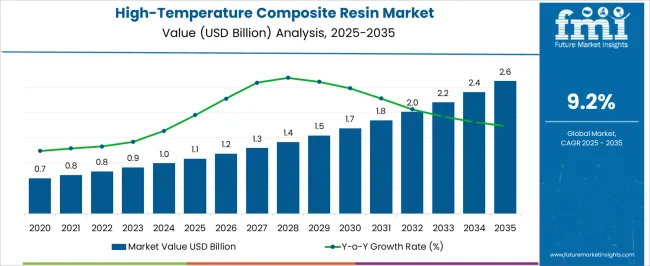

The High-Temperature Composite Resin Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. This growth is supported by a CAGR of 9.2%, driven by the increasing demand for advanced composite resins in industries such as aerospace, automotive, and electronics, where high-temperature resistance and durability are essential. During the first five years (2025–2030), the market will expand from USD 1.1 billion to USD 1.7 billion, adding USD 0.6 billion, which accounts for 38.5% of the total incremental growth, with a 5-year multiplier of 1.54x.

This phase is driven by the increasing applications of high-temperature composite resins in the aerospace and automotive sectors, where they are utilized in engine components, heat shields, and lightweight structural materials. The second phase (2030–2035) will contribute USD 0.9 billion, representing 61.5% of the total growth, driven by the stronger momentum of renewable energy projects, electric vehicles, and evolving aerospace applications.

Annual increments will rise from USD 0.2 billion in the early years to USD 0.3 billion by 2035, indicating a faster pace of growth as industries seek lightweight, high-performance materials for extreme conditions. Manufacturers focusing on improving the resin’s thermal stability, resistance, and environmental impact will capture the largest share of this USD 1.5 billion opportunity.

| Metric | Value |

|---|---|

| High-Temperature Composite Resin Market Estimated Value in (2025 E) | USD 1.1 billion |

| High-Temperature Composite Resin Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The high-temperature composite resin market is undergoing substantial growth, primarily influenced by the rising need for advanced materials that can endure prolonged exposure to extreme thermal and mechanical stress. These resins are being increasingly incorporated into structural applications requiring high strength-to-weight ratios, especially in sectors with demanding operational conditions such as aerospace, automotive, and industrial manufacturing.

The evolution of resin chemistries and crosslinking technologies has improved thermal resistance, flame retardancy, and mechanical durability, supporting their usage in next-generation structural composites. Industry players are investing in R&D to develop resins with improved processing capabilities and compatibility with modern fabrication techniques like automated fiber placement and resin transfer molding.

Furthermore, stringent regulations on emissions and fuel efficiency have reinforced the push toward lightweight alternatives in both commercial and defense applications As global supply chains evolve toward higher-value, thermally stable composite systems, high-temperature resins are expected to remain essential in enabling high-performance and lightweight engineering solutions across developed and emerging economies.

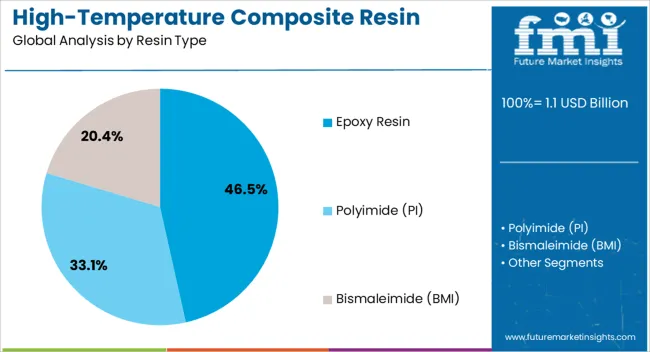

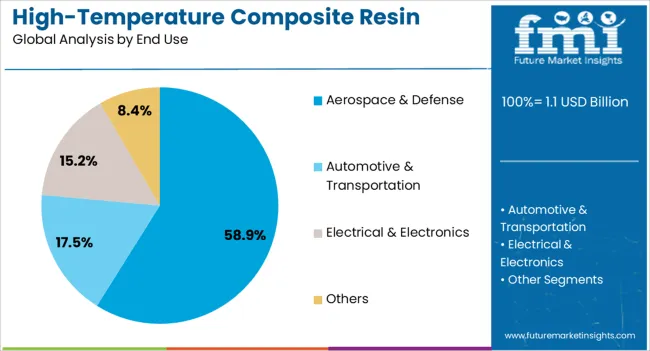

The high-temperature composite resin market is segmented by resin type, end use, and geographic regions. By resin type, the high-temperature composite resin market is divided into Epoxy Resin, Polyimide (PI), and Bismaleimide (BMI). In terms of end use, the high-temperature composite resin market is classified into Aerospace & Defense, Automotive & Transportation, Electrical & Electronics, and Others. Regionally, the high-temperature composite resin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The epoxy resin segment is expected to account for 46.5% of the total revenue share in the high-temperature composite resin market in 2025, making it the leading resin type. This leadership position is attributed to the exceptional balance epoxy resins provide between thermal resistance, mechanical strength, and chemical durability. The segment has gained traction due to its ability to maintain structural integrity under elevated temperatures while offering excellent adhesion to reinforcements such as carbon and glass fibers.

Epoxy systems have been optimized to meet the processing demands of high-precision applications, particularly in industries that require long service life and thermal stability under cyclic loading. Their compatibility with various curing agents and post-curing methods allows for customization based on application-specific requirements.

Enhanced resistance to delamination and moisture ingress has made epoxy resins particularly suited for high-performance composite structures. These features, coupled with a well-established manufacturing and supply ecosystem, have supported widespread adoption of epoxy systems in both aerospace-grade and industrial composite parts.

The aerospace and defense segment is projected to hold 58.9% of the total revenue share in the high-temperature composite resin market in 2025, positioning it as the dominant end-use industry. The extensive use of high-temperature composite materials in this segment is driven by the critical need for lightweight, thermally resilient, and structurally reliable components in both air and space platforms.

High-temperature resins have become foundational in the production of interior structures, engine components, heat shields, and fuselage elements where extreme thermal conditions are encountered. The push for improved fuel efficiency, payload optimization, and reduced emissions has prompted aircraft manufacturers and defense agencies to adopt advanced composite formulations that meet strict weight and performance standards.

Long-term material reliability, resistance to flame and smoke propagation, and compliance with aerospace safety regulations have further accelerated the integration of these resins. As defense modernization and commercial aerospace expansion continue, high-temperature resins are being strategically prioritized for their role in enhancing operational performance and structural longevity.

The high-temperature composite resin market is propelled by rising demand from aerospace, automotive, and manufacturing sectors. Opportunities in these industries, especially for lightweight and high-performance materials, continue to drive growth. Emerging trends in advanced composites highlight the push for weight reduction and superior strength. However, market growth is constrained by raw material cost fluctuations and supply chain challenges. By 2025, overcoming these obstacles while leveraging opportunities in the aerospace and automotive sectors will be crucial for sustained growth in the high-temperature composite resin market.

The high-temperature composite resin market is expanding due to the growing demand for materials that can withstand extreme conditions in industries like aerospace, automotive, and manufacturing. These resins are crucial for creating parts that need to maintain structural integrity under high heat, such as engine components and industrial equipment. As industries like aerospace and automotive push toward higher efficiency and performance, the need for high-temperature resistant resins will continue to increase, driving the market growth through 2025.

Opportunities in the aerospace and automotive industries are a major driver for the high-temperature composite resin market. The aerospace sector requires materials that can endure extreme heat during flight, and automotive manufacturers are increasingly adopting these materials for engine parts and body components to reduce weight and increase performance. By 2025, the increasing use of composite materials in both sectors will create significant opportunities for manufacturers, especially with the growing trend of electric vehicles and next-generation aircraft that require advanced materials.

The market is witnessing a shift toward lightweight, high-performance composite resins, which offer both heat resistance and weight reduction benefits. As manufacturers in automotive and aerospace industries seek to reduce fuel consumption and improve operational efficiency, composite resins are increasingly favored for their ability to deliver superior strength without adding significant weight. By 2025, high-temperature resins designed for weight-sensitive applications will become even more important, further driving demand for advanced composites that meet performance, safety, and regulatory standards.

Despite growth, the commercial micro inverter market faces challenges such as high initial costs and market fragmentation. Micro inverters, while highly efficient, generally come with a higher upfront cost compared to traditional inverters, which can deter some commercial users. Additionally, the market is fragmented with several players offering various solutions, leading to competitive pricing pressures. By 2025, addressing these challenges will require the development of more cost-effective solutions, as well as standardization and improved integration processes to ensure broad adoption.

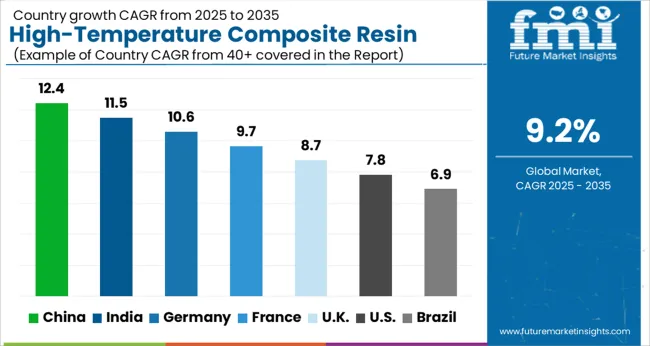

| Countries | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

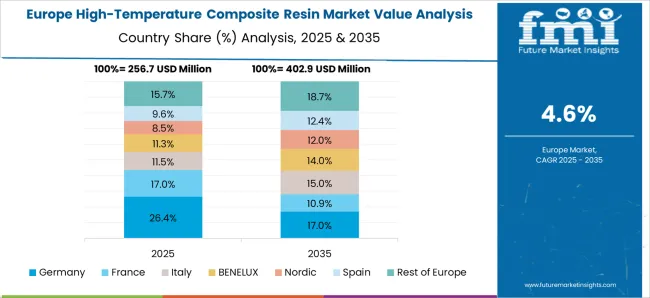

The global high-temperature composite resin market is projected to grow at a 9.2% CAGR from 2025 to 2035. China leads with a growth rate of 12.4%, followed by India at 11.5%, and Germany at 10.6%. The United Kingdom records a growth rate of 8.7%, while the United States shows the slowest growth at 7.8%. These varying growth rates are driven by increasing demand for high-performance materials in industries such as aerospace, automotive, and industrial applications. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, technological advancements, and increasing demand for advanced composite materials, while more mature markets like the USA and the UK see steady growth driven by stringent regulations, advanced manufacturing technologies, and the growing adoption of high-temperature composites in critical applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The high-temperature composite resin market in China is growing rapidly, with a projected CAGR of 12.4%. China’s expanding aerospace, automotive, and industrial sectors are key drivers of demand for high-performance composite resins. The country’s strong manufacturing base, coupled with increasing demand for lightweight and durable materials in high-temperature applications, is contributing to market growth. China’s focus on technological advancements, combined with government support for the aerospace and automotive industries, further accelerates the adoption of high-temperature composites. Additionally, China’s growing emphasis on sustainability and reducing carbon emissions fuels the demand for energy-efficient composite materials in various industrial applications.

The high-temperature composite resin market in India is projected to grow at a CAGR of 11.5%. India’s rapidly expanding aerospace and automotive industries, along with growing industrial applications, are driving significant demand for high-performance composite resins. The country’s focus on advancing technology in manufacturing and transportation sectors continues to contribute to market growth. India’s increasing investments in infrastructure and the automotive sector’s shift toward lightweight, high-performance materials fuel the demand for high-temperature composites. Additionally, government incentives for the use of energy-efficient materials in manufacturing and the growing focus on reducing emissions further accelerate the adoption of composite resins in critical applications.

The high-temperature composite resin market in Germany is projected to grow at a CAGR of 10.6%. Germany’s strong aerospace, automotive, and industrial sectors continue to drive steady demand for high-performance composite materials. The country’s focus on high-tech manufacturing, along with its commitment to energy efficiency and sustainability, is contributing to the adoption of high-temperature composites. Germany’s growing emphasis on reducing carbon emissions and improving fuel efficiency in transportation sectors accelerates the demand for lightweight and durable composite materials. Additionally, regulatory frameworks promoting the use of eco-friendly materials in manufacturing contribute to the market’s growth in Germany.

The high-temperature composite resin market in the United Kingdom is projected to grow at a CAGR of 8.7%. The UK’s focus on reducing carbon emissions and improving fuel efficiency in industries such as aerospace, automotive, and manufacturing is driving steady demand for high-performance composite resins. The growing focus on sustainability and energy-efficient materials, coupled with regulatory policies promoting eco-friendly solutions, accelerates the adoption of high-temperature composites. Additionally, the UK’s increasing demand for lightweight materials in aerospace and automotive sectors, as well as investments in industrial applications, contributes to the market’s growth.

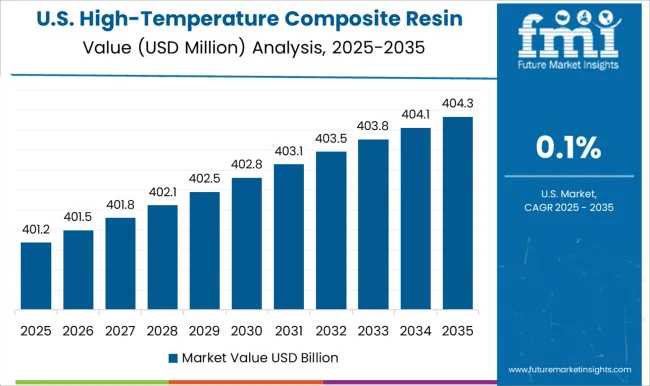

The high-temperature composite resin market in the United States is expected to grow at a CAGR of 7.8%. The USA market remains steady, driven by the growing demand for lightweight and durable composite materials in aerospace, automotive, and industrial applications. The country’s increasing focus on reducing carbon emissions, improving energy efficiency, and advancing manufacturing technologies is contributing to the steady growth of the market. Additionally, the rise of electric vehicles and advancements in sustainable manufacturing processes further support the demand for high-performance composite materials. The USA government’s push for cleaner, more efficient materials in manufacturing continues to accelerate the adoption of high-temperature composite resins.

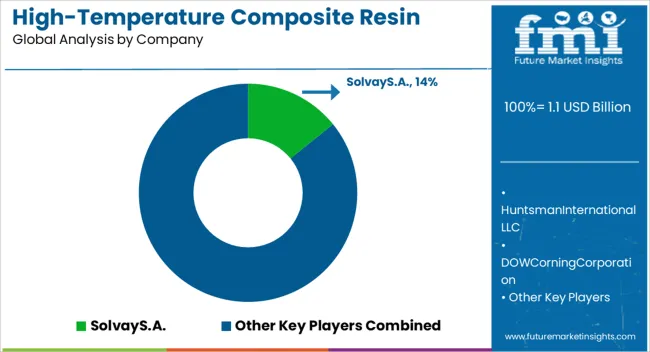

The high-temperature composite resin market is dominated by Solvay S.A., which leads with its advanced resin solutions designed for aerospace, automotive, and industrial applications requiring exceptional thermal stability and strength. Solvay’s dominance is supported by its innovative product offerings, strong R&D capabilities, and extensive market presence in high-performance resins. Key players such as Huntsman International LLC, Arkema S.A., and Henkel AG & Co. maintain significant market shares by offering high-temperature composite resins that provide superior performance under extreme conditions, with applications in industries such as defense, transportation, and energy. These companies focus on enhancing the resin's durability, reducing weight, and improving the overall material properties for high-stress environments. Emerging players like Hexion Inc., DIC Corporation, and Wacker Chemie AG are expanding their market presence by offering specialized high-temperature resins for niche applications such as electronic components, renewable energy systems, and high-performance industrial products. Their strategies include focusing on material innovation, improving resin formulations for better heat resistance, and offering customizable solutions to meet specific industry requirements.

Market growth is driven by the increasing demand for lightweight, heat-resistant materials in aerospace, automotive, and energy sectors, as well as the growing emphasis on high-performance composites in manufacturing. Innovations in resin chemistry, sustainability, and advanced manufacturing techniques are expected to continue shaping competitive dynamics and fuel further growth in the global high-temperature composite resin market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Resin Type | Epoxy Resin, Polyimide (PI), and Bismaleimide (BMI) |

| End Use | Aerospace & Defense, Automotive & Transportation, Electrical & Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SolvayS.A., HuntsmanInternationalLLC, DOWCorningCorporation, HenkelAG&Co., RoyalTencateN.V., ArkemaS.A., E.IDupontDeNemoursandCompany, MitsuiChemicalsInc., HexionInc., DICCorporation, WackerChemieAG, UBEIndustriesLtd., and NexamChemicalHoldingAB |

| Additional Attributes | Dollar sales by resin type and application, demand dynamics across aerospace & defense, automotive, and electronics sectors, regional trends in high-temperature composite resin adoption, innovation in thermoplastic and thermoset formulations, impact of regulatory standards on performance and environmental compliance, and emerging use cases in electric vehicles and advanced manufacturing processes. |

The global high-temperature composite resin market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the high-temperature composite resin market is projected to reach USD 2.6 billion by 2035.

The high-temperature composite resin market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in high-temperature composite resin market are epoxy resin, polyimide (pi) and bismaleimide (bmi).

In terms of end use, aerospace & defense segment to command 58.9% share in the high-temperature composite resin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Breaking Down Market Share in Composite Cardboard Tube Packaging

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA