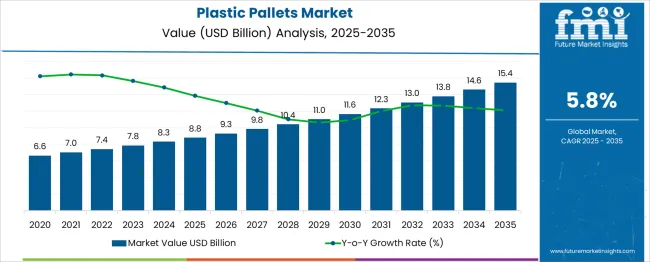

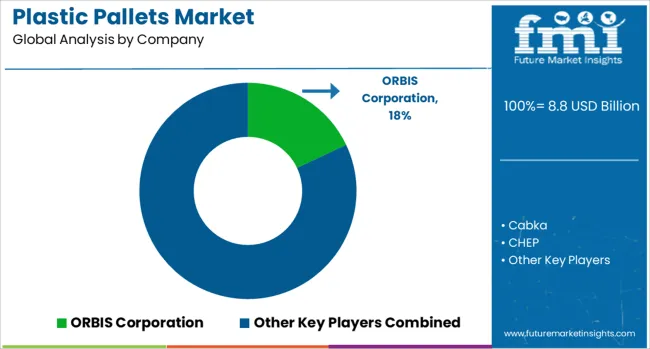

The Plastic Pallets Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 15.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. Between 2020 and 2030, the market value increases from USD 6.6 billion to around USD 11.0 billion, reflecting an average annual growth rate close to 5.4%. This growth phase is driven by rising demand for efficient and durable material handling solutions across logistics, warehousing, and manufacturing industries. The shift from traditional wooden pallets to plastic pallets is supported by the benefits of improved hygiene, longer lifespan, and recyclability.

Growing adoption in the food and beverage, pharmaceutical, and retail sectors further propels market expansion due to stringent sanitation requirements and supply chain efficiency goals. From 2030 to 2035, the market accelerates from USD 11.6 billion to USD 15.4 billion, fueled by increasing investments in automated material handling systems and smart logistics infrastructure. Emerging markets demonstrate rapid uptake driven by expanding industrial activity and modernizing supply chains, while established markets benefit from innovations in lightweight, high-strength plastic materials and sustainable pallet designs. The market is evolving in response to technological advancements, environmental concerns, and evolving logistics practices, with sustained growth expected through 2035, supported by increasing demand for efficient, eco-friendly, and cost-effective pallet solutions worldwide.

| Metric | Value |

|---|---|

| Plastic Pallets Market Estimated Value in (2025 E) | USD 8.8 billion |

| Plastic Pallets Market Forecast Value in (2035 F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The plastic pallets market is witnessing consistent expansion, driven by the global shift toward sustainable and hygienic logistics solutions. Regulatory pressures surrounding food safety, supply chain traceability, and export packaging standards have increased reliance on durable, reusable pallets that offer moisture resistance and ease of cleaning.

Rising automation in warehousing and distribution has further elevated demand for standardized pallet designs compatible with conveyors and robotic systems. Manufacturers are increasingly focusing on lightweight, impact-resistant materials to reduce transportation costs and enhance operational efficiency.

In addition, the growth of e-commerce, cold chain logistics, and cross-border trade is creating new avenues for plastic pallet adoption across both developed and emerging economies. As cost-efficiency and recyclability remain key procurement criteria, innovation in material formulation and design is expected to drive the next wave of growth.

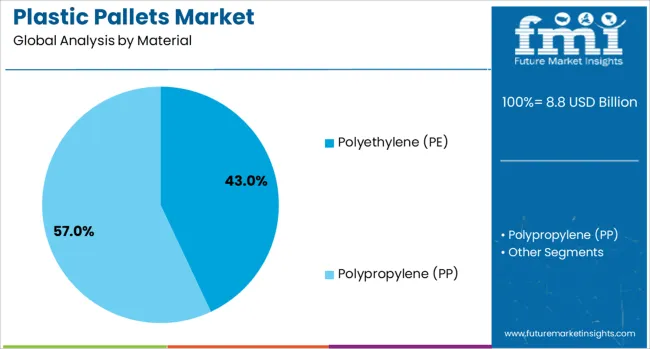

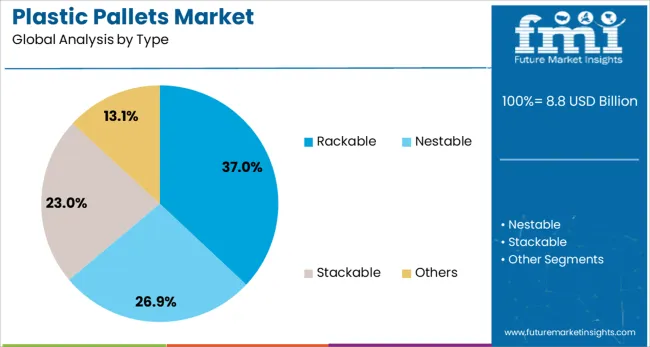

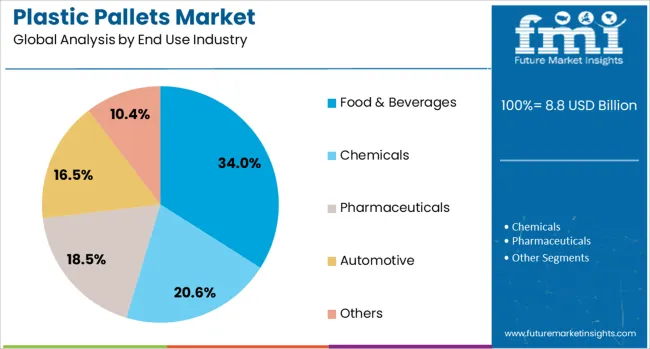

The plastic pallets market is segmented by material, type, end-use industry, and geographic regions. The material of the plastic pallets market is divided into Polyethylene (PE) and Polypropylene (PP). In terms of the type of plastic pallets, the market is classified into Rackable, Nestable, Stackable, and others. Based on end-use industry, the plastic pallets market is segmented into Food & Beverages, Chemicals, Pharmaceuticals, Automotive, and others. Regionally, the plastic pallets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene (PE) is projected to account for 43.0% of the overall plastic pallets market revenue in 2025, making it the leading material segment. The preference for PE is being driven by its superior chemical resistance, impact durability, and cost-effectiveness in manufacturing high-volume pallet units.

Its ability to withstand variable temperature conditions without warping makes it well-suited for use in both ambient and cold storage environments. Furthermore, its recyclability and compatibility with food-grade requirements position it favorably for industries prioritizing safety and sustainability.

Manufacturers are also leveraging high-density polyethylene (HDPE) variants for applications requiring heavier load capacities and extended lifecycle value.

Rackable pallets are estimated to capture 37.0% of total market share in 2025, leading the type segment due to their structural strength and compatibility with high-density racking systems. These pallets are increasingly used in industries with bulk storage needs, where vertical stacking and warehouse automation are prevalent.

Their reinforced design ensures consistent load-bearing capacity, making them ideal for closed-loop logistics and long-haul distribution. The cost savings associated with reduced product damage, lower maintenance, and longer service life have positioned rackable pallets as a preferred investment in modernized supply chain networks.

This trend is particularly strong in organized retail, pharmaceuticals, and industrial manufacturing segments.

The food & beverages sector is anticipated to command 34.0% of the total revenue in the plastic pallets market by 2025, emerging as the dominant end-use industry. Stringent hygiene standards, frequent product rotation, and contamination control protocols have driven this segment’s reliance on plastic pallets.

Their non-porous surfaces, ease of sanitization, and compliance with HACCP and FDA guidelines make them indispensable in food handling and storage operations. Additionally, increased global demand for packaged foods and temperature-sensitive items has led to widespread adoption across processing plants, cold chains, and distribution centers.

The segment’s continued growth is further supported by regulatory oversight and consumer expectations around food safety.

Plastic pallets are gaining momentum due to compliance with international shipping regulations, suitability for hygiene-sensitive industries, and seamless use in automated facilities, while offering long-term cost benefits. These factors are driving adoption across diverse sectors worldwide.

The increasing complexity of international trade regulations has positioned plastic pallets as a preferred choice for exporters due to their compliance with ISPM-15 exemption standards. These pallets eliminate the need for heat treatment or fumigation, reducing processing time and costs. Their consistent dimensions and strength make them compatible with automated handling systems in global logistics hubs. Industries such as pharmaceuticals, electronics, and packaged foods rely heavily on them for maintaining hygiene during transportation. The rapid growth of e-commerce-driven cross-border shipments further accelerates adoption, as businesses seek reliable, reusable solutions that withstand long-haul transit without damage or contamination. This trend is expected to strengthen across major exporting nations.

Plastic pallets have gained strong traction in sectors with stringent hygiene requirements such as food and beverage, pharmaceuticals, and healthcare. Their non-porous surfaces prevent moisture absorption, eliminating risks associated with mold, bacteria, and pest infestation. Easy-to-clean designs enable repeated use without compromising safety standards. With regulatory bodies tightening compliance for packaging and transport in sensitive industries, the appeal of plastic pallets has expanded significantly. In pharmaceutical cold chain logistics, these pallets help maintain product integrity by reducing contamination risks. The growing use of color-coded pallets for segregation of product categories further enhances their operational value for compliance-driven environments.

The increasing shift toward warehouse automation and robotic handling has heightened demand for pallets with precision dimensions and uniform weight distribution, making plastic pallets an ideal fit. Their compatibility with conveyor belts, automated guided vehicles (AGVs), and high-density storage racks improves throughput and reduces downtime. Unlike wooden pallets, they do not warp, splinter, or vary in size over time, ensuring seamless integration into automated workflows. This compatibility leads to fewer operational disruptions and lower equipment maintenance costs. As businesses expand automated facilities for large-scale distribution, the role of plastic pallets in maintaining efficiency and consistency continues to grow.

While initial costs for plastic pallets remain higher than wooden alternatives, their extended lifespan, reduced damage rates, and lower maintenance needs make them cost-effective over time. Companies operating in high-frequency handling environments benefit from reduced replacement cycles and lower disposal expenses. The reusability factor supports closed-loop logistics models, allowing businesses to recover pallet investments through multiple rotations. With increased awareness of lifecycle cost savings, procurement strategies are shifting toward bulk purchasing of high-grade polymer pallets. This economic advantage is particularly evident in industries with continuous shipment cycles, where pallet durability directly impacts operational budgets and return on investment.

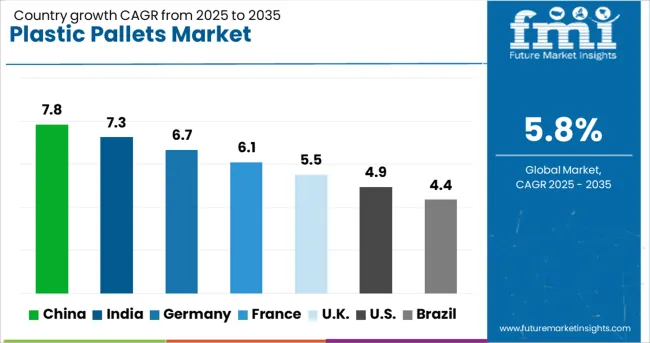

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

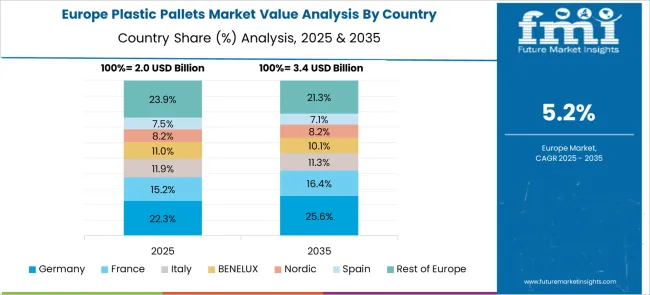

The plastic pallets market is projected to expand globally at a CAGR of 5.8% between 2025 and 2035, driven by the demand for durable, reusable, and hygiene-compliant material handling solutions. China leads with a CAGR of 7.8%, supported by manufacturing growth, export-oriented logistics, and large-scale adoption in automated warehousing. India follows at 7.3%, propelled by expansion in FMCG, pharmaceuticals, and organized retail, alongside strong e-commerce penetration. France records 6.1%, benefiting from advanced cold chain networks and adoption in high-value product transportation. The United Kingdom grows at 5.5%, backed by increased investments in logistics automation and compliance with hygiene regulations in food and healthcare. The United States posts a CAGR of 4.9%, influenced by stable demand in industrial sectors, warehouse modernization, and closed-loop supply chain practices. The analysis spans over 40 countries, with these five representing benchmarks for technology adoption, market penetration, and investment prospects in the global plastic pallets industry.

China is projected to deliver a 7.8% CAGR during 2025–2035, outpacing the global average of 5.8% as pallet standardization in export hubs is widened and automated warehouses are scaled across coastal provinces. During 2020–2024, CAGR was near 6.6%, supported by steady upgrades from wood to polymer in food, pharma, and electronics corridors. Adoption has been encouraged by ISPM-15 exemption, uniform sizing for conveyors, and lower unit loss in closed loops. In my view, vendor financing and rental pools have been used smartly to lift penetration among mid-tier shippers. Cold chain growth and tighter hygiene control will keep the mix tilting toward HDPE and PP platforms.

India is expected to post a 7.3% CAGR in 2025–2035, supported by FMCG distribution upgrades, pharmaceutical exports, and rising use in organized retail backrooms. The 2020–2024 CAGR stood around 6.1%, helped by migration to reusable transport packaging in metro clusters. As I see it, pay-per-use models have reduced upfront capex for small consignors, which has pushed trials into adoption. PET and PP strap compatibility with reinforced decks improved load integrity on rail corridors, which matters for long hauls. With GST-linked hub consolidation, pallet fleets are being standardized to reduce handling loss and cycle times across regional DC networks.

France is projected at a 6.1% CAGR for 2025–2035, a touch above the global pace, as food, beverage, and cosmetics hubs continue to demand cleanable, splinter-free platforms. During 2020–2024, CAGR was about 4.9%, when conversions were focused on hygiene-critical plants and selective export lanes. From my vantage point, pallet pooling has been deployed effectively to manage reverse logistics and shrinkage. Uniform dimensions have favored integration with shuttle systems and AGVs in regional DCs. The outlook is improved by premium grocery supply chains that prize low debris and steady deck stiffness under mixed-case loads.

The United Kingdom is set to grow at 5.5% CAGR during 2025–2035, compared with an estimated about 4.4% CAGR in 2020–2024. A slower early phase was seen as wooden pallets remained prevalent in general merchandise and capex stayed tight. The later pace looks firmer as automated parcel hubs expand and hygiene rules in food and healthcare are applied strictly. Conversions are being pulled by e-grocery, chilled distribution, and 3PL consolidation. Now, a different phrasing for the growth metric: the UK market is moving from a mid-4 percent trajectory in 2020–2024 to the 5.5 percent path in 2025–2035. This rise is explained by pooling penetration, better backhaul capture, and improved return rates.

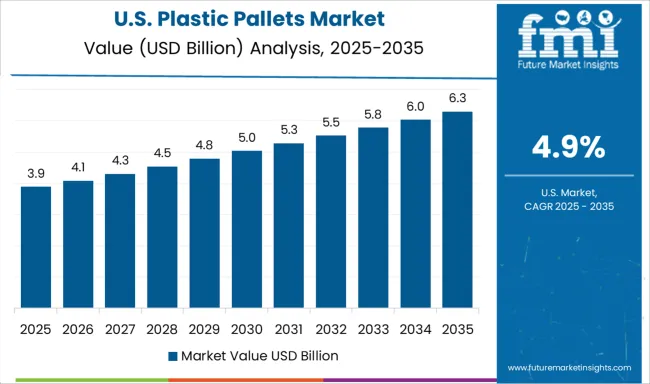

The United States is expected at a 4.9% CAGR in 2025–2035, following about 3.9% CAGR during 2020–2024. Growth has been steadier than flashy, driven by warehouse modernization, private label food distribution, and returnable packaging in chemicals and pharma. My view is that safety, sanitation, and dimensional stability are being valued over lowest first cost in high-cycle networks. Nestable designs are favored for backhaul density, while rackable units serve high-bay storage with consistent deflection. With omni-channel fulfillment rising, pallets that resist moisture and maintain deck flatness are being specified to reduce jams and line stops.

The plastic pallets market features a mix of globally established logistics solution providers and specialized regional manufacturers competing on durability, cost efficiency, and supply chain compatibility. ORBIS Corporation leads with its extensive range of reusable plastic pallets, offering tailored solutions for automotive, food, and retail sectors, while integrating RFID and IoT-enabled tracking features to improve asset visibility. Cabka is recognized for its expertise in recycled material-based pallets, producing nestable and export-oriented designs that reduce storage costs and support lightweight freight requirements. CHEP dominates the pooling services segment, leveraging its large-scale network and standardized pallet systems to optimize supply chain flow for multinational FMCG and retail clients.

Craemer GmbH specializes in high-load and hygienic pallets for the food and pharmaceutical industries, with a focus on injection-molded precision and long product lifecycles. Schoeller Allibert offers a broad portfolio of heavy-duty pallets integrated with containerized logistics systems, enabling modular transport solutions across industries. Bekuplast GmbH emphasizes ergonomic design, lightweight construction, and compatibility with automation systems for retail distribution and closed-loop logistics. BENOPLAST targets cost-sensitive markets with competitively priced, durable pallets tailored to regional export needs. Competitive strategies include investing in recycled and high-performance resins, expanding pooling and rental networks, and integrating digital asset management technologies for tracking and lifecycle optimization. Partnerships with 3PLs, advancements in hygienic design, and scaling production in growth regions remain key levers for capturing market share. Future success will depend on the ability to deliver lightweight, standardized, and automation-ready pallet systems that enhance operational efficiency while reducing total logistics costs.

In October 2024, ORBIS Corporation acquired Creative Techniques, Inc. (CTI), to boost its customer base.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Billion |

| Material | Polyethylene (PE) and Polypropylene (PP) |

| Type | Rackable, Nestable, Stackable, and Others |

| End Use Industry | Food & Beverages, Chemicals, Pharmaceuticals, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ORBIS Corporation, Cabka, CHEP, Craemer GmbH, Schoeller Allibert, Bekuplast GmbH, and BENOPLAST |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive positioning, raw material cost impact, pricing benchmarks, industry growth rates, end-use sector adoption, and regulatory compliance requirements. |

The global plastic pallets market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the plastic pallets market is projected to reach USD 15.4 billion by 2035.

The plastic pallets market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in plastic pallets market are polyethylene (pe), _hdpe, _ldpe, polypropylene (pp) and _others.

In terms of type, rackable segment to command 37.0% share in the plastic pallets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA