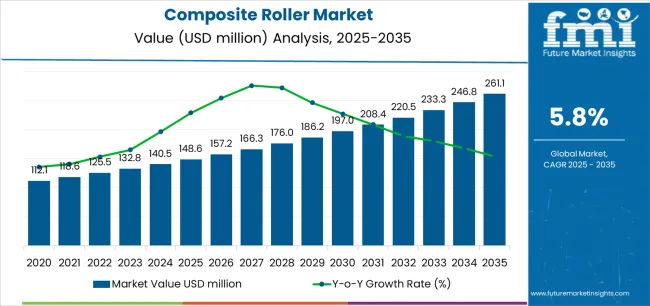

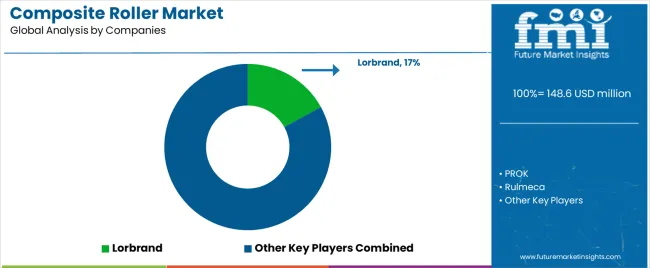

The composite roller market stands at the threshold of a decade-long expansion trajectory that promises to reshape material handling technology and conveyor system solutions. The market's journey from USD 148.6 million in 2025 to USD 261.5 million by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced composite materials and lightweight roller systems across packaging operations, mining facilities, and manufacturing installations.

The first half of the decade (2025-2030) will witness the market climbing from USD 148.6 million to approximately USD 200.8 million, adding USD 52.2 million in value, which constitutes 46% of the total forecast growth period. This phase will be characterized by the rapid adoption of thermoset composite roller systems, driven by increasing warehouse automation requirements and the growing need for corrosion-resistant conveyor solutions worldwide. Enhanced durability capabilities and reduced maintenance features will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 200.8 million to USD 261.5 million, representing an addition of USD 60.7 million or 54% of the decade's expansion. This period will be defined by mass market penetration of lightweight composite technologies, integration with comprehensive material handling platforms, and seamless compatibility with automated logistics infrastructure. The market trajectory signals fundamental shifts in how warehouses and industrial facilities approach conveyor reliability and operational efficiency, with participants positioned to benefit from growing demand across multiple roller types and end-use segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New roller installations (warehouses, mines, plants) | 48% | Greenfield facilities, new conveyor lines |

| Retrofit & replacement projects | 32% | Brownfield upgrades, maintenance replacement | |

| OEM equipment integration | 12% | Conveyor manufacturers, system integrators | |

| Aftermarket parts & service | 6% | Bearing replacement, shell refurbishment | |

| Engineering & customization | 2% | Special designs, application engineering | |

| Future (3-5 yrs) | Automated logistics retrofits | 32-36% | E-commerce fulfillment, parcel hubs |

| Mining & bulk materials handling | 24-28% | Idler roller upgrades, corrosion resistance | |

| New installation (packaging/food) | 18-22% | Hygienic conveyors, high-speed lines | |

| Monitoring-ready smart rollers | 8-12% | IIoT sensors, predictive maintenance | |

| OEM integration | 8-10% | Equipment manufacturing, system packaging | |

| Service & refurbishment | 4-6% | Shell replacement, bearing upgrades |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 148.6 million |

| Market Forecast (2035) | USD 261.5 million |

| Growth Rate | 5.8% CAGR |

| Leading Technology | Conveyor Rollers |

| Primary Application | Packaging & Warehousing Segment |

The market demonstrates strong fundamentals with conveyor roller systems capturing dominant share through advanced material handling capabilities and packaging operations optimization. Packaging and warehousing applications drive primary demand, supported by increasing e-commerce fulfillment requirements and automated distribution center development. Geographic expansion remains concentrated in developed markets with established logistics infrastructure, while emerging economies show accelerating adoption rates driven by manufacturing expansion initiatives and rising automation standards.

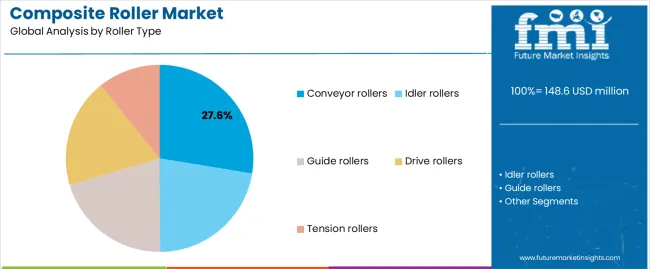

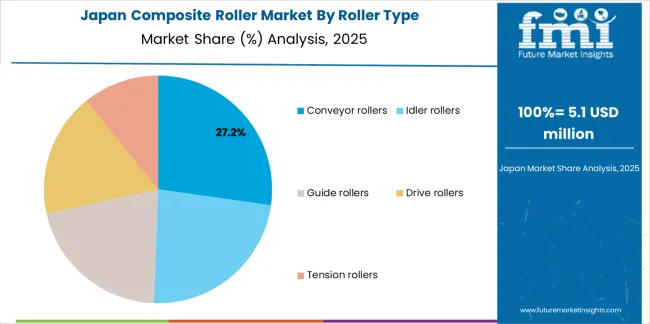

Primary Classification: The market segments by roller type into conveyor rollers, idler rollers, guide rollers, drive rollers, and tension rollers, representing the evolution from basic material transport to sophisticated conveyor system solutions for comprehensive handling optimization.

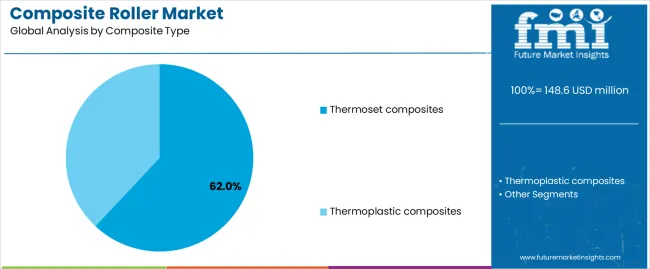

Secondary Classification: Composite type segmentation divides the market into thermoset composites and thermoplastic composites, reflecting distinct requirements for mechanical properties, chemical resistance, and manufacturing flexibility standards.

Tertiary Classification: End-use segmentation covers packaging and warehousing, mining, textile and paper, food and beverage, automotive, and chemicals and pharmaceuticals sectors.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading installations while emerging economies show accelerating growth patterns driven by logistics expansion programs.

The segmentation structure reveals technology progression from standard steel roller replacement toward sophisticated composite systems with enhanced performance and maintenance reduction capabilities, while application diversity spans from warehouse automation to mining operations requiring reliable material handling solutions.

Market Position: Conveyor rollers command the leading position in the composite roller market with 27.6% market share through essential transport features, including reliable material movement, load-carrying capability, and packaging facility optimization that enable warehouse operators to achieve efficient goods handling across diverse distribution center and manufacturing environments.

Value Drivers: The segment benefits from warehouse preference for durable roller systems that provide smooth material flow, reduced maintenance requirements, and operational longevity without requiring frequent replacement. Advanced composite features enable lightweight construction, corrosion resistance, and noise reduction, where reliability and operational efficiency represent critical facility requirements.

Competitive Advantages: Conveyor roller systems differentiate through proven material handling performance, weight reduction benefits reducing motor loads, and compatibility with comprehensive automation strategies that enhance throughput effectiveness while maintaining optimal durability suitable for diverse logistics and manufacturing applications.

Key market characteristics:

Idler rollers maintain a 22.4% market position in the composite roller market due to their bulk material handling capabilities and belt support advantages. These rollers appeal to mining facilities requiring corrosion-resistant components with reduced weight for belt conveyor installations. Market strength is driven by mining expansion and materials handling modernization, emphasizing reliable support solutions through composite material technology.

Guide rollers capture 18% market share through belt alignment and tracking requirements in precision conveyor applications. Drive rollers hold 17% market share, while tension rollers account for 15% through belt tensioning and power transmission applications requiring specialized composite construction.

Market Context: Thermoset composites demonstrate the dominant market position in the composite roller market with 62% market share due to widespread adoption of high-strength materials and increasing focus on chemical resistance, dimensional stability, and elevated temperature performance that maximize operational durability while maintaining structural integrity standards.

Appeal Factors: Thermoset composite users prioritize superior mechanical properties, chemical compatibility, and high-temperature tolerance that enable reliable operation across demanding industrial environments. The segment benefits from substantial mining investment and chemical processing programs that emphasize the deployment of durable composite systems for corrosive and abrasive applications.

Growth Drivers: Mining facility expansions incorporate thermoset composite rollers for harsh environment durability, while chemical processing growth increases demand for corrosion-resistant capabilities that comply with operational standards and minimize replacement frequency.

Market Challenges: Higher initial cost compared to thermoplastic alternatives and limited recyclability may restrict adoption in cost-sensitive segments or sustainability-focused facilities.

Application dynamics include:

Thermoplastic composites capture 38% market share through manufacturing efficiency advantages, recyclability benefits, and cost-effective production for moderate-duty applications requiring lighter weight and design flexibility.

Market Position: Packaging and warehousing applications command dominant market position with 24.8% market share through extensive automation adoption and e-commerce fulfillment expansion.

Value Drivers: This end-use segment provides fundamental demand for lightweight, low-noise rollers in distribution centers, parcel hubs, and automated warehouses where throughput efficiency, noise reduction, and maintenance minimization drive consistent composite roller procurement.

Growth Characteristics: The segment benefits from e-commerce growth, warehouse automation investments, and high-speed conveyor requirements supporting composite roller adoption and retrofit upgrade cycles.

Mining applications capture 21% market share through coal handling, ore transport, and bulk materials conveying requiring heavy-duty idler rollers with corrosion resistance. Textile and paper hold 18.5%, food and beverage accounts for 13.7%, automotive represents 11%, while chemicals and pharmaceuticals maintain 11% of the market.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | E-commerce fulfillment & warehouse automation (distribution center expansion, parcel sorting, high-speed conveyors) | ★★★★★ | Online retail growth driving massive DC construction; automated fulfillment centers requiring lightweight, low-noise composite rollers for high-throughput sorting and reduced energy consumption. |

| Driver | Mining industry expansion & bulk materials handling (coal transport, ore conveying, materials processing) | ★★★★★ | Global mining activity increasing conveyor installations; composite idler rollers offering corrosion resistance, weight reduction, and extended service life in harsh, remote environments reducing maintenance costs. |

| Driver | Corrosion resistance & harsh environment performance (chemical exposure, moisture, temperature extremes) | ★★★★☆ | Steel roller corrosion creating high replacement costs; composite alternatives eliminating rust, reducing maintenance, and extending service intervals in food processing, chemicals, and coastal mining applications. |

| Restraint | Higher upfront cost vs. steel alternatives (material expense, manufacturing complexity, market education) | ★★★★☆ | Initial composite roller premium deterring adoption; facilities focusing on capital cost rather than lifecycle value despite operational savings from reduced maintenance and energy consumption. |

| Restraint | Limited awareness & established steel roller incumbency (traditional specifications, procurement inertia, familiarity) | ★★★☆☆ | Engineering specifications defaulting to steel; facilities lacking awareness of composite benefits and performance validation creating adoption barriers despite proven advantages. |

| Trend | Lightweight design & energy efficiency (reduced motor loads, belt tension optimization, operational cost reduction) | ★★★★★ | Sustainability goals and energy costs driving efficiency focus; composite rollers reducing conveyor power consumption by 20-30% through weight reduction and friction optimization. |

| Trend | Smart rollers with integrated monitoring (embedded sensors, predictive maintenance, condition monitoring platforms) | ★★★★☆ | IIoT and Industry 4 driving intelligent conveyor adoption; sensor-integrated composite rollers enabling vibration monitoring, bearing temperature tracking, and predictive replacement scheduling. |

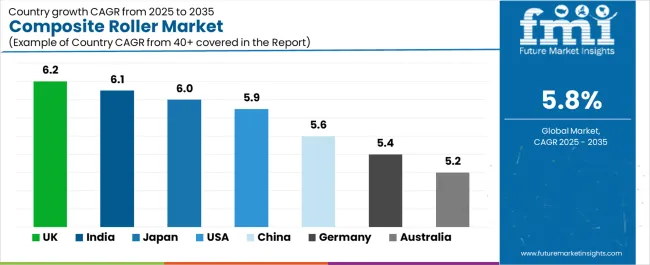

The composite roller market demonstrates varied regional dynamics with Growth Leaders including United Kingdom (6.2% growth rate) and India (6.1% growth rate) driving expansion through logistics automation initiatives and mining capacity development. Steady Performers encompass Japan (6% growth rate), United States (5.9% growth rate), and China (5.6% growth rate), benefiting from established manufacturing industries and warehouse automation adoption. Developed Markets feature Germany (5.4% growth rate) and Australia (5.2% growth rate), where automotive manufacturing and mining operations support consistent growth patterns.

Regional synthesis reveals European markets leading adoption through parcel fulfillment automation and manufacturing modernization, while Asian countries maintain strong growth supported by mining expansion and packaging machinery development. North American markets show steady growth driven by distribution center throughput upgrades and food processing facility improvements.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| United Kingdom | 6.2% | Focus on logistics retrofit | Skills shortage; installation capacity |

| India | 6.1% | Lead with mining durability | Price sensitivity; quality perception |

| Japan | 6% | Push cleanroom/low-noise solutions | Conservative adoption; deflation pressures |

| United States | 5.9% | Energy-efficiency ROI messaging | Long sales cycles; steel roller incumbency |

| China | 5.6% | Scale manufacturing partnerships | Local competition; margin pressure |

| Germany | 5.4% | IIoT-ready smart rollers | Over-engineering; lengthy validation |

| Australia | 5.2% | Mining remote site advantages | Project timing; commodity cycles |

United Kingdom establishes fastest market growth through aggressive logistics automation programs and comprehensive parcel fulfillment expansion, integrating composite rollers as advanced components in distribution centers and e-commerce installations. The country's 6.2% growth rate reflects e-commerce sector growth and automation intensity that support the use of lightweight conveyor systems in warehouse and fulfillment facilities. Growth concentrates in major logistics hubs, including East Midlands distribution parks, Northwest fulfillment centers, and Southeast parcel sorting facilities, where automation infrastructure showcases composite roller deployment that appeals to operators seeking noise reduction and energy efficiency capabilities.

UK logistics markets are adopting composite roller technology through warehouse retrofit programs and new automated facility construction that combine performance advantages with operational cost reduction, including low-noise operation and reduced power consumption. Installation channels through material handling system integrators and conveyor manufacturers expand market access, while e-commerce growth and labor cost pressures support adoption across diverse retail and third-party logistics segments.

Strategic Market Indicators:

In Jharkhand mining regions, Gujarat industrial corridors, and nationwide warehousing developments, mining operators and logistics facilities are implementing composite rollers as durable components for materials handling and goods transport applications, driven by mining capacity expansion and Make-in-India manufacturing initiatives that emphasize the importance of reliable conveyor systems. The market holds a 6.1% growth rate, supported by coal sector investment and warehousing infrastructure development that promote corrosion-resistant roller systems for mining and logistics facilities. Indian operators are deploying composite rollers that provide lightweight performance and extended service life, particularly appealing in remote mining regions where maintenance access and component durability represent critical operational requirements.

Market expansion benefits from substantial mining infrastructure investment and e-commerce warehousing growth that require efficient material handling solutions. Technology adoption follows patterns established in conveyor equipment, where lifecycle cost advantages and reduced maintenance drive procurement decisions and facility-scale deployment.

Market Intelligence Brief:

In Tokyo cleanroom facilities, Osaka manufacturing plants, and nationwide high-tech production, industrial operators are implementing advanced composite rollers as precision components for contamination control and noise reduction applications, driven by manufacturing quality standards and cleanroom requirements that emphasize the importance of low-particulate material handling. The market holds a 6% growth rate, supported by high-speed manufacturing adoption and quality control emphasis that promote specialized roller systems for electronics and pharmaceutical production facilities. Japanese operators are deploying composite rollers that provide low-noise operation and minimal particle generation, particularly appealing in precision manufacturing regions where contamination prevention and acoustic comfort represent paramount operational requirements.

Market expansion benefits from established quality culture and comprehensive cleanroom standards that require specialized material handling solutions. Technology adoption follows patterns established in precision equipment, where contamination control and performance reliability drive specification decisions and premium system deployment.

Market Intelligence Brief:

United States establishes strong market position through comprehensive warehouse upgrade programs and food processing facility improvements, integrating composite rollers across automated distribution centers and manufacturing operations. The country's 5.9% growth rate reflects established logistics infrastructure and mature food processing industry that support widespread composite roller adoption in fulfillment centers and production facilities. Demand concentrates in major distribution regions, Midwest food processing clusters, and nationwide warehouse networks, where facility modernization showcases energy-efficient roller deployment that appeals to operators seeking operational cost reduction and maintenance optimization.

American logistics markets leverage established material handling ecosystems and energy efficiency focus, including throughput optimization programs and operational expense reduction initiatives that support composite roller specifications. The market benefits from sustainability goals and predictive maintenance adoption that drive advanced roller technology and smart monitoring integration.

Market Intelligence Brief:

In Zhejiang packaging equipment clusters, Jiangsu paper mill operations, and industrial manufacturing zones, machinery builders and facility operators are implementing composite rollers as standard components for production efficiency and corrosion resistance applications, driven by packaging industry growth and humid environment challenges that emphasize the importance of rust-free conveyor systems. The market holds a 5.6% growth rate, supported by pulp and paper expansion and packaging machinery manufacturing that promote composite roller systems for production and processing facilities. Chinese operators are deploying composite rollers that provide moisture resistance and operational longevity, particularly appealing in coastal and humid production regions where steel roller corrosion and frequent replacement represent significant operational challenges.

Market expansion benefits from massive packaging industry scale and domestic machinery manufacturing that incorporate composite roller technology. Adoption follows patterns established in industrial equipment, where corrosion elimination and maintenance reduction drive component selection and production-scale deployment.

Market Intelligence Brief:

Germany's advanced manufacturing demonstrates sophisticated composite roller deployment with emphasis on automotive production lines and Industry 4.0 monitoring integration through established quality standards. The country maintains a 5.4% growth rate, driven by engineering-led adoption and preventive maintenance programs.

Market dynamics focus on precision-manufactured composite rollers meeting automotive production requirements combined with smart monitoring integration supporting predictive maintenance strategies. Engineering culture and IIoT infrastructure create sustained opportunities for advanced composite roller adoption in manufacturing applications.

Strategic Market Considerations:

Australia's resource sector demonstrates composite roller deployment with emphasis on bulk materials conveying and remote site reliability through harsh environment requirements. The country maintains a 5.2% growth rate, driven by mining activity and materials handling infrastructure.

Market dynamics focus on lightweight corrosion-resistant idler rollers reducing maintenance in remote mining operations and enabling longer conveyor spans. Resource sector investment and operational efficiency focus create consistent demand for durable composite rollers in mining applications.

Strategic Market Considerations:

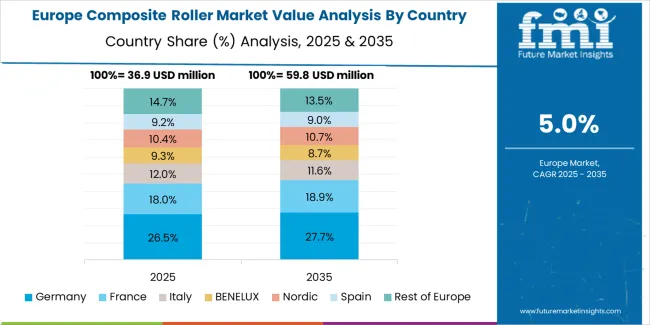

The composite roller market in Europe is projected to grow from USD 49.5 million in 2025 to USD 86.2 million by 2035, registering a CAGR of 5.5% over the forecast period. Germany is set to lead with a 24.1% share in 2025, edging to 24.6% by 2035 on the back of automotive production, machinery manufacturing, and paper processing line retrofits.

Italy follows with an 18.7% share in 2025, expected at 18.9% by 2035, driven by packaging machinery exports and food processing facility upgrades. United Kingdom holds a 16.3% share in 2025, projected to 16.6% by 2035 as parcel hubs and grocery distribution centers scale automation. France accounts for a 14.8% share in 2025, reaching 15% by 2035 with pharmaceutical manufacturing and beverage conveying upgrades. Spain represents an 11.6% share in 2025, advancing to 11.8% by 2035 on FMCG warehousing growth. Rest of Europe collectively adjusts from 14.5% to 13.1%, reflecting share gains by core markets and modernization programs in Nordics and Eastern Europe accelerating composite roller adoption.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Specialized composite roller manufacturers | Material formulation, production technology, application expertise | Technical depth, custom capability, performance optimization | Distribution reach; brand awareness |

| Conveyor system OEMs | Equipment integration, customer relationships, system design | Market access, installation base, package solutions | Roller technology depth; material innovation |

| Industrial distributors | Inventory availability, regional coverage, technical support | Stock depth, delivery speed, customer service | Manufacturing control; product development |

| Material handling integrators | Project management, system design, end-user access | Application optimization, turnkey delivery | Component specialization; aftermarket service |

| Mining equipment suppliers | Mining relationships, harsh environment expertise, regional service | Application knowledge, rugged designs, field support | High-volume logistics; manufacturing scale |

| Item | Value |

|---|---|

| Quantitative Units | USD 148.6 million |

| Roller Type | Conveyor rollers, Idler rollers, Guide rollers, Drive rollers, Tension rollers |

| Composite Type | Thermoset composites, Thermoplastic composites |

| End-use | Packaging & warehousing, Mining, Textile & paper, Food & beverage, Automotive, Chemicals & pharmaceuticals |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Australia, Canada, Brazil, France, South Korea, and 25+ additional countries |

| Key Companies Profiled | PROK, Rulmeca, Lorbrand, Pronexos, EPSILON Composite, Double E Company, Luff Industries, Artur Küpper GmbH & Co. KG, CPS Conveyor Products & Solutions, Interroll Group |

| Additional Attributes | Dollar sales by roller type and end-use categories, regional installation trends across Western Europe, South Asia Pacific, and East Asia, competitive landscape with composite roller manufacturers and material handling equipment suppliers, facility operator preferences for weight reduction and corrosion resistance, integration with automated conveyor systems and monitoring platforms, innovations in composite material technology and smart roller capabilities, and development of specialized roller solutions with enhanced performance and maintenance optimization capabilities. |

The global composite roller market is estimated to be valued at USD 148.6 million in 2025.

The market size for the composite roller market is projected to reach USD 261.1 million by 2035.

The composite roller market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in composite roller market are conveyor rollers, idler rollers, guide rollers, drive rollers and tension rollers.

In terms of composite type, thermoset composites segment to command 62.0% share in the composite roller market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Breaking Down Market Share in Composite Cardboard Tube Packaging

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Biocomposite Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA