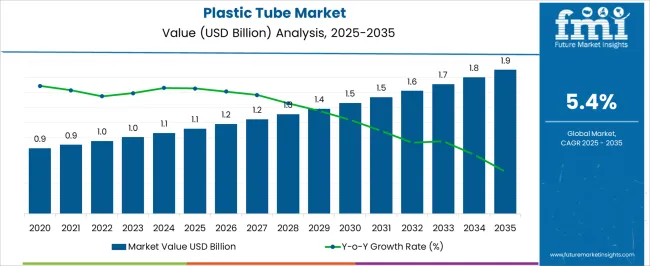

The plastic tube market is projected to grow from USD 1.1 billion in 2025 to USD 1.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.4%. Demand expansion shows the increasing importance of plastic tubes as versatile packaging solutions across personal care, pharmaceuticals, food, and industrial applications. The growth is underpinned by consumer demand for lightweight, cost-efficient, and durable formats that balance convenience with product protection. Rising global consumption of cosmetics and healthcare products, coupled with the expanding food packaging sector, has ensured consistent adoption of plastic tubes as an effective medium for storage and dispensing.

Current industry momentum is being shaped by advancements in extrusion and molding technologies, which have significantly improved product uniformity, precision, and design flexibility. These innovations have enhanced the performance of plastic tubes, ensuring better compatibility with automated filling systems while optimizing barrier properties. At the same time, a shift toward recyclable and eco-friendly materials is transforming the market landscape. Manufacturers are investing in bio-based plastics and recyclable laminates to meet sustainability goals and comply with regulatory frameworks that favor circular economy practices. This transition is particularly relevant in mature economies where consumer awareness of environmental issues is influencing packaging choices.

The pharmaceutical and healthcare industries remain among the strongest drivers of plastic tube adoption. The demand for hygienic, tamper-resistant, and portable packaging for ointments, gels, and creams has made plastic tubes indispensable. The personal care and cosmetics segment, however, continues to dominate usage, where product differentiation, shelf appeal, and dispensing convenience play critical roles in shaping consumer preferences. Food packaging is emerging as a significant growth area as single-serve, portion-controlled formats gain traction in urbanized markets, supported by the rise of e-commerce distribution channels.

During the forecast period, the plastic tube market is expected to benefit from a combination of material innovation and design adaptability. Advances in barrier coatings, biodegradable resins, and improved closure mechanisms will help extend shelf life, enhance user experience, and reduce material waste. Manufacturers are also focusing on digital printing technologies that enable high-quality labeling, customization, and branding opportunities, strengthening the appeal of plastic tubes in competitive markets. Meanwhile, regional growth patterns highlight rapid adoption in Asia-Pacific, driven by expanding consumer markets and industrial capacity, while North America and Europe are expected to focus on premium and sustainable packaging solutions.

| Metric | Value |

|---|---|

| Plastic Tube Market Estimated Value in (2025 E) | USD 1.1 billion |

| Plastic Tube Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

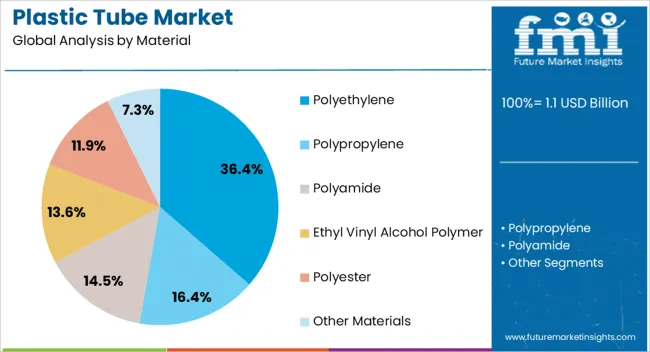

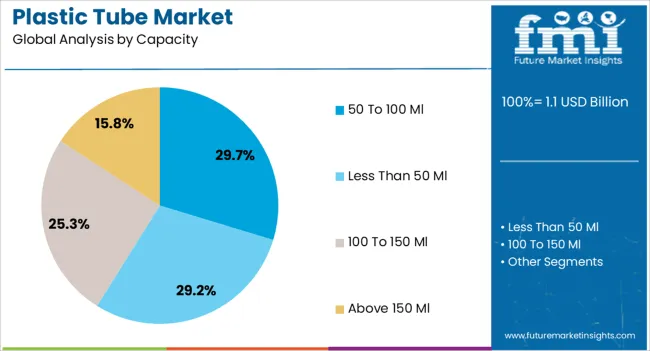

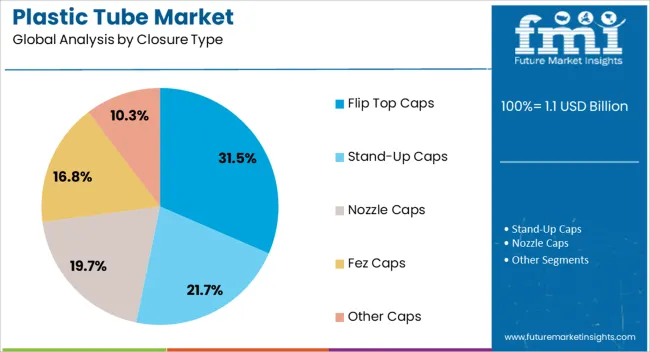

The market is segmented by Material, Capacity, Closure Type, and Application and region. By Material, the market is divided into Polyethylene, Polypropylene, Polyamide, Ethyl Vinyl Alcohol Polymer, Polyester, and Other Materials. In terms of Capacity, the market is classified into 50 To 100 Ml, Less Than 50 Ml, 100 To 150 Ml, and Above 150 Ml. Based on Closure Type, the market is segmented into Flip Top Caps, Stand-Up Caps, Nozzle Caps, Fez Caps, and Other Caps. By Application, the market is divided into Cosmetic, Dental, Pharmaceutical, Food, Commercial and Processing, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene segment, accounting for 36.40% of the material category, has maintained its leadership due to its superior flexibility, chemical resistance, and cost efficiency. Its dominance is reinforced by wide applicability in personal care, food, and pharmaceutical packaging. The segment’s performance has benefited from easy processability and recyclability, aligning with global sustainability goals.

Advances in high-density and low-density polyethylene formulations have improved durability and transparency, enhancing consumer appeal. Manufacturers are increasingly leveraging polyethylene for both mono- and multilayer tube constructions to balance strength and aesthetics.

Stable raw material supply and established production infrastructure are further supporting steady growth Over the forecast period, ongoing R&D in bio-based polyethylene and improved mechanical performance are expected to sustain this segment’s strong position within the overall market landscape.

The 50 to 100 ml segment, representing 29.70% of the capacity category, has emerged as the preferred size range due to its practicality and convenience for end-users. This capacity is widely used across skincare, pharmaceutical creams, and travel-size packaging owing to its portability and optimal volume for single or short-term use.

The segment’s adoption has been supported by brand marketing strategies emphasizing compact packaging and reduced material usage. Advancements in tube design have enabled better sealing and reduced leakage, improving product shelf life and consumer satisfaction.

The balance between usability and cost efficiency has positioned this size range as a standard in multiple industries With e-commerce-driven demand for compact, easy-to-ship formats, this segment is expected to sustain its leadership and drive incremental market share gains in the near term.

The flip top caps segment, holding 31.50% of the closure type category, has become the leading choice due to its user-friendly design and superior product dispensing control. Its popularity is driven by consumer preference for one-handed operation, resealability, and hygiene assurance. Manufacturers have increasingly integrated flip top closures in personal care and healthcare packaging to enhance convenience and product safety.

Technological enhancements in cap molding have enabled improved sealing performance and reduced material waste. The segment’s growth has also been supported by branding flexibility, allowing for aesthetic customization and brand differentiation.

As sustainability trends advance, recyclable flip top closures made from single-material systems are gaining traction These developments are expected to strengthen the segment’s position and ensure sustained adoption across high-volume packaging applications.

Increasing Consumption of Cosmetic Products Upscale the Market

The global cosmetics and beauty industry frequently uses plastic tubes. The industry's growing focus on wellness and beauty is driving the cosmetics and personal care industry. Consumption of cosmetic plastic tubes in cosmetic and beauty industries for skin, hair, and body care treatments is one the major factors spurring the sales in the plastic tube market.

Millennials are increasingly mindful of their health. Social media and the internet are promoting the importance of skincare and hair care routines. As a result, the use of plastic tubes in the cosmetic industry is expected to rise. Further, plastic tubes are predominantly used to pack anti-aging creams, shampoos, hair conditioners, and other cosmetics products. Further, plastic tubes are predominantly used to pack anti-ageing creams, shampoos, hair conditioners, and other cosmetics products.

Fast-moving consumer goods (FMCG) manufacturers of hair care and skincare segments adopt these plastic tubes due to their appealing look, softness, and ease of use. Consequently, the demand for cosmetic plastic tubes is surging as leading global cosmetics and beauty companies are consistently introducing new skin and hair care treatment products.

Plastic tubes possess excellent bounce-back properties to reduce wrinkles and dents, which widens their applicability in the packaging of cosmetic products. Rising awareness of personal care and wellness is expected to reshape the growth in the market in the coming years.

Expansion of Pharmaceutical Sector Boost Plastic Tubes Adoption

Plastic tubes are frequently used in the pharmaceutical industry for packaging and storing topical drug forms such as creams, lotions, ointments, and others. The excellent dispensing properties of plastic tubes meet the precise packaging requirements of the pharmaceutical industry, especially for topical medication.

Expansion of pharmaceutical industry is mainly driven by rising expenditure on healthcare, growing geriatric population, and the development of healthcare infrastructure. Rapidly rising demand for pharmaceutical drugs has led companies to increase the production of pharmaceutical drugs, including topical drugs. Countries such as China, India, the United States, and the United Kingdom are extensively focusing on pharmaceutical packaging, bolstering the demand for pharmaceutical packaging.

According to the Organization for Economic Cooperation and Development (OCED), the health expenditure to GDP ratio of the United States was 16.6% in 2025, the highest followed by Germany with 12.7% and France with 12.1% in 2025 health statistic of OCED. Consequently, with increasing sales of pharmaceutical drugs, demand for plastic tubes is expected to burgeon over the forecast period.

Availability of Alternative Packaging Format Hamper Demand for Plastic Tubes

Cosmetics, pharmaceuticals, and food products can be packed and stored in various packaging formats, such as pouches, airless pumps, stick packs, sachets, and others. The packaging manufacturers serving these industries are always ready to switch to advancement in the packaging formats.

Also, the demand for collapsible aluminum tubes in the cosmetic and pharmaceutical industries is still notable owing to their high barrier properties and chemical resistance. The availability of these alternative packaging formats and product development is restricting the market growth of plastic tubes to a certain extent.

The global market recorded a CAGR of 1% during the historical period between 2020 and 2025. The plastic tubes industry experienced positive growth, reaching a value of USD 1,018.1 million in 2025 from USD 0.9 million in 2020. Consumption of plastic tubes is driven by a growing preference for flexible and semi-flexible packaging solutions in end-use industries such as personal care and cosmetics.

Demand is expected to increase on the back of convenient usage and the prolonged shelf life of these tubes. Plastic tubes are also known as extruded tubes, which are semi-flexible packaging products that produce paste and semi-liquid solutions with excellent dispensing properties. In the past, consumers used heavy, robust, and long-lasting packaging formats such as jars, bottles, and small pails made of glass, metal, and plastic. However, the shift towards flexible packaging, including plastic tubes, has been driven by the need for convenient usage and reduced storage space.

The demand for packaging solutions with high barrier properties has gained significant traction which is contributing to the demand for plastic tubes. The inclination of end users towards multilayer plastic tubes owing to the quality of the inside product is fueling the sales of plastic laminated tubes. Plastic tubes are universally acceptable and popular packaging solutions for protecting product contents, promoting the brand, and easing consumers.

The squeezable plastic tubes are widely adopted due to their affordable price and high demand due to their ease of use. Attributes like lightweight and effective protection during transportation due to sturdiness, are driving the surge in demand for plastic tubes in the cosmetic, dental, and pharmaceutical industries.

The section below covers the industry analysis for the plastic tube market in various countries. Information on key countries in several parts of the globe, including North America, Asia Pacific, Europe, and others, is provided. Canada is anticipated to remain at the forefront in North America, with a CAGR of 6% through 2035. In Asia Pacific, India is projected to witness a CAGR of 7.1% by 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Canada | 6% |

| Brazil | 5.5% |

| Benelux | 5.2% |

| Poland | 5.7% |

| India | 7.1% |

| Japan | 4.4% |

| GCC Countries | 6.5% |

The plastic tube industry in India is set to grow at an impressive CAGR of 7.1% through 2035. This robust growth is fueled by several key factors. The increasing demand in sectors such as cosmetics, pharmaceuticals, and personal care significantly contributes to this upward trajectory. Indian consumers' preference for plastic tubes, driven by their durability, flexibility, and cost-effectiveness, enhances market expansion.

The government's Make in India initiative has provided a significant boost to the manufacturing sector, improving infrastructure and fostering a business-friendly environment. These trends are translating into higher consumption of packaged goods, further driving the demand for plastic tubes. The growing middle class in India is more inclined towards products that offer convenience and reliability, where plastic tubes excel.

The market is anticipated to register a CAGR of 6% in Canada for the forecast period. In Canada, the burgeoning plastic tube market finds its momentum in the flourishing pharmaceutical and food industries. The demand for advanced and user-friendly packaging solutions has been a key driver behind the extensive adoption of plastic tubes within these sectors.

Notably, the industry's emphasis on sustainable packaging practices and the recyclability of plastic tubes has further bolstered their appeal, aligning with the nation's environmentally conscious consumer base. This growing preference for eco-friendly packaging solutions has incentivized manufacturers to innovate and invest in sustainable practices, thus contributing to the escalating popularity of plastic tubes in Canada.

The market is set to progress at a CAGR of 5.7% in Poland for the forecast period. In Poland, the dynamic expansion of the plastic tube market is intricately linked to the robust growth of the cosmetics and toiletries industry. The escalating consumer inclination towards products housed in hygienic and convenient packaging has significantly propelled the demand for plastic tubes.

Furthermore, the industry's concerted focus on embracing eco-friendly packaging materials has notably catalyzed the widespread adoption of recyclable plastic tubes in the Polish market. This strategic shift towards sustainable packaging aligns with the evolving consumer consciousness and regulatory initiatives promoting environmental responsibility.

Consequently, the market for plastic tubes in Poland continues to thrive, driven by a confluence of consumer preferences and industry-wide sustainability efforts.

The section contains the leading market segments of the plastic tube industry. By capacity, the 100 to 150 ml capacity tubes are estimated to account for a share of more than 50% throughout 2035. The cosmetics industry category is projected to dominate by holding a share of 54% in 2035.

| Segment | Polyethylene (Material) |

|---|---|

| Value CAGR (2025 to 2035) | 54.4% |

Polyethylene plastic tubes are forecasted to dominate 53.8% of the market share by 2025, with a further 5.5% expansion rate. In the cosmetic packaging sector, polyethylene's lightweight, flexible, squeezable, and impact-resistant properties make it an ideal choice for manufacturing. The monolayer plastic tubes, extruded from pure polyethylene, provide a compatible and visually appealing surface, catering to the demands of the beauty and personal care market.

The recyclable mono-material PE tubes not only meet sustainability goals but also contribute significantly to a circular economy in the cosmetics industry. The soft and smooth texture, along with attractive aesthetics, printability, and transparency, are driving forces behind the segment's growth.

| Segment | Cosmetic Industry (Application) |

|---|---|

| Value CAGR (2025 to 2035) | 53.7% |

The cosmetics industry dominates the plastic tubes industry accounting for over 52.5% of market share by 2025. Sales in the cosmetic industry are increasing due to the growing consumption of hair, body, skin, and personal care treatments and products. Cosmetic application of plastic tubes is projected to gain an opportunity of USD 432 million during the assessment years.

The demand for plastic tubes in the cosmetics industry is expected to be augmented by the advent of eCommerce platforms, the penetration of social media, the introduction of customer-centric products, and changing consumer trends toward personal appearance. The cosmetic industry has been experiencing substantial growth driven by a rising inclination towards personal care and wellness. Consumers using cosmetic products are demanding convenient and effective packaging, resulting in increased plastic tube consumption.

In the competitive landscape of the plastic tube market, these efforts are positioning them as leaders in sustainable and innovative packaging solutions. Key players operating in the plastic tubes industry are focusing on using sustainable materials, and hygienic solutions coupled with an excellent visual aesthetic appearance.

To reduce the environmental impact and improve the footprint of packaging solutions, manufacturers are gradually replacing plastic with eco-friendly material. Leading players are using sustainable materials coupled with the eco-design concept using recycled contents, renewable resources, and product safety to increase their sales.

They are also aiming for strategic partnerships with other companies for sustainable tube packaging and are also focusing on offering innovative plastic tubes.

Recent Industry Developments in Plastic Tube Market

The industry is segregated into polyethylene, polypropylene, polyamide, ethyl vinyl alcohol polymer, polyester, and other materials.

In terms of capacity, the industry is divided into less than 50 ml, 50 to 100 ml, 100 to 150 ml, and above 150 ml.

Plastic tubes with closures of stand-up caps, nozzle caps, fez caps, flip top caps, and other caps are described.

Few of the important applications include dental, cosmetic, pharmaceutical, food, commercial and processing, and other applications.

Key countries of North America, Latin America, Asia Pacific excluding Japan, Japan, Western Europe, Eastern Europe, and the Middle East and Africa, are covered.

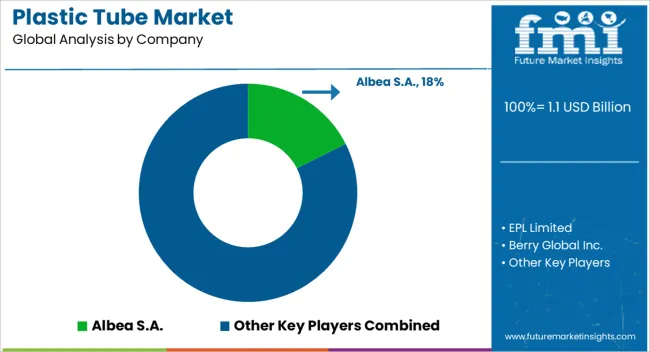

The global plastic tube market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the plastic tube market is projected to reach USD 1.9 billion by 2035.

The plastic tube market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in plastic tube market are polyethylene, polypropylene, polyamide, ethyl vinyl alcohol polymer, polyester and other materials.

In terms of capacity, 50 to 100 ml segment to command 29.7% share in the plastic tube market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Caulk Tube Market: Global Industry Analysis 2020 to 2024 and Opportunity Assessment 2025 to 2035

Competitive Overview of Plastic Caulk Tube Manufacturers

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA