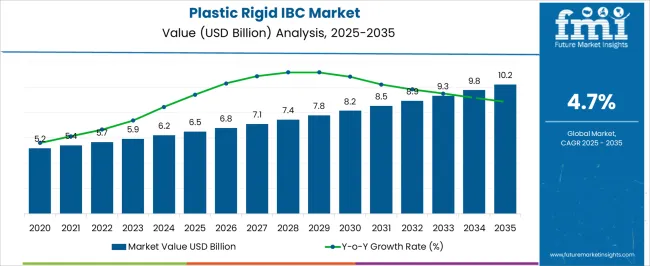

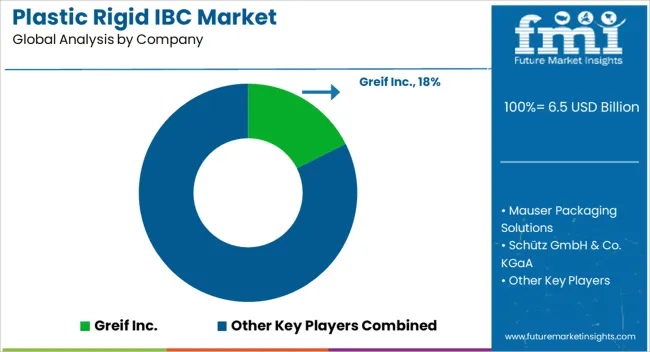

The Plastic Rigid IBC Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Plastic Rigid IBC Market Estimated Value in (2025 E) | USD 6.5 billion |

| Plastic Rigid IBC Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The plastic rigid IBC market is experiencing robust growth driven by increasing demand for safe and efficient bulk storage and transportation solutions across industrial and commercial sectors. Current market conditions are characterized by widespread adoption in chemical, food, pharmaceutical, and logistics applications, supported by the durability, chemical resistance, and cost-effectiveness of plastic IBCs.

Regulatory emphasis on safe handling and environmental compliance is influencing product design and material selection. The future outlook is shaped by expansion of industrial production capacities, growth in e-commerce and logistics networks, and rising awareness of operational efficiency and sustainability.

Technological innovations in container design, lightweight construction, and modular handling are enhancing usability and reducing operational costs Growth rationale is anchored on the versatility of IBCs in diverse storage and transport scenarios, the ability of manufacturers to provide standardized yet customizable solutions, and the strengthening of distribution and supply chain networks, which collectively ensure consistent market expansion and higher adoption across industrial and commercial end users.

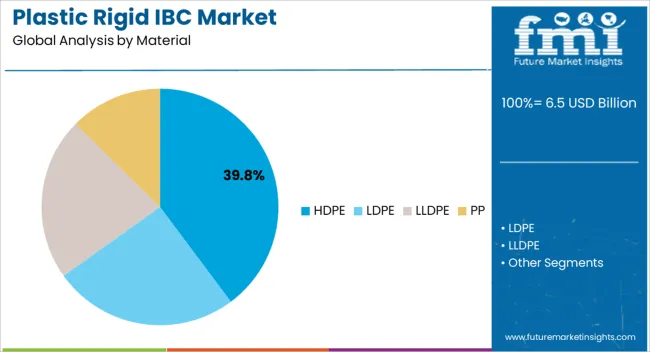

The HDPE segment, holding 39.80% of the material category, has been leading due to its high chemical resistance, durability, and adaptability for various industrial applications. Adoption has been supported by consistent performance in harsh chemical and environmental conditions, while ease of manufacturing and cost-effectiveness have reinforced its preference among buyers.

Market confidence has been strengthened through adherence to regulatory and safety standards, ensuring reliability in storage and transport. Technological improvements in HDPE formulation and molding processes have enhanced container strength, longevity, and recyclability.

Growth is further supported by increasing demand from industrial and commercial sectors requiring robust and reusable bulk containers HDPE IBCs are expected to maintain their market leadership due to their balanced performance, cost efficiency, and scalability in production.

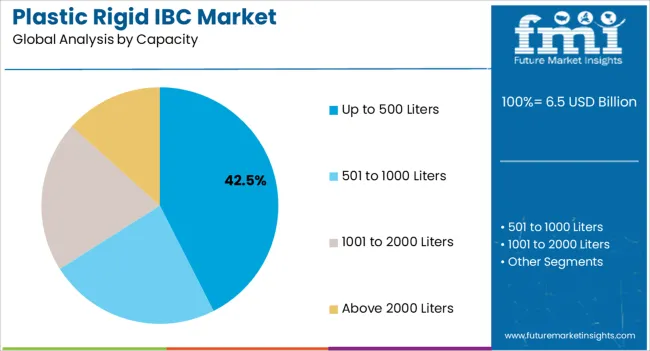

The up to 500 liters capacity segment, representing 42.50% of the capacity category, has maintained prominence due to its suitability for medium-scale industrial and commercial applications where handling, storage, and transport efficiency are critical. Adoption has been facilitated by compatibility with standard handling equipment, ease of stacking, and reduced footprint requirements.

Operational efficiency and safety compliance have strengthened preference among industrial buyers, while cost optimization and versatility in usage across chemicals, food, and pharmaceutical sectors have reinforced market dominance.

Continued innovation in container design, including ergonomic features and modular handling capabilities, is expected to sustain the segment’s market share and support steady growth across industries.

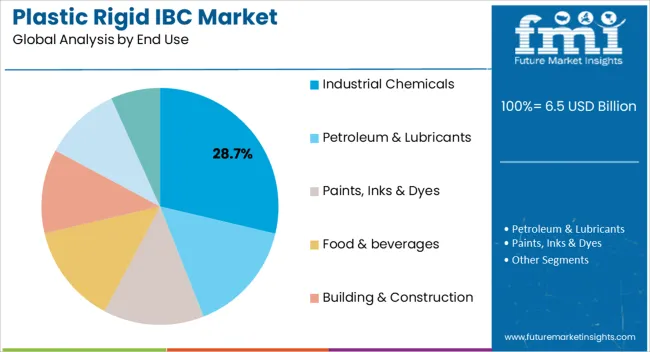

The industrial chemicals segment, accounting for 28.70% of the end-use category, has emerged as the leading application due to high demand for safe and chemically resistant storage solutions. Adoption has been driven by the need for reliable bulk containment, regulatory compliance, and operational efficiency in handling reactive and hazardous materials.

Performance consistency, durability, and adherence to industry safety standards have reinforced market confidence. Growth is further supported by increasing chemical production capacities, expansion of industrial infrastructure, and adoption of reusable containers to optimize cost and sustainability.

The segment is expected to maintain its market share as industrial chemical applications continue to rely on plastic rigid IBCs for safe and efficient storage and transportation.

Various factors restrain global market growth. A few of these factors are as follows:

The global market recorded remarkable historical growth, with a valuation of USD 6.5 billion in 2025. The increasing demand for storage of goods, liquids, and powders is raising the adoption of plastic rigid IBC. These IBCs are reducing the high cost of transportation. Plastic rigid IBCs are reusable containers that enhance the safety of goods. These are available in different shapes and sizes as per consumers' desire.

The plastic rigid IBCs can save nearly three-forth in storage and transportation works. The chemical, beverages, and other sectors are shifting their preferences towards plastic rigid IBC due to its durability and strength.

China is estimated to secure a CAGR of 13.9% in the global market during the forecast period. China is influenced by several factors as follows:

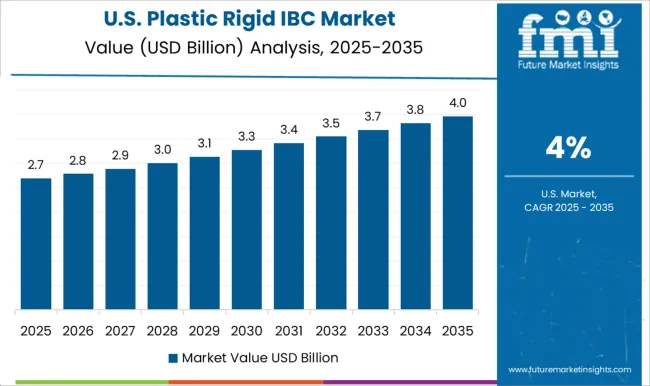

The United States is anticipated to dominate the global market by capturing a CAGR of 18.3% by 2035. The United States plastic rigid IBC market is significantly driving the global market through various aspects, including:

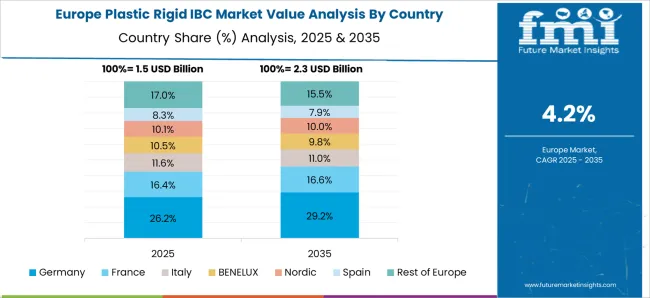

Germany is anticipated to capture a CAGR of 6.8% in the global market during the forecast period. Several factors robust to the German plastic rigid IBC market are as follows:

Canada is likely to register a CAGR of 3.0% in the global market during the forecast period. The following drives are enhancing Canada's plastic rigid IBC market.

India is anticipated to secure a CAGR of 5.3% in the global market during the forecast period. A few factors are uplifting India’s plastic rigid IBC market.

Based on material type, the PP material segment is likely to lead the global market by securing a share of 71.6% in the global market by 2035. PP is an excellent material type with chemical resistance, such as bases, acids, and solvents. The demand for PP is widely increasing due to its durability in harsh environmental conditions, and various industries popularly adopt it.

| Top Segment | PP Material |

|---|---|

| CAGR (2025 to 2035) | 71.6% |

PP has relatively low costs, and end users are surging its usage due to affordability, which is expanding the market reach. Due to its lightweight and thermal stability, end users, such as the automotive and packaging sector, are increasing its adoption. PP can easily be modified through advanced manufacturing techniques such as extrusion and blow molding, which are fueling the plastic rigid IBC market share.

Based on end use, the chemical sector is estimated to dominate the global market by capturing a share of 26.5% during the forecast period. The chemical industry is a huge sector that offers intermediates, raw materials, and other materials that are advancing market growth.

| Top Segment | Chemical Sector |

|---|---|

| CAGR (2025 to 2035) | 26.5% |

The chemical industry is a fundamental sector due to its wide range as compared to the automotive and construction sectors. The growing innovations and research activities are developing improved chemical compounds, processes, and materials to expand plastic rigid IBC market growth.

The global market is highly competitive because of prominent vendors globally. These prominent vendors are developing advanced and improved products by investing their million-dollar amount in research activities. They are carrying new ideas to expand their global reach.

Key players are the backbone that uplifts the global market through their innovations and marketing tactics. They are adopting various marketing methodologies such as mergers, agreements, collaborations, partnerships, and product launches.

Recent Developments in the Plastic Rigid IBC Market

The global plastic rigid ibc market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the plastic rigid ibc market is projected to reach USD 10.2 billion by 2035.

The plastic rigid ibc market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in plastic rigid ibc market are hdpe, ldpe, lldpe and pp.

In terms of capacity, up to 500 liters segment to command 42.5% share in the plastic rigid ibc market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Rigid IBC Market Share

Europe Healthcare Rigid Plastic Packaging Market Trends – 2024-2034

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Rigid Foam Market Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Rigid Box Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Rigid Sleeve Boxes Market Size and Share Forecast Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

Rigid Food Containers Market Size and Share Forecast Outlook 2025 to 2035

IBC Liner Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA