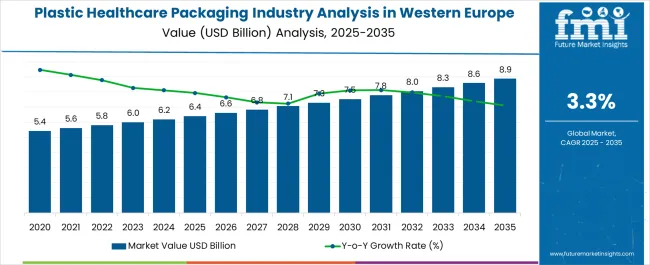

The Plastic Healthcare Packaging Industry Analysis in Western Europe is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Healthcare Packaging Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 6.4 billion |

| Plastic Healthcare Packaging Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The plastic healthcare packaging industry in Western Europe is experiencing steady growth. Increasing demand for safe, durable, and lightweight packaging solutions across pharmaceutical, biotechnology, and medical device sectors is driving market expansion. Current dynamics are influenced by stringent regulatory frameworks, growing emphasis on patient safety, and the adoption of innovative packaging designs to enhance product stability and shelf life.

Advancements in polymer technology and automated manufacturing processes are enabling manufacturers to improve efficiency and reduce production costs. The future outlook is characterized by continued investment in sustainable materials, rising prevalence of chronic diseases, and expansion of pharmaceutical production across key regional markets.

Growth rationale is anchored on the increasing need for high-quality packaging that ensures product integrity, compliance with European Union regulations, and compatibility with modern logistics and distribution channels Adoption of advanced polymer materials, coupled with evolving healthcare infrastructure and patient-centric packaging solutions, is expected to sustain market growth and reinforce Western Europe’s position as a key hub for healthcare packaging innovation.

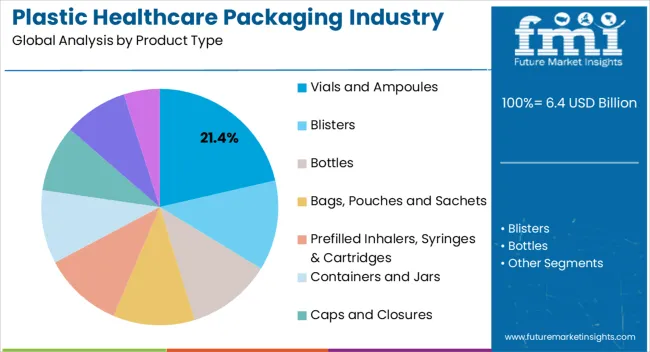

The vials and ampoules segment, holding 21.40% of the product type category, has been leading due to its critical role in safe storage, transport, and administration of injectable drugs and vaccines. Market adoption has been supported by strict quality control measures and compliance with Good Manufacturing Practices.

Design innovations that enhance sealing, sterility, and ease of use have reinforced preference among pharmaceutical manufacturers. Production efficiency improvements and material standardization have enabled consistent supply to hospitals, clinics, and laboratories.

The segment’s growth is further supported by increasing demand for parenteral drugs and vaccines, while regulatory compliance and supply chain reliability continue to strengthen market confidence Expansion of healthcare services and vaccination programs in Western Europe is expected to sustain the segment’s market share and drive incremental adoption across both public and private healthcare sectors.

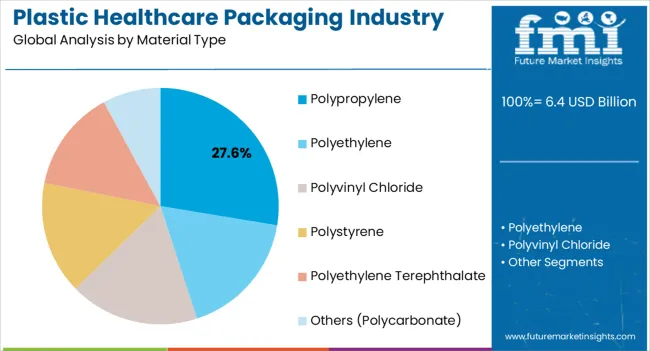

The polypropylene segment, representing 27.60% of the material type category, has maintained dominance due to its chemical resistance, lightweight properties, and cost-effectiveness. Adoption has been facilitated by compatibility with sterilization processes, regulatory compliance, and adaptability to diverse packaging formats.

Polypropylene’s durability and thermal stability have reinforced preference for high-volume pharmaceutical packaging applications. Technological improvements in polymer processing and molding have enhanced product consistency and operational efficiency.

Growth potential is being supported by rising demand for sustainable and recyclable polymers and increasing integration of polypropylene in vials, ampoules, and other medical containers Continued innovation and adherence to European safety standards are expected to sustain market leadership and enable broader utilization across the healthcare packaging ecosystem.

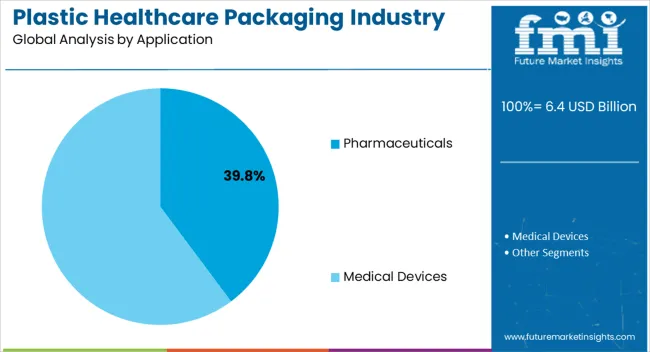

The pharmaceuticals application segment, accounting for 39.80% of the application category, has emerged as the leading application due to the growing need for safe and compliant packaging of drugs, biologics, and vaccines. Market adoption has been driven by increasing production volumes, stringent regulatory oversight, and the critical role of packaging in maintaining product integrity and patient safety.

Demand stability has been supported by ongoing investments in hospital, retail, and distribution infrastructure. Innovations in packaging design, including tamper-evident and child-resistant features, have enhanced product security and usability.

Expansion of pharmaceutical manufacturing and distribution networks in Western Europe, along with rising healthcare expenditure, is expected to sustain the segment’s market share and drive continuous adoption across the region.

Polypropylene has excellent resistance to chemicals, making it suitable for packaging pharmaceuticals and healthcare products that may require protection from external factors such as moisture, light, or gases.

| Plastic Healthcare Packaging in Western Europe based on Material | Polypropylene |

|---|---|

| Share in % in 2025 | 35.7% |

In terms of material, the polypropylene segment is expected to account for a share of 35.7% in 2025. Polypropylene is a lightweight material, which is advantageous for healthcare packaging. It helps reduce the overall weight of the packaging, contributing to cost effective transportation and logistics, as well as minimizing environmental impact.

Polypropylene exhibits good durability and strength characteristics, providing robust protection for pharmaceuticals, medical devices, and other healthcare products. The durability is crucial for ensuring the integrity of products throughout the supply chain.

Polypropylene is a recyclable material, aligning with the growing emphasis on sustainability in packaging. The recyclability of polypropylene can contribute to reducing the environmental impact of healthcare packaging and meeting regulatory requirements.

The growing demand for various types of medical devices, including diagnostic equipment, monitoring devices, and disposable medical instruments, is a significant driver for the packaging of these products. The medical devices segment benefits from the overall expansion of the healthcare industry in Western Europe.

| Plastic Healthcare Packaging in Western Europe based on Application | Medical Devices |

|---|---|

| Share in % in 2025 | 59.0% |

Based on application, the medical devices segment is expected to account for a share of 59.0% in 2025. The continuous increase in healthcare spending in Western Europe, driven by factors such as an aging population and technological advancements, contributes to the demand for medical devices. Packaging is essential to ensure the integrity, sterility, and safety of these devices.

Ongoing innovations in packaging technologies for medical devices, including the use of advanced materials and design features, play a crucial role in driving the growth of the medical devices segment. Packaging innovations often focus on improving product protection, tamper evidence, and user convenience.

Many medical devices, especially those used in surgical procedures and critical healthcare applications, require sterile packaging. The packaging must protect the devices from contamination and maintain sterility until the point of use.

The below table showcases revenues in terms of the top 3 leading regions, spearheaded by Germany and the United Kingdom. The countries are expected to lead the industry through 2035.

Forecast CAGRs from 2025 to 2035

| The United Kingdom | 4.0% |

|---|---|

| France | 3.1% |

| Germany | 4.2% |

Ongoing advancements in medical treatments, drug delivery systems, and medical devices are anticipated to propel the demand for innovative and specialized plastic packaging solutions to ensure the safety, stability, and efficacy of healthcare products.

| Region | The United Kingdom |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.0% |

The overall growth in healthcare expenditure, driven by factors such as an aging population and advancements in medical technology, is expected to result in higher demand for pharmaceuticals and medical devices, consequently boosting the need for healthcare packaging. The United Kingdom is expected to expand at a CAGR of 4.0% through 2035.

Compliance with stringent regulatory standards for pharmaceutical and healthcare products is essential, which is expected to augment innovation in plastic healthcare packaging materials and designs to meet quality, safety, and traceability requirements.

| Region | Germany |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.2% |

The growth of e-commerce, including the online sale of pharmaceuticals and healthcare products, may lead to increased demand for secure and tamper evident plastic packaging to ensure the integrity of products during transportation. Germany is expected to expand at a CAGR of 4.2% through 2035.

The adoption of advanced packaging technologies, such as smart packaging with features like radio frequency identification and near field communication, is anticipated to enhance supply chain visibility and provide real time information on product integrity.

| Region | France |

|---|---|

| Forecast CAGR from 2025 to 2035 | 3.1% |

The emphasis on patient centered care extends to packaging design, with a focus on creating user friendly, informative, and accessible packaging for pharmaceuticals and medical devices. France is expected to expand at a CAGR of 3.1% through 2035.

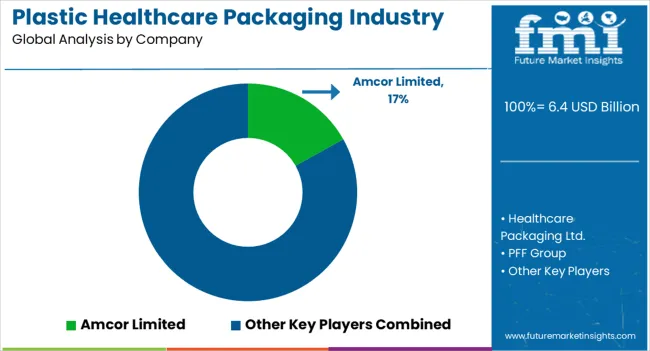

The plastic healthcare packaging landscape in Western Europe is characterized by intense competition among key players, including packaging manufacturers, material suppliers, and technology providers. The industry is driven by the need for innovative, high quality, and regulatory compliant packaging solutions to meet the evolving demands of the healthcare and pharmaceutical industries in the region.

Recent Developments in Plastic Healthcare Packaging Industry in Western Europe

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 6.4 billion |

| Projected Industry Size in 2035 | USD 8.9 billion |

| Anticipated CAGR from 2025 to 2035 | 3.3% |

| Historical Analysis of Demand for Plastic Healthcare Packaging in Western Europe | 2020 to 2025 |

| Demand Forecast for Plastic Healthcare Packaging in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing plastic healthcare packaging demand in Western Europe, Insights on Global Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Providers in Western Europe |

| Key Countries Analyzed while Studying Opportunities in Plastic Healthcare Packaging in Western Europe | The United Kingdom, Germany, France, Netherlands, Italy |

| Key Companies Profiled | Healthcare Packaging Ltd.; PFF Group; Riverside Medical Packaging; Bilcare Research; Gerresheimer AG; Amcor Limited; Constantia Flexibles Group; Nipro Corporation; Klockner Pentaplast Group; Becton & Dickinson Company |

The global plastic healthcare packaging industry analysis in Western Europe is estimated to be valued at USD 6.4 billion in 2025.

The market size for the plastic healthcare packaging industry analysis in Western Europe is projected to reach USD 8.9 billion by 2035.

The plastic healthcare packaging industry analysis in Western Europe is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in plastic healthcare packaging industry analysis in Western Europe are vials and ampoules, blisters, bottles, _dropper bottles, _nasal spray bottles, _liquid bottles, bags, pouches and sachets, _iv bags, _medical specialty bags, prefilled inhalers, syringes & cartridges, containers and jars, caps and closures, trays and medication tubes.

In terms of material type, polypropylene segment to command 27.6% share in the plastic healthcare packaging industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Plastic Transistors Market Size and Share Forecast Outlook 2025 to 2035

Plastic Pallets Market Size and Share Forecast Outlook 2025 to 2035

Plastics-To-Fuel (PTF) Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Plastic Fillers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA