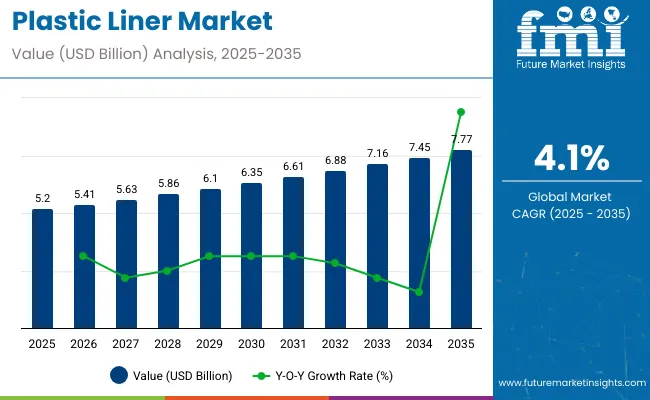

The global plastic liner market is expected to grow steadily over the forecast period, expanding from USD 5.20 billion in 2025 to USD 7.77 billion by 2035, reflecting a CAGR of 4.1%. This growth is primarily driven by increasing demand from diverse industries such as food and beverage, pharmaceuticals, chemicals, and agriculture.

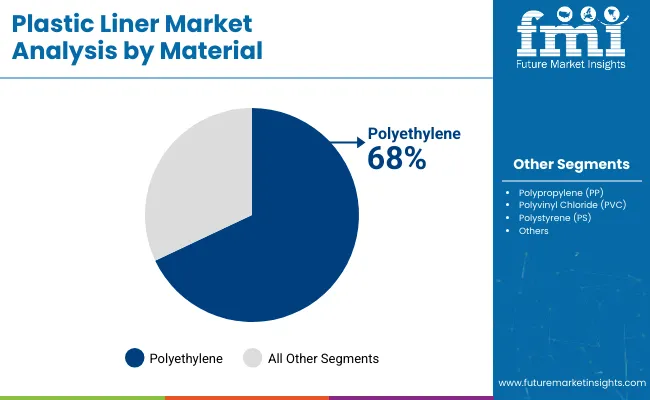

Plastic liners play a critical role in packaging solutions by offering protection, flexibility, and enhanced shelf life. Among the various materials used, polyethylene (PE)-based liners dominate the market owing to their versatility, cost-effectiveness, and favorable physical properties. Additionally, evolving consumer preferences for convenience, hygiene, and sustainable packaging are accelerating the adoption of plastic liners globally.

Technological advancements in manufacturing processes are also fueling market growth by improving the barrier properties, durability, and environmental compatibility of plastic liners. Innovations such as enhanced strength liners and eco-friendly materials have expanded applications in specialty packaging and industrial sectors.

Regionally, Asia Pacific is anticipated to hold a substantial share due to rapid industrialization, growing manufacturing hubs, and rising disposable incomes. North America and Europe are also expected to witness consistent growth, driven by stringent regulatory frameworks and increasing demand for high-performance, sustainable packaging solutions. These factors collectively position the plastic liner market for sustained expansion through 2035.

Key industry players are actively responding to market demands by focusing on innovation, sustainability, and strategic collaborations. Berry Global Group recently partnered with Mars to develop packaging with 100% recycled content, eliminating over 1,300 metric tons of virgin plastic annually, and expanded its B Circular Range of sustainable products.

Other notable companies include RRR Supply, Inc., specializing in durable poly truck liners; A-Pac Manufacturing Co., Inc., known for custom poly bags and films; and Champion Plastics, which leverages over four decades of expertise to provide ISO-certified packaging solutions. Dana Poly, Inc. has incorporated recycling processes into its production line, advancing sustainability efforts.

Similarly, Shagoon Packaging Pvt. Ltd., Synpack Avonflex Pvt. Ltd., and Caltex Plastics Inc. emphasize quality and environmentally friendly products. The market’s trajectory is strongly influenced by material innovations, improved manufacturing efficiencies, and an industry-wide shift toward circular economy principles, ensuring that plastic liners will remain essential in meeting global packaging needs.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 5.20 Billion |

| Market Size (2035F) | USD 7.77 Billion |

| CAGR (2025 to 2035) | 4.1% |

The plastic liners market features significant trade flows between countries with strong plastic manufacturing industries and regions with growing packaging and industrial demands. High-quality plastic liners are exported globally to meet requirements in sectors such as agriculture, waste management, construction, and packaging.

Plastic liners are subject to regulatory frameworks that focus on safety, environmental sustainability, and product performance, especially when used in food packaging, waste management, and industrial applications. These regulations aim to minimize environmental impact and ensure consumer safety.

The below table presents the expected CAGR for the global plastic liner market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 4.3% |

| H1 (2024 to 2034) | 5.1% |

| H2 (2024 to 2034) | 3.1% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.3% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.1% in the first half and remain relatively moderate at 3.1% in the second half. In the first half (H1) the market witnessed a decrease of 120 BPS while in the second half (H2), the market witnessed an increase of 120 BPS.

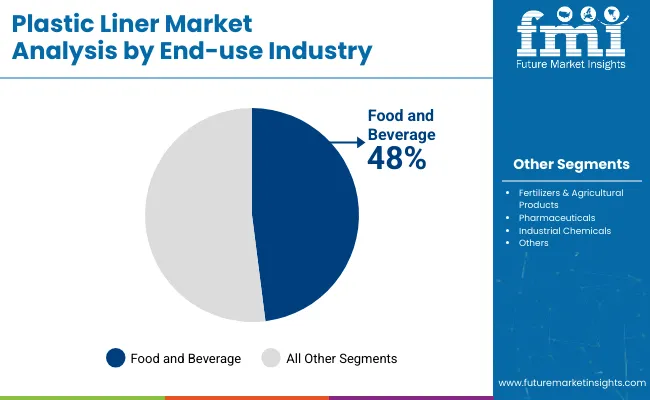

The plastic liners market is driven primarily by the food and beverage sector and polyethylene material usage. Food and beverage applications dominate due to high demand for food safety, freshness preservation, and contamination protection. Polyethylene leads as the preferred material owing to its cost-effectiveness, versatility, and increasing availability of recyclable and biodegradable options, supporting sustainable packaging trends.

The food and beverage sector is projected to account for the largest share of 48% in the plastic liners market by 2025. This dominance has been driven by the growing demand for enhanced food safety, contamination prevention, and shelf life extension. Plastic liners are widely applied in bulk food packaging, liquid containers, and the transportation of fresh produce, where their ability to preserve product freshness and prevent leakage has been highly valued.

The high barrier protection provided by these liners against oxygen and moisture ingress is a critical factor that has increased their adoption. The surge in grocery e-commerce, the popularity of ready-to-eat meals, and growing interest in sustainable packaging solutions have further fueled demand for food-grade plastic liners globally.

Leading manufacturers such as Berry Global, Sealed Air Corporation, and Amcor have been investing in innovative liner solutions tailored for food applications. This trend is expected to continue as the food and beverage sector increasingly prioritizes product integrity and consumer safety through advanced packaging materials.

Polyethylene (PE) is forecasted to dominate the plastic liners market by holding a significant share of 68% in 2025. This dominance has been attributed to the material’s cost-effectiveness, mechanical strength, and exceptional versatility. PE liners have been widely utilized across food packaging, industrial storage, and agricultural sectors due to their flexibility, chemical inertness, and excellent water resistance.

Both high-density polyethylene (HDPE) and low-density polyethylene (LDPE) variants have been employed extensively to meet diverse packaging needs. The increasing development and adoption of recyclable and biodegradable PE liners have further enhanced polyethylene’s market position, driven by stringent environmental regulations and rising consumer demand for sustainable packaging.

Manufacturers, including Dow Chemical Company, ExxonMobil, and LyondellBasell have been innovating in the PE liner segment to improve recyclability and reduce environmental impact. The balance of affordability, performance, and environmental compliance has ensured PE’s continued preference by producers and end-users alike, making it the material of choice in plastic liners.

The growing concern for hygiene and contamination-free storage has been attributed as one of the primary drivers pushing the growth of the plastic liner industry. Some such industries are food & beverage, pharmaceuticals, and chemicals in which plastic liners are utilized to protect the contents from moisture, dust, and cross-contamination.

Plastic liners particularly in the food industry assist to safeguard perishables against spoilage by keeping them closed off to air, consequently saving shelf life and minimizing food waste. Similarly, the healthcare industry is accustomed to the uses of plastic liners in aseptic packaging of drugs, so providing for the clean storage.

Indeed, multi-material bulk containers like drums, intermediate bulk containers (IBCs), and flexible intermediate bulk containers (FIBCs) are employing plastic liners very abundantly these days for protective purposes during storage and transportation.

Online retailers and logistics firms rely heavily on long-lasting packaging solutions that ensure any type of product damage during handling and shipping. Plastic liners are therefore essential in offering tamper-resistant and waterproof protection for sensitive, liquid, and fragile products.

In addition, with the rise of specialized cross-border transactions, producers are also widely using heavy-duty plastic liners to enable safe transportation of bulk materials such as chemicals, building materials, and agriculture. As firms seek affordable ways of improving product safety and reducing returns of defective products, increasingly there is a demand for highly engineered and tailored plastic liners.

Higher environmental issues and rigorous plastic waste regulations become the biggest issues for most plastic liner markets. Nearly all the nations imposed some limit and requirement, like prohibiting such a material, mandatory recycling, and extended producer responsibility (EPR) laws to counteract other facets of plastic pollution. Most retail single-use plastic liners are landfill waste and contribute to ocean pollution and therefore pose sustainability issues.

Once again, companies are forced to switch from traditional plastic liners that are recyclable or biodegradable and more expensive and less resilient than standard plastic liners. Regulations at a more linear point contribute to manufacturers' total cost per operation by enabling massive investments in material and circular economy practices at the final point of the value chain, affecting profitability.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Eco-Friendly Materials | Investment in biodegradable, recyclable, and compostable plastic liners will reduce environmental impact and comply with global requirements. |

| Durability & Leak-Proof Design | Higher puncture resistance, moisture barrier, and strength will improve performance in food, chemical, and waste management applications. |

| Customization & Industry-Specific Solutions | Designing liners in different sizes, thicknesses, and material formulations will address application in agriculture, pharmaceuticals, and industrial packaging. |

| Lightweight & Cost-Effective Solutions | Material efficiency while sustaining durability will decrease production costs and enhance logistics effectiveness. |

| Automation & Advanced Manufacturing | Using high-speed extrusion, co-extrusion, and automated sealing technologies will increase the efficiency of production and consistency of products. |

The global plastic liner market achieved a CAGR of 3.1% in the historical period of 2020 to 2024. Overall, the plastic liner market performed well since it grew positively and reached USD 4,996.8 million in 2024 from USD 4,379.9 million in 2020.

Liner plastic market has been witnessing consistent growth in the past couple of years due to the product's extensive use in packaging, transportation, and inventory management across varying sectors.

Plastic liners are water-proof, and dirt-proof, and even reduce the risks of spillages in their operation therefore, they are usually used in food packaging, chemicals, agriculture, and the industrial sector. Developments in the area of material strength, flexibility, and barrier properties have enhanced their lifespan and effectiveness, facilitating market growth.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Material Trends | Largely polyethylene (PE), polypropylene (PP), and high-density polyethylene (HDPE) liners. |

| Regulatory Environment | Adherence to food safety, hazardous material packaging, and plastic waste reduction regulations. |

| Consumer Demand | High demand from food & beverages, healthcare, industrial, and waste management markets. |

| Technological Developments | Advances in multi-layer co - extrusion, anti-microbial coatings, and high-strength liners. |

| Sustainability Initiatives | Focus on reducing thickness while maintaining durability, enhancing recyclability, and increasing post-consumer resin (PCR) content. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Material Trends | Transition towards biodegradable, compostable, and recycled-content plastic liners for eco-friendly packaging solutions. |

| Regulatory Environment | Restrictive norms on single-use plastics, Extended Producer Responsibility (EPR), and mandates for recyclable materials. |

| Consumer Demand | Increasing preference for sustainable, long-lasting, and multi-layered liners with enhanced strength and leak resistance. |

| Technological Developments | Innovations in self-degrading plastics, intelligent liners with embedded sensors, and ultra-light yet strong materials. |

| Sustainability Initiatives | Strong push for carbon-neutral manufacturing, reusable liner systems, and fully biodegradable plastic liners. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Product Availability & Convenience |

|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Strength, Moisture Resistance, Durability) |

|

| Regulatory Compliance & Safety |

|

| Automation & Smart Technology |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Product Availability & Convenience |

|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Strength, Moisture Resistance, Durability) |

|

| Regulatory Compliance & Safety |

|

| Automation & Smart Technology |

|

The increase in environmental regulations and the shift towards sustainable packaging solutions will contribute to a growth of plastic liners in the period of 2025 to 2035. The advances in the use of plastic liners that can be decomposed, recycled, or composted will make a major contribution as companies search for greener options.

Also, the areas such as e-commerce, pharmaceuticals, and industrial automation that are further developing will be a necessity for tailored anti-static and moisture-resistant plastic liners as they need to keep the product and supply chain intact.

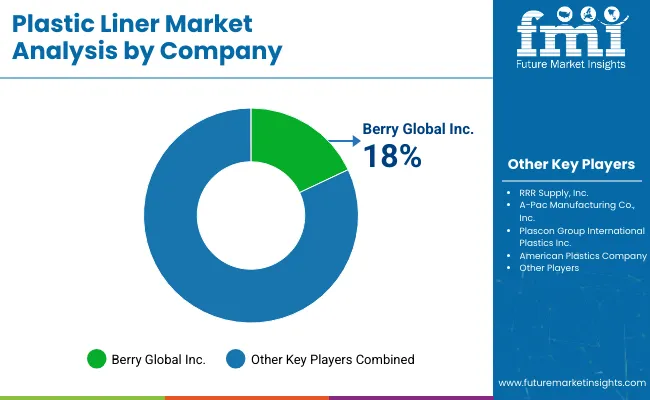

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 includeBerry Global Group, RRR Supply, Inc., A-Pac Manufacturing Co., Inc., Plascon Group, International Plastics Inc.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 includeAmerican Plastics Company, Champion Plastics, Dana Poly, Inc., Shagoon Packaging Pvt. Ltd., SynpackAvonflex Pvt. Ltd., Caltex Plastics Inc., ILC Dover LP, Polymer-Synthese-Werk GmbH, Chiltern Plastics, NITTEL GmbH.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | Steady demand from industrial, food, and waste management sectors. |

| Latin America | Moderate growth driven by agricultural, commercial, and packaging applications. |

| Europe | Strong market presence due to strict plastic waste reduction policies. |

| Middle East & Africa | Growing usage in construction, food storage, and industrial applications. |

| Asia Pacific | Fastest-growing market due to rising industrialization and e-commerce packaging needs. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Shift towards biodegradable and recycled plastic liners due to sustainability regulations. |

| Latin America | Increased investment in cost-effective and eco-friendly liner production. |

| Europe | Higher adoption of compostable and circular economy-focused plastic liners. |

| Middle East & Africa | Expansion in durable and high-strength liners for diverse applications. |

| Asia Pacific | Large-scale production of recyclable and lightweight plastic liners. |

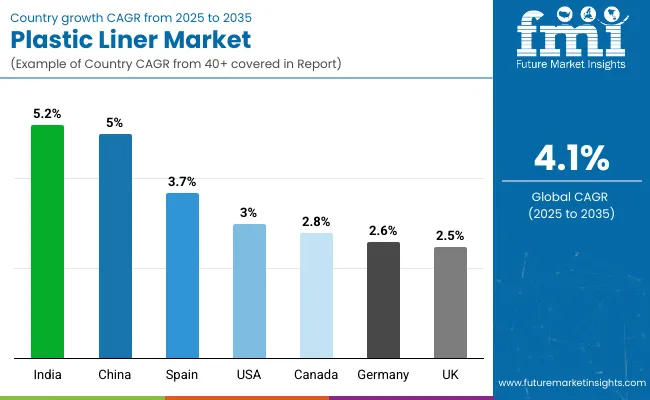

The section below covers the future forecast for the plastic liner marketin terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3% through 2035. In Europe, Spainis projected to witness a CAGR of 3.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.0% |

| Germany | 2.6% |

| China | 5.0% |

| UK | 2.5% |

| Spain | 3.7% |

| India | 5.2% |

| Canada | 2.8% |

Harsh FDA rules and enhanced safety requirements in the food and beverage industry have led to a heightened demand for food-grade and industrial plastic liners in America. Retailers and American food processors have used high-barrier-plastic liners to keep food products free from contamination when they are in storage and transport.

Also, other industries such as chemicals, pharma, and agriculture are implementing custom plastic liners that are tailored to their needs in a bid to meet rules for safe warehousing of merchandise. Special food-grade plastic liners that maintain freshness and shelf life of food are thus highly needed as a result of the growth of the packaged food and quick-service restaurant (QSR) sectors.

The very rigid environmental litigation of Germany and the sustainable packaging solutions drive demand for recyclable and bio-degradable plastic liners. According to the German Packaging Act or VerpackG, a business should lessen plastic wastes and improve recycling rates; hence, it motivates manufacturers towards the development of environmentally friendly liner solutions.

Many German companies are now opting for bio-based and compostable plastic liners because they want to comply with EU sustainability goals or offer more options to eco-esteem customers. On the other hand, the growth of a sophisticated automotive, drug comfort and industrial sectors in Germany makes that country a high-demand market for quality protective liners to bulk material handling and secure transportation.

The plastic liner market is experiencing steady growth, driven by the increasing demand for protective and contamination-free packaging solutions across industries such as food & beverage, pharmaceuticals, chemicals, agriculture, and industrial goods. Plastic liners serve as barrier layers that prevent leakage, contamination, and product degradation, ensuring safe storage and transportation of materials.

Sustainability is a key trend reshaping the market, with manufacturers developing biodegradable, recyclable, and reusable plastic liners to align with global environmental regulations. The integration of advanced polymer materials and multi-layered high-barrier liners is enhancing durability and product protection. Additionally, automation and AI-driven quality control systems in liner manufacturing are improving efficiency and reducing waste.

Berry Global Inc. (18%-22%)

Berry Global leads the market with customized plastic liners for various industries, emphasizing high-barrier properties and recyclability. Its lightweight yet durable solutions reduce material usage while ensuring product protection.

Greif Inc. (14%-18%)

Greif is known for its industrial-grade plastic liners, particularly for hazardous and chemical applications. Its leak-proof and tamper-resistant designs enhance safety and compliance with regulatory standards.

Novolex Holdings, Inc. (10%-14%)

Novolex focuses on sustainable plastic liners, offering biodegradable, compostable, and recycled plastic solutions for retail, foodservice, and industrial applications.

International Plastics Inc. (8%-12%)

International Plastics is a leader in multi-layered plastic liner manufacturing, ensuring high moisture resistance, puncture-proof durability, and extended product shelf life.

WestRock Company (6%-10%)

WestRock integrates plastic liners into its flexible and paper-based packaging solutions, focusing on food-safe, recyclable, and lightweight designs to meet growing sustainability demands.

Other Key Players (30-40% Combined)

Several emerging and regional manufacturers are contributing to the plastic liner market with innovative and industry-specific solutions:

Key Developments in Plastic Liner Market:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.20 billion |

| Projected Market Size (2035) | USD 7.77 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Segments Analyzed (Segment 1) | Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Others (including Polylactic Acid - PLA) |

| End-Use Industry Segments (Segment 2) | Food and Beverages, Fertilizers & Agricultural Products, Pharmaceuticals, Industrial Chemicals, Other Applications |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia & New Zealand (ANZ), GCC Countries, South Africa |

| Key Players influencing the Plastic Liner Market | Berry Global Group, RRR Supply, Inc., A-Pac Manufacturing Co., Inc., Plascon Group International Plastics Inc., American Plastics Company, Champion Plastics, Dana Poly, Inc., Shagoon Packaging Pvt. Ltd., Synpack Avonflex Pvt. Ltd., Caltex Plastics Inc. |

| Additional Attributes | Dollar sales by material type, Trends in biodegradable and sustainable plastic liners, Impact of regulatory policies on plastic usage, Growing demand in food and pharmaceutical sectors, Innovations in liner technology and materials |

The plastic liner market is categorized by material type into polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and others, including polylactic acid (PLA).

The market is segmented based on end-use industries, including food and beverages, fertilizers & agricultural products, pharmaceuticals, industrial chemicals, and other applications.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

The global plastic liner industry is projected to witness CAGR of 4.1% between 2025 and 2035.

The global plastic liner industry stood at USD 4,996.8 million in 2024.

Global plastic liner industry is anticipated to reach USD 7.77 billion by 2035 end.

East Asia is set to record a CAGR of 5.2% in assessment period.

The key players operating in the global plastic liner industry include Berry Global Group, RRR Supply, Inc., A-Pac Manufacturing Co., Inc., Plascon Group, International Plastics Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Western Europe Market Volume (MT) Forecast by Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 30: Western Europe Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (MT) Forecast by Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 38: Eastern Europe Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (MT) Forecast by Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 54: East Asia Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (MT) Forecast by Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 62: Middle East and Africa Market Volume (MT) Forecast by Capacity, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Western Europe Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 86: Western Europe Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 110: Eastern Europe Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: East Asia Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 158: East Asia Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Capacity, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Plastic Liner Industry

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA