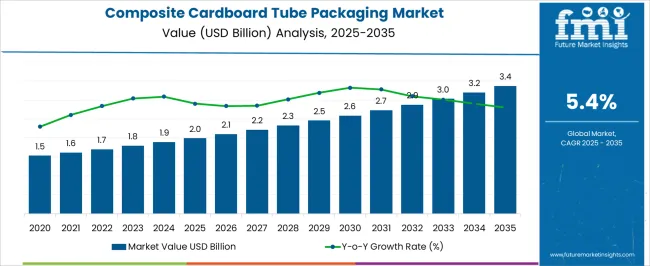

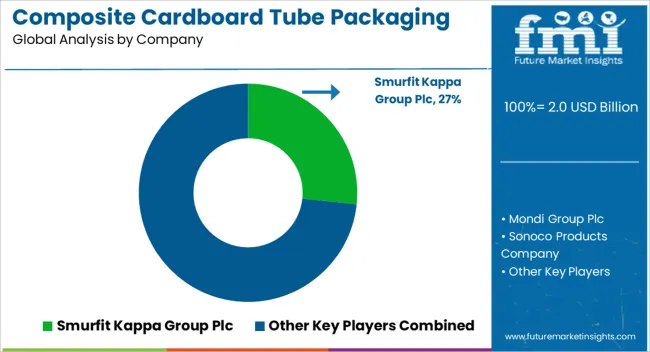

The Composite Cardboard Tube Packaging Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Composite Cardboard Tube Packaging Market Estimated Value in (2025E) | USD 2.0 billion |

| Composite Cardboard Tube Packaging Market Forecast Value in (2035F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The composite cardboard tube packaging market is experiencing accelerated momentum due to growing demand for sustainable, customizable, and protective packaging solutions across multiple industries. Consumer preference is shifting toward eco friendly materials that offer both structural integrity and visual appeal, supporting the replacement of conventional plastic or metal containers.

Advancements in recyclable liner technologies, branding flexibility through digital printing, and cost effectiveness in production have elevated the use of cardboard tubes. Regulatory emphasis on biodegradable and low impact packaging solutions is also driving widespread adoption.

The future outlook is positive as industries seek innovative packaging formats that support both performance and sustainability goals, especially within fast moving consumer goods, premium products, and e commerce.

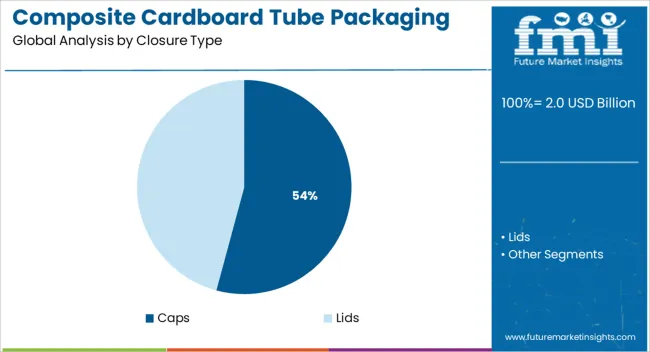

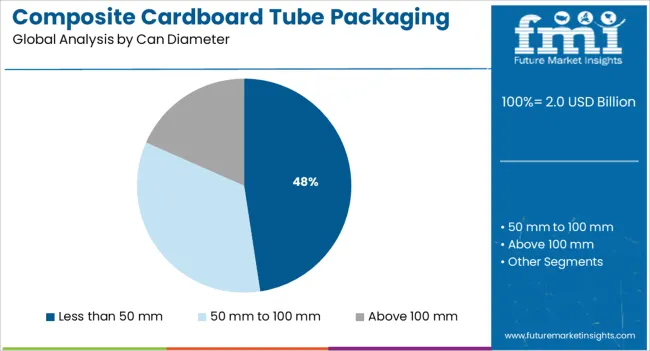

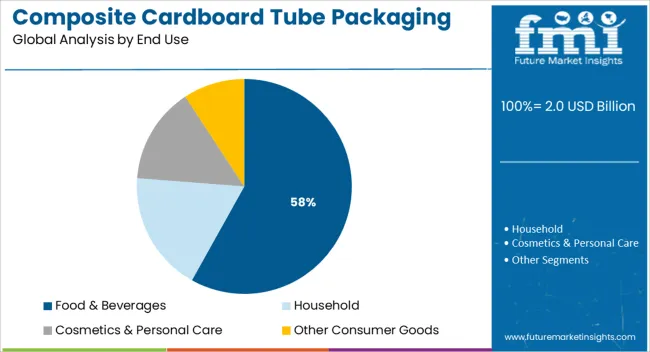

The market is segmented by Closure Type, Can Diameter, and End Use and region. By Closure Type, the market is divided into Caps and Lids. In terms of Can Diameter, the market is classified into Less than 50 mm, 50 mm to 100 mm, and Above 100 mm. Based on End Use, the market is segmented into Food & Beverages, Household, Cosmetics & Personal Care, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The caps segment is projected to hold 54.20% of total market revenue by 2025 within the closure type category, making it the dominant option. This is due to its practicality, resealability, and alignment with consumer convenience preferences.

Caps allow for repeated use and effective content protection which supports product longevity. In addition, their compatibility with various branding and labeling methods has enhanced their attractiveness across retail and food segments.

The simplicity of cap application in automated manufacturing environments and the ability to integrate tamper evidence have also contributed to their widespread use. These advantages collectively position the caps segment as the preferred closure solution in the composite cardboard tube packaging landscape.

The less than 50 mm segment is expected to account for 47.60% of market revenue by 2025 under the can diameter category, establishing it as the leading size format. Its prominence is supported by demand for compact, lightweight, and portable packaging, especially for items like snacks, cosmetics, and spices.

This diameter range offers ease of handling, storage efficiency, and attractive shelf presence, which are essential in high volume retail environments. The format also allows for reduced material usage, aligning with cost optimization and environmental sustainability strategies.

Its adaptability across various closure types and compatibility with automated filling systems have further strengthened its market position.

The food and beverages segment is projected to contribute 58.10% of the overall market share by 2025, making it the largest end use category. This leadership is attributed to the demand for packaging solutions that preserve freshness, protect against external elements, and enhance shelf appeal.

Composite cardboard tubes offer barrier protection and moisture resistance while maintaining eco friendly credentials, making them suitable for dry goods, snacks, tea, and powdered beverages. The format’s premium look and feel support branding in competitive shelf environments, while its resealability and portion control advantages add further consumer value.

As food and beverage brands aim to reduce plastic usage and improve packaging sustainability, this segment continues to drive growth within the composite cardboard tube packaging market.

The global composite cardboard tube packaging market share witnessed a growth rate of 3.6% from 2020 to 2024 and reached USD 1.9 Billion in 2024.

Composite cardboard tube packaging is a lightweight, easily openable packaging solution that is mainly used to store and transport products. Composite cardboard tube packaging is a fiber-based packaging solution that is sturdy, protective, and biodegradable.

This cardboard tube packaging is resistant to water and external factors such as temperature because moisture and heat may damage the products stored inside them. The usage of composite cardboard tube packaging increases the shelf life of food, preserving the taste and aroma.

It also reduces the risk of spillage. Composite cardboard tube packaging has high crushing strength and can be carried anywhere with ease.

In recent years, the composite cardboard tube packaging market has witnessed significant growth in the food & beverage and retail industries. The increased consumption of tube packaging in food & beverage packaging plays a vital role in contributing to growth opportunities for the key players in the composite cardboard tube packaging market. Thus, they are gaining significant traction in the food & beverage, personal care & cosmetics, as well as household industries.

The usage of composite cardboard tube packaging, particularly for attractive retail packaging, is likely to witness a substantial increase. On the back of these factors, the composite cardboard tube packaging market is expected to witness significant growth during the forecast period.

Over the years, plastic tube packaging was majorly used by all key players for storing and carrying food & beverage products. But recently, due to consumer preferences and rising awareness about environmental concerns, consumers’ focus is shifting towards composite cardboard tube packaging, which is 100% recyclable and has the same primary properties as plastic tube packaging, such as protecting the food product from any contamination, spillage, increase the shelf life and make it easy to carry.

Therefore, manufacturers can develop composite cardboard tube packaging instead of plastic tube packaging, thereby increasing the opportunity for all the small players to enter the sustainability market. The brand owners are also focusing on adopting sustainable packaging solutions such as composite cardboard tube packaging For instance, Hans Freitag, a food manufacturer, launched its new Fit for Fun biscuits using composite cardboard tube packaging.

Also, the replacement of plastic tube packaging with recyclable composite cardboard tube packaging will contribute to regulations framed by the government for various environmental issues.

By closure type, the caps segment holds the major portion of the global composite cardboard tube packaging market. The caps segment is projected to expand at a CAGR of 5.2% during the forecast period.

The food & beverages segment is projected to generate hefty demand for composite cardboard tube packaging during the forecast period. The food & beverages segment is estimated to hold around 57% of the market value share by the end of 2035.

The increasing consumption of packed food and the trend for rigid sustainable packaging is supplementing the sales of composite cardboard tube packaging in the food & beverage industry.

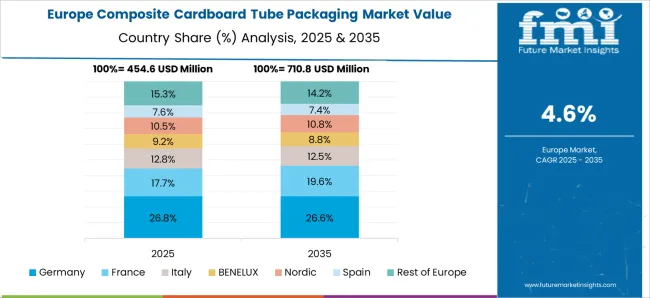

As per the FMI analysis, the German composite cardboard tube packaging market is estimated to expand at a CAGR of 4.5% during the forecast period due to the increasing consumption of packed food in Germany.

As per the data provided by the Food Export Association of the Midwest USA and Food Export USA Northeast, Germany is the fourth largest packed food market in the globe. This is projected to augment the demand for rigid containers such as composite cardboard tube packaging.

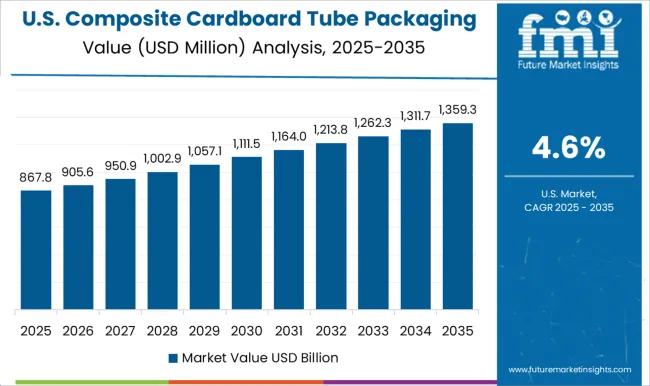

The USA is expected to hold around 81% of the North American composite cardboard tube packaging market by the end of the forecast period. The composite cardboard tube packaging is used to pack wine bottles to provide a premium look and to protect the bottle during storage & transportation.

The increased consumption of Wine in the USA is anticipated to create a growth opportunity for the composite cardboard tube packaging market. According to the American Addiction Centers (AAC), the USA is the largest consumer of wine with an annual consumption rate of 4.3 Billion bottles per year. This creates a growth opportunity for Cardboard Container manufacturers including composite cardboard tube packaging.

The players engaged in manufacturing composite cardboard tube packaging are trying to focus on expanding their presence and resources to meet the growing demand for packaging in various regions. The key players are adopting merger/acquisition and expansion strategies. Some of the latest developments are as follows:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Closure type, By Can Diameter, By End Users |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Smurfit Kappa Group Plc; Mondi Group Plc; Sonoco Products Company; Ace Paper Tube Corp; Irwin Packaging Pty Ltd; Paper Tubes and Sales(PTS)Manufacturing; Canfab Packaging Inc.; Bharath Paper Conversions; Nagel Paper; Halaspack bt Packaging; Corex Group; Quality Container Company; Hangzhou Qunle Packaging Co., Ltd; Heartland Products Group, LLC; Maxky Co. Ltd.; Shetron Group |

| Customization & Pricing | Available upon Request |

The global composite cardboard tube packaging market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the composite cardboard tube packaging market is projected to reach USD 3.4 billion by 2035.

The composite cardboard tube packaging market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in composite cardboard tube packaging market are caps and lids.

In terms of can diameter, less than 50 mm segment to command 47.6% share in the composite cardboard tube packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in Composite Cardboard Tube Packaging

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Composite Cardboard Tubes Market from 2025 to 2035

Biocomposite Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA