The plastic jar industry in the United States is witnessing steady expansion driven by evolving consumer packaging preferences, advancements in material technology, and strong demand across food, beverage, and personal care sectors. Current market conditions are influenced by the growing need for lightweight, cost-effective, and recyclable packaging solutions. The industry is benefiting from increasing retail penetration and the rise of e-commerce, which have boosted the demand for durable and transparent packaging formats.

Regulatory emphasis on sustainability is encouraging the adoption of recyclable resins and eco-friendly manufacturing practices. Manufacturers are focusing on improving design flexibility, product safety, and visual appeal to align with brand differentiation strategies.

The future outlook is supported by continued urbanization, rising consumption of packaged goods, and technological progress in blow molding and barrier protection The growth rationale rests on the ability of producers to balance performance, cost, and environmental compliance while meeting diverse end-use requirements, ensuring consistent market growth across both consumer and industrial packaging domains.

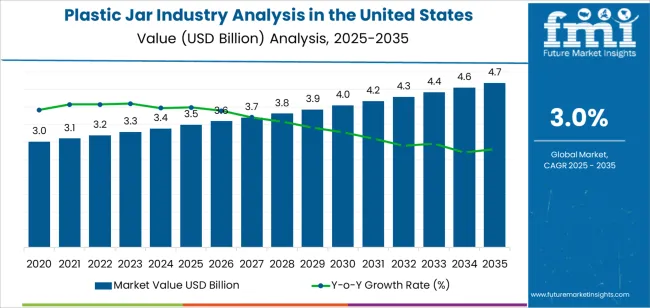

| Metric | Value |

|---|---|

| Plastic Jar Industry Analysis in the United States Estimated Value in (2025 E) | USD 3.5 billion |

| Plastic Jar Industry Analysis in the United States Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

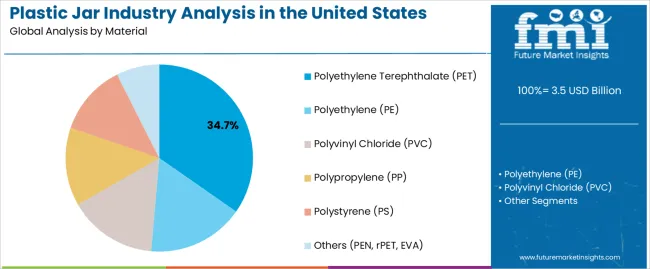

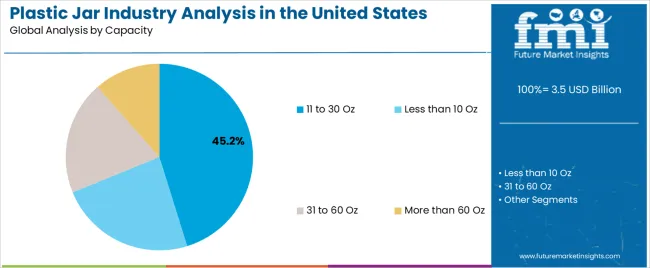

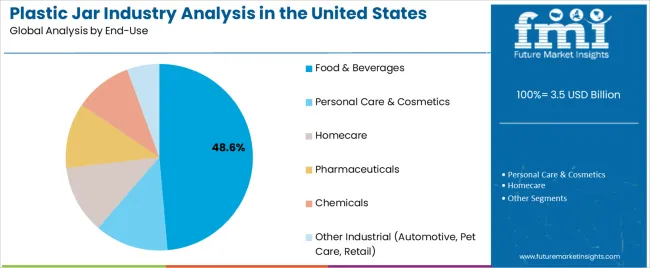

The market is segmented by Material, Capacity, and End-Use and region. By Material, the market is divided into Polyethylene Terephthalate (PET), Polyethylene (PE), Polyvinyl Chloride (PVC), Polypropylene (PP), Polystyrene (PS), and Others (PEN, rPET, EVA). In terms of Capacity, the market is classified into 11 to 30 Oz, Less than 10 Oz, 31 to 60 Oz, and More than 60 Oz. Based on End-Use, the market is segmented into Food & Beverages, Personal Care & Cosmetics, Homecare, Pharmaceuticals, Chemicals, and Other Industrial (Automotive, Pet Care, Retail). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene terephthalate (PET) segment, accounting for 34.70% of the material category, has been leading the market due to its superior clarity, strength, and recyclability. Its lightweight nature and resistance to impact make it ideal for food, beverage, and household packaging applications.

The dominance of PET is being reinforced by increasing adoption of sustainable packaging solutions that align with circular economy principles. Technological enhancements in resin formulation and recycling infrastructure have improved cost efficiency and quality retention, encouraging broader usage across multiple industries.

Demand stability has been further supported by the material’s regulatory approval for direct food contact and its compatibility with existing filling and labeling systems With growing brand emphasis on eco-friendly packaging and the continued push for post-consumer recycled PET integration, the segment is expected to maintain its leadership position over the forecast period.

The 11 to 30 Oz segment, holding 45.20% of the capacity category, has emerged as the most prominent due to its versatility across a broad range of packaging applications. This capacity range caters effectively to both single-use and family-size product formats, ensuring optimal shelf appeal and ease of handling for consumers. Market dominance is supported by its widespread utilization in food, beverage, and personal care packaging, where portion control and convenience remain key drivers.

Manufacturers have optimized production lines for this capacity range to achieve high throughput and cost efficiency. The segment’s growth is being reinforced by the proliferation of ready-to-eat foods, sauces, and nutraceutical products, alongside increasing demand from online retail packaging.

Its adaptability to various closure systems and labeling formats has further strengthened its position, ensuring sustained preference within the U.S plastic jar market.

The food and beverages segment, representing 48.60% of the end-use category, has remained dominant due to consistent consumption trends and expanding product diversification. The demand for plastic jars in this segment is being driven by the need for safe, lightweight, and resealable packaging suitable for items such as condiments, snacks, dairy, and nutritional products.

Enhanced product protection and extended shelf life offered by plastic jars have supported their growing use among manufacturers seeking packaging that balances functionality with cost effectiveness. The segment’s expansion is further supported by the rise in processed and convenience foods and the preference for transparent packaging that enhances product visibility.

Continued innovation in barrier properties and compatibility with sustainable materials is expected to reinforce the leadership of the food and beverages category, ensuring long-term growth across retail and institutional packaging applications.

| Historical CAGR (2020 to 2025) | 2.6% |

|---|---|

| Forecast CAGR (2025 to 2035) | 3.0% |

Increasing Adoption of Food-grade Plastic Jars in the Food Industry

The food industry is highly controlled by regulatory authorities. It is also subjected to stringent rules related to packaging materials. These rules have generated a high demand for food-grade plastic jars in the United States.

Food-grade plastic jars are safe to use for food packaging. At the same time, these jars help fulfill the requirements of regulatory authorities, ensuring safe and secure food packaging. This compliance has been contributing to increasing demand for food-grade small plastic containers with lids in the food industry.

Food-grade plastic jars further allow for the maintenance of the quality, freshness, and flavor of food items. The inertness of plastic jars helps in preventing any leaching or interaction. This ensures the contents remain unattained and maintains the quality of packaged food products.

Food-grade plastic jars also offer versatility in packaging and accommodate several food products such as spices, condiments, sauces, and snacks. The vast adaptability of plastic jars with different shapes and sizes provides flexibility to manufacturers meeting diverse product packaging needs.

Food-grade plastic jars with barrier properties are gaining high popularity. Round plastic containers with lids aid ineffective food protection and preservation from external factors, which contributes to extending the shelf life of food products and reducing food waste.

Expansion of Cosmetics and Personal Care Industry

The personal care and cosmetics industry is a prominent consumer of plastic jars in the United States. The industry significantly relies on premium and aesthetic presentation.

Plastic jar packaging allows for the provision of innovative designs, different shapes, and vibrant colors. These help fulfill today’s consumers' demand for visually appealing packaging, thereby enhancing product value.

Clear plastic containers with lids have effective barrier properties that protect unique formulations from external factors. The protection offered by plastic jars increases the shelf life of products and ensures that high-quality products are supplied.

Rising demand for durable and protective packaging in the cosmetics and personal care industry is driving the application of plastic jars. As convenience has taken the front stage, plastic jars with user-friendly dispensing lids are gaining popularity. The requirement for user-friendly packaging and precision dosing is fulfilled by plastic jars, which contributes to industry growth.

| Particular | Value CAGR |

|---|---|

| H1 | 3.2% (2025 to 2035) |

| H2 | 2.6% (2025 to 2035) |

| H1 | 3.5% (2025 to 2035) |

| H2 | 2.8% (2025 to 2035) |

The section below shows the PET segment dominating based on material. It is forecast to thrive at 3.2% CAGR between 2025 and 2035. Based on end-use, the personal care & cosmetics segment is set to exhibit a CAGR of 4.4% during the forecast period.

Industry Growth Outlook by Material

| Material | Value CAGR (2025 to 2035) |

|---|---|

| PET | 3.2% |

| PE | 2.6% |

Industry Growth Outlook by End-use

| End-use | Value CAGR (2025 to 2035) |

|---|---|

| Food & Beverages | 2.9% |

| Personal Care & Cosmetics | 4.4% |

Food and Beverage Industry to Look for Sturdy Plastic Jars

Sustainability has become a top priority for consumers, and plastic jar manufacturers are responding by adopting environmentally friendly practices. Manufacturers are using recycled materials, reducing packaging waste, and exploring biodegradable or compostable options.

Sustainable packaging options, including refillable jars and bulk packaging options, are becoming more prevalent. Recent activities of industry players operating in the United States plastic jar industry are:

| Attribute | Details |

|---|---|

| Estimated Industry Valuation (2025) | USD 3,385.8 million |

| Projected Industry Valuation (2035) | USD 4,567.7 million |

| Anticipated Growth Rate (2025 to 2035) | 3.0% |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Capacity, End-use, Sub Region |

| Key Country Covered | Northwest, Southwest, West, Southeast, Midwest |

| Key Companies Profiled | Amcor Plc; Berry Global Inc.; ALPLA Group; Pretium Packaging, LLC; Silgan Holdings Inc.; TRICORBRAUN; Graham Packaging Company; Comar LLC; Gerresheimer AG; PACT Group; Taral Plastics, Inc.; Altium Packaging; Tim Plastics, Inc.; Thornton Plastics Co. |

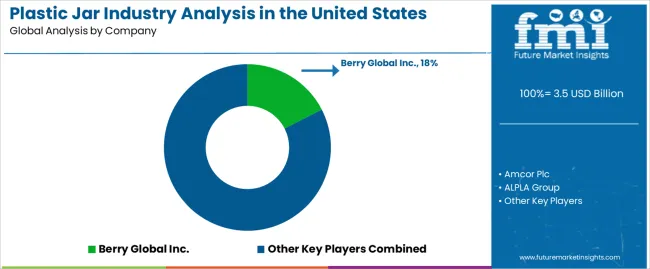

The global plastic jar industry analysis in the united states is estimated to be valued at USD 3.5 billion in 2025.

The market size for the plastic jar industry analysis in the united states is projected to reach USD 4.7 billion by 2035.

The plastic jar industry analysis in the united states is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in plastic jar industry analysis in the united states are polyethylene terephthalate (pet), polyethylene (pe), _ldpe, _hdpe, polyvinyl chloride (pvc), polypropylene (pp), polystyrene (ps) and others (pen, rpet, eva).

In terms of capacity, 11 to 30 oz segment to command 45.2% share in the plastic jar industry analysis in the united states in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Solenoid Valve Market Growth – Trends & Forecast 2024-2034

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Growth – Trends & Forecast 2024-2034

U.S. Phlebotomy Equipment Market Analysis – Trends, Growth & Forecast 2024-2034

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

End-of-line Packaging Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

United States Distributed Antenna System (DAS) Market Growth – Trends & Forecast 2024-2034

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

United States Cold Laser Therapy Market Outlook – Trends, Demand & Forecast 2025-2035

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Outbound Travel Industry Analysis in the United Kingdom Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA