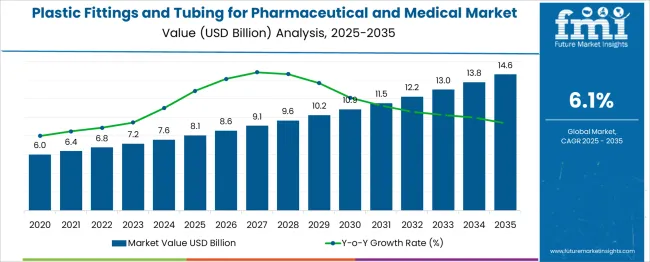

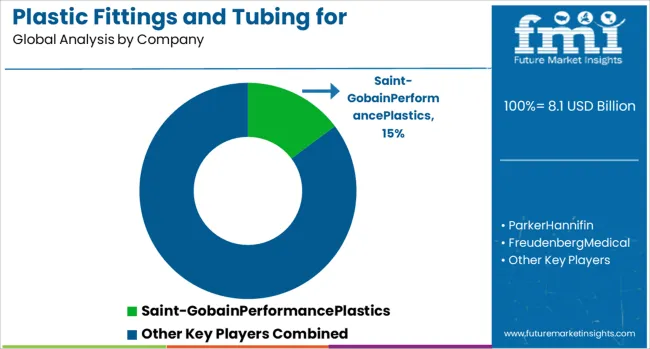

The Plastic Fittings and Tubing for Pharmaceutical and Medical Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 14.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Between 2025 and 2030, the market is expected to reach approximately USD 10.9 billion, accounting for a five-year absolute gain of USD 2.8 billion, which represents over 43% of the entire ten-year value growth. The absolute dollar opportunity reflects rising adoption of medical-grade plastic tubing in applications such as IV administration, dialysis, enteral feeding, and bioprocessing. Unlike reusable metal systems, plastic fittings and tubing provide improved safety through disposability, while also offering chemical resistance, flexibility, and cost efficiency.

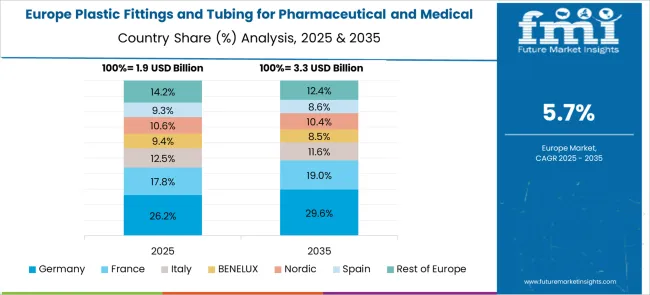

Growth is particularly strong in North America and Europe, where regulatory adherence and GMP-compliant manufacturing demand sterile, validated fluid handling systems. Additionally, the ongoing shift to continuous biomanufacturing and personalized medicine further accelerates demand for high-purity, contamination-resistant components. As the healthcare infrastructure scales globally, especially in Asia-Pacific and Latin America, the absolute dollar opportunity in this sector remains both significant and predictable.

| Metric | Value |

|---|---|

| Plastic Fittings and Tubing for Pharmaceutical and Medical Market Estimated Value in (2025 E) | USD 8.1 billion |

| Plastic Fittings and Tubing for Pharmaceutical and Medical Market Forecast Value in (2035 F) | USD 14.6 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

In the Plastic Fittings and Tubing market for pharmaceutical and medical applications, manufacturers compete by aligning product quality, regulatory compliance, and production scalability. A core strategy involves offering USP Class VI and ISO 10993-certified materials, ensuring biocompatibility and adherence to FDA or EU MDR requirements critical for gaining approval in regulated environments.

Leading manufacturers invest in cleanroom production (Class 7 or better) and maintain rigorous traceability protocols, as over 80% of buyers demand full documentation for sterility assurance and batch control. Customization is another differentiator; tubing and fittings must match exact specifications for inner diameters ranging from 1/16” to 1”, pressure ratings, and chemical compatibility especially for single-use systems in bioprocessing.

To meet rising demand from biologics and cell therapy, companies are expanding single-use assembly capabilities, enabling them to supply ready-to-integrate systems that cut OEM assembly times by 30–40%. Additionally, manufacturers strategically position regional manufacturing hubs to serve major pharma markets (e.g., North America, EU, Asia), reducing lead times and logistical costs. Strategic partnerships with biopharma firms and medical device OEMs further enhance product lock-in, while long-term agreements provide volume stability. Overall, success in this market hinges on precision manufacturing, validated materials, and responsiveness to evolving therapeutic production needs.

The plastic fittings and tubing for pharmaceutical and medical market is experiencing robust expansion, propelled by the rising demand for sterile, durable, and chemically inert components within clinical and drug manufacturing environments. As healthcare systems worldwide place greater emphasis on infection control, fluid integrity, and single-use technologies, plastic-based solutions are being preferred over traditional materials due to their high performance and lower contamination risk.

The surge in global pharmaceutical production, combined with the growing adoption of minimally invasive procedures, has significantly elevated the requirement for precise and flexible fluid handling systems. Regulatory pressure to meet stringent standards for biocompatibility and extractables has further accelerated innovation in material formulations and production technologies.

Increasing investment in healthcare infrastructure and personalized treatment protocols has amplified the use of plastic fittings and tubing across various diagnostic, therapeutic, and surgical applications. The market is expected to witness continued growth, supported by the convergence of material science, automation in fluid transport systems, and patient-centric delivery models.

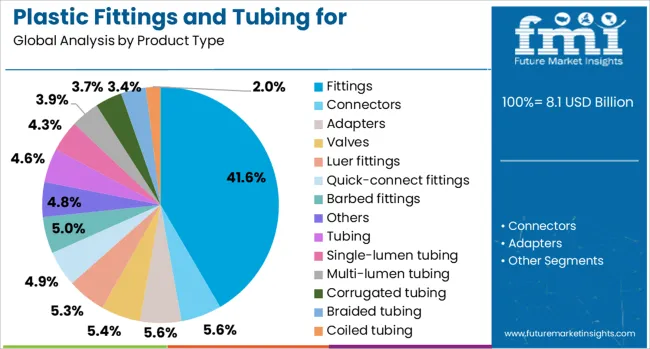

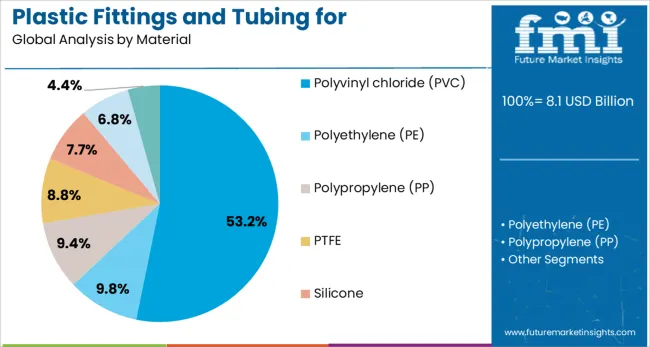

The plastic fittings and tubing for pharmaceutical and medical market are segmented by product type, material, end use, and distribution channel and geographic regions. The plastic fittings and tubing for the pharmaceutical and medical market are divided into Fittings, Connectors, Adapters, Valves, Luer fittings, Quick-connect fittings, Barbed fittings, Others, Tubing, Single-lumen tubing, Multi-lumen tubing, Corrugated tubing, Braided tubing, Coiled tubing, and Others. In terms of the material of the plastic fittings and tubing for the pharmaceutical and medical market, it is classified into Polyvinyl chloride (PVC), Polyethylene (PE), Polypropylene (PP), PTFE, Silicone, Thermoplastic elastomers (TPE), and Others (nylon, thermoplastic polyurethane, etc.).

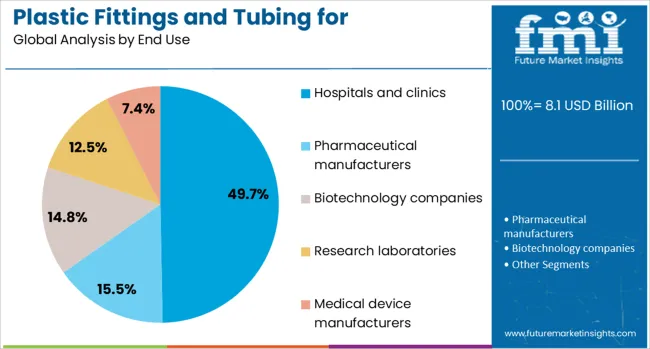

Based on the end use of the plastic fittings and tubing for the pharmaceutical and medical market, it is segmented into Hospitals and clinics, Pharmaceutical manufacturers, Biotechnology companies, Research laboratories, and Medical device manufacturers. The distribution channel of the plastic fittings and tubing for the pharmaceutical and medical market is segmented into Direct and Indirect. Regionally, the plastic fittings and tubing for the pharmaceutical and medical industry are classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fittings segment is projected to contribute 41.6% of the total revenue share in the plastic fittings and tubing for pharmaceutical and medical market in 2025, reflecting its central role in ensuring leak-proof and secure fluid connections. The increasing deployment of disposable fluid transfer systems in hospitals, laboratories, and pharmaceutical manufacturing setups is driving growth in this segment.

Fittings offer high reliability in maintaining sterility and minimizing exposure during drug delivery and fluid exchange, which has positioned them as a critical component in both invasive and non-invasive procedures. Enhanced design features such as quick-connect mechanisms and precision molding have improved the safety and efficiency of clinical workflows.

The adoption of advanced polymer-based fittings has also enabled resistance to a wide range of chemicals and temperatures, aligning with compliance requirements for cleanroom and aseptic processing environments. As demand grows for modular and scalable fluid systems across diagnostic, therapeutic, and production pipelines, the importance of high-quality fittings will remain paramount.

Polyvinyl chloride is expected to hold 53.2% of the material share in the plastic fittings and tubing for pharmaceutical and medical market in 2025, reinforcing its dominant position due to its balance of flexibility, chemical resistance, and cost-effectiveness. PVC’s extensive use in medical applications is attributed to its proven performance in delivering blood, saline, and intravenous fluids safely, without compromising sterility.

The material’s adaptability in both rigid and flexible forms has facilitated its usage in tubing, connectors, catheters, and drainage systems. Technological advancements in plasticizer formulations and non-DEHP alternatives have further strengthened the regulatory and clinical acceptance of PVC, particularly in sensitive environments.

The material’s ease of processing and compatibility with sterilization techniques such as gamma irradiation and ethylene oxide have ensured consistent quality across high-volume production. As sustainability concerns grow, recyclable and bio-attributed PVC grades are being adopted, supporting long-term use in pharmaceutical and medical settings while meeting evolving compliance standards.

The hospitals and clinics segment is projected to account for 49.7% of the total revenue share in the plastic fittings and tubing for pharmaceutical and medical market in 2025, reflecting its pivotal role in frontline patient care and treatment delivery. The segment’s dominance is being reinforced by the widespread integration of fluid transfer systems in infusion therapy, wound care, catheterization, and respiratory support across clinical facilities.

Increased patient admissions, expansion of surgical capacities, and growing demand for sterile, ready-to-use components have accelerated the use of plastic fittings and tubing within hospital environments. These components are essential in minimizing infection risks, ensuring consistent fluid flow, and enabling rapid response in emergency care settings.

The adoption of single-use systems for patient-specific treatments has also led to higher consumption rates in hospitals and clinics. Moreover, continuous improvements in clinical protocols and digital health integration have driven the need for tubing systems that support real-time monitoring and compatibility with automated dispensing units, ensuring their sustained relevance in modern healthcare.

Single-use systems in healthcare and biopharmaceutical production are boosting demand for plastic fittings and tubing. Manufacturers focus on sterile performance, chemical compatibility, and simplified assembly to meet end-use expectations.

Medical and pharmaceutical sectors continue expanding their use of plastic tubing and fittings in fluid handling systems. Hospitals rely on flexible tubing for IV sets, catheters, suction devices, and respiratory equipment, while biopharma companies use precision tubing in vaccine production, cell therapies, and filtration units. Single-use components reduce contamination risks and eliminate cleaning validation steps, making them essential in sterile environments. End users require tubing that resists kinking, supports consistent flow rates, and works with sterilization techniques like gamma irradiation or autoclaving. Fittings must offer tight seals and allow secure connections without introducing dead space or particulates. As drug manufacturers and care providers prioritize cleanroom compliance and patient safety, demand grows for products that deliver repeatable performance across multiple procedures. This application-driven approach creates consistent market pull for high-performance plastic fluid components.

Suppliers continue to develop tubing and fittings in materials that meet strict medical and pharmaceutical standards. Silicone and thermoplastic elastomers lead in applications that require flexibility, softness, or temperature tolerance, while polyolefins and fluoropolymers serve chemical transfer and high-purity uses. Tubing with co-extruded layers improves function by combining properties such as anti-kink structure, drug resistance, and visual clarity. Multi-lumen tubing enables separate fluid paths in a compact form, often used in diagnostic instruments or infusion systems. Fittings made from USP Class VI or ISO 10993 compliant materials support regulatory approval and patient contact safety. Suppliers also deliver tubing kits with pre-attached connectors or clamps, reducing setup time and lowering assembly risks in cleanroom environments. By combining material performance with ease of use, manufacturers offer complete fluid path solutions that align with the high standards of modern healthcare and drug production.

Plastic fittings and tubing for pharmaceutical and medical use must meet stringent quality standards, including FDA or ISO‑10993 biocompatibility and design controls. Suppliers face the challenge of validating production systems, performing batch-level testing, and maintaining full traceability from raw polymer to finished component. Design changes or material substitutions lead to requalification costs and process delays. Cross-contamination prevention, endotoxin control, and cleaning validation add complexity when materials touch injectable or biologic products. Shrinking lead times for bioprocessing customers put pressure on suppliers to maintain consistent documentation and rapid quality response systems. Without robust quality management and validation infrastructure, suppliers risk delays in device approvals, customer rejection, or withdrawal of existing product lines.

Growing adoption of single-use systems in biopharmaceutical manufacturing and hospital settings is driving demand for high-purity plastic tubing and fittings. Such systems eliminate cleaning validation and lower cross-contamination risks in IV therapy, vaccine manufacturing, and drug infusion pathways. Disposable tubing assemblies support flexibility in small batch biologics processing and reduce downtime between runs. Hospitals and clinics represent a prominent end-use segment, frequently relying on pre-sterilized kits for simplicity and safety. Fittings integrated into single-use disposable packs accelerate system adoption. Demand is expanding for tubing materials compliant with autoclave, gamma or electron beam sterilization, and chemical resistance requirements. This growth segment provides recurring revenue from consumables and supports scale in custom assembly operations.

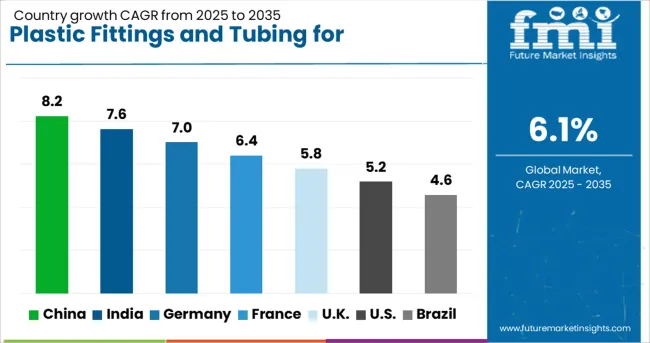

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global Plastic Fittings and Tubing Market for pharmaceutical and medical applications is forecasted to grow at a CAGR of 6.1% through 2035, supported by rising usage in fluid transfer systems, IV sets, and sterile processing. In the BRICS group, China leads with 8.2% growth, driven by expansion in domestic drug manufacturing and hospital infrastructure. India follows at 7.6%, where increased public health spending has encouraged local production and system upgrades. In the OECD region, Germany holds a strong 7.0% growth, backed by standardized manufacturing protocols and high export volumes of precision medical components.

France, growing at 6.4%, has seen consistent demand through hospital procurement programs and clinical trial supply chains. The UK, at 5.8%, reflects steady uptake across diagnostics, laboratory services, and outpatient care. Product adoption has been influenced by sterility requirements, flow control standards, and compliance with pharmacopoeial regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The plastic fittings and tubing market for pharmaceutical and medical use in China is expanding at a CAGR of 8.2%, supported by growth in fluid transfer systems, diagnostics equipment, and intravenous delivery infrastructure. PVC and polyolefin-based tubing formats are being used in infusion sets and peristaltic pump assemblies. Quick-connect fittings with medical-grade compliance are being sourced for use in cleanroom manufacturing lines. Flexible tubing solutions have been integrated into automated filling units for vaccine and biological packaging. Sterilizable tube sets with multilayer wall structures are being supplied to support extended shelf life in transport and storage. Tubing resistant to kinks and stress fatigue is being adopted in high-use medical environments. Local firms have been approved to supply bulk reels and pre-assembled kits for OEM and hospital use. Procurement volumes have increased across provincial distribution centers linked to national healthcare expansion.

In India, plastic fittings and tubing market for pharmaceutical and medical use is advancing at a CAGR of 7.6%, with demand being generated from infusion therapy, bulk drug manufacturing, and diagnostic consumables. Low-extractable tubing made from TPE and silicone is being deployed in drug contact applications. Luer-lock and barbed fittings are being standardized in blood collection sets and catheter assemblies. Tubing with gamma and ETO sterilization compatibility is being supplied to hospitals and device manufacturers. Local extrusion units have begun producing biocompatible tube formats for dialysis and ventilator circuits. Push-fit connectors are being distributed through medical supply chains serving secondary and tertiary care facilities. Government health procurement agencies have increased sourcing of disposable tubing kits. Packaging lines have been outfitted with fluid connectors and tubing that meet current pharmacopoeia standards for extractables and leachables.

In Germany, plastic fittings and tubing market for pharmaceutical and medical use is advancing at a CAGR of 7.0%, with volume supported by pharmaceutical fluid handling, cleanroom transfer lines, and device assembly operations. Co-extruded tubing formats are being used in bioprocessing systems to manage solvent compatibility and pressure control. Polypropylene fittings are being selected in autoclave-compatible assemblies for reusable diagnostic systems. Color-coded tubing and fittings are being supplied to simplify line identification in hospital and laboratory setups. Peristaltic-grade tubing has been integrated into automated drug delivery pumps. Equipment makers have issued specifications favoring fittings with consistent inner bore diameters for flow accuracy. Tubing with validated bioburden levels is being procured for use in IV compounding centers. Medical-grade connectors with lock-proof design have been introduced to prevent accidental disconnection during use in ambulatory setups.

France is witnessing a CAGR of 6.4% in its plastic fittings and tubing market for pharmaceutical and medical applications, supported by medical fluid transfer, packaging systems, and parenteral equipment assembly. Tubing certified for low protein binding is being applied in IV drug delivery and transfusion lines. Snap-on and twist-lock fittings are being distributed to local device manufacturers. Flexible PVC and co-polyester tubing formats are being chosen in automated syringe filling stations. Specialized crimp connectors are being attached to drug dispensing systems to ensure seal integrity. Cleanroom tubing lines are being installed in injectable formulation units to handle sterile compound transfer. Silicone tubing designed for peristaltic motion has been adopted in dosing and sampling instruments. Supplies have been distributed through hospital logistics centers with focus on patient safety and repeatable performance.

The plastic fittings and tubing market for pharmaceutical and medical use in the United Kingdom is growing at a CAGR of 5.8%, supported by hospital infrastructure, diagnostic labs, and contract packaging facilities. Tube sets with validated pressure ratings are being supplied for suction and vacuum systems in operating rooms. Fittings with tamper-evident features are being introduced in unit-dose drug packaging operations. Thermoplastic elastomer tubing is being used in low-volume infusion pumps across pediatric and outpatient care settings. Standardized barbed fittings have been stocked by regional medical distributors. Multi-lumen tubing has been installed in blood separation and filtration equipment. Bulk tubing reels are being sent to cleanroom operations for use in modular compounding systems. Private-label medical brands have sourced fittings and tubing certified to meet ISO 10993 requirements for direct patient exposure.

The plastic fittings and tubing market for pharmaceutical and medical applications is defined by companies that prioritize biocompatibility, cleanliness, and regulatory adherence. Saint-Gobain Performance Plastics leads the space with advanced solutions for IV systems, drug delivery, and bioprocessing. Parker Hannifin and Freudenberg Medical offer high-precision components designed for diagnostics and surgical fluid control.

Tekni-Plex and Raumedic serve OEMs with cleanroom-extruded tubing systems, particularly for catheters and infusion sets, combining technical customization with strict quality control. Trelleborg and Smiths Medical contribute key components for respiratory, infusion, and critical care, trusted in both hospital and homecare environments. Specialized suppliers like Nordson Medical and Eldon James focus on modular connectors and high-purity tubing for lab and single-use pharmaceutical systems.

Their offerings meet stringent standards for sterile fluid transfer and compatibility with complex drug compounds. Qosina and Polymer Solutions are widely used in rapid prototyping and small-batch medical production, offering a vast catalog of customizable fittings. Supporting niche applications, NewAge Industries, Navtar, Atlas Copco, and AP Extrusion manufacture tailored tubing for pharmaceutical packaging and transfer processes.

DuPont introduced Liveo Pharma TPE Ultra-Low Temp Tubing for single-use bioprocessing down to −86 °C, weldable and sealable with broad regulatory data.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.1 Billion |

| Product Type | Fittings, Connectors, Adapters, Valves, Luer fittings, Quick-connect fittings, Barbed fittings, Others, Tubing, Single-lumen tubing, Multi-lumen tubing, Corrugated tubing, Braided tubing, Coiled tubing, and Others |

| Material | Polyvinyl chloride (PVC), Polyethylene (PE), Polypropylene (PP), PTFE, Silicone, Thermoplastic elastomers (TPE), and Others (nylon, thermoplastic polyurethane, etc.) |

| End Use | Hospitals and clinics, Pharmaceutical manufacturers, Biotechnology companies, Research laboratories, and Medical device manufacturers |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saint-GobainPerformancePlastics, ParkerHannifin, FreudenbergMedical, Tekni-Plex, Raumedic, Trelleborg, SmithsMedical, Nordson, EldonJames, Qosina, PolymerSolutions, NewAgeIndustries, Navtar, AtlasCopco, and APExtrusion |

| Additional Attributes | Dollar by sales, plastic fittings and tubing are led by silicone and PVC products used extensively in IV sets, drug delivery, and dialysis applications. Growth is driven by rising chronic disease rates, expanding biopharmaceutical manufacturing, and increased infection control measures. Innovations include bio-based polymers and antimicrobial coatings, with Asia-Pacific growing fastest. |

The global plastic fittings and tubing for pharmaceutical and medical market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the plastic fittings and tubing for pharmaceutical and medical market is projected to reach USD 14.6 billion by 2035.

The plastic fittings and tubing for pharmaceutical and medical market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in plastic fittings and tubing for pharmaceutical and medical market are fittings, connectors, adapters, valves, luer fittings, quick-connect fittings, barbed fittings, others, tubing, single-lumen tubing, multi-lumen tubing, corrugated tubing, braided tubing, coiled tubing and others.

In terms of material, polyvinyl chloride (pvc) segment to command 53.2% share in the plastic fittings and tubing for pharmaceutical and medical market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA