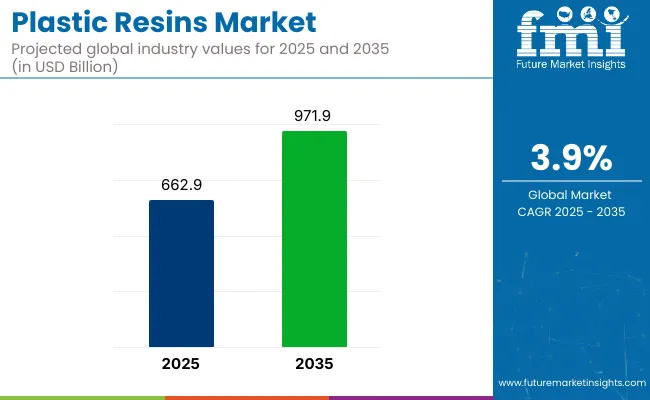

The plastic resins market is projected to grow from USD 662.9 billion in 2025 to USD 971.9 billion by 2035, registering a CAGR of 3.9% during the forecast period. Sales in 2024 reached USD 637.1 billion, reflecting steady growth driven by increasing demand across various end-use industries such as packaging, automotive, construction, and electronics.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 662.9 billion |

| Projected Market Size in 2035 | USD 971.9 billion |

| CAGR (2025 to 2035) | 3.9% |

This growth is attributed to the versatility of plastic resins, which are used in manufacturing a wide range of products due to their durability, lightweight, and resistance to corrosion and chemicals. The market's expansion is further supported by innovations in plastic resin manufacturing processes and the rising demand for sustainable and eco-friendly plastics.

In October 2024, The Plastics Industry Association (PLASTICS) released its annual Global Trends report during the Association’s inaugural National Plastics Conference. “The USA plastics industry’s position as a leader in the global plastics trade underscores the essential role of plastics and its importance across multiple industries,” said PLASTICS President and CEO, Matt Seaholm. “Our members are consistently innovating and investing in new technologies to enhance sustainability and efficiency while continuing to supply critical materials that improve lives worldwide.”

The plastic resins market is increasingly shaped by sustainability, as producers emphasize the development of resins using recyclable and environmentally friendly materials. Innovations include the development of biodegradable resins, integration of smart features such as improved barrier properties, and advancements in polymer chemistry to enhance performance.

These advancements align with global sustainability goals and regulatory requirements, making plastic resins an attractive option for environmentally conscious consumers. Additionally, the development of advanced recycling technologies has enhanced efficiency and reduced environmental impact, further driving market growth.

Strong growth is anticipated in the plastic resins market, propelled by rising demand for efficient and sustainable materials in the packaging, automotive, construction, and electronics sectors. Companies investing in innovative, eco-friendly technologies are expected to gain a competitive edge.

The market's expansion is further supported by the growing emphasis on circular economy models and recycling initiatives. With continuous advancements in materials and manufacturing processes, the plastic resins market is set to offer lucrative opportunities for stakeholders over the forecast period.

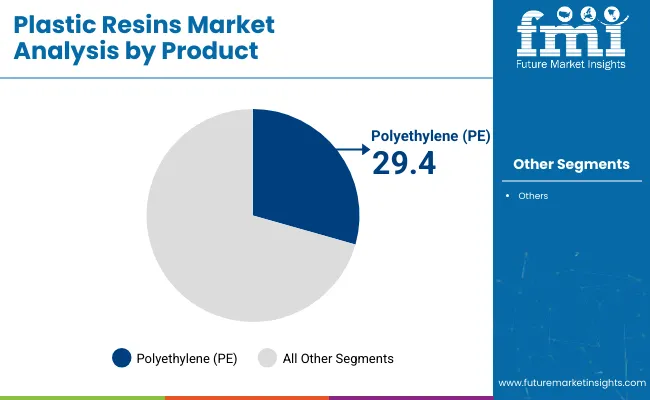

The market is segmented based on resin type, end-use industry, and region. By resin type, the market includes polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), polyethylene terephthalate (PET), acrylonitrile butadiene styrene (ABS), and other specialty resins.

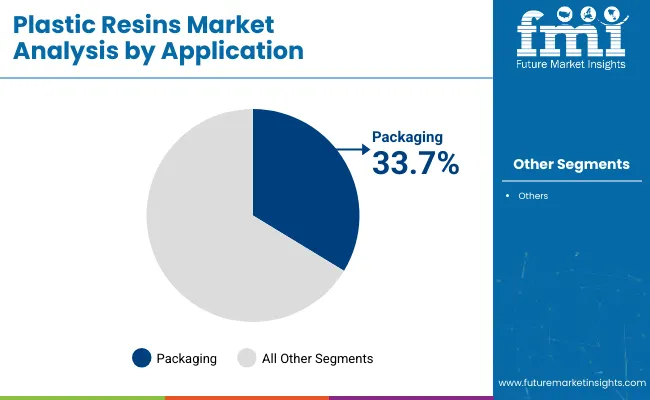

In terms of end-use industry, the market is categorized into food & beverage, healthcare & pharmaceuticals, building & construction, automotive & transportation, electrical & electronics, consumer products, agriculture, and industrial manufacturing. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Polyethylene (PE) has been projected to account for 29.4% of the global plastic resins market by 2025, owing to its widespread applicability in flexible and rigid packaging, household containers, industrial films, and agricultural sheets. Both high-density polyethylene (HDPE) and low-density polyethylene (LDPE) variants have been utilized based on tensile strength, transparency, and sealing characteristics.

Process ability through blow molding, injection molding, and film extrusion has supported polyethylene's integration into cost-sensitive and high-throughput production environments. Moisture resistance, chemical inertness, and FDA compliance have made PE a preferred material for food-grade and pharmaceutical contact packaging.

Packaging manufacturers, FMCG firms, and agricultural film producers have continued to rely on polyethylene for its cost-performance balance, ease of recycling, and global availability. Developments in metallocene catalyst technologies and bio-based PE production have further extended the material's relevance in low-carbon and recyclable formats.

Global regulations promoting single-material recyclability and circular economy adoption have reinforced the dominance of polyethylene in both primary and secondary packaging formats. Investments in closed-loop systems and PCR-enhanced PE grades have aligned with brand commitments to sustainable material sourcing.

The food and beverage industry has been estimated to contribute 33.7% of the global plastic resins market by 2025, supported by the increasing demand for lightweight, barrier-enhanced, and tamper-evident packaging solutions. Rigid and flexible containers, closures, films, trays, and multilayer laminates have been widely manufactured using PE, PET, PP, and PS resins.

Barrier protection against moisture, oxygen, and light has been enhanced through coextrusion and multilayer resin engineering, particularly in applications involving perishable products, dairy, beverages, and frozen meals. PET and PP have been favored for hot-fill and retort packaging formats, while LDPE has been deployed for flexible wrapping and sealant layers.

Multinational food processors, dairy cooperatives, and beverage bottlers have continued to invest in resin-optimized lines to balance cost, shelf-life, and recyclability. Resin selection has been increasingly influenced by lifecycle analysis (LCA), EPR regulations, and labeling transparency for food-contact materials.

Legislation restricting single-use plastics and promoting reusable or recyclable packaging formats has driven rapid reformulation across food categories. Investment in Monomaterial resin blends and infrastructure for resin-to-resin recycling has gained momentum, particularly in Europe and North America.

Environmental Regulations and Petrochemical Dependency

The ever-increasing challenges for the plastic resins industry from stringent environmental regulations (such as single-use plastic restrictions), increased landfill taxes and carbon emissions limits. Most classical resins, like polyethylene (PE), polypropylene (PP), and polystyrene (PS), are petroleum-derived, which connects the market directly to volatile crude oil prices and fossil fuel dependency.

Rise of Bio-Based Resins, Circular Economy Models, and High-Performance Engineering Plastics

Regulatory pressures have been a challenging barrier for the plastic resins market, but strong growth potential remains in bio-based and recycled resins, especially in packaging, automotive, consumer goods, and electronics.

New closed-loop recycling technologies, biodegradable resins (such as PLA, PHA), and even post-consumer recycled (PCR) resins are transforming what sustainable plastics actually look like. At the same time, industries including electric vehicles, 5G infrastructure, and medical device printing are spurring demand for high-performance engineering resins (for example, PEEK, PA66, PC and ABS) that provide lightweighting, heat resistance and durability.

According to forecasts, growth in the US plastic resins market will continue, driven by sustained interest from packaging, automotive, and healthcare sectors. Polyethylene (PE), polypropylene (PP) and PET are the most common and widely used in consumer goods and industrial applications.

Regulatory pressure and corporates sustainability goals are pushing more towards recycled resins and bio-based alternatives. Investments in high-performance engineering plastics for lightweighting in automotive and aerospace are increasing in the United States as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

Increasing demand from food and beverage packaging, medical devices & packaging, construction applications, among others, are driving the growth of the UK Plastic Resins market moderately. Nevertheless, growing environment-related regulations and plastic tax is leading to a shift towards recyclable and biodegradable resin types.

Indeed, the manufacturers are ramping up investments in many circular economy projects - from closed-loop recycling to the development of bio-resins. The demand for post-consumer recycled (PCR) resins is also increasing in response to sustainability commitments by retail and fast-moving consumer goods (FMCG) brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

These trends in plastic resins market are primarily driven by EU Green Deal, Circular Economy action plan, and single-use plastics ban in the region transform the plastic resins market in Europe. Industrial and automotive remain strong areas of demand, and innovation in bio-based and compostable resins is accelerating as well.

Germany, France, and Italy are at the forefront of advanced polymer applications and plastic recycling technologies. To comply with regulatory and ESG requirements, the market is increasingly moving towards high-performance and recyclable resins.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.6% |

Market of plastic resins in Japan is steadily growing on the back of electronics, automotive, and medical packaging sectors. Novus specialty materials are coveted among niche markets stemming from the trend toward miniaturization and innovation, electric vehicles and precision components are just a few high-performance resins in demand including ABS, PC, and PBT.

Big efforts are being made for sustainable materials and advanced recycling technologies, supported by R&D partnerships between government and industry wings in bio-based and ocean-degradable resins.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 22.1% |

South Korea plastic resins market is growing with the supporting growth from consumer electronics, semiconductors and packaging industry. The growing demand for specialty resins in 5G infrastructure and electric vehicles will push high-value segment growth.

Sustainability initiatives are prompting local enterprises to put their money into chemical recycling, biodegradable plastics and low-carbon resin manufacturing. There is also exciting innovation happening around light-weight composite resins.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Plastic resins market is growing steadily due to demand in the packaging, automotive, construction, consumer goods, electronics, and medical industries. What are the raw materials from which plastic products are made? Plastic resins are the raw materials used to manufacture most plastic products via processes such as injection molding, extrusion, blow molding, and thermoforming. Increasing demand for biodegradable plastics, sustainability of polymers, and lightweighting development projects drive market growth.

The overall market size for plastic resins market was USD 662.9 billion in 2025.

The plastic resins market is expected to reach USD 971.9 billion in 2035.

Expanding applications in packaging, automotive, and construction industries, rising demand for lightweight and durable materials, and advancements in recyclable and bio-based resins will drive market growth.

The top 5 countries which drives the development of plastic resins market are USA, European Union, Japan, South Korea and UK.

Polyethylene (PE) and polypropylene (PP) expected to grow to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Calendering Resins Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA