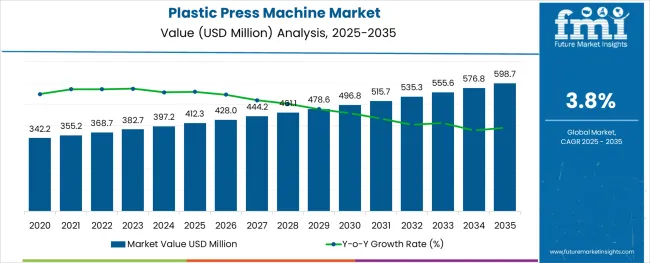

The plastic press machine market is projected to grow from USD 412.3 million in 2025 to USD 598.6 million by 2035, at a CAGR of 3.8% during the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 412.3 million |

| Industry Value (2035F) | USD 598.6 million |

| CAGR (2025 to 2035) | 3.8% |

This moderate yet steady expansion is supported by the rising demand for precision plastic forming solutions across automotive, consumer goods, and packaging industries.In 2023, over 37% of installed press machines in Asia were deployed in thermoplastic sheet processing for lightweight structural components.

By 2025, demand is expected to remain concentrated in China, India, and Germany, where plastic component manufacturing for automotive and consumer electronics continues to scale. Roughly 44% of units shipped globally in 2025 will be configured for thermoforming and hydraulic compression molding. Automation upgrades and the shift toward precision forming tools are influencing machine retrofits across North American and European facilities.

From 2026 to 2035, market growth will be led by packaging and medical device production, particularly in Southeast Asia and Latin America. Increased regulatory scrutiny on recycled content is prompting demand for high-tolerance forming machines capable of processing reclaimed resins.

The plastic press machine market serves as a critical niche across multiple industrial verticals. Within the USD 45 billion global plastic processing machinery sector, these machines represent 6-8%, supported by rising demand for precision forming and thermoplastics shaping.

In the USD 700 billion broader manufacturing equipment market, plastic press systems account for roughly 1-2%, mainly in packaging and electronics production. Roughly 10-12% of the injection molding machinery segment is attributed to press-type units, which are favored for their efficiency in short-cycle runs.

In the USD 300 billion packaging machinery industry, 3-4% is contributed by plastic press applications. Around 2-3% of the USD 400 billion industrial automation market is influenced by press machine integration in smart factory setups.

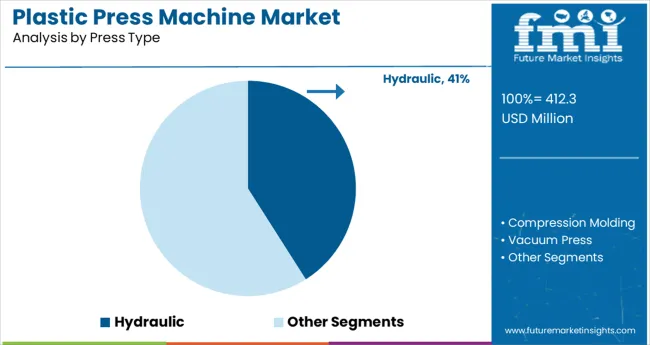

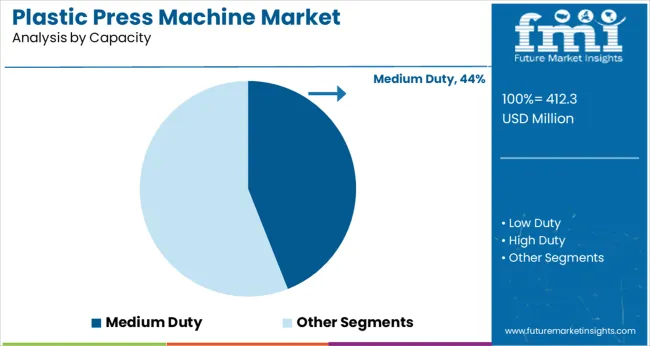

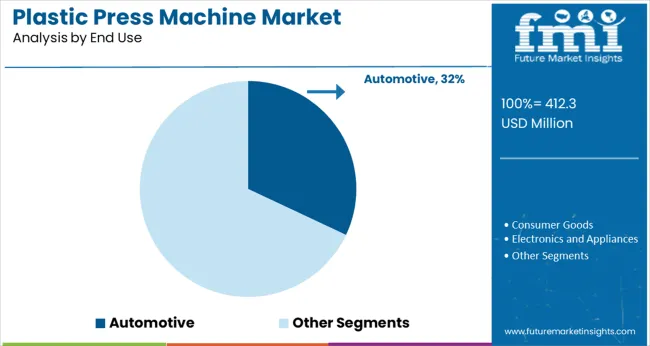

The demand for plastic press machine is expanding steadily, with hydraulic systems, medium-duty capacity machines, and automotive applications emerging as top growth areas. Manufacturers seek precision molding, energy efficiency, and automation to meet evolving industrial and automotive production standards.

Hydraulic plastic press machines are forecasted to contribute 41% of the market by 2025. Their ability to exert uniform pressure and form intricate plastic shapes makes them essential in manufacturing. These systems provide superior control, minimal material waste, and high reliability, supporting operations that require complex molding.

Medium-duty press machines are projected to hold a 44% market share by 2025. Their versatility across small to mid-sized manufacturing units makes them highly attractive. These systems deliver a combination of moderate force, reliability, and ease of maintenance, aligning with the needs of mid-tier producers.

The automotive segment is expected to account for 32% of the total market share by 2025. Increasing focus on weight reduction, design flexibility, and cost-efficiency is propelling demand for plastic press machines in this space. Press molding is key to producing durable interior and exterior parts.

The global market is advancing as manufacturers prioritize cycle time reduction, mold flexibility, and material efficiency. Servo-hydraulic and hybrid machines are gaining traction in automotive and consumer goods, while investment is shifting toward high-tonnage presses with closed-loop control for better dimensional accuracy and energy-saving production cycles.

High-Tonnage Demand Rises in Automotive Applications

Orders for plastic press machines above 800 tons surged 31% YoY, fueled by rising demand for bumper fascias, dashboards, and battery enclosures. OEMs using servo-hydraulic presses cut molding cycle time by 18% compared to traditional hydraulic systems. Part rejection rates fell by 22% after integrating real-time clamping force monitoring.

Automotive tier-1 suppliers in Germany and Mexico deployed multi-cavity molds with automated part pickers, achieving 27% throughput gains per shift. Retooling frequency was lowered by 36% with modular mold interfaces. These machines now represent over 49% of capital expenditure in high-volume auto plastic parts manufacturing across Europe, North America, and East Asia.

Hybrid Machines Gain Share in Consumer Packaging Lines

Hybrid plastic press machines with electric screw drives and hydraulic clamping accounted for 44% of unit sales in consumer packaging by mid-2025. Facilities producing cosmetic caps and dispensers reported energy savings of up to 21% per batch using these machines. Flash defect rates fell by 19% through auto-synchronized injection parameters.

Line changeovers dropped from 3.5 to 2.2 hours due to pre-programmed mold data recall. Southeast Asian converters expanded floor space productivity by 29% using vertical hybrid presses. As packaging formats diversify and margins tighten, processors are shifting toward compact, precise machines that offer repeatability, lower scrap, and reduced operating costs.

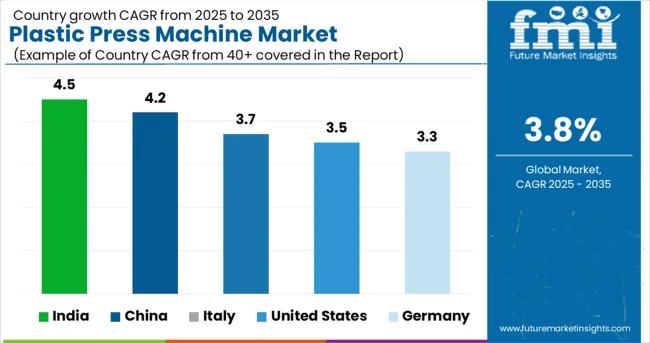

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.5% |

| China | 4.2% |

| Italy | 3.7% |

| United States | 3.5% |

| Germany | 3.3% |

The global market is expected to expand at a CAGR of 3.8% from 2025 to 2035. India outpaces this benchmark with a growth rate of 4.5%, driven by BRICS-aligned initiatives in plastics processing and domestic manufacturing demand. China follows with a 4.2% CAGR, supported by capacity expansions and export-focused machine tooling.

Both BRICS countries exceed the global average, reflecting their alignment with cost-sensitive automation. The USA, part of the OECD group, registers a slightly below-average growth of 3.5%, tempered by mature production bases and slower equipment upgrades.

Italy records 3.7%, nearly matching the global trend, while Germany, also in the OECD, lags with 3.3%, suggesting moderate replacement cycles and stringent sustainability regulations. The regional performance gap underscores how market dynamism in Asia is being met with cautious investment across developed European economies. The divergence is expected to persist over the forecast period.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India is projected to expand at a CAGR of 4.5% from 2025 to 2035. Between 2020 and 2024, demand centered on low-cost hydraulic presses for rigid packaging and furniture manufacturing. Moving into the next decade, increased precision requirements in medical molding and electronics are accelerating demand for servo-electric machines. Equipment imports from Taiwan and Germany have surged, especially in Pune and Chennai clusters.

China is expected to grow at a CAGR of 4.2% from 2025 to 2035. From 2020 to 2024, the market was led by the packaging and FMCG sectors. In contrast, the forecast period is shaped by automotive component suppliers and EV battery casing manufacturers upgrading to fully automated machines. Domestic brands are enhancing their exports to Southeast Asia.

Italy is forecast to witness a CAGR of 3.7% during the 2025 to 2035 period. Earlier demand was largely from irrigation pipe and basic consumer plastic production. More recently, manufacturers of medical disposables and food-grade plastics are seeking ultra-clean, energy-efficient machines. Specialty production lines are now looking for modular, hybrid servo presses.

The United States is anticipated to record a CAGR of 3.5% between 2025 and 2035. In the 2020-2024 period, the segment was dominated by medium-duty presses in consumer and general industrial molding. Currently, growing defense procurement and life sciences sectors are fueling investments in smart, multi-injection machines.

Germany is set to achieve a CAGR of 3.3% through 2035. From 2020 to 2024, press machine demand was driven by education institutes and small toolrooms. The next decade is expected to favor automotive lightweighting and industrial electronics manufacturing, with buyers preferring fully integrated, energy-recovering systems.

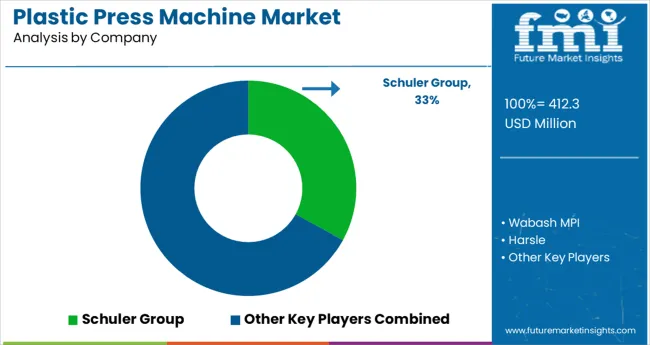

The global market is moderately consolidated, with global firms like Schuler Group (Andritz Schuler), Trinks Inc., and Arburg GmbH dominating high-performance segments. Schuler holds the leading position, capturing an estimated 33% global market share, driven by its comprehensive metal and plastic press systems, especially in high-tonnage and servo-driven applications. Trinks Inc. specializes in hydraulic presses for thermoplastics and thermosets, catering primarily to North American packaging and automotive clients.

Arburg GmbH brings strength in modular injection press systems, targeting precision molding in electronics and medical sectors. Mid-tier players like Wabash MPI and Harsle focus on laboratory and low-tonnage industrial applications. Technological upgrades such as energy-efficient servos, precision pressure control, and remote diagnostics are key differentiators across tiers.

Recent Plastic Press Machine Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 412.3 million |

| Projected Market Size (2035) | USD 598.6 million |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Press Types Analyzed (Segment 1) | Hydraulic, Compression Molding, Vacuum Press, Servo Hydraulic |

| Capacities Analyzed (Segment 2) | Low Duty, Medium Duty, High Duty, Ultra High Duty |

| End Uses Analyzed (Segment 3) | Automotive, Consumer Goods, Electronics & Appliances, Packaging, Other Industrial Sectors |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Schuler Group, Arburg GmbH, Wabash MP I, Harsle, Cosmos, Trinks Inc. |

| Additional Attributes | Dollar sales by press type and end use, rising demand for precision forming in plastic packaging, increased automation in compression and servo hydraulic systems, and sustained growth across automotive and electronics sectors. |

Classified into hydraulic, compression molding, vacuum press, and servo hydraulic types based on operational mechanism.

Divided into low duty, medium duty, high duty, and ultra-high duty machines according to force and output performance.

Utilized in automotive, consumer goods, electronics & appliances, packaging, and other industrial sectors.

Analyzed across North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is valued at USD 412.3 million in 2025.

The market is forecasted to reach USD 598.6 million by 2035, reflecting a CAGR of 3.8%.

Medium duty machines will lead the capacity segment, accounting for 44% of the global market share in 2025.

Automotive applications will dominate the end-use segment with a 32% share in 2025.

India is projected to grow at the fastest rate, with a CAGR of 4.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA