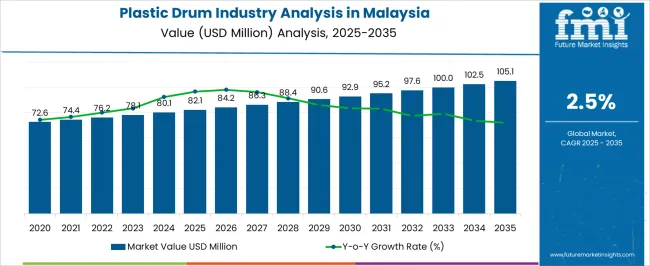

The Plastic Drum Industry Analysis in Malaysia is estimated to be valued at USD 82.1 million in 2025 and is projected to reach USD 105.1 million by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Drum Industry Analysis in Malaysia Estimated Value in (2025 E) | USD 82.1 million |

| Plastic Drum Industry Analysis in Malaysia Forecast Value in (2035 F) | USD 105.1 million |

| Forecast CAGR (2025 to 2035) | 2.5% |

The plastic drum industry in Malaysia is expanding steadily, supported by rising demand from the chemicals, food and beverages, and pharmaceuticals sectors where safe and efficient bulk storage is essential. The industry benefits from the country’s strategic role as a manufacturing hub in Southeast Asia, with strong logistics infrastructure and increasing exports driving higher adoption of plastic-based containers.

Durability, lightweight handling, and chemical resistance have positioned plastic drums as a preferred choice over traditional metal options. Current growth is reinforced by heightened safety standards and regulatory compliance requirements in hazardous material storage.

With innovations in high-performance polymers and growing sustainability initiatives such as recyclable and reusable designs, the market outlook remains positive. The long-term trajectory is supported by industrial growth, rising export activities, and the adaptability of plastic drums across both domestic and international supply chains.

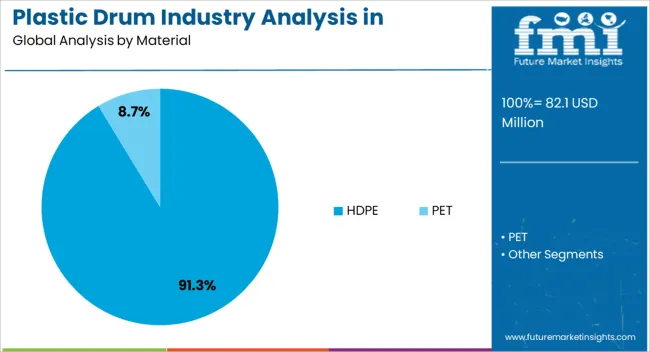

The HDPE segment dominates the material category with approximately 91.3% share, attributed to its superior strength, chemical resistance, and cost efficiency compared to alternative materials. HDPE drums provide high durability under extreme handling conditions, making them suitable for transporting hazardous chemicals, oils, and food-grade products.

The widespread availability of HDPE resin and established molding processes have further strengthened its adoption in Malaysia’s industrial landscape. The segment benefits from its recyclability and alignment with sustainability practices, which are increasingly prioritized by manufacturers and end-users.

With HDPE’s proven performance in maintaining product safety and extending container lifespan, this segment is projected to maintain its leading position over the forecast horizon.

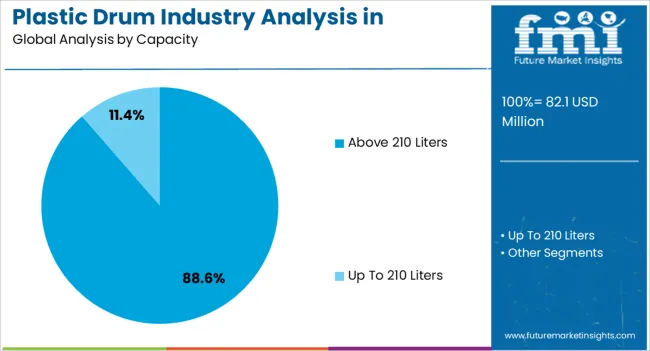

The above 210 liters segment accounts for approximately 88.6% of the capacity category in Malaysia’s plastic drum industry. This dominance reflects its critical role in large-scale bulk handling and storage requirements across industries.

Larger capacity drums reduce logistical complexity by minimizing handling frequency and optimizing transport efficiency. The segment has gained traction in sectors such as chemicals, lubricants, and food processing, where high-volume packaging ensures streamlined supply chain operations.

Its prevalence is reinforced by cost-effectiveness in per-liter storage and compatibility with global shipping standards. With industrial expansion and rising bulk export activities, the above 210 liters segment is expected to remain the preferred capacity choice in the Malaysian market.

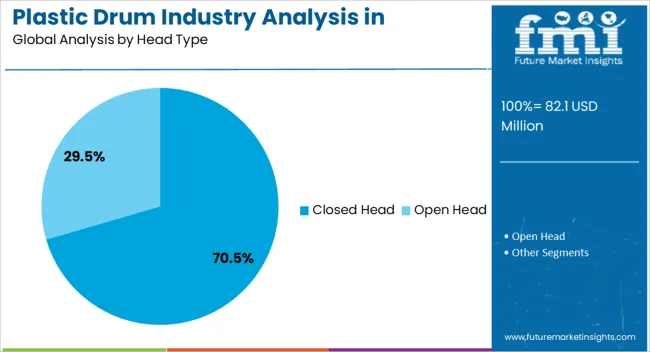

The closed head segment leads the head type category with approximately 70.5% share, supported by its effectiveness in securing liquids and semi-liquids during transport and storage. Closed head designs offer enhanced leak resistance, tamper-proof sealing, and durability under pressure, making them ideal for hazardous materials and sensitive products.

The segment benefits from widespread adoption in chemical, petrochemical, and food-grade applications where product integrity is critical. Manufacturing advancements in drum molding have improved precision in closed head designs, reinforcing their reliability.

With industries demanding high safety assurance in logistics, the closed head segment is projected to maintain its dominant position in Malaysia’s plastic drum market.

Rising Need for Oleochemicals in Malaysia Boosting Plastic Drum Demand

Malaysia is currently supplying around 20% of the world's oleochemical capacity, and is a leading producer as well as user of oleochemicals. The country’s oleo chemical sector grew significantly in 2025, with exports amounting to USD 7.7 billion.

The growing usage of oleochemicals is important in several applications like cosmetics and personal care which is a key factor driving this demand spike. In order to meet this demand, oleochemical manufacturers are increasing derivative and value-added capacity, thereby gaining a bigger portion of the value chain.

As Malaysia solidifies its position as one of the world's primary oleochemical producers and exporters, the plastic packaging sector is subjected to gain benefit from the same. The need for efficient storage and transportation of oleo chemicals, coupled with the country’s significant role in this sector, is set to drive demand for HDPE and PET drums from 2025 to 2035.

Malaysia's Free Trade Agreements Opening Doors for Development

Malaysia is one of the 15 signatory nations of the Regional Comprehensive Economic Partnership (RCEP), a significant free trade agreement. In this agreement, the country holds a key position representing 30% of the global population and GDP, which is further expected to increase up to 50% by 2035.

Malaysia currently holds 16 Free Trade Agreements (FTAs), with the potential size extending up to USD 3.3 billion people. The nation has signed bilateral FTAs with key players like Japan, Pakistan, India, New Zealand, Chile, Australia, and Türkiye. These ties will flourish the trading between Malaysia and other countries, resulting in more requirements for packaging solutions like HDPE and PET drums for efficient transportation.

Industrial-grade containers like HDPE drums that are lightweight and cost-effective are being widely used for transportation and shipping of bulk materials. The drums also comply with the UN regulations for packaging hazardous materials, making these safe for shipping.

The widespread applications of PET and HDPE drums across different sectors supported by the free trade agreements are set to create opportunities for expansion. Similarly, favorable government policies will benefit the sector through 2035.

Increasing Plastic Pollution Limiting Growth

Several factors are negatively impacting the target sector. These include increasing plastic pollution levels, growing environmental concerns, and implementation of stringent regulations.

Challenges in plastic waste management impact the overall sustainability of HDPE drums. These include insufficient quality of local plastic waste, limited recycling capacity, and a lack of alternative end-of-life solutions.

The absence of macro data to monitor plastic production, consumption, waste collection, and materials recovery hampers informed decision-making and strategic planning for the industry. This can be addressed by providing fully recyclable and biodegradable drums that can fulfill these circular economy goals.

Plastic drum sales in Malaysia recorded a sluggish CAGR of 1.9% during the historical period between 2020 and 2025. The total size of the country reached around USD 82.1 million at the end of 2025.

The outbreak of the COVID-19 pandemic resulted in worldwide lockdowns and a halt in import-export activities. This, in turn, reduced the demand for packaging solutions, especially large industrial-grade drums.

The Malaysian government also implemented regulations to limit the usage of plastic products. This encouraged industries to opt for sustainable or reusable packaging alternatives like IBC tanks or metal drums.

The future plastic drum industry forecast looks bright in Malaysia. This is attributable to growing demand for safe and secure packaging solutions across several industries.

The target sector in Malaysia will have a moderate growth rate in the future. Increasing adoption of HDPE drums across industries like chemicals, pharmaceuticals, industrial chemicals, and food and beverages.

HDPE and PET drums meet the requirements of chemical and pharmaceutical manufacturers. This is due to lightweight, durable, and cost-efficient features of these rigid packaging solutions. Government norms for the adoption of biodegradable materials are anticipated to positively impact the plastic drum industry's growth.

Plastic drums are generally not reactive to the materials, such as chemicals, oils, and lubricants present inside. As a result, these are often used for storing and transporting a wide variety of chemicals and other products.

The increasing demand for packaged food will further boost growth of plastic drum sector in the country. Similarly, advances in recycling and biodegradable packaging are anticipated to benefit manufacturers.

The section below covers the future forecast for HDPE and PET drums in sub-regions of Malaysia. Information on key sub-regions of the country, including southern, northern, east, and others, is provided in this section. The central part of Malaysia leads the sector with the topmost share. Southern Peninsula is projected to witness a prominent CAGR of 3.3% through 2035.

| Sub-region | Value CAGR 2025 to 2035 |

|---|---|

| Southern Peninsula | 3.3% |

| East Coast | 2.9% |

| Northern Peninsula | 2.5% |

Southern Malaysia is becoming a manufacturing hub for plastic industry due to presence of several manufacturing companies for various products. The region has a favorable business environment for the drum industry to rise.

Increasing export of various goods, especially in packaging formats like drums, is set to boost growth. Similarly, the booming food and beverage, healthcare, and personal care industries are anticipated to create opportunities for growth.

East Coast is going through a transformation and witnessing significant industrial development. The region has the presence of petrochemical companies and refineries which is generating a substantial demand for plastic drums.

The East Coast region has several ports that are used for international trading. Plastic packaging solutions like drums are commonly used for shipping. Hence, developed ports in the region will lead to a steady demand for HDPE and PET drums.

Initiatives taken by governments, such as the formation of the East Coast Economic Region (ECER), are anticipated to create opportunities for plastic drum manufacturers. As a result, the East Coast is predicted to register a CAGR of 2.9% from 2025 to 2035.

The Northern Peninsula is poised to record a CAGR of 2.5% between 2025 and 2035. This is attributable to thriving chemical sector and growing demand for cost-effective packaging solutions.

HDPE and PET drums are widely employed for storing and transporting several chemicals, including resins, solvents, and industrial cleaners. As the demand for these chemicals continues to surge in the Northern Peninsula, so will sales of plastic drums.

The section contains information about the leading segments in Malaysia. HDPE drums currently hold 91.3% of value share in 2025, fueled by widespread adoption across diverse sectors. Plastic drums with closed ends are set to dominate the sector, accounting for a value share of 70.5% in 2025. On the other hand, demand for open-top plastic drums in Malaysia is set to increase significantly through 2035.

| Segment | HDPE (Material) |

|---|---|

| Value Share (2025) | 91.3% |

HDPE remains preferred across Malaysia for manufacturing drums. This is attributable to several excellent properties, including high strength, versatility, corrosion resistance, lightweight, and cost-effectiveness.

Sales of HDPE drums in Malaysia are projected to total USD 105.1 million in 2035, accounting for a value share of 88%. Further, a CAGR of 5.7% has been estimated for the target segment between 2025 and 2035.

HDPE drums have high molecular weight and density, which makes these suitable for transportation and shipping of various materials. The inertness and resistance to different PH levels make these suitable for a variety of hazardous and non-hazardous chemicals.

HDPE drums fulfill the regulations and standards required for shipping and warehousing. The strength and protection provided by HDPE drums are boosting adoption. Hence, the target segment will likely retain its dominance through 2035.

| Segment | Close Head (Head Type) |

|---|---|

| Value Share (2025) | 70.5% |

Closed-head plastic drums currently account for over 70.5% of value share. Over the forecast period, demand for closed-head drums is projected to increase at 3.5%, propelled by high adoption on account of advantages like leak prevention, durability, and tamper-evident nature.

Closed-head drums are without a removable lid which completely seals the drum from both openings. These drums have two designated small openings for running the liquid materials, which are secured with a stopper. This sealing helps in secured transportation and storage of liquid materials.

Closed-head drums help to easily fill and remove liquids without product spillage. Such packaging solutions work well with oil, chemicals, and beverages of large quality, leading to the segment’s dominance in Malaysia.

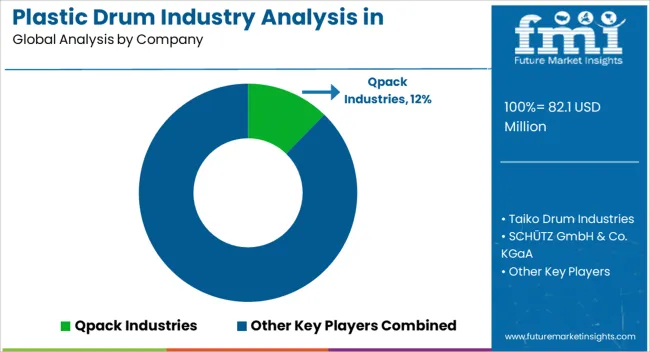

The plastic drum industry in Malaysia is becoming competitive, with Tier 1 players accounting for 40% to 55% of the total share. A wide range of strategies, including new product launches and innovative facility establishments are adopted by leading producers of plastic drums in Malaysia to succeed.

With sustainability taking center stage, key manufacturers are focusing on using recycled materials in novel products to woo eco-conscious customers. Several companies are also innovating to develop drums that are more efficient, durable, or stackable.

Certain plastic drum companies in Malaysia are utilizing novel manufacturing technologies to reduce product costs and enhance quality. Implementing strategies like partnerships, mergers, acquisitions, and collaborations are also becoming common among Malaysian drum suppliers and manufacturers. Few of the leading companies are focusing on joining hands with government agencies to provide industries with sustainable drums to reduce carbon footprint.

Industry Updates

On the basis of material, the sector is segregated into HDPE and PET.

In terms of capacity, the sector is divided into up to 210 liters and above 210 liters.

Few of the important head types include open head and closed head.

By end-use, the target sector is segmented into cosmetic and perfumery, oleo chemicals, agrochemicals, industrial chemicals, pharmaceuticals, food and beverages, flavor and fragrances, petroleum and lubricants, and others (home care and personal care).

Malaysia is further categorized into Northern Peninsula, Southern Peninsula, Central, East Coast, and East Malaysia.

The global plastic drum industry analysis in Malaysia is estimated to be valued at USD 82.1 million in 2025.

The market size for the plastic drum industry analysis in Malaysia is projected to reach USD 105.1 million by 2035.

The plastic drum industry analysis in Malaysia is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in plastic drum industry analysis in Malaysia are hdpe and pet.

In terms of capacity, above 210 liters segment to command 88.6% share in the plastic drum industry analysis in Malaysia in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Malaysia Plastic Jerry Can Market Trends & Forecast 2024-2034

Plastic Drums Market Trends and Demand 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Vietnam Plastic Jerry Can Market Analysis – Growth & Forecast 2023-2033

Vietnam Plastic Drum Market Analysis – Growth & Forecast 2023-2033

Western Europe Industrial Drum Market Growth – Trends & Forecast 2023-2033

Korea Industrial Drum Market Analysis – Growth & Forecast 2023-2033

Japan Industrial Drum Market Insights – Growth & Forecast 2023-2033

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Automotive Plastic Market in BRIC Countries - Size, Share, and Forecast 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Europe Healthcare Rigid Plastic Packaging Market Trends – 2024-2034

Master Recharge API Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA