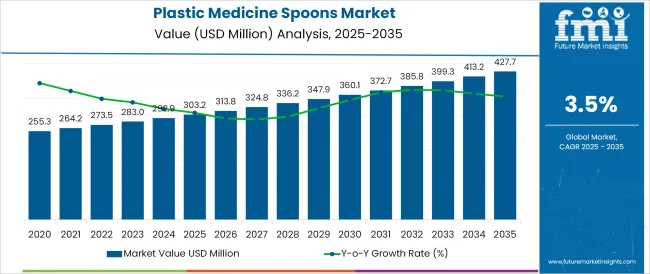

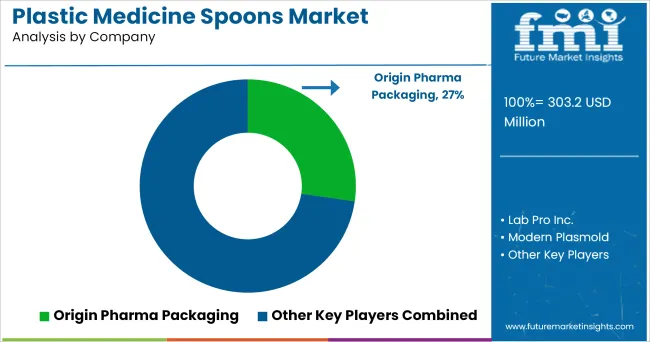

The Plastic Medicine Spoons Market is estimated to be valued at USD 303.2 million in 2025 and is projected to reach USD 427.7 million by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The plastic medicine spoons market is witnessing steady growth, supported by increasing demand from pharmaceutical packaging sectors and over-the-counter medication manufacturers. Industry reports and corporate announcements have highlighted the importance of precise dosing devices in improving patient compliance and medication safety. Manufacturers have introduced design innovations that enhance ease of use, measurement accuracy, and hygienic storage, addressing healthcare provider and patient needs alike.

Growth in pediatric and geriatric medication consumption has further driven the adoption of user-friendly dosing tools. Additionally, regulatory emphasis on safe and standardized drug delivery systems has influenced the market, leading to widespread incorporation of calibrated spoons with pharmaceutical products.

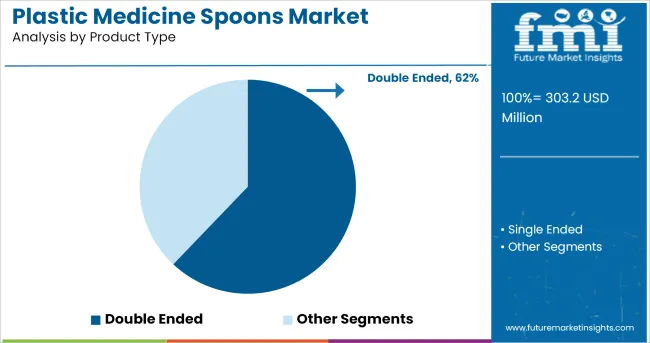

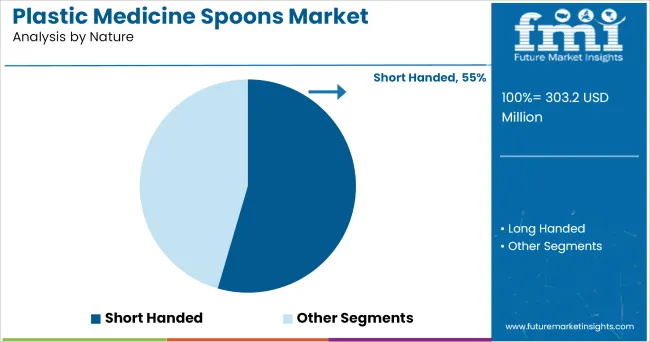

Expansion of generic medicine production and wider retail pharmacy distribution have also supported market penetration. Segmental growth is expected to be led by Double Ended spoons, Short Handed nature designs, and the 5 ml capacity range, reflecting industry preferences for versatility, compactness, and standardized dosage measurements.

The market is segmented by Product Type, Nature, and Capacity and region. By Product Type, the market is divided into Double Ended and Single Ended. In terms of Nature, the market is classified into Short Handed and Long Handed. Based on Capacity, the market is segmented into 2.5 Ml, 5 Ml, 10 Ml, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Double Ended segment is projected to account for 61.40% of the plastic medicine spoons market revenue in 2025, securing its position as the leading product type. Growth of this segment has been driven by its dual-capacity design, offering flexibility for administering multiple dose sizes within a single tool. Pharmaceutical companies have preferred double ended spoons for their cost-efficiency in packaging and consumer convenience, eliminating the need for multiple separate dosing devices.

Additionally, these spoons have been adopted widely across pediatric and adult medication packaging due to their clear measurement markings and versatility in liquid formulation administration. Manufacturing advancements have improved the durability and clarity of calibration on double ended spoons, enhancing their reliability in clinical and home care settings.

As pharmaceutical packaging trends continue to emphasize functional design and user safety, the Double Ended segment is expected to retain its leadership in the product type category.

The Short Handed segment is projected to contribute 54.70% of the plastic medicine spoons market revenue in 2025, leading the market based on product nature. This segment’s growth has been fueled by consumer preference for compact, space-saving designs that enhance portability and ease of handling. Short handed spoons have been widely adopted in travel-size medication packs and single-use pharmaceutical kits, aligning with consumer lifestyles that prioritize convenience.

Manufacturers have optimized short handed designs for ergonomic grip and ease of storage within medicine bottles and blister packs, reducing packaging waste. Healthcare providers have favored these spoons in outpatient and homecare settings where simplified dosing tools minimize user error.

With ongoing demand for lightweight and user-friendly medical accessories, the Short Handed segment is expected to remain the preferred choice for liquid medicine dosing.

The 5 ml segment is projected to hold 43.60% of the plastic medicine spoons market revenue in 2025, establishing itself as the leading capacity category. Growth of this segment has been driven by the global standardization of 5 ml as the recommended single dose for many pediatric and adult liquid medications. Pharmaceutical product packaging has consistently included 5 ml spoons to align with dosing instructions approved by healthcare regulators and medical associations.

Additionally, consumer familiarity with the 5 ml capacity has reinforced its position as the default size for over-the-counter syrups and prescription liquid medications. Manufacturers have continued to refine the clarity of volume markings and the durability of 5 ml spoons to ensure dosing accuracy and patient safety.

As liquid oral formulations remain a mainstay of pediatric and geriatric therapy, the 5 ml segment is expected to maintain its dominance, supported by its universal applicability and ease of use.

Sterile medication dosage spoons are commonly used in clinics, hospitals, and medicinal product packaging for accurate fluid medication quantification. Measuring and administering oral medications is a common application for the plastic medicine spoons. Increasing usage of plastic medicine spoons in hospitals, clinics and pharmaceuticals are important factors due to which sales of plastic medicine spoons is propelling.

The rules and regulations for plastic use from various governments have been identified as a major obstacle to the growth of the plastic medicine spoons market. Alternative products such as droppers and the availability of biodegradable and sustainable material to plastic can restrict the use of plastic medicine spoons over the forecasted market.

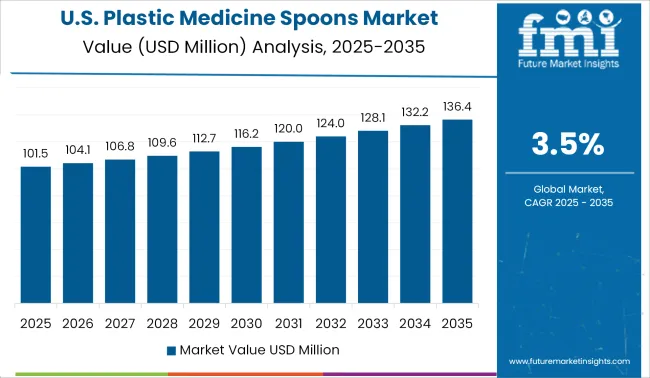

The USA is one of the leading covered markets for plastic medicine spoons worldwide. The USA plastic medicine spoons market is to notice remarkable CAGR during the valuation period 2024 to 2035 as innovation in spoons market is taking place.

The plastic medicine spoons industry is growing intensively with various innovations in terms of design. Manufacturers are coming up with a product which suffices the need of customer in a holistic approach.

For instance, medical spoon manufacture brand Ultraspec Medical has come up with a spoon with an encased bowl and a narrow aperture, crafted for administering medicines to infants or mentally unstable patients without spilling, distinguishing itself from competitors.

Plastic medicine spoons is extensively sold in European countries, with the United Kingdom and Germany having the dominant market shares. Manufactures in Europe are offering certified and safe and convenient products.

Plastic medicine spoons are dishwasher safe and made from certificated, non-toxic plastics. The technical department of the manufacturer is willing to enhance the understanding of an appropriate medication dosing device, designed around the consumer of specific medicine and thus increasing convenience of is likely to boost the market of plastic medicines spoons market.

Some key manufacturers functioning the business in the plastic medicine spoons market globally include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global plastic medicine spoons market is estimated to be valued at USD 303.2 million in 2025.

The market size for the plastic medicine spoons market is projected to reach USD 427.7 million by 2035.

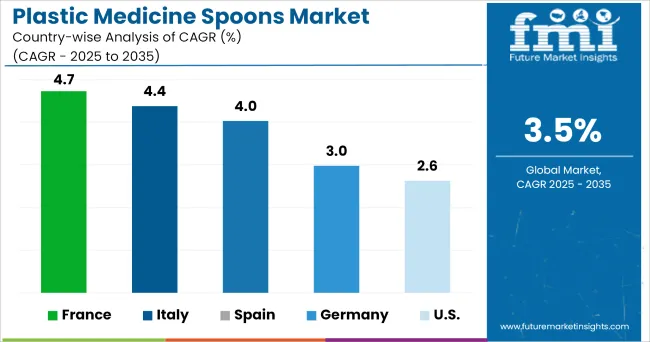

The plastic medicine spoons market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in plastic medicine spoons market are double ended and single ended.

In terms of nature, short handed segment to command 54.5% share in the plastic medicine spoons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Plastic Medicine Spoon Manufacturers

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA