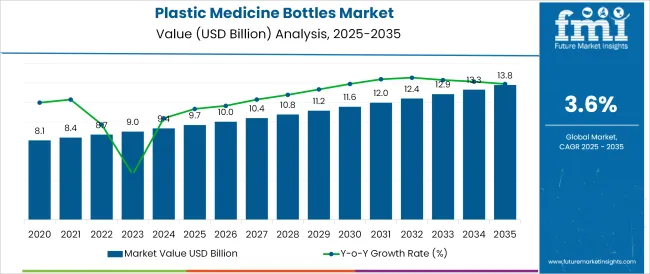

The Plastic Medicine Bottles Market is estimated to be valued at USD 9.7 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

The plastic medicine bottles market is witnessing steady expansion driven by the increasing demand for secure, lightweight, and cost-effective pharmaceutical packaging. The healthcare sector’s growing emphasis on patient safety, dosage accuracy, and child-resistant solutions is fostering widespread adoption of high-quality plastic containers. Rising regulatory scrutiny over product integrity and traceability, particularly in emerging economies, is reinforcing the shift toward compliant and tamper-evident packaging formats.

Developments in plastic resin engineering have enabled the production of chemically inert, UV-resistant, and shatterproof bottles that meet strict pharmacological standards. Moreover, sustainability trends are prompting manufacturers to explore recyclable polymers and reduce resin content per unit, aligning with environmental benchmarks.

With evolving formulations in liquid medicine, vitamins, and nutraceuticals, plastic bottles continue to be preferred due to their compatibility with a variety of closure systems and dispensing technologies. The market outlook remains optimistic as both pharmaceutical companies and contract manufacturers invest in automation, labeling compliance, and protective primary packaging to meet future therapeutic demands.

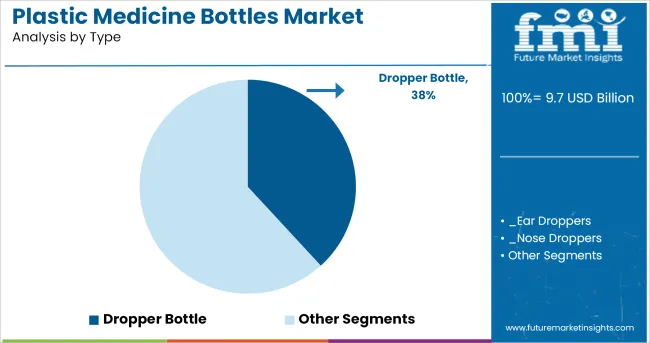

It has been noted that dropper bottles represent 38.20% of total revenue within the type category, securing their position as the leading segment. This dominance is attributed to the rising consumption of liquid medications, ophthalmic solutions, and pediatric formulations that require precise, unit-controlled dispensing.

The dropper format has been favoured due to its suitability for low-viscosity liquids and its capacity to reduce dosage errors, thereby improving patient safety. Additionally, dropper bottles are increasingly used in alternative medicine and herbal formulations, further expanding their market reach.

The integration of tamper-evident features and improved barrier properties has enhanced their compliance with pharmaceutical standards. Their lightweight and compact design also supports cost-effective logistics and consumer convenience, reinforcing their widespread application across therapeutic categories.

It is observed that the e-liquid application segment accounts for 33.70% of the overall market, making it the top-performing use case. This share is supported by the rapid growth of the vaping and e-cigarette sector, where precision filling, leak prevention, and safe storage are critical. Plastic bottles used for e-liquids are typically designed to be squeezable with narrow dispensing tips, providing ease of use and portability.

Regulatory guidelines requiring child-resistant closures and standardized labelling have further prompted the use of compliant plastic bottles in this segment. Additionally, customization options for branding and volume calibration have positioned these bottles as a preferred choice for both niche and large-scale e-liquid manufacturers.

This widespread integration in the e-liquid supply chain has driven the segment’s leading position in the application category.

The screw cap closure type holds a 41.40% share in the market, emerging as the dominant closure mechanism across plastic medicine bottles. This prevalence is due to its ease of use, cost-efficiency, and strong sealing capability, which helps prevent contamination and evaporation.

Screw caps offer versatility across various bottle neck finishes and are widely compatible with automation in both filling and capping processes. They are also favoured for their reusability and compatibility with tamper-evident and child-resistant designs.

In pharmaceutical applications where repeat access to medication is required, screw caps offer dependable performance and convenience, especially for elderly and pediatric users. Their robust sealing attributes, combined with low production costs and regulatory compliance, have solidified their leadership in the closure type segment.

Plastic Medicine Bottles are one of the most preferred modes of packaging for medicine. As the pharmaceuticals are sensitive in nature they can lose their therapeutic qualities when exposed to the environment and as the plastic medicine bottles stores, the medicine effectively and also help the medicine to maintain its therapeutic qualities the medicine manufacturers usually prefers plastic medicine bottles to store their medicine.

The wide availability of environmentally acceptable alternatives to PE and PET, like glass, metal, and sugarcane, may limit the plastic medicine bottles market's growth.

Moreover, Government rules and regulations on the use of plastics are hampering the growth of the plastic medicine bottles market share. In addition to this consumers are becoming more concerned about the use of plastic as it can have an adverse effect on the environment. This rising concern is also one of the key factors which are having a negative impact on the plastic medicine bottles market.

Hence understanding this growing environmental concern the key players in the market are investing a high amount in research and development to resolve these concerns and make plastic bottles safer for pharmaceutical usage.

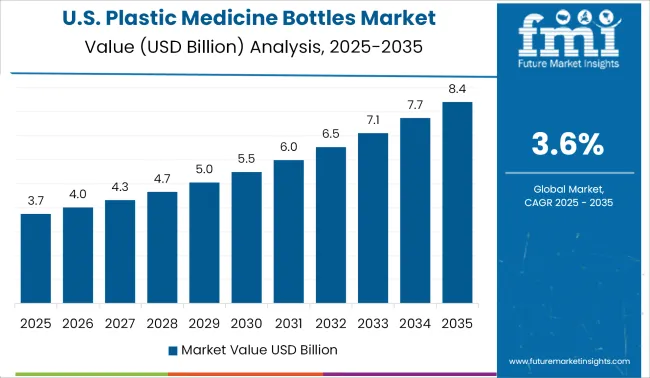

The USA and Canada have shown lucrative growth for the plastic medicine bottles market. The low cost required for the plastic medicine bottles packaging is one of the key reasons behind the growth of the plastic medicine bottles market in the USA and Canada.

Lowering the medicinal cost is being one of the main concerns in the USA and Canada region. Thus to lower the cost, the medicine manufacturers prefer packaging which is cost effective also has strong medicine handing capabilities which are expected to propel growth to the plastic medicine bottles market.

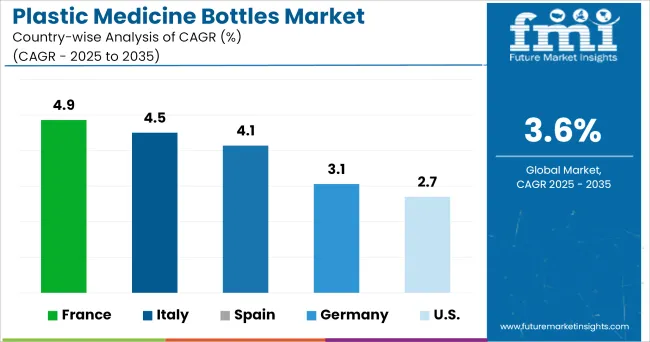

From the past few years, Europe has become one of the significant markets for plastic medicine bottles and it is expected to show significant growth during the forecasted period 2024 to 2035.

One of the key reasons behind the growth of plastic medicine bottles is product innovation. Consumers in the European region are highly attracted to innovation. These consumer base usually prefers product which has something innovative or different. Thus the key players in the plastic medicine bottles industry are coming with innovative products to attract more consumer bases and to have a greater hold on the plastic medicine bottles market.

For instance, Amcor limited who is a global leader in packaging solutions introduced a 53-ounce polyethylene terephthalate (PET) bottle made entirely of post-consumer recycled (PCR) PET resin for Method Products.

Thus the product innovation brought by the plastic medicine bottles manufacturers is expected to propel growth to the plastic medicine bottles market in the European region.

Some of the leading manufacturers of Plastic Medicine Bottles are

These are the key players driving market demand for Plastic medicine bottles and they are investing in adopting advanced technology to manufacture high quality plastic medicine bottles.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global plastic medicine bottles market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the plastic medicine bottles market is projected to reach USD 13.8 billion by 2035.

The plastic medicine bottles market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in plastic medicine bottles market are dropper bottle, ear droppers, nose droppers, eye droppers, liquid bottles, solid containers and others.

In terms of application, e-liquid segment to command 33.7% share in the plastic medicine bottles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

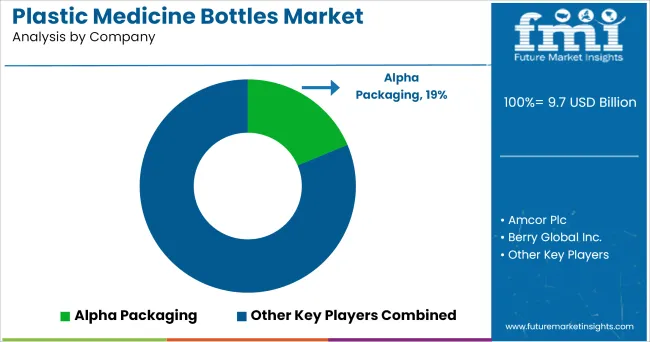

Market Share Breakdown of Plastic Medicine Bottles Manufacturers

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Medicine Spoons Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Plastic Medicine Spoon Manufacturers

Glass Medicine Bottles Market

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA