The Plastic Cutlery market is experiencing significant growth, driven by the increasing demand for convenient, cost-effective, and disposable tableware solutions across households, food service establishments, and retail channels. Rising consumption of fast food, takeout, and packaged meals has fueled adoption, as plastic cutlery offers hygiene, portability, and ease of use. The market is further supported by innovations in materials and design, which enhance durability, aesthetics, and sustainability.

Regulatory emphasis on food safety standards and lightweight, single-use utensils has also contributed to demand. Retailers and food service providers are increasingly leveraging plastic cutlery to improve operational efficiency and customer satisfaction, particularly in high-volume service environments. Growing urbanization, lifestyle changes, and rising disposable incomes in emerging markets are expanding the user base.

As businesses focus on cost-effective solutions for large-scale catering, events, and quick-service meals, the Plastic Cutlery market is expected to sustain growth The development of eco-friendly alternatives and adoption of recyclable plastics are likely to further shape market dynamics over the coming decade.

| Metric | Value |

|---|---|

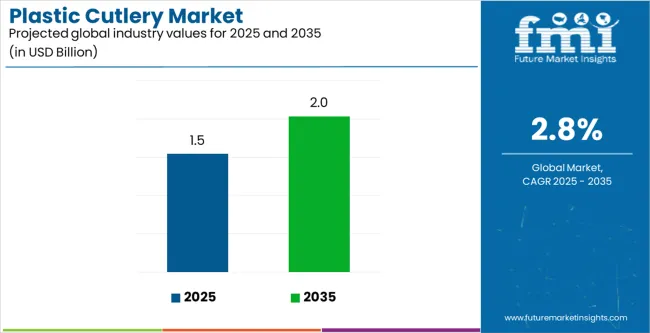

| Plastic Cutlery Market Estimated Value in (2025 E) | USD 1.5 billion |

| Plastic Cutlery Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

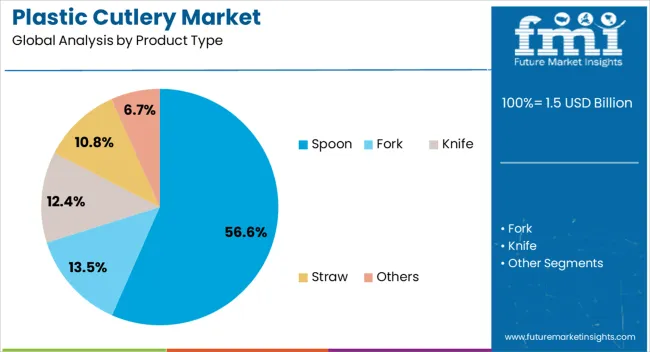

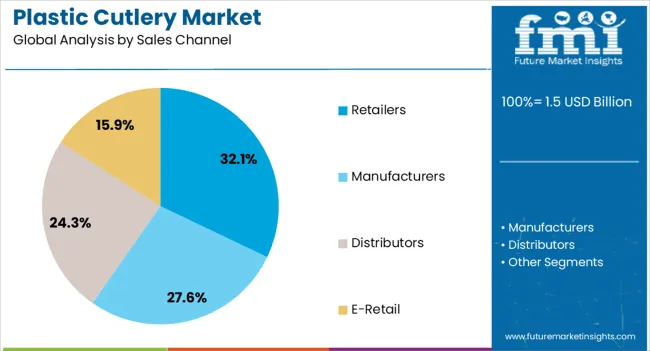

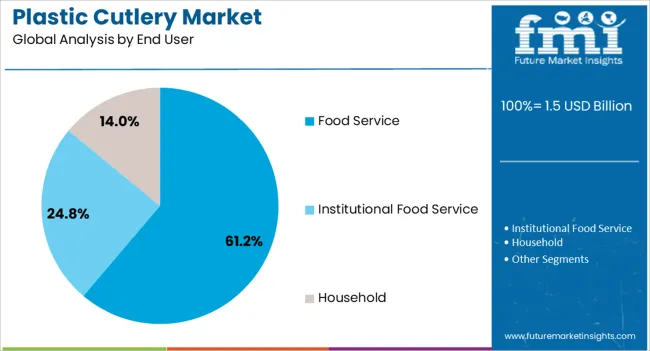

The market is segmented by Product Type, Sales Channel, and End User and region. By Product Type, the market is divided into Spoon, Fork, Knife, Straw, and Others. In terms of Sales Channel, the market is classified into Retailers, Manufacturers, Distributors, and E-Retail. Based on End User, the market is segmented into Food Service, Institutional Food Service, and Household. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spoon segment is projected to hold 56.6% of the Plastic Cutlery market revenue in 2025, establishing it as the leading product type. Growth is being driven by the universal utility of spoons in a wide range of food consumption scenarios, from liquid-based meals to desserts, which ensures consistent demand across households, restaurants, and catering services. Plastic spoons offer hygiene, cost-effectiveness, and ease of disposal, making them the preferred choice in high-volume food service and retail environments.

Manufacturers are focusing on improving material quality, design ergonomics, and sustainability, which enhances user experience and broadens market appeal. Integration with eco-friendly materials and lightweight production techniques has increased adoption among environmentally conscious businesses and consumers.

Operational efficiency in bulk preparation, packaging, and distribution further reinforces their market dominance As demand continues to grow for disposable tableware that combines convenience, safety, and affordability, the spoon segment is expected to maintain its leading position, supported by ongoing innovation and scalable production capabilities.

The retailers segment is expected to account for 32.1% of the market revenue in 2025, making it the leading sales channel. Growth in this segment is driven by the widespread distribution of plastic cutlery through supermarkets, hypermarkets, convenience stores, and online retail platforms. Retailers provide easy access to bulk and individual packaging options, meeting both household and small business demand.

Product visibility, shelf placement, and promotional strategies by retailers enhance purchase decisions and consumer trust. The availability of varied product types, designs, and eco-friendly alternatives through retail channels has further accelerated adoption. Retailers also benefit from partnerships with manufacturers that allow efficient supply chain management and inventory replenishment.

With increasing consumer preference for convenience and the rising penetration of organized retail, the retail channel remains a critical driver of market growth The combination of accessibility, variety, and marketing influence ensures that the retailer segment sustains its leading share in the market.

The food service segment is projected to hold 61.2% of the market revenue in 2025, positioning it as the leading end-user category. Growth is primarily being driven by restaurants, catering companies, fast food chains, and event organizers that require high volumes of disposable tableware for hygiene, convenience, and operational efficiency. Plastic cutlery enables quick service, reduces cleaning costs, and ensures compliance with food safety regulations, which is critical in high-turnover environments.

The versatility of plastic utensils across diverse cuisines and serving formats further reinforces their adoption. Increasing demand for takeout, delivery services, and packaged meals has expanded the reliance on disposable cutlery. Businesses are also focusing on eco-friendly options and innovative designs to meet consumer expectations while reducing environmental impact.

Operational scalability, cost-effectiveness, and regulatory compliance make the food service segment the largest contributor to market revenue As the food service industry continues to expand and evolve, the demand for plastic cutlery is expected to maintain strong growth, sustaining its leading position among end users.

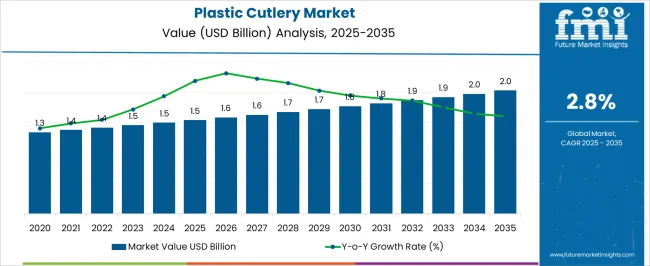

The plastic cutlery market experienced a historical CAGR of 2.30% and is projected to register a CAGR of 2.80% up to 2035, indicating a steady increase in disposable cutlery sales in the forthcoming decade.

| Attributes | Details |

|---|---|

| Plastic Cutlery Market Historical CAGR for 2020 to 2025 | 2.30% |

Acute aspects that are anticipated to influence the demand for plastic cutlery through 2035 include:

Fast Food Service Centers Cater to the Demand for Plastic Cutlery

Outdoor Activities Gathers Novel Consumer Base for the Disposable Plastic Cutlery Industry

Quick-Service Restaurants (QSRs) Across the Globe Boost Plastic Cutlery Demand

The plastic cutlery market is categorized by product type and end-user industry, with spoons in high demand across various industries. The food service sector is the most popular end-user sector in the global plastic cutlery market.

| Attributes | Details |

|---|---|

| Top Product Type | Spoon |

| Market Share in 2025 | 56.6% |

The plastic cutlery industry is seeing developing demand for plastic spoons, acquiring a market share of 56.6% in 2025. The following aspects impact the development of plastic spoons:

| Attributes | Details |

|---|---|

| Top End Use | Food Service |

| Market share in 2025 | 61.2% |

The food service sector utilizes plastic cutlery significantly and the industry is anticipated to acquire 61.2% market share in 2025. The development of demand from the food service sector is attributable to the following drivers:

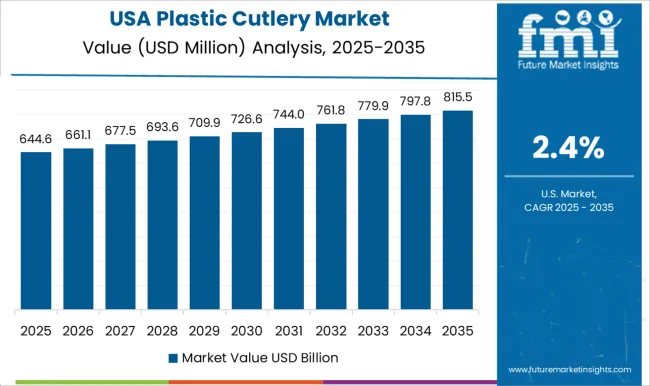

The following section describes the demand for plastic cutlery in various countries. The Spanish and Thai industries are expected to grow moderately in the next decade, while China and India's plastic cutlery industry is experiencing significant growth, with the United States plastic cutlery industry having an inferior CAGR.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 1.3% |

| Spain | 2.8% |

| China | 4.5% |

| Thailand | 4.1% |

| India | 5.9% |

The plastic cutlery industry in the United States is projected to experience a CAGR of 1.3% through 2035. Here are a few of the major trends:

Demand for plastic cutlery in Spain is expected to develop at a CAGR of 2.8% for the forecast period. The following factors are propelling the demand for plastic cutlery in Spain:

The demand for plastic cutlery in China is expected to display a CAGR of 4.5% between 2025 and 2035. Some of the primary trends in the industry are:

The demand for plastic cutlery in Thailand is expected to report a CAGR of 4.1% from 2025 to 2035. Some of the primary trends are:

The plastic cutlery industry in India is expected to demonstrate a CAGR of 5.9% through 2035. Among the primary drivers of the market are:

The global plastic cutlery market is slightly competitive in nature, with several market players competing for significance in the market. Given the current scenario, market players are expected to adopt various strategies to stay forward. Some of the methods likely adopted by organizations in the plastic cutlery market include forming strategic partnerships and collaborations, mergers and acquisitions, investing in research and development, and launching new products.

Market players in the plastic cutlery industry are anticipated to grow their customer base and increase revenue by adopting sustainable strategies. Focusing on innovation and product development is expected to help them differentiate their products from competitors, attracting more customers and giving them an edge in the market. The plastic cutlery market is expected to extend significantly in the coming years, with players using various strategies to capitalize on this growth and raise their market presence.

Recent Developments in the Plastic Cutlery Market

The global plastic cutlery market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the plastic cutlery market is projected to reach USD 2.0 billion by 2035.

The plastic cutlery market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in plastic cutlery market are spoon, fork, knife, straw and others.

In terms of sales channel, retailers segment to command 32.1% share in the plastic cutlery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA