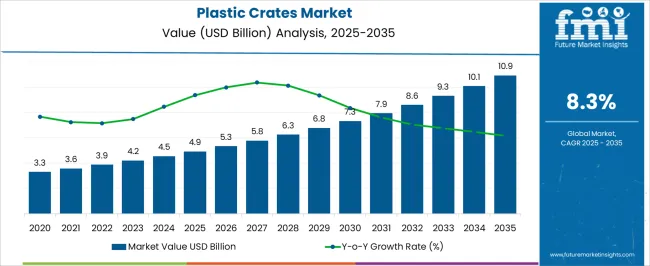

The plastic crates market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period. Governments and regulatory agencies across regions are increasingly imposing mandates to curb plastic waste and promote circular economy initiatives, directly influencing the design and material composition of plastic crates.

Compliance with environmental regulations, such as restrictions on single-use plastics and requirements for recyclable or bio-based polymers, is becoming a key driver for manufacturers to adopt sustainable alternatives, which can affect cost structures and operational strategies. The international standards for food-grade and industrial packaging, including hygiene and chemical safety norms, directly impact the adoption of certain polymer grades and processing technologies. These regulations necessitate rigorous testing and certification, influencing both capital investment and recurring compliance expenditures.

The extended producer responsibility policies and waste management legislation are shaping the reverse logistics and recycling processes for plastic crates, encouraging manufacturers to implement take-back programs and closed-loop systems. The market’s regulatory landscape exerts a dual influence by creating compliance-related costs while simultaneously driving innovation in sustainable and certified plastic crate solutions. Manufacturers that proactively integrate regulatory requirements into design, production, and lifecycle management are likely to achieve competitive differentiation, ensure market access, and align growth trajectories with evolving environmental and safety standards.

Manufacturing facilities experience operational tensions when switching between traditional petroleum-based polymers and bio-based alternatives. Production lines require recalibration for different material properties, while maintenance teams report varying equipment wear patterns depending on polymer composition. Quality control departments document how recycled content percentages affect dimensional stability and load-bearing capacity, creating ongoing dialogue between engineering teams and customer specifications departments about acceptable performance trade-offs.

Supply chain relationships between crate manufacturers and end-users reveal shifting dynamics around product lifecycle management. Food processing facilities now evaluate suppliers based on take-back program capabilities alongside traditional metrics like delivery reliability and unit cost. Logistics coordinators at distribution centers report that tracking recyclable versus non-recyclable inventory creates additional complexity in warehouse management systems, requiring new protocols for returned product handling.

Cross-functional teams encounter practical challenges when implementing circular economy initiatives. Operations managers coordinate with finance departments to evaluate the cost implications of designing products for disassembly and material recovery. Engineering groups work closely with sales teams to explain to customers why certain design modifications necessary for recyclability might affect stacking efficiency or impact resistance compared to conventional alternatives.

| Metric | Value |

|---|---|

| Plastic Crates Market Estimated Value in (2025 E) | USD 4.9 billion |

| Plastic Crates Market Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The plastic crates market is witnessing notable growth as industries prioritize sustainable, reusable, and lightweight packaging solutions. The shift from traditional wood and metal storage systems toward plastic-based alternatives has been driven by the need for hygiene compliance, ease of handling, and material longevity. Regulatory emphasis on sustainable packaging and circular economy practices has further propelled the adoption of recyclable polymers in crate production.

Additionally, rising labor costs and the need for efficient warehouse utilization have encouraged industries to adopt space-saving crate designs that support stackability and nesting. Advancements in polymer processing and injection molding technologies have enabled manufacturers to design high-strength crates suitable for heavy loads and harsh handling environments.

Increasing automation in warehousing and logistics, especially in fast-moving consumer goods, pharmaceuticals, and e-commerce, is also accelerating demand for uniform, RFID-compatible crate solutions Over the forecast period, the market is expected to benefit from rising demand for hygienic and standardized packaging across global supply chains, particularly in temperature-sensitive and returnable transit packaging applications.

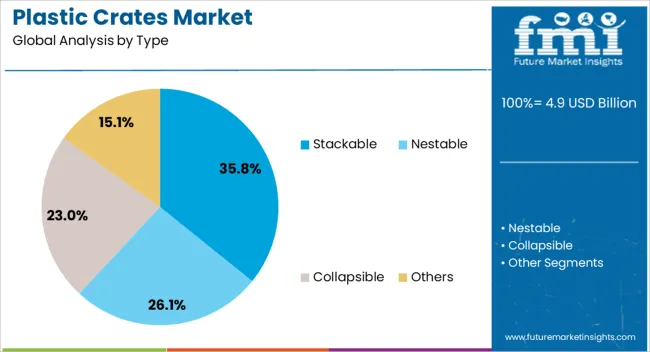

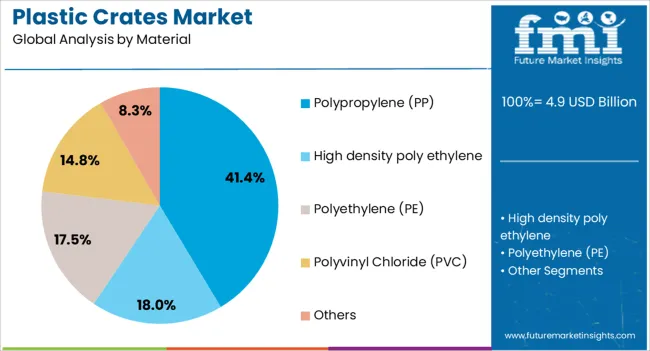

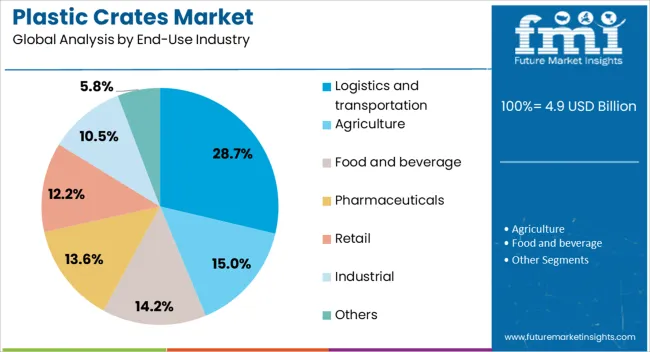

The plastic crates market is segmented by type, material, end-use industry, and geographic regions. By type, the plastic crates market is divided into stackable, nestable, collapsible, and others. In terms of material, the plastic crates market is classified into polypropylene (PP), high-density polyethylene, polyethylene (PE), polyvinyl chloride (PVC), and others. Based on end-use industry, the plastic crates market is segmented into logistics and transportation, agriculture, food and beverage, pharmaceuticals, retail, industrial, and others. Regionally, the plastic crates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stackable type segment is projected to hold 35.8% of the total revenue share in the plastic crates market in 2025, indicating its leadership in terms of preference and adoption. The segment’s growth is being driven by the increasing need for vertical storage efficiency and spatial optimization in distribution centers and warehouses. Stackable crates are widely used for their ability to reduce the required floor space, lower transportation costs, and support modular handling in automated storage and retrieval systems.

Their rigid structure and interlocking features enable safe stacking of multiple units without compromising product integrity, which has proven beneficial in high-volume logistics operations. The durability and structural reliability of stackable designs have made them well-suited for repeated usage in closed-loop supply chains.

Additionally, their compatibility with various material handling equipment and enhanced airflow features has increased their usage in food processing, agriculture, and pharmaceutical sectors. The segment is expected to maintain its position as a preferred solution where space utilization and operational efficiency are critical.

The polypropylene material segment is expected to contribute 41.4% of the plastic crates market revenue in 2025, making it the most dominant material used in crate manufacturing. The preference for polypropylene is being influenced by its high strength-to-weight ratio, excellent chemical resistance, and recyclability, which align well with the growing sustainability goals of end-use industries. PP-based crates offer greater impact resistance and flexibility under temperature variations, making them suitable for applications involving cold storage, outdoor transport, and high-frequency reuse.

Manufacturers have favored polypropylene due to its processability and ability to support design innovations like ventilation slots, foldable walls, and RFID tags. The segment’s prominence is also supported by compliance with food-grade safety norms, which has increased its usage in perishable goods logistics.

Its resistance to corrosion and ability to withstand sterilization processes have expanded its role in pharmaceutical and hygiene-sensitive environments. As global supply chains continue to emphasize durability and lifecycle cost efficiency, polypropylene is expected to remain the preferred choice for crate production.

The logistics and transportation end-use industry segment is projected to account for 28.7% of the plastic crates market revenue in 2025, making it the largest consumer of these products. This dominance is being driven by the growing complexity and scale of global supply chains, which require durable, reusable, and standardized packaging for efficient handling and tracking. Plastic crates have become integral to returnable packaging systems, reducing single-use waste and lowering the total cost of ownership for logistics providers.

Their uniformity and stackability enhance vehicle load efficiency and reduce breakage during transit, which has increased their adoption across third-party logistics and distribution networks. The use of crates in transportation is further supported by evolving safety regulations and quality assurance practices that demand consistent packaging solutions.

Their suitability for intermodal transportation and compatibility with automated logistics systems have also contributed to their widespread usage. As the e-commerce and FMCG sectors continue to expand, the demand for plastic crates in logistics and transportation is expected to grow in parallel, supporting supply chain resilience and operational scalability.

The market has been expanding due to rising demand for durable, lightweight, and reusable storage and transportation solutions across food, beverage, agriculture, and logistics sectors. Plastic crates have been valued for their strength, stackability, and resistance to moisture, chemicals, and impact. Market growth has been reinforced by innovations in injection molding, recyclable polymers, and ergonomic design. Increasing emphasis on supply chain efficiency, hygiene standards, and cost-effective handling solutions has further strengthened adoption, positioning plastic crates as critical components in modern logistics, storage, and retail operations globally.

The market has been significantly driven by adoption in the food and beverage sector, where safe and hygienic handling of produce, dairy, and packaged goods is critical. Crates have been used for storage, sorting, and transportation of fruits, vegetables, meat, and beverages while reducing damage and spoilage. Lightweight and stackable designs have facilitated space-efficient storage in warehouses and trucks, improving logistics efficiency. Hygienic materials, easy cleaning surfaces, and resistance to contamination have made plastic crates preferred over traditional wooden or cardboard alternatives. Manufacturers have developed customized crates for specific product dimensions, weight requirements, and handling conditions. The consistent need for operational efficiency, product safety, and regulatory compliance has reinforced market adoption of plastic crates across retail, wholesale, and food processing segments worldwide.

Technological innovations have strengthened the market by enhancing material performance, design flexibility, and manufacturing efficiency. Injection molding, rotational molding, and recycled polymer blends have enabled production of lightweight yet robust crates with high impact resistance. Ventilated designs, modular stacking systems, and ergonomic handles have improved usability and airflow for perishable goods. UV-resistant coatings and chemical-stable materials have increased durability in outdoor storage and transport conditions. Automated production lines and precision molding technologies have reduced manufacturing defects and enabled mass customization. These innovations have allowed plastic crates to meet diverse application requirements in food logistics, pharmaceuticals, retail, and agriculture, ensuring operational reliability and sustainability while minimizing replacement costs across global supply chains.

The market has been reinforced by adoption in agriculture and logistics operations, where secure and efficient material handling is essential. Crates have been used for harvesting, packaging, and transporting perishable crops, ensuring minimal damage and extended shelf life. Cold chain logistics and last-mile delivery systems have leveraged stackable, lightweight, and ventilated crates to optimize space and maintain product quality. Industrial and e-commerce logistics operations have utilized plastic crates for durable, reusable storage of consumer goods, electronics, and packaged items. Integration with barcode and RFID systems has enabled tracking and inventory management. The combination of operational efficiency, durability, and adaptability has driven widespread adoption of plastic crates in agriculture, industrial logistics, and retail sectors globally.

Despite strong growth, the market has faced challenges linked to raw material costs, environmental impact, and recycling limitations. Fluctuations in polymer prices have influenced manufacturing costs and profitability. Single-use or poorly recycled crates have raised environmental concerns, prompting regulatory scrutiny and sustainability initiatives. End-of-life collection, sorting, and reprocessing of plastic crates require infrastructure investment, which can limit adoption in certain regions. Manufacturers have responded with recyclable materials, modular designs, and initiatives to promote crate return and reuse programs. Continuous innovation in biodegradable polymers, lightweight construction, and closed-loop recycling has been critical to balancing cost efficiency with environmental responsibility while sustaining the global growth of the plastic crates market.

| Countries | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The market is projected to grow at a CAGR of 8.3% between 2025 and 2035, driven by rising demand in logistics, food and beverage storage, and retail supply chains. China leads with an 11.2% CAGR, producing at scale to meet domestic and export demands across industries. India follows at 10.4%, expanding rapidly due to increasing industrial and e-commerce logistics requirements. Germany, at 9.5%, benefits from advanced manufacturing capabilities and sustainability-focused production practices. The UK, growing at 7.9%, innovates in lightweight and durable crate designs, while the USA, at 7.1%, experiences steady demand in warehousing and retail sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The plastic crates market in China is projected to witness a robust growth trajectory, with a country-specific CAGR of 11.2% during the forecast period. The market expansion is primarily driven by the increasing demand for efficient storage and transportation solutions across the logistics, food, and retail industries. Manufacturing facilities are adopting lightweight, durable, and reusable crates to reduce handling costs and improve operational efficiency. Industrial sectors are increasingly standardizing crate dimensions to facilitate automated material handling and reduce manual labor. In addition, local players are investing in high-quality polymer materials that offer resistance to temperature variations, chemical exposure, and mechanical stress. Government policies encouraging sustainable packaging practices further support market penetration, while international collaborations facilitate technology transfer and innovations.

In India, the plastic crates marketis forecasted to expand at a CAGR of 10.4%, reflecting growing adoption across agricultural, retail, and food processing industries. Rising consumer demand for fresh produce and packaged goods has necessitated robust and hygienic storage solutions. Manufacturers are focusing on producing crates with modular designs and stackable features to optimize warehouse space and reduce operational costs. Local companies are increasingly leveraging recycled polymers to balance cost-effectiveness with durability, while technological advancements in injection molding allow for faster production cycles. Additionally, government initiatives promoting cold chain infrastructure and food safety standards are accelerating the uptake of standardized plastic crates. The market is also influenced by e-commerce growth, which requires efficient last-mile delivery packaging solutions.

Germany is expected to witness steady growth in the Plastic Crates Market, with a CAGR of 9.5%, fueled by the logistics, automotive, and food industries. High standards of quality, durability, and hygiene drive manufacturers to offer crates that meet stringent EU regulations. The trend toward automation in warehouses and manufacturing plants has led to the demand for crates compatible with robotic handling systems. German companies are also investing in lightweight yet high-strength polymers to reduce transportation energy costs while maintaining product safety. Sustainability initiatives are encouraging the use of recyclable and reusable crates, promoting circular economy practices. Collaboration between local players and international firms has enabled technology transfer and innovation in crate designs.

The plastic crates market in the United Kingdom is projected to grow at a CAGR of 7.9%, driven by increased adoption in retail, food, and logistics sectors. The market is witnessing innovations in ergonomic designs, stackability, and material durability to meet evolving industry requirements. Companies are focusing on manufacturing crates from high-density polyethylene and polypropylene to enhance chemical resistance and extend service life. Retailers and distributors are increasingly adopting crates to improve operational efficiency, reduce handling damages, and comply with hygiene standards. The growth of e-commerce has further increased demand for lightweight, reusable packaging solutions that can endure repeated transportation cycles. Governmental guidelines on waste reduction and recycling also support the uptake of sustainable plastic crates.

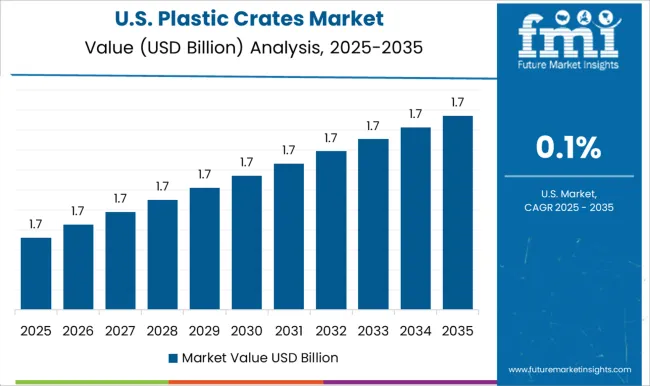

In the United States, the plastic crates market is anticipated to grow at a CAGR of 7.1%, reflecting strong demand in logistics, food processing, and retail sectors. Manufacturers are prioritizing crates that offer durability, hygiene, and adaptability to automated material handling systems. The rise of organized retail chains, cold chain facilities, and e-commerce distribution centers has heightened the need for standardized, stackable crates that facilitate efficient storage and reduce damage during transportation. Companies are also experimenting with eco-friendly materials and recycled plastics to align with environmental policies and corporate responsibility initiatives. Strategic partnerships between domestic and international firms support technology transfer and product innovation, enhancing market competitiveness.

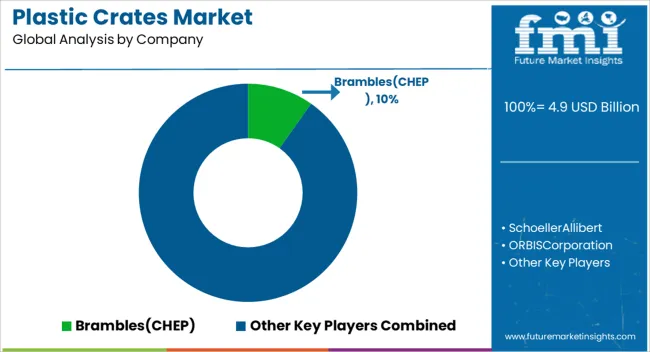

The market has witnessed significant growth due to increasing demand for durable, reusable, and lightweight storage and transportation solutions across industries such as food and beverages, logistics, and retail. Leading companies like Brambles (CHEP), Schoeller Allibert, and ORBIS Corporation dominate the market by providing modular and stackable crates that enhance supply chain efficiency while reducing environmental impact through reuse. These providers focus on innovative designs, high-strength materials, and ergonomic solutions to meet diverse industrial and commercial needs.

Nilkamal, Rehrig Pacific Company, Tosca Services, and The Supreme Industries offer a wide range of crates tailored for specific applications, including cold chain logistics, fresh produce, and pharmaceuticals. Their emphasis on quality, durability, and cost-effective manufacturing ensures reliability and long service life, making them preferred partners for businesses aiming to streamline material handling processes. Craemer Group, Georg Utz Holding, and Alfa Plastic Industry complement the market by introducing customized crate solutions with advanced features such as ventilation, foldability, and resistance to harsh conditions. Companies such as Gamma-Wopla, TranPak, Monoflo International, Zhejiang Zhengji Plastic Industry, RPP Containers, ENKO Plastics, Croma Plast, Cosmoplast, BDI Group, and PLIHSA contribute to market diversity by focusing on regional supply, specialized applications, and niche customer requirements. Collectively, these leading plastic crate providers are enhancing operational efficiency, reducing environmental footprint, and supporting the global shift toward sustainable and reusable packaging solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Type | Stackable, Nestable, Collapsible, and Others |

| Material | Polypropylene (PP), High density poly ethylene, Polyethylene (PE), Polyvinyl Chloride (PVC), and Others |

| End-Use Industry | Logistics and transportation, Agriculture, Food and beverage, Pharmaceuticals, Retail, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Brambles(CHEP), SchoellerAllibert, ORBISCorporation, Nilkamal, RehrigPacificCompany, ToscaServices, TheSupremeIndustries, CraemerGroup, GeorgUtzHolding, AlfaPlasticIndustry, Gamma-Wopla, TranPak, MonofloInternational, ZhejiangZhengjiPlasticIndustry, RPPContainers, ENKOPlastics, CromaPlast, Cosmoplast, BDIGroup, and PLIHSA |

| Additional Attributes | Dollar sales by crate type and end-use industry, demand dynamics across food and beverage, logistics, and retail sectors, regional trends in plastic storage adoption, innovation in durability, stackability, and lightweight design, environmental impact of plastic production and disposal, and emerging use cases in cold chain management and automated warehousing. |

The global plastic crates market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the plastic crates market is projected to reach USD 10.9 billion by 2035.

The plastic crates market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in plastic crates market are stackable, nestable, collapsible and others.

In terms of material, polypropylene (pp) segment to command 41.4% share in the plastic crates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Folding Plastic Crates Market

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA