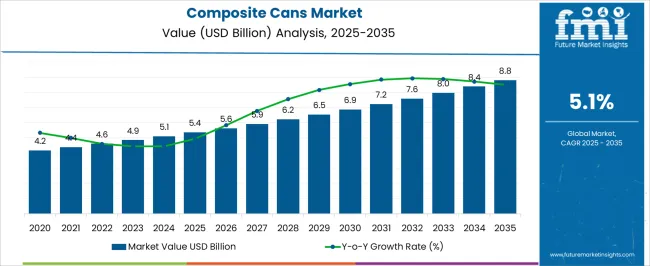

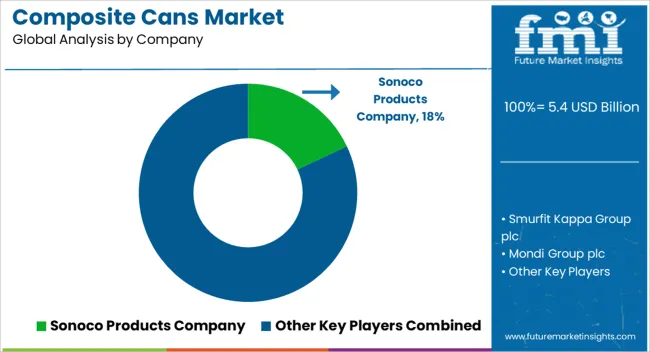

The composite cans market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 8.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

. Growth in this phase is strongly influenced by rising adoption of composite cans in food and beverage packaging, personal care products, and household items. Their durability, ease of storage, and ability to maintain product freshness make them attractive to both manufacturers and consumers. The steady year-on-year increase during this period reflects how composite cans are establishing themselves as a reliable packaging format with expanding applications. Between 2030 and 2035, the market is expected to continue its consistent growth trajectory, moving from USD 6.9 billion to USD 8.8 billion. This stage of expansion highlights growing demand from industries seeking packaging that combines protection, cost-effectiveness, and design flexibility.

Composite cans are gaining traction across multiple end-use sectors due to their lightweight nature and convenience in handling. The demand is further supported by wider penetration in emerging markets, where changing consumption patterns and modern retail formats are influencing packaging choices. The predictable curve demonstrates a stable growth outlook, with opportunities for manufacturers to expand production capacities and diversify applications. This positions the composite cans market on a long-term growth track, offering consistent value creation for stakeholders.

| Metric | Value |

|---|---|

| Composite Cans Market Estimated Value in (2025 E) | USD 5.4 billion |

| Composite Cans Market Forecast Value in (2035 F) | USD 8.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The composite cans market secures a noticeable share across several larger packaging domains, with variations depending on the breadth and maturity of each category. Within the rigid packaging market, composite cans account for nearly 4%, reflecting their use as an alternative to metal and plastic containers. In the paperboard packaging market, their contribution is more significant at about 7%, as composite cans rely heavily on paperboard structures combined with other materials for strength and barrier protection. Within the food and beverage packaging market, composite cans represent close to 5%, driven by their adoption in snack foods, powdered beverages, and specialty items where branding and convenience play key roles.

In the consumer goods packaging market, their share stands at approximately 3%, since composite cans compete with a wide variety of flexible and rigid formats for personal care and household products. Lastly, in the sustainable packaging materials market, composite cans contribute around 6%, reflecting their partial reliance on recyclable components and appeal as an eco-friendly alternative compared to pure plastic containers. Taken together, these shares illustrate that composite cans maintain their strongest positioning in paperboard and sustainability-focused sectors, where their unique blend of durability and recyclability is valued, while their footprint in broader rigid and consumer goods packaging remains relatively modest. This distribution signals growth potential as manufacturers prioritize cost efficiency, branding, and environmentally aligned packaging choices.

The market is experiencing steady growth, supported by the increasing demand for sustainable and lightweight packaging solutions across food, beverage, personal care, and industrial sectors. Rising consumer preference for eco-friendly alternatives is driving adoption, with manufacturers focusing on recyclable and biodegradable materials.

The combination of paperboard, metal, and plastic in composite cans enables superior product protection, extended shelf life, and branding opportunities through high-quality printing. Market growth is further reinforced by advancements in manufacturing technologies that allow precision design, cost efficiency, and customization to meet varied consumer and industry requirements.

Regulatory pressures toward reducing single-use plastics and promoting circular economy practices are also accelerating the shift toward composite packaging The market outlook remains positive, with expanding applications in emerging economies, innovation in closure systems, and increased production capabilities expected to create new growth opportunities in the coming years.

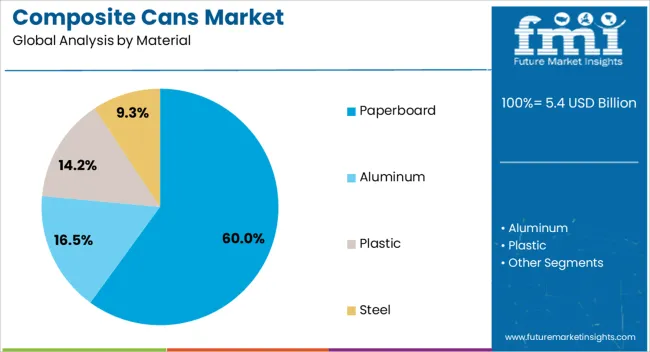

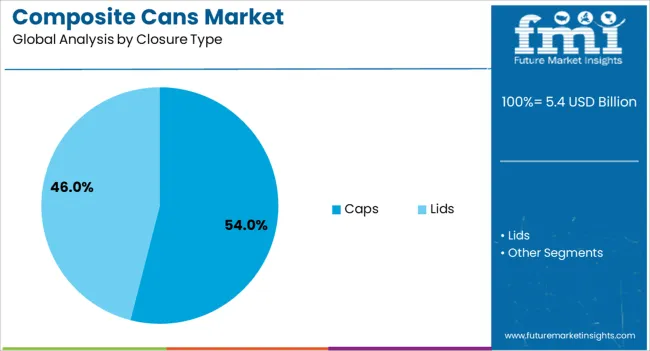

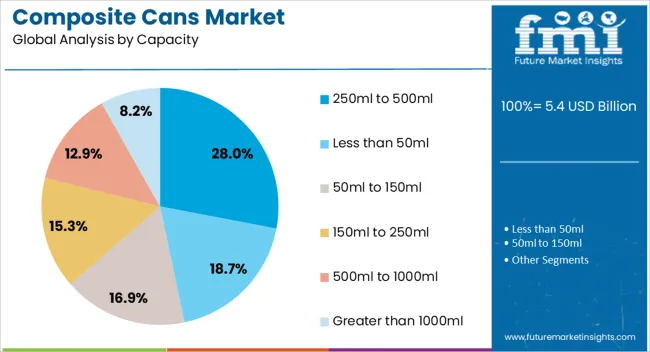

The composite cans market is segmented by material, closure type, capacity, industry vertical, and geographic regions. By material, composite cans market is divided into paperboard, aluminum, plastic, and steel. In terms of closure type, composite cans market is classified into caps and lids. Based on capacity, composite cans market is segmented into 250ml to 500ml, less than 50ml, 50ml to 150ml, 150ml to 250ml, 500ml to 1000ml, and greater than 1000ml. By industry vertical, composite cans market is segmented into food and beverage, pharmaceutical, personal care, industrial & chemicals, and others. Regionally, the composite cans industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paperboard material segment is projected to account for 60% of the composite cans market revenue share in 2025, making it the dominant material type. This leadership is attributed to paperboard’s eco-friendly profile, cost efficiency, and compatibility with a wide range of products. Its lightweight nature reduces transportation costs, while high printability enhances branding and consumer appeal.

The growing regulatory emphasis on reducing plastic waste has driven manufacturers to integrate paperboard as the primary structural component in composite cans. Paperboard’s ability to be combined with barrier linings for moisture, oxygen, and aroma protection has expanded its use in food and beverage packaging.

Additionally, the recyclability of paperboard aligns with sustainability goals of both brands and consumers, reinforcing its adoption across global markets As manufacturers invest in advanced coating technologies and improved sealing methods, paperboard composite cans are expected to maintain their competitive edge and continue dominating the material segment.

The caps closure type segment is estimated to hold 54% of the market revenue share in 2025, positioning it as the leading closure solution. This dominance is driven by the functional convenience caps provide, including resealability, product protection, and extended shelf life. Caps offer enhanced consumer usability, making them preferred for food, beverage, and personal care products where freshness retention is critical.

Manufacturers have been innovating with materials and designs to create closures that are tamper-evident, lightweight, and recyclable, aligning with sustainability trends. The compatibility of caps with automated filling and packaging lines has also supported their widespread adoption in large-scale production environments.

Caps enable differentiation in packaging design, contributing to brand visibility on retail shelves As consumer demand for convenience and product safety continues to grow, the caps closure type is expected to maintain its leadership in the market, reinforced by technological advancements and evolving sustainability standards.

The 250ml to 500ml capacity segment is anticipated to capture 28% of the market revenue share in 2025, establishing it as a prominent capacity range. This growth is supported by strong demand in the food and beverage sector, where this size range offers an optimal balance between portability and adequate serving volume. The segment benefits from consumer preference for portion-controlled packaging, which aligns with on-the-go lifestyles and convenience-driven consumption patterns.

Composite cans within this capacity are widely used for snacks, powdered beverages, and specialty products due to their protective barrier properties and attractive shelf presence. Manufacturers have optimized production processes to meet high-volume demand for this size range while maintaining quality and cost-effectiveness.

The capacity’s compatibility with multiple closure types and ease of stacking and transport have further supported its market relevance As consumer purchasing habits continue to shift toward compact and eco-friendly packaging, this capacity range is expected to sustain its strong position in the overall market.

The composite cans market is expanding as industries adopt durable, lightweight, and customizable packaging solutions for food, beverages, and personal care. Opportunities are particularly strong in packaged food applications and emerging economies, while trends point toward premiumization, customization, and convenience-driven designs. Challenges persist due to recycling complexities and competition from alternative formats like flexible plastics. In my opinion, long-term success will favor manufacturers who invest in recyclability improvements, design innovation, and strategic expansion into high-growth regions to secure a stronger position in the global packaging landscape.

Demand for composite cans has been rising due to their lightweight construction, durability, and ability to protect products from external factors such as moisture and contamination. Widely used in food, beverages, snacks, and personal care, composite cans offer branding advantages through customizable printing and unique designs. Their stackability and easy handling further drive adoption in retail environments. In my opinion, demand will continue to expand as both manufacturers and consumers prefer practical, visually appealing, and cost-effective packaging options that balance performance with convenience across diverse product categories.

Opportunities are most prominent in the food and beverage sector, where composite cans are increasingly chosen for snacks, powdered drinks, coffee, and dairy products. Their resealable design and extended shelf-life benefits make them appealing to both producers and consumers. Emerging economies with rising packaged food consumption provide significant growth potential. I believe companies that strengthen their presence in fast-growing markets and innovate in barrier coatings to enhance product safety will capture greater opportunities, positioning composite cans as a strong alternative to metal and rigid plastic packaging formats.

Trends in composite cans reflect a growing preference for premium packaging formats that enhance consumer experience. Brands are investing in eye-catching graphics, tactile finishes, and personalized labeling to differentiate products on crowded retail shelves. Convenience-driven features like easy-open ends and resealable closures are also gaining momentum. In my opinion, this trend shows a decisive shift toward packaging as a marketing tool, with composite cans evolving beyond functional containment into vehicles for branding, consumer engagement, and premium positioning across global retail landscapes.

Challenges for composite cans arise from recycling limitations, as their multi-material construction complicates recovery and reuse. This issue has led some regions to favor packaging alternatives that are easier to recycle. Competition from flexible pouches and lightweight plastics, which often offer lower production costs, also pressures growth. Logistics-related costs, especially in export markets, remain a concern. In my assessment, companies that improve recyclability, optimize raw material sourcing, and build partnerships for closed-loop systems will be better positioned to address these challenges and secure long-term adoption of composite cans.

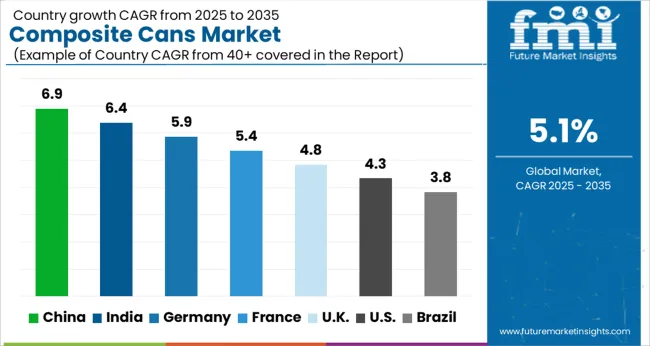

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global composite cans market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and Germany at 5.9%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. Rising demand for lightweight, recyclable, and cost-efficient packaging is fueling adoption. Emerging markets such as China and India are experiencing higher growth due to expanding food and beverage sectors and strong demand for convenient packaging, while developed economies like Germany, the UK, and the USA focus on premiumization, innovative closures, and compliance with environmental standards.

The composite cans market in China is projected to grow at a CAGR of 6.9%. Growth is driven by rising demand for packaged snacks, powdered beverages, and dairy-based products. Expanding urban populations and increasing disposable incomes are fueling adoption of lightweight and convenient packaging solutions. Domestic manufacturers are focusing on integrating recyclable materials, supported by government initiatives to reduce plastic waste. E-commerce expansion has further enhanced demand for protective and durable composite cans that ensure product integrity during transport.

The composite cans market in India is expected to grow at a CAGR of 6.4%. Expansion in food and beverage industries, especially in confectionery, dairy, and ready-to-drink products, is driving growth. Rising disposable incomes and lifestyle shifts are supporting higher demand for convenient packaging formats. Domestic and international brands are introducing innovative can designs to capture consumer attention, particularly in urban retail channels. Increasing awareness of recyclability and affordability of composite cans compared to rigid packaging also strengthens adoption in India.

The composite cans market in Germany is projected to grow at a CAGR of 5.9%. Strong packaging regulations and consumer preference for recyclable and premium-quality solutions drive adoption. The food industry, especially coffee, powdered milk, and snacks, is a major consumer of composite cans. Germany’s strong industrial base and innovation in barrier technologies enhance the performance of composite cans. Additionally, premiumization trends in packaging design and the demand for convenience-based formats in retail channels contribute to steady growth.

The composite cans market in the UK is projected to grow at a CAGR of 4.8%. The market is shaped by demand from premium food, beverages, and personal care products, where packaging differentiation plays a key role. Growing focus on recyclable packaging materials supports steady adoption. Retailers and manufacturers are investing in innovative closures and decorative formats to attract consumers. Although growth is slower than in emerging economies, the UK market remains significant due to its emphasis on high-quality and eco-conscious packaging.

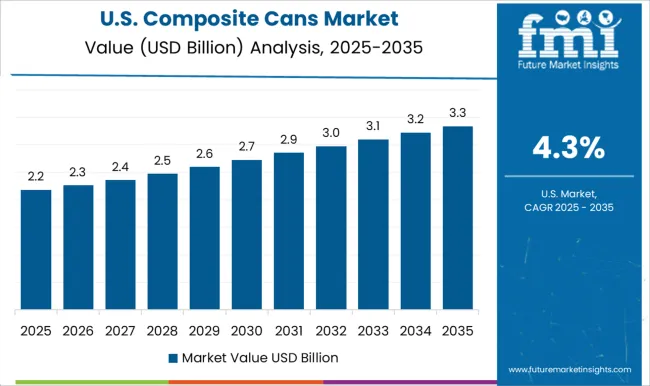

The composite cans market in the USA is projected to grow at a CAGR of 4.3%. While growth is slower compared to Asia, steady demand persists across snacks, frozen foods, and dry beverages. Manufacturers are focusing on enhancing can strength, barrier protection, and recyclability to meet consumer expectations. Premiumization trends, such as decorative labeling and convenient resealable closures, are gaining popularity in retail channels. Regulatory focus on reducing single-use plastics also strengthens the adoption of composite cans.

Competition in the composite cans market has been shaped by leading global packaging companies supported by specialized regional manufacturers. Sonoco Products Company has been recognized as a market pioneer, where a strong history in composite can production has created significant brand equity. Smurfit Kappa Group has been strengthening its presence through innovative paper-based solutions, where its global network has enabled widespread availability and product customization. Mondi Group has been applying its expertise in paper and flexible packaging, introducing composite can formats that balance durability and presentation appeal. Amcor has been recognized for its diversified packaging portfolio, where composite cans have been positioned as a complementary solution to its rigid and flexible product lines.

Crown Holdings has been leveraging its strength in metal packaging, integrating composite cans into its food and beverage customer base. WestRock Company has been promoting paperboard-based composite packaging supported by sustainable sourcing credentials and global supply strength. Irwin Packaging has been maintaining a regional footprint by addressing niche requirements, where custom composite tubes and cans for industrial use have been highlighted. Ace Paper Tube has been carving space as a specialist, delivering cost-effective and flexible designs to smaller and mid-size brand owners. The strategies among these companies have been differentiated by scale, innovation focus, and target markets.

Sonoco and Smurfit Kappa have been regarded as innovation leaders, offering advanced designs that combine protective performance with high visual impact. Mondi and WestRock have been recognized for emphasizing fiber-based packaging, where the balance of strength and consumer convenience has influenced their market acceptance. Amcor and Crown Holdings have been positioning composite cans as part of their global packaging ecosystems, capitalizing on long-standing client relationships in food and beverage sectors. Irwin Packaging and Ace Paper Tube have been competing as agile specialists, tailoring designs for industrial goods, promotional packaging, and regional customers seeking smaller batch runs. This competitive field has been driven by the ability to combine packaging functionality with brand presentation, where long-term leadership is granted to companies delivering both reliable performance and tailored customer solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 billion |

| Material | Paperboard, Aluminum, Plastic, and Steel |

| Closure Type | Caps and Lids |

| Capacity | 250ml to 500ml, Less than 50ml, 50ml to 150ml, 150ml to 250ml, 500ml to 1000ml, and Greater than 1000ml |

| Industry Vertical | Food and beverage, Pharmaceutical, Personal care, Industrial & chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sonoco Products Company, Smurfit Kappa Group plc, Mondi Group plc, Amcor plc, Crown Holdings, Inc., WestRock Company, Irwin Packaging Pty Ltd, and Ace Paper Tube |

| Additional Attributes | Dollar sales by product type (spiral wound vs convolute wound), Dollar sales by application (food, beverages, personal care, industrial goods), Trends in lightweight and recyclable packaging demand, Use in snacks, powdered drinks, and cosmetics, Growth of branding through customizable formats, Regional consumption differences across North America, Europe, and Asia-Pacific. |

The global composite cans market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the composite cans market is projected to reach USD 8.8 billion by 2035.

The composite cans market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in composite cans market are paperboard, aluminum, plastic and steel.

In terms of closure type, caps segment to command 54.0% share in the composite cans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Breaking Down Market Share in Composite Cardboard Tube Packaging

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Biocomposite Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA