, such as hybrid composites and bio-based fibers, is contributing to the growth of the market. The push for more eco-friendly manufacturing processes is driving the adoption of eco-friendly production techniques and materials. The expansion of the electric vehicle (EV) and wind energy industries is also contributing to increased demand for composite textiles. As industries evolve, the market for composite textile production equipment is expected to continue evolving, driven by innovation in both material technology and manufacturing processes.

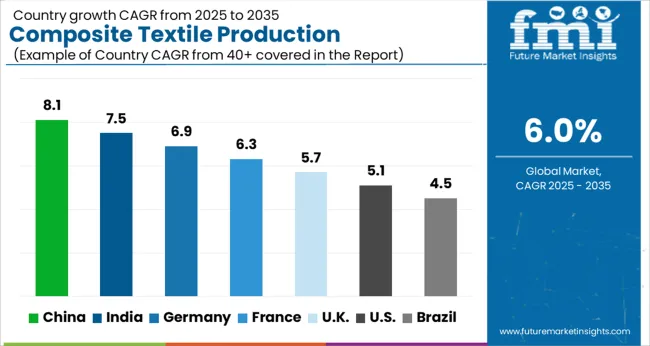

| Countries | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global composite textile production equipment market is projected to grow at a CAGR of 6.0% from 2025 to 2035. China leads with a growth rate of 8.1%, followed by India at 7.5%, and Germany at 6.9%. The United Kingdom and the United States show more moderate growth rates of 5.7% and 5.1%, respectively. The market growth is driven by increasing demand in automotive, aerospace, and construction sectors, where lightweight, high-strength composite materials are crucial. Advancements in manufacturing technologies, innovation, and sustainability are key factors supporting the market’s expansion across these regions. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the composite textile production equipment market with a projected CAGR of 8.1% from 2025 to 2035. As a global manufacturing powerhouse, China’s extensive textile industry and focus on expanding its capabilities in advanced materials and composites play a significant role in this growth. The demand for composite textiles in sectors such as automotive, aerospace, and construction is rising rapidly, fueling the need for specialized production equipment. Government initiatives promoting high-tech manufacturing and industrial innovation further accelerate market growth. The increasing focus on lightweight, high-strength materials in industries like automotive and construction is expected to boost the demand for composite textile production equipment in China.

The composite textile production equipment market in India is forecasted to grow at a CAGR of 7.5% from 2025 to 2035. India’s rapidly growing textile industry, combined with increasing investments in advanced manufacturing technologies, is a key factor driving market expansion. As demand for composite materials rises across various industries, including automotive, defense, and sports, the need for specialized production equipment becomes more pronounced. India’s expanding manufacturing base and focus on innovation in textile production technologies are contributing to the growth of the market. The market is also supported by the country’s increasing emphasis on sustainable and cost-effective textile manufacturing.

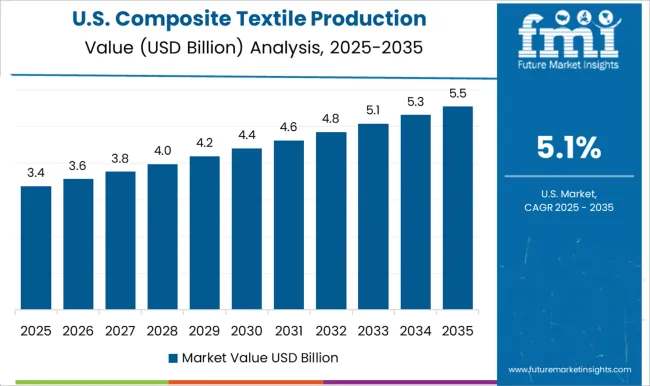

The USA composite textile production equipment market is projected to grow at a CAGR of 5.1% from 2025 to 2035. The USA market is largely driven by the growing demand for advanced composite materials in the automotive, aerospace, and construction sectors. As industries increasingly adopt lightweight, high-strength materials to improve performance and reduce environmental impact, the need for specialized textile production equipment rises.

The USA continues to focus on innovation in composite manufacturing and sustainability, further supporting market growth. The expanding focus on the use of composite textiles in various high-performance applications will continue to drive equipment demand.

The composite textile production equipment market in the United Kingdom is expected to grow at a CAGR of 5.7% from 2025 to 2035. The UK’s strong automotive and aerospace industries drive the demand for lightweight, high-strength composite materials, which in turn boosts the need for specialized production equipment. With growing emphasis on sustainable manufacturing practices and innovation in textile production technologies, the market in the UK is poised for steady growth. The rising demand for high-performance materials across various industries further supports the expansion of the composite textile production equipment market.

The collaboration display market in the United States is projected to grow at a CAGR of 6.0% from 2025 to 2035. The country’s strong demand for collaboration displays in business, education, and government sectors is driven by the increasing need for effective communication and teamwork. The rise in remote working, online learning, and virtual meetings is also fueling the market. As industries continue to adopt advanced technology and digital platforms for collaboration, the USA market for collaboration displays will continue to expand. With continued investments in digital infrastructure and remote communication technologies, market growth is expected to remain steady.

The composite textile production equipment market is increasingly shaped by the rising adoption of advanced machinery across sectors such as automotive, aerospace, and industrial textiles. Demand for high-strength, lightweight composite fabrics has driven manufacturers to invest in innovative equipment capable of improving productivity, efficiency, and material performance.

Key players in this landscape include Karl Mayer, Picanol, Oerlikon, Rieter, and Saurer / SSM, each offering distinct capabilities that address evolving industry requirements. Karl Mayer is recognized for its expertise in warp knitting and composite textile machinery, delivering solutions that optimize production efficiency and ensure consistent material quality. Its focus on innovation has allowed manufacturers to produce complex fabric structures while reducing operational bottlenecks. Picanol provides high-speed weaving systems adapted specifically for composite fabrics, emphasizing precision, operational efficiency, and integration with automated production lines.

Oerlikon offers a broad portfolio of machinery for technical textiles, with a strong focus on automation, process optimization, and adaptability for various composite materials. Rieter is known for its fiber-to-yarn systems and equipment designed to streamline the transition from raw fibers to finished composite textiles, improving throughput and reducing waste. Saurer / SSM delivers reliable machinery for spinning and composite fabric production, addressing the demands of high-volume manufacturing while accommodating intricate textile structures. These companies differentiate themselves through technological innovation, process reliability, and strong after-sales support, enabling manufacturers to scale production without compromising quality.

Competitive advantage is further strengthened by tailored solutions for industrial-scale operations and specialized applications, reflecting the increasing complexity and performance requirements of composite textile production. Their combined focus on precision, durability, and automation ensures that evolving market needs are consistently met.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 Billion |

| Equipment Type | Weaving machines, Knitting machines, Braiding machines, Prepreg machines, and Others |

| Fiber Type | Carbon fiber, Glass fiber, Aramid fiber, Natural fibers, and Others |

| End Use Industry | Aerospace & defense, Transportation, Construction, Sports & leisure, Medical, and Others |

| Technology Level | Fully automated equipment, Semi-automated systems, and Manual equipment |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Karl Mayer, Picanol, Oerlikon, Rieter, and Saurer / SSM |

| Additional Attributes | Dollar sales by equipment type (weaving, knitting, spinning, auxiliary systems), production capacity (low, medium, high), and application (automotive, aerospace, industrial textiles). Demand dynamics are driven by increasing adoption of lightweight and high-strength composite fabrics, rising automation in textile manufacturing, and expansion of advanced textile applications. Regional trends highlight strong growth in Europe, Asia-Pacific, and North America, supported by industrial investments and increasing focus on high-performance composite materials. |

The global composite textile production equipment market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the composite textile production equipment market is projected to reach USD 12.9 billion by 2035.

The composite textile production equipment market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in composite textile production equipment market are weaving machines, knitting machines, braiding machines, prepreg machines and others.

In terms of fiber type, carbon fiber segment to command 50.0% share in the composite textile production equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Breaking Down Market Share in Composite Cardboard Tube Packaging

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Biocomposite Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA