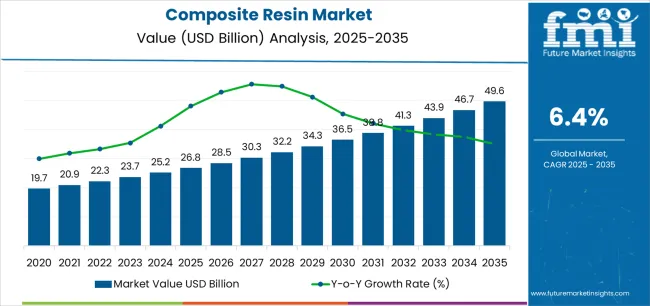

The Composite Resin Market is estimated to be valued at USD 26.8 billion in 2025 and is projected to reach USD 49.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The composite resin market is growing steadily due to increasing demand across automotive, aerospace, and construction sectors for lightweight, high-performance materials. Composite resins offer superior mechanical strength, chemical resistance, and design flexibility, making them essential in modern manufacturing.

The market’s growth is further reinforced by technological advancements in resin formulation, which enhance thermal stability and sustainability through bio-based alternatives. Expanding adoption in electric vehicles and renewable energy components, such as wind turbine blades, is also contributing to long-term demand.

As manufacturers seek to reduce production costs and improve process efficiency, automated manufacturing methods using composite resins are gaining traction. With continuous innovation and the rising need for durable, eco-efficient materials, the composite resin market is expected to maintain steady growth globally.

| Metric | Value |

|---|---|

| Composite Resin Market Estimated Value in (2025 E) | USD 26.8 billion |

| Composite Resin Market Forecast Value in (2035 F) | USD 49.6 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

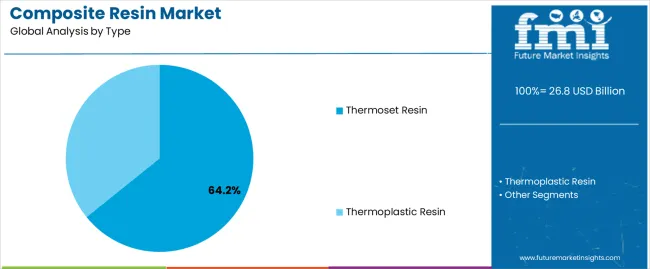

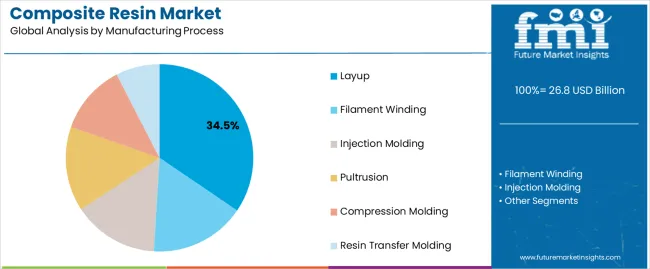

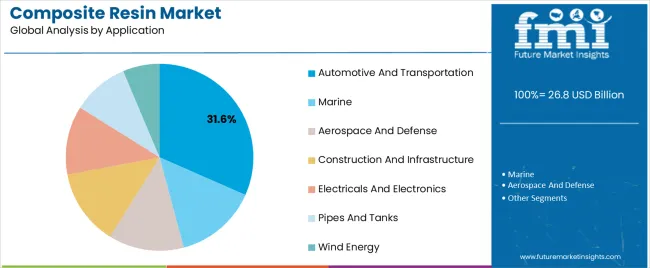

The market is segmented by Type, Manufacturing Process, and Application and region. By Type, the market is divided into Thermoset Resin and Thermoplastic Resin. In terms of Manufacturing Process, the market is classified into Layup, Filament Winding, Injection Molding, Pultrusion, Compression Molding, and Resin Transfer Molding. Based on Application, the market is segmented into Automotive And Transportation, Marine, Aerospace And Defense, Construction And Infrastructure, Electricals And Electronics, Pipes And Tanks, and Wind Energy. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thermoset resin segment leads the type category, accounting for approximately 64.2% share of the composite resin market. Its dominance is supported by superior heat resistance, mechanical strength, and dimensional stability, which make it ideal for high-stress applications.

The irreversible curing process ensures long-term durability, making thermoset resins suitable for automotive, aerospace, and marine components. The segment benefits from widespread use of epoxy, polyester, and vinyl ester resins in advanced composite structures.

Ongoing innovation in low-VOC and recyclable thermoset formulations has further strengthened its sustainability profile. With continuous demand for lightweight and high-performance materials, the thermoset resin segment is projected to retain its leading market position.

The layup segment dominates the manufacturing process category with approximately 34.5% share, reflecting its extensive use in producing complex, high-quality composite parts. Both hand and automated layup techniques are widely applied in industries such as aerospace, wind energy, and transportation.

The process offers flexibility in fiber orientation, enabling customized component performance. Continuous improvements in automation and resin infusion have enhanced efficiency and reduced production costs.

The segment’s strength lies in its adaptability to diverse applications requiring precision and strength. With the growing demand for lightweight structures and high-end composite components, the layup process is expected to sustain its market leadership.

The automotive and transportation segment holds approximately 31.6% share within the application category, driven by the need for lightweight materials that improve fuel efficiency and reduce emissions. Composite resins are increasingly used in vehicle body panels, structural parts, and interior components due to their strength-to-weight advantage.

The transition toward electric vehicles has amplified demand for composite materials to offset battery weight while maintaining safety standards. The segment also benefits from ongoing innovations in resin transfer molding and automated manufacturing techniques that enable mass production of composite parts.

With stringent environmental regulations and continued technological advancements, the automotive and transportation segment is expected to remain a key growth driver for the composite resin market.

The scope for global composite resin market insights expanded at an 8.4% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 6.7% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 8.4% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 6.7% |

Between 2020 and 2025, the global market exhibited robust growth, with an impressive 8.4% CAGR. During this period, the market witnessed significant expansion, reflecting increased adoption across various dental, automotive, and construction industries.

This growth was propelled by composite resins' versatility, durability, aesthetic appeal, and ongoing research and development initiatives enhancing their properties.

From 2025 to 2035, market forecast projections indicate a slightly moderated but still substantial growth trajectory, with a projected CAGR of 6.7%. Despite a marginally slower pace than the previous period, the market is expected to continue evolving, driven by sustained demand in key sectors and advancements in composite resin applications.

Factors such as increased emphasis on sustainability and material eco-friendly characteristics are likely to contribute to the positive outlook of the market during the forecast period.

| Attributes | Details |

|---|---|

| Opportunities |

|

The table emphasizes the CAGRs in five pivotal countries, namely the United States, Japan, China, the United Kingdom, and South Korea.

South Korea emerges as a dynamic and rapidly progressing market, projecting significant growth with a 9% CAGR anticipated by 2035. Renowned for its commitment to innovation, the country plays a crucial role across diverse industries, depicting a flourishing economic landscape marked by continuous development.

The substantial CAGR underscores the proactive stance of the United Kingdom in embracing and steering advancements in the market, solidifying its standing as a key contributor to the global sustainable materials industry. This reflects the dedication to sustainable practices and positions it as a noteworthy player in driving positive global developments within the industry.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 7% |

| Japan | 8.3% |

| China | 7.7% |

| The United Kingdom | 8% |

| South Korea | 9% |

The automotive and aerospace industries primarily drive the utilization of composite resins in the United States. These sectors leverage composite resins for their lightweight properties, contributing to fuel efficiency and overall performance.

The demand for aesthetically pleasing and durable materials in dental applications further fuels the use of composite resins in the United States.

The market is notably influenced by its thriving electronics and automotive industries. The demand for high-performance materials in electronic components and the emphasis on light weighting in the automotive sector contribute to the widespread use of composite resins. The versatility of the material aligns with the commitment to technological innovation and product development.

The rapid growth of the construction and infrastructure sectors drives the market in China. Composite resins offer structural integrity and design flexibility, making them suitable for various construction applications.

The expansion of the automotive industry and increasing focus on renewable energy contribute to rising demand for composite resins of China.

The United Kingdom stands out for its proactive approach to embracing sustainable materials. Composite resins find extensive use in the United Kingdom due to their eco-friendly characteristics, supporting the commitment to the environmental responsibility of the country.

The construction sector, in particular, adopts composite resins for their durability and versatility in various building applications.

The dedication to innovation across industries fuels the vibrant market for composite resins. The rapid growth is particularly evident in the electronics and automotive sectors, where composite resins are valued for their advanced properties.

The commitment to staying at the forefront of technological advancements contributes to the significant adoption of composite resins in various applications.

The table below provides an overview of the composite resin landscape on the basis of resin type and manufacturing process. Thermoset resin is projected to lead the resin type of market at a 6.5% CAGR by 2035, while layup in the manufacturing process category is likely to expand at a CAGR of 6.3% by 2035.

The widespread adoption of thermoset resin in the market is propelled by its inherent characteristics, such as high strength, durability, and resistance to heat. The growing preference for the layup manufacturing process is driven by its versatility and cost-effectiveness.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Thermoset Resin | 6.5% |

| Layup | 6.3% |

Thermoset resin is anticipated to take the forefront in the resin type category, exhibiting a projected CAGR of 6.5% by 2035. This suggests a sustained and robust demand for thermoset resin-based composite materials, driven by their durability, heat resistance, and versatility across industries.

Layup is expected to showcase noteworthy expansion in the manufacturing process category, with a projected CAGR of 6.3% by 2035. This indicates a growing preference for the layup process in composite resin production, reflecting its efficiency and applicability in creating complex structures.

The data underscores the enduring significance of thermoset resins and the increasing prominence of the layup manufacturing process in shaping the evolving landscape of the market.

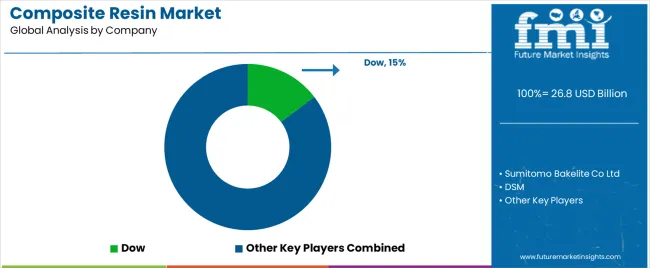

The competitive landscape of the composite resin market is marked by key players vying for market share and influence. Major companies in the industry engage in strategies such as mergers, acquisitions, and partnerships to strengthen their market position.

Innovation in product development, particularly in formulating composite resin solutions for diverse applications, is a focal point for market leaders. These companies emphasize geographic expansion to tap into emerging markets.

The market dynamics also include a mix of established industry giants and emerging players, creating a competitive environment that encourages continuous advancements in technology and materials.

Factors such as research and development initiatives, regulatory compliance, and sustainable practices contribute to the differentiation strategies companies adopt within the market.

Overall, the landscape is dynamic, characterized by a balance of market leaders stability and the agility of emerging players, fostering a competitive atmosphere that drives innovation and market growth.

Some key market developments are as follows

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 26.8 billion |

| Projected Market Valuation in 2035 | USD 49.6 billion |

| CAGR Share from 2025 to 2035 | 6.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Market Segments Covered | By Resin Type, By Manufacturing, By Application, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Argentina, Germany, Italy, France, United Kingdom, Spain, Russia, BENELUX, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC |

| Key Companies Profiled | Sumitomo Bakelite Co Ltd; Dow; DSM; Hexion Inc; Scott Bader Company Ltd; Huntsman International LLC; Celanese Corporation; Evonik Industries AG; Allnex GmbH; SABIC |

The global composite resin market is estimated to be valued at USD 26.8 billion in 2025.

The market size for the composite resin market is projected to reach USD 49.6 billion by 2035.

The composite resin market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in composite resin market are thermoset resin and thermoplastic resin.

In terms of manufacturing process, layup segment to command 34.5% share in the composite resin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-Temperature Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Breaking Down Market Share in Composite Cardboard Tube Packaging

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA