United States market, in cold laser therapy are significantly expanding. With rate of 3.8%, the market will reach to 66.6 million in 2035 from 45.7 million in 2025.

| Attributes | Values |

|---|---|

| Estimated United States Industry Size (2025) | USD 45.7 million |

| Projected United States Value (2035) | USD 66.6 million |

| Value-based CAGR (2025 to 2035) | 3.8% |

Cold laser therapy’s abilities are acknowledged in sectors like healthcare, sports medicine, and physiotherapy, thus, being a multifunctional and preferred option. Its popularity has been due to the growing populations of chronic pain, musculoskeletal disorders, and sports injury patients in the USA-the primary cold laser therapy populations.

While health care professionals increasingly are looking toward cold laser therapy, it has become an attractive option that provides treatment efficacy without the risks of surgery or medications. Technologies developed, including portable devices and combination therapy units, add more features to clinicians' and patients' usability.

The greater preference of patients in the USA for non-invasive treatments largely boosts demand for portable laser therapy equipment. As such, this trend is driving adoption in clinic and into the home.

Awareness of the beneficial effects of cold laser therapy improved among the patients and the healthcare workers which in turn resulted in a rise in the use of it in the treatment of pain and in the sports medicine domain.

The market expansion is also being driven by innovations in laser technology such as cold laser devices, including portable systems, wearables, multi-wavelength lasers, etc. that make therapy less expensive and more effective.

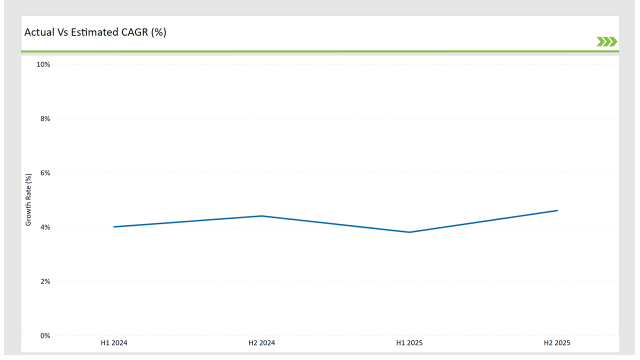

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States cold laser therapy market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The cold laser therapy sector for the United States market is expected to rise at 4.0% growth rate in the first half of 2024, which will increase to 4.4% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 3.8% in H1 but is expected to rise to 4.6% in H2.

This pattern shows a decline of 20.0 basis points from the first half of 2023 to the first half of 2025, while in the second half of 2024, it is higher by 13.7 basis points compared to the second half of 2024.

The nature of the United States cold laser therapy market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: Apira Science Inc. focuses on expanding its presence in the global market by increasing its research and development activities. It also focuses on gaining patents and approvals from various organizations for its research. |

| 2024 | Collaboration: B-Cure Laser Australia (Good Energies Ltd.) focuses on collaborating or partnering with different companies or media partners.. |

| 2024 | Expansion: Erchonia Corporation focuses on expanding its presence in the global market. |

Increased Usage in Sports Medicine and Rehabilitation

These days, sportsmen and physically active people use cold laser therapy to recover from injuries faster and become stronger. The fact that it encourages faster healing, lessens inflammation, and improves blood flow gives it a robust place in the sporting arena.

Introduction of Portable and Wearable Devices

The tech sector has successfully advanced the cold laser unit to practical sizes, such that handheld units for in-house home use become possible for its users. Such devices flood the market, making it conceivable and accessible for consistent and effective therapy.

Patient-Centered Care Gaining Significance

Patient-centered care is a clear priority for USA healthcare providers, and treatment with cold laser therapy is a good fit for this model. The therapy can be adapted to the particular conditions of patients thus ensuring improved outcomes and more patient satisfaction.

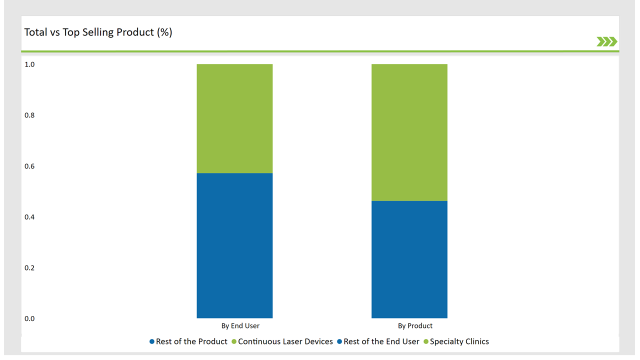

% share of Individual categories by Product Type and End User in 2025

Continuous laser devices records significant surge in cold laser therapy market

Continuous laser devices dominate the USA cold laser therapy market due to their effectiveness in offering high precision, rapid treatment times, efficacy in pain management, and tissue healing. These devices provide a continuous laser output and thus guarantee optimal therapeutic outcome for both acute and chronic conditions.

The large end-user segment of the USA cold laser therapy market is specialty clinics, which play a crucial role in providing targeted pain management and rehabilitation services. Specialty clinics prefer continuous laser devices due to their superior ability to treat sports injuries, arthritis, neuropathy, and post-surgical recovery.

Additionally, the increasing preference for non-pharmaceutical pain relief amid concerns over opioid dependency has boosted demand for cold laser therapy in specialized clinical settings.

Note: above chart is indicative in nature

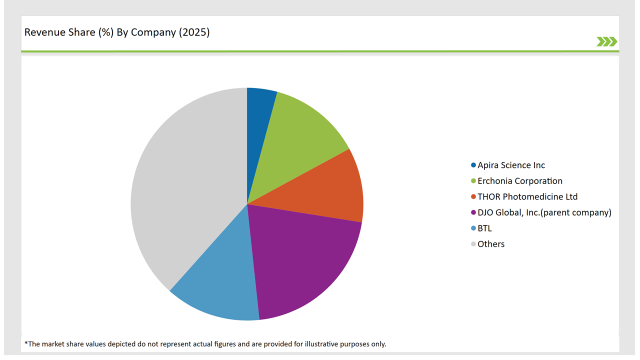

Some key players operating in the USA cold laser therapy market are Erchonia Corporation, DJO Global, Inc., BTL, THOR Photomedicine Ltd, and BioLight Technologies LLC. These key players hold a major market share of the USA cold laser therapy market owing to continuous technological advancements and expansion of their therapeutic use.

These Tier 1 companies are significantly investing in R&D to develop very efficient LLLT devices for both medical and home-use applications. The strict regulations by the USA FDA and the growing demand for evidence-based treatment solutions have driven these companies to strive for clinically validated, high-precision, FDA-cleared products, ensuring their products meet strict medical device standards in the country.

Meanwhile, Tier 2 companies like Irradia, Omega Laser Systems, and Multi Radiance Medical are finding their niche by offering cost-effective yet high-performance solutions, thus making cold laser therapy more accessible across mid-sized clinics to home care settings.

The industry includes various product type such as Continuous Laser Devices Pulse Laser Devices and Combination Laser Devices

The industry includes various materials such as single wavelength cold laser therapy devices, multiple wavelength cold laser therapy devices.

The industry includes various indications such as pain management, arthritis wound healing, nerve regeneration, dermatology, musculoskeletal and others

Available in end user like hospitals, specialty clinics, ambulatory surgical centers, and homecare settings.

The market is expected to grow at a CAGR of 3.8% from 2025 to 2035.

Continuous laser devices are the leading products in the market.

Key players include Apira Science Inc, BioLight Technologies LLC, B-Cure laser Australia, Erchonia Corporation, Theralase Inc., THOR Photomedicine Ltd, DJO Global, Inc., BTL, Spectro Analytic Irradia AB, and Photomedex.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

UK Cold Laser Therapy Market Report – Size, Share & Innovations 2025-2035

United States & Canada Cold Chain Packaging Market Insights- Demand and Growth Forecast 2025 to 2035

Japan Cold Laser Therapy Market Insights – Demand, Size & Industry Trends 2025-2035

Germany Cold Laser Therapy Market Outlook – Share, Growth & Forecast 2025-2035

Australia and New Zealand Cold Laser Therapy Market Report – Trends & Innovations 2025-2035

Pharmaceutical Cold Chain Packaging Industry Analysis in United States - Size, Share, and Forecast Outlook 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA