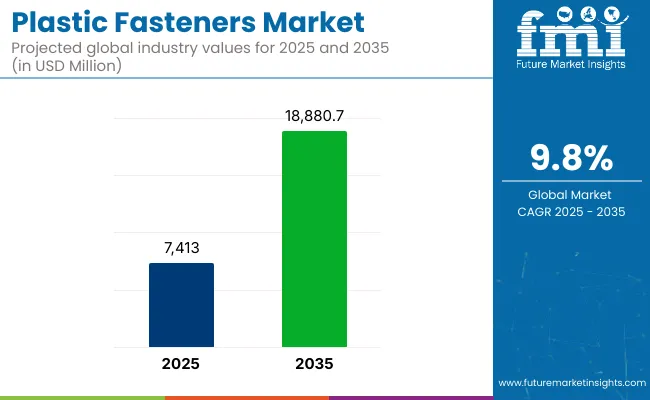

The global plastic fasteners market is projected to grow from USD 7,413.0 million in 2025 to USD 18,880.7 million by 2035, advancing at a compound annual growth rate (CAGR) of 9.8%.

| Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 7,413.0 million |

| Industry Value (2035F) | USD 18,880.7 million |

| CAGR (2025 to 2035) | 9.8% |

This growth is being supported by the increasing demand for lightweight, corrosion-resistant, and cost-effective fastening solutions across automotive, electronics, and construction sectors.

Plastic fasteners have seen rising adoption as industries prioritize materials that combine functional strength with material efficiency. High-performance polymers, such as polyamide, polypropylene, and PEEK, are being selected for their enhanced chemical resistance, thermal stability, and mechanical integrity. These materials allow for the development of fasteners that meet the demanding requirements of next-generation assemblies while reducing overall system weight.

In the automotive sector, plastic fasteners are used in interior panels, trim systems, under-hood components, and electric vehicle battery enclosures.

The shift toward electrification and vehicle light-weighting has intensified interest in polymer-based fasteners, particularly in electric vehicle (EV) platforms where reducing mass directly contributes to extended range and improved energy efficiency. Manufacturers are also focusing on fasteners that can withstand thermal cycling, vibration, and chemical exposure typically found in powertrain and underbody applications.

Within the electrical and electronics industry, plastic fasteners serve key functions in cable routing, printed circuit board (PCB) mounting, and enclosures for consumer and industrial devices. These components are chosen for their non-conductive nature and resistance to electromagnetic interference, which supports the ongoing trend toward miniaturized, high-speed electronics.

Applications in servers, communication equipment, and home appliances are increasingly using plastic clips, screws, and rivets that offer design flexibility and insulation performance.

The construction industry is also integrating plastic fasteners into wall paneling systems, cable trays, and HVAC equipment due to their ease of installation, resistance to environmental degradation, and long service life. As building codes evolve to include non-metallic components in infrastructure projects, demand for certified and flame-retardant plastic fastening systems continues to rise.

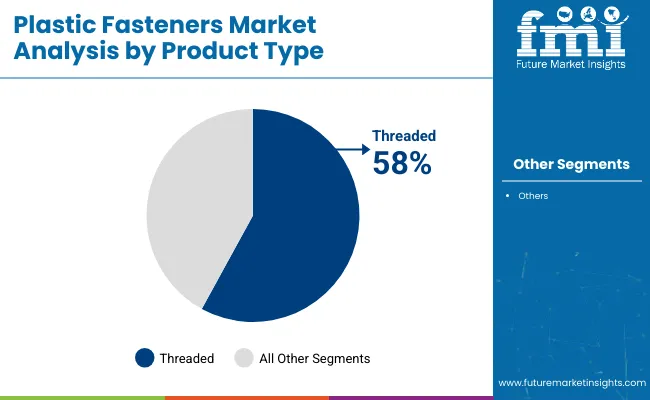

Threaded fasteners are projected to account for approximately 58% of the global plastic fasteners market share in 2025 and are expected to grow at a CAGR of 9.6% through 2035. Products such as nuts, bolts, screws, and inserts are widely used in light-duty assemblies where corrosion resistance, non-conductivity, and chemical inertness are essential. Applications span electronics, home appliances, and automotive interiors, where plastic alternatives to metal fasteners help reduce weight and cost. With growing miniaturization in consumer electronics and expansion of plastic-intensive design in automotive dashboards and under-hood components, demand for threaded plastic fasteners is expected to remain strong across diverse sectors.

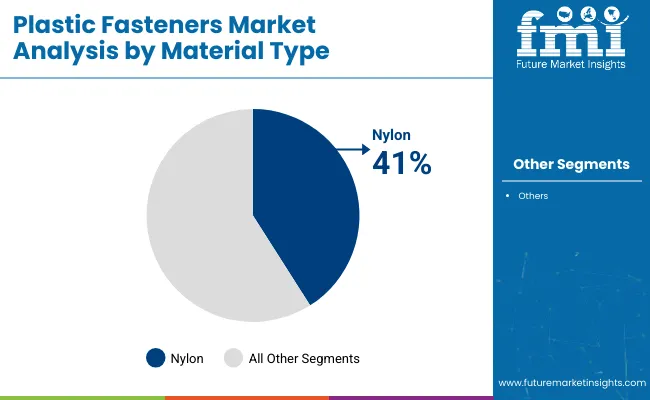

Nylon-based fasteners are estimated to hold approximately 41% of the global market share in 2025 and are projected to grow at a CAGR of 9.9% through 2035. Known for their excellent balance of tensile strength, impact resistance, and chemical durability, nylon fasteners are used extensively in electrical systems, construction fixtures, and HVAC assemblies. They perform reliably across a broad temperature range and are often specified in environments that require non-corrosive and electrically insulating components. With manufacturers prioritizing lightweight, cost-effective alternatives to metal parts, nylon continues to dominate in applications where safety, longevity, and performance under stress are key selection criteria.

Raw Material Price Volatility

Volatility affects the raw materials prices of the market, notably engineering plastics like nylon, polycarbonate, and polypropylene. The production costs and profitability may be affected by supply chain breakdowns, shortage of resins, and geopolitical tensions.

Strength & Load-Bearing Limitations

Although they provide numerous benefits, they are less mechanically strong than metal fasteners. Their application is restricted to high-load applications, including heavy machinery or aerospace components. The challenge is being met by manufacturers through the creation of reinforced composites and hybrid fastener systems.

Environmental Problems & Recycling Problems

Stricter regulations on plastic waste are pushing the industry to develop sustainable and recyclable fastening solutions. This shift toward using bio-based and recycled materials requires significant investment in research and adaptation within manufacturing processes.

Growth in Electric Vehicles & Light-Weight Automotive Parts

The fast expansion of electric and autonomous cars is driving huge demand for light, non-conductive fasteners that will improve battery efficiency and structural integrity. Advances in thermoplastic composites and high-performance polymers are unlocking new opportunities in automotive fastening.

The need for light, strong, and corrosion-resistant fastening solutions is increasing in different industries. With the increasing growth of smart devices, IoT applications, and wearable electronics, there is a growing demand for small and high-strength fasteners that can improve product design.

Companies also look for sustainable materials, such as bio-based and recycled substitutes, to meet environmental requirements and reduce carbon footprints. Making high-performance, eco-friendly substitutes is poised to drive future industry growth, creating new opportunities for manufacturers, material scientists, and suppliers.

The USA is projected to experience steady growth with 9% CAGR as industries adopt lightweight and high-performance fastening solutions to enhance efficiency and sustainability. As the fuel economy and emissions laws get tougher and tougher, manufacturers will replace these done-to-death metal parts with lighter alternatives for more efficient performance.

With the increasing production of smartphones, laptops, and other household appliances, demand for precision fastening solutions with electrical insulation and durability is also on the rise. Corrosion-resistant and quick installation solutions are being driven by the growth of prefabricated and modular construction. The shift towards bio-based and recyclable materials aligns with the corporate and government objective of sustainability and contributes to minimizing environmental footprint.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.0% |

Different sectors within the United Kingdom including electronics, green building, and automobile production have been continuously flourishing. According to Future Market Insights, country is expected to reflect a CAGR of 9.2% during the forecast period. Government incentives and legislation promoting the use of sustainable products have further fueled the shift to new fastening technologies. The increasing popularity of electric vehicles (EVs) is propelling demand for light-weight components, especially battery enclosures, powertrain systems, and interior fittings.

Government-led smart city projects are promoting the use of non-corrosive and durable fastening solutions in high-tech construction and modular buildings. With Stringent regulations encouraging recyclable materials and eco-friendly construction practices are accelerating the adoption of sustainable alternatives in green building projects. Aerospace and defense growth is escalating demand for high-performance fastening solutions requiring strength, heat resistance, and lightweight.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.2% |

For several years, China was the engine of rapid industrialization that rapidly triumphed in the expansion of its manufacturing output with strong budgetary support from the government for advancing high-tech industries. The country is projected to grow at 10.5% CAGR in the assessment period. Such market growth would see an increase in the demand for fasteners that are cost-effective, efficient, and lightweight. At its peak is very much in need of plastic fasteners in electric and hybrid vehicles because the automobile manufacturers focus on light weighting with cost performance.

Increasing end-user electronics demand would definitely create opportunities in the market going through a process of rapid precision fastener adoption in smartphones, tablets, and devices for smart homes. The mega projects such as smart cities and high-speed rail networks are increasing the demand for cost-effective and long-lasting fasteners. Government Policies Supporting Plastics Innovation: New material development investments and the promotion of sustainable plastics are keeping alive potential activities in this arena with a greater focus on high-performance polymer fasteners.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 10.5% |

Emerging Technologies in Tie and Tie Construction Technology The domain is also associated with miniaturization and miniaturization trends in electronic components and precision manufacturing. Material innovation propels Japan's high demand for specialized fastening solutions, in which the country is an international leader. The demand for these tiny, tough fasteners has increased due to growth in microelectronics, wearables, and ultra-high-performance computing systems that require miniaturized electronic devices.

The automotive and aerospace sectors are adopting lightweight, heat-resistant materials to enhance performance and efficiency. There is a strong industry focus on sustainability, with a growing shift toward biodegradable and recyclable materials in line with Japan’s environmental policies. Japanese companies are at the forefront of developing innovative polymer formulations for high-strength applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.8% |

South Korea is emerging as a key market, fueled by advancements in semiconductor manufacturing, smart devices, and electric vehicles. The country’s industrial landscape is shifting toward high-performance materials. Demand for high-precision plastic fasteners in chip fabrication, circuit board assembly, and cleanroom environments.

Increasing application of lightweight plastic components in battery enclosures, power electronics, and vehicle interiors. Adoption of automated and AI-driven manufacturing is increasing demand for durable fastening solutions. Developments in solar and wind energy installations are increasing the demand for high durability plastic fasteners in energy infrastructures.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.6% |

The plastic fasteners industry is driven by major manufacturers that specialize in high-performance fastening solutions for diverse applications. Companies like Illinois Tool Works Inc., Nifco Inc., and Stanley Black & Decker Inc. utilize advanced polymer technologies to produce durable, lightweight fasteners. Their expertise in precision molding and material science allows them to supply industries that require high-strength, corrosion-resistant components.

In the automotive sector, lightweight fastening solutions play a crucial role in vehicle assembly by reducing overall weight and improving fuel efficiency. Leading manufacturers design these components to withstand extreme temperatures and mechanical stress while maintaining structural integrity. As the industry transitions toward electric vehicles, the demand for advanced fastening technologies continues to grow, driving further innovation.

The electronics industry depends on non-conductive fastening solutions to prevent short circuits and electrical malfunctions. Manufacturers develop specialized components that securely hold delicate electronic parts while providing insulation from external interference. With rising demand for consumer electronics and high-performance computing devices, precision-engineered fastening solutions are becoming increasingly essential.

In construction, modern fastening systems offer significant advantages over traditional metal alternatives by resisting corrosion, lowering maintenance costs, and simplifying installation. Builders and contractors use these solutions for insulation panels, roofing systems, and modular structures. With a growing focus on sustainable building materials, manufacturers are developing eco-friendly alternatives that align with green construction initiatives and regulatory standards.

Asia-Pacific has emerged as the fastest-growing region for fastening solutions, driven by rapid industrialization and large-scale infrastructure projects. Countries like China and India are increasing production capacity to meet demand across the automotive, electronics, and construction industries. Companies in the region are investing in automation and material innovation to enhance product quality while maintaining cost efficiency in a highly competitive global market.

Manufacturers are investing in engineered fastening systems with snap-fit designs, integrated seals, and automated assembly compatibility to align with evolving manufacturing practices. This positions plastic fasteners as a critical enabler of lightweight, high-efficiency design across industries.

The plastic fasteners market is projected to grow from USD 7,413.0 million in 2025 to USD 18,880.7 million by 2035.

The market is expected to grow at a CAGR of 9.8% from 2025 to 2035, driven by rising demand in automotive, electronics, and construction industries.

Anil Plastics & Enterprises, Araymond, Arconic, Bossard Group, Bulte Plastics, Canco Fasteners, Craftech Industries, E & T Fasteners, Fontana Gruppo, Illinois Tool Works, Joxco Seals, KGS Kitagawa Industries Co., Micro Plastics, MW Industries, Nifco, Nyltite Corporation, Penn Engineering, Shamrock International Fasteners, Shanghai Yuanmao Fastener Co., and Stanley Black & Decker are the major manufacturers in the industry.

Asia-Pacific, particularly China and India, is expected to offer the most lucrative growth opportunities due to rapid industrialization and expanding manufacturing sectors.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Hot and Cold Pipe Market Size and Share Forecast Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA