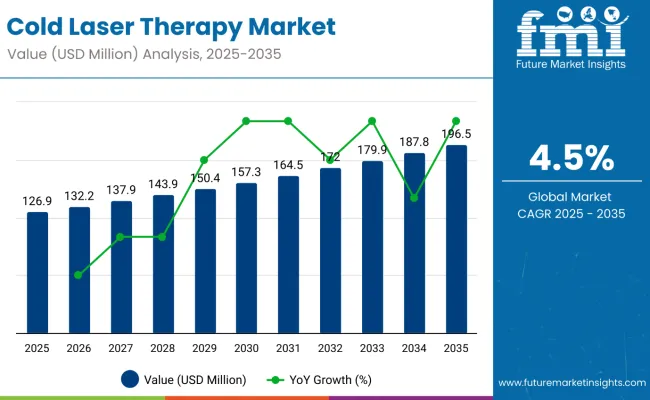

The global cold laser therapy market is worth USD 126.9 million in 2025 and is poised to rise significantly to approximately USD 196.5 million by 2035. This growth reflects a steady CAGR of 4.5% during the forecast period from 2025 to 2035. The market expansion is strongly tied to the rising prevalence of chronic musculoskeletal disorders, an aging global population, and increasing demand for non-invasive pain management therapies.

Cold laser therapy, also known as low-level laser therapy (LLLT), is rapidly gaining acceptance across medical fields for its ability to accelerate tissue repair, reduce inflammation, and manage pain without the side effects typically associated with pharmaceuticals.

One of the primary factors driving this market’s growth is the technological advancement of continuous laser devices. These systems provide superior tissue penetration and sustained therapeutic energy delivery, allowing for more effective treatment outcomes, particularly in sports injuries, rehabilitation, and post-surgical recovery.

As a result, they are highly favored by clinics and healthcare professionals. Additionally, the growing awareness among patients about the benefits of non-invasive procedures is fueling demand in developed as well as emerging economies. The proliferation of home-use Class 3B devices and the development of combination lasers for broader clinical applications, such as neurorehabilitation and dermatological disorders, are opening new avenues for market expansion.

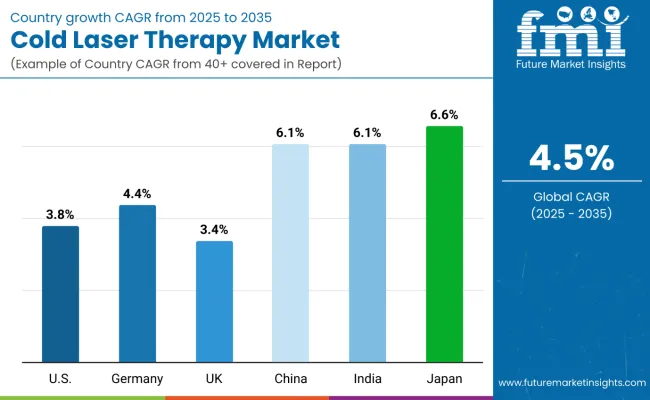

Moreover, the Asia Pacific region, particularly countries like Japan and India, is set to witness the fastest adoption rates. This is attributed to increased healthcare expenditure, growing elderly populations, and a cultural inclination towards alternative and complementary therapies. In contrast, growth in North America and Europe is comparatively moderate due to insurance coverage limitations and stringent regulatory frameworks.

The market landscape is further shaped by key players such as Erchonia Corporation, Theralase Technologies, and BioFlex Laser Therapy, who are investing heavily in FDA-cleared product development, expanding therapeutic indications, and innovating in portable and clinic-based cold laser devices.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 126.9 million |

| Industry Value (2035F) | USD 196.5 million |

| CAGR (2025 to 2035) | 4.5% |

Leading companies in the cold laser therapy market are integrating smart technologies such as real-time dosage control, digital connectivity, AI-powered treatment modes, and remote monitoring capabilities. These advancements improve treatment accuracy, patient compliance, and ease of use in both clinical and home-care settings.

Cold laser therapy devices are regulated as medical devices and must adhere to strict regional frameworks to ensure safety and effectiveness. In the United States, the Food and Drug Administration (FDA) oversees these devices, requiring premarket clearance or approval based on their risk classification. Similarly, in the European Union, such devices must comply with the Medical Device Regulation (EU MDR 2017/745) and obtain the CE mark, which confirms conformity with essential health, safety, and environmental standards. These regulations help protect patients and promote reliable treatment outcomes.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the cold laser therapy industry outlook between 2024 and 2025 on a six-month basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global cold laser therapy market from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics. H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.2%, followed by a slightly lower growth rate of 4.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H2 | 4.9% (2024 to 2034) |

| H1 | 4.5% (2025 to 2035) |

| H2 | 4.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.5% in the first half and projected to lower at 4.0% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

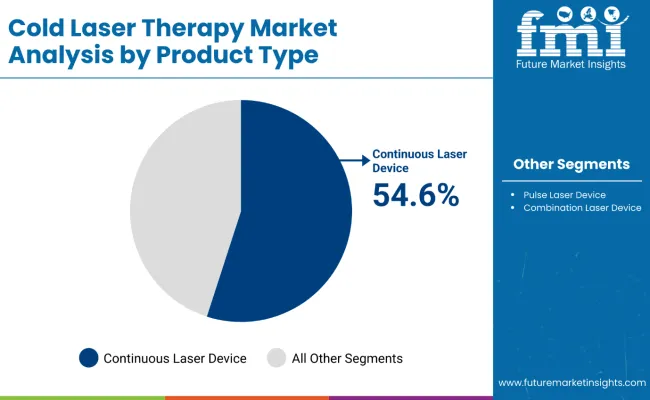

The section contains information about the leading segments in the industry. Based on product type, continuous laser devices systems are expected to account 54.6% of the global share in 2025.

| Product Type | Value Share (2025) |

|---|---|

| Continuous Laser Devices | 54.6% |

By product type, continuous laser devices will dominate the cold laser therapy market with a share of 54.6% in 2025. Continuous type lasers have emerged as the dominant product category within the cold laser treatment market due to their capabilities of providing steady and concentrated therapy for extended durations. These types of devices ensure that the light deeply penetrates tissues; such tissue penetration is necessary to effectively trigger cellular repair processes and reduce inflammation.

Besides, continuous lasers are preferred in the clinical environment for their precision in dosage control, which is just what is desired for therapeutic applications that require consistency and predictability of results. The control and reliability at this level make the continuous laser devices quite attractive, especially for medical professionals and patients after effective pain management for the long term.

| By End User | Value Share (2025) |

|---|---|

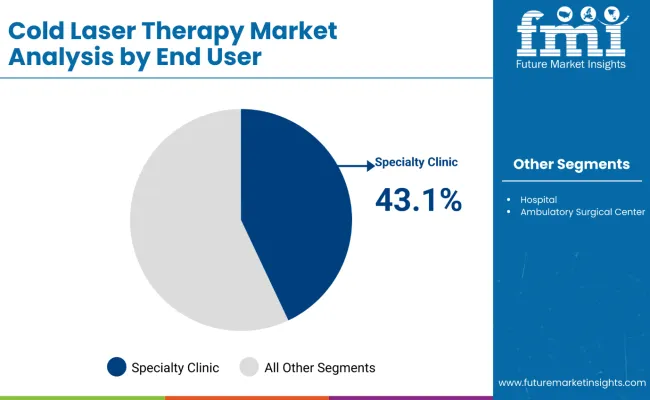

| Specialty Clinics | 43.1% |

Specialty clinics will account for 43.1% of the end user segment in 2025, and exhibit the highest CAGR in the forecast period.

Specialty clinics, such as pain management centers, physiotherapy practices, and sports rehabilitation centers, are the largest end-user segment for cold laser therapy. These are specialty clinics that focus their operations on the treatment of chronic pain, injury recovery, and musculoskeletal disorders-all indications where cold laser therapy is particularly effective.

The non-invasive nature of cold laser therapy remains one of the leading benefits for clinics and is considerably more pleasing than the idea of avoiding surgery or taking lengthy medication. Other advantages, as mentioned earlier in the report, in using cold lasers are also handled appropriately with better knowledge in these specialist clinics, enhanced to provide the best results to the patient, hence allowing the segment to expand within the market further.

Non-invasive pain management treatment has gain significant traction in recent past. Cold laser therapy is yet another modality that assists in pain relief and is widely accepted by healthcare professionals for certain categories of chronic pain. There is a wide adoption across care cold therapy devices in home care settings as it helps patients to receive treatment on continuously for a given duration according to patient needs.

After numerous studies, it has been concluded that cold laser therapy devices are more convenient and effective treatment option for pain disorders, musculoskeletal disorders, arthritis, wound care, and many other conditions. They have fewer side effects as compared to traditional methods, such as surgeries. Cold or low-level laser therapy is the best-known specific type of modulation therapy.

For instance, according to an article from NCBI, annually, USD 91 billion in medical expenses are spent on back pain disorders with an additional USD 50 billion indirect costs incurred due to the loss in productivity and disability benefit payments.

Continuous technological innovations in cold laser therapy devices continue to push this market. These newest devices have now made cold laser therapy far easier for use clinically and in a home setting-compact, small in size, and rather user-friendly.

To a large extent, therapy-at-home conveniences have revolutionized patient self-management possibilities independent of visits to traditional medical settings. For example, the ability to make adjustments at home and ease of operation have empowered patients, taking some burden off healthcare systems and giving reason for better outcomes.

Cold lasers have also been much improved by manufacturers in terms of precision and effectiveness, with developments in wavelength and power settings that permit more tailored treatments. These technological enhancements are improving therapeutic results not only for a wide range of conditions, including musculoskeletal pain, arthritis, and soft tissue injuries, but also made successful clinical trials in treating neurodegenerative disorders effectively.

Companies are working by reducing production costs and increasing device efficiency to make cold laser therapy accessible. Such convergence of technological innovation with ease of use makes cold laser therapy the most effective and convenient treatment modality and has further spread its reach to almost all patient demographics.

The growth opportunities for cold laser therapy arise from the worldwide movement towards non-invasive treatments and alternative therapies. Increasing awareness about long-term medication side effects, especially in pain management and chronic ailments, bolsters demand for drug-free solutions. Thus, cold laser therapy has grown in popularity because it fosters healing and pain with no use of pharmaceuticals and is a natural and non-addictive alternative.

Opioid crisis remains as a concern across many countries. This crisis has led to many discussions on the continuous use of pain medication and future negative impact on the patient health. This trend remains prominent in those countries where the opioid crisis has raised concern about the safety and long-term effects of pain medications. The health care systems and the Ministry of Healthcare across all countries are increasingly focusing on a cost-effective solution that can be a suitable alternative in treating chronic pain management.

This makes the opportunities for market penetration very compelling due to the Cold Laser Therapy options that can handle these needs, reducing dependence on very expensive surgical procedures and pharmaceuticals. Indeed, the market is expected to continue growing as more and more patients, along with general practitioners, start looking for alternative, non-invasive therapies for pain management and healing processes.

High initial investment has been a major restraint factor for the cold laser therapy market, as these devices, though very effective for treatment, come at high prices, which keeps many small clinics and individual practitioners who want to be participants in the healthcare sector from investing in cold laser therapy technology. This is further exacerbated by the costs related to the lack of maintenance, training, and calibration of the devices-things that may further discourage prospective buyers, especially from a region with a meager health budget.

Another challenge to the wider growth of this market is related to the lack of general insurance coverage for cold laser therapy. Most insurance companies, particularly in USA and European markets, have not included cold laser treatments within the ambit of their service reimbursement. This makes certain patients bear a substantial part of the costs out-of-pocket, preventing access to the treatment in low-income groups.

This also presents a problem in terms of wide-scale acceptance, as many people may not be able or willing to pay for therapy without reimbursement options. Market penetration is likely to get better once insurance providers become more open to covering such non-invasive treatments as cold laser therapy. Till then, though, it remains a very real financial barrier.

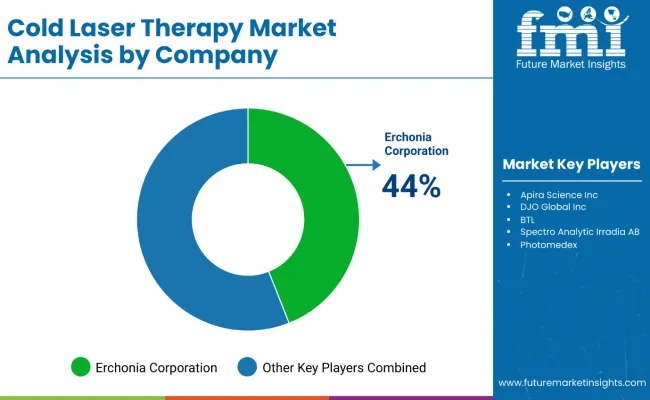

Tier 1 players in this market holds 55.2%. In the tier 1 are companies with a significant global presence, such as Apira Science Inc, B-Cure laser Australia, Erchonia Corporation, DJO Global, Inc., BTL. These companies have a diverse product portfolio, including cutting-edge cold laser devices and strong distribution networks across multiple regions. They are industry leaders, recognized for their high-quality devices and extensive research and development.

In the tier 2, companies like BioLight Technologies LLC, THOR Photomedicine Ltd, Irradia are prominent players that occupies around 18.1% market share with a solid presence in specific regional markets. These firms are often innovators, focusing on specialized solutions and catering to niche segments such as pain management and dermatological treatments.

The section below covers the cold laser therapy industry analysis for the sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 3.8% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 6.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

| Germany | 4.4% |

| UK | 3.4% |

| China | 6.1% |

| India | 6.1% |

| Japan | 6.6% |

The United States cold laser therapy market dominates the global market with a maximum share in 2024. The market exhibits a CAGR of 3.8% over the forecast period 2025 to 2035.

United States challenge on opioid crisis has brought new dimensions into healthcare practices, placing added scrutiny on pharmaceutical interventions towards chronic pain. But beyond their addictive nature, pain medications have enough side effects and long-term use issues to warrant legitimate alternative which is non-addictive and with minimal side effects.

Cold laser therapy, at this point, presents a very interesting alternative. The cold laser is extremely effective for such conditions as arthritis, sports injuries, tendinitis, and back pain without the risks associated with pharmaceuticals. This makes it especially popular among patients as a non-invasive treatment when they seek to pursue a course of pain management that does not include drugs.

Such has introduced a new frontier in pain management, with new attitudes setting a course to turn the US Health System more preventive and non-pharmaceutical. This becomes quite an especially favorable context that cold laser therapy finds fertile soil on. Under these circumstances, cold laser therapy is in a position to play an important role in managing a number of chronic pains with minimum dependence on opioids and other pharmaceuticals, while the market for non-invasive pain therapies continues to expand.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.4%.

German leadership in medical innovation stretches to cold laser therapy. More precisely, with its long-standing tradition of precision engineering, Germany is a home for a number of manufacturing companies with high-quality and state-of-the-art medical devices as their focal point. More specifically, firms from this country are competent enough to incorporate the latest laser developments into cold laser treatment devices.

This includes the development of laser wavelength, power output, and precision of treatment with the view of optimizing therapeutic effects for a variety of conditions including musculoskeletal pain, joint disorders, and soft tissue injuries.

A key driving factor for the growth of cold laser therapy in Germany is the increasing demand within the healthcare system for treatment without invasion. Considering the robustness of the healthcare infrastructure, the belief in advanced technologies by German medical professionals continues to adopt the cold laser therapy particularly for rehabilitation and physiotherapy purposes.

New, very effective, and inexpensive portable devices have greatly enhanced the accessibility of this therapy, allowing it to be employed not only in the hospital setting but also in outpatient clinics and even home care.

Preciseness and efficiency are the characteristics of German medical devices, and this corresponds with the growing interest in non-invasive treatments around the world. This trend, combined with an already established medical device industry in Germany, is very likely to further spur the market for cold laser therapy in the country as the demand for more advanced, efficient, and user-friendly devices rises.

India occupies a leading value share in South Asia & Pacific market in 2024 and is expected to grow with a CAGR of 6.1% during the forecasted period.

Most specifically, India is experiencing significant demand within its healthcare market for non-invasive, affordable pain management treatments, with chronic pain and musculoskeletal disorders being on the rise. The country also has a growing middle class increasingly interested in alternatives to invasive procedures; therefore, cold laser therapy has gained acceptance as an effective option that is drug-free.

Adverse side effects of medicines involved in conventional treatments or high costs of surgical interventions have led many patients towards the treatment of cold laser therapy. The modality of treatment being non-invasive, safe, and inexpensive, and the easy integration of therapy into one's daily routine means lesser number of visits one has to make to clinics.

Also, the transition of India toward preventive health care is one factor in cold laser therapy's growth. With growing awareness among people for alternative therapies, especially among the younger, health-conscious population, cold laser therapy is placed as a proactive treatment to avoid bigger medical conditions and surgeries. This is the reason why demand is on the rise not only in pain management centers but also in wellness and fitness clinics, where people seek non-pharmacological ways of managing pain and enhancing recovery.

The competitive landscape of the cold laser therapy market is characterized by the presence of several key players, including both established medical device manufacturers and emerging companies focused on innovative technologies. Major players such as Erchonia Corporation, Theralase Inc., and Apira Science Inc. are leading the market with advanced laser devices, while smaller companies are increasingly entering the space, offering specialized products.

Competitive strategies primarily revolve around technological innovation, product differentiation, and expanding applications, with a growing emphasis on affordability and accessibility.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 126.9 million |

| Projected Market Size (2035) | USD 196.5 million |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| By Product Type | Continuous laser devices, Pulse laser devices, and Combination Laser Devices |

| By Technology | Single Wavelength Cold Laser Therapy Devices and Multiple Wavelength Cold Laser Therapy Devices |

| By Applications | Pain Management, Arthritis, Wound Healing, Nerve Regeneration, Dermatology, and Musculoskeletal |

| By End User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Homecare Settings |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Apira Science Inc, BioLight Technologies LLC, B-Cure Laser Australia, Erchonia Corporation, Theralase Inc., THOR Photomedicine Ltd, DJO Global, Inc., BTL, Spectro Analytic Irradia AB, Photomedex |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

In terms of product type, the industry is divided into continuous laser devices, pulse laser devices, and combination laser devices.

In terms of technology, the industry is divided into single wavelength cold laser therapy devices and multiple wavelength cold laser therapy devices

In terms of application, the industry is divided into pain management, arthritis, wound healing, nerve regeneration, dermatology, musculoskeletal, and others

In terms of end user, the industry is segregated into hospitals, specialty clinics, ambulatory surgical centers and homecare settings.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global cold laser therapy industry is projected to witness CAGR of 4.5% between 2025 and 2035.

The global cold laser therapy industry stood at USD 121.9 million in 2024.

The global cold laser therapy industry is anticipated to reach USD 196.5 million by 2035 end.

China is expected to show a CAGR of 6.1% in the assessment period.

The key players operating in the global cold laser therapy industry include Apira Science Inc, BioLight Technologies LLC, B-Cure laser Australia, Erchonia Corporation, Theralase Inc., THOR Photomedicine Ltd, DJO Global, Inc., BTL, Spectro Analytic Irradia AB, and Photomedex

Table 01: Global Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 03: Global Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 04: Global Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 05: Global Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Table 06: North America Market Value (US$ million) Analysis 2016 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 09: North America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 10: North America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 11: North America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Table 12: Latin America Market Value (US$ million) Analysis 2016 to 2022 and Forecast 2023 to 2033, by Country

Table 13: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 14: Latin America Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 15: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 16: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 17: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Table 18: Europe Market Value (US$ million) Analysis 2016 to 2022 and Forecast 2023 to 2033, by Country

Table 19: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 20: Europe Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 21: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 22: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 23: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Table 24: South Asia Market Value (US$ million) Analysis 2016 to 2022 and Forecast 2023 to 2033, by Country

Table 25: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 26: South Asia Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 27: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 28: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 29: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Table 30: East Asia Market Value (US$ million) Analysis 2016 to 2022 and Forecast 2023 to 2033, by Country

Table 31: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 32: East Asia Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 33: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 34: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 35: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Table 36: Oceania Market Value (US$ million) Analysis 2016 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 38: Oceania Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 39: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 40: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 41: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Table 42: MEA Market Value (US$ million) Analysis 2016 to 2022 and Forecast 2023 to 2033, by Country

Table 43: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Product

Table 44: MEA Market Volume (Units) Analysis and Forecast 2016 to 2033, by Product

Table 45: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Application

Table 46: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2033, by Technology

Table 47: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2033, by End User

Figure 01: Global Market Volume (Units), 2016 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis,

Figure 03: Cold Laser Therapy, Pricing Analysis per unit (US$), in 2023

Figure 04: Cold Laser Therapy, Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ million) Analysis, 2016 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ million) Analysis, 2022 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Application

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Technology

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Technology

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Technology

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by End User

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 20: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 22: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 23: North America Market Value (US$ million) Analysis, 2016 to 2022

Figure 24: North America Market Value (US$ million) Forecast, 2023 to 2033

Figure 25: North America Market Value Share, by Product (2023 E)

Figure 26: North America Market Value Share, by Application (2023 E)

Figure 27: North America Market Value Share, by Technology (2023 E)

Figure 28: North America Market Value Share, by End User (2023 E)

Figure 29: North America Market Value Share, by Country (2023 E)

Figure 30: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 31: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 32: North America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 33: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 34: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 35: The USA Market Value Proportion Analysis, 2022

Figure 36: Global Vs. The USA Growth Comparison

Figure 37: The USA Market Share Analysis (%) by Product, 2022 to 2033

Figure 38: The USA Market Share Analysis (%) by Application, 2022 to 2033

Figure 39: The USA Market Share Analysis (%) by Technology, 2022 to 2033

Figure 40: The USA Market Share Analysis (%) by End User, 2022 to 2033

Figure 41: Canada Market Value Proportion Analysis, 2022

Figure 42: Global Vs. Canada. Growth Comparison

Figure 43: Canada Market Share Analysis (%) by Product, 2022 to 2033

Figure 44: Canada Market Share Analysis (%) by Application, 2022 to 2033

Figure 45: Canada Market Share Analysis (%) by Technology, 2022 to 2033

Figure 46: Canada Market Share Analysis (%) by End User, 2022 to 2033

Figure 47: Latin America Market Value (US$ million) Analysis, 2016 to 2022

Figure 48: Latin America Market Value (US$ million) Forecast, 2023 to 2033

Figure 49: Latin America Market Value Share, by Product (2023 E)

Figure 50: Latin America Market Value Share, by Application (2023 E)

Figure 51: Latin America Market Value Share, by Technology (2023 E)

Figure 52: Latin America Market Value Share, by End User (2023 E)

Figure 53: Latin America Market Value Share, by Country (2023 E)

Figure 54: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 55: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 56: Latin America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 57: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 58: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 59: Mexico Market Value Proportion Analysis, 2022

Figure 60: Global Vs Mexico Growth Comparison

Figure 61: Mexico Market Share Analysis (%) by Product, 2022 to 2033

Figure 62: Mexico Market Share Analysis (%) by Application, 2022 to 2033

Figure 63: Mexico Market Share Analysis (%) by Technology, 2022 to 2033

Figure 64: Mexico Market Share Analysis (%) by End User, 2022 to 2033

Figure 65: Brazil Market Value Proportion Analysis, 2022

Figure 66: Global Vs. Brazil. Growth Comparison

Figure 67: Brazil Market Share Analysis (%) by Product, 2022 to 2033

Figure 68: Brazil Market Share Analysis (%) by Application, 2022 to 2033

Figure 69: Brazil Market Share Analysis (%) by Technology, 2022 to 2033

Figure 70: Brazil Market Share Analysis (%) by End User, 2022 to 2033

Figure 71: Argentina Market Value Proportion Analysis, 2022

Figure 72: Global Vs Argentina Growth Comparison

Figure 73: Argentina Market Share Analysis (%) by Product, 2022 to 2033

Figure 74: Argentina Market Share Analysis (%) by Application, 2022 to 2033

Figure 75: Argentina Market Share Analysis (%) by Technology, 2022 to 2033

Figure 76: Argentina Market Share Analysis (%) by End User, 2022 to 2033

Figure 77: Europe Market Value (US$ million) Analysis, 2016 to 2022

Figure 78: Europe Market Value (US$ million) Forecast, 2023 to 2033

Figure 79: Europe Market Value Share, by Product (2023 E)

Figure 80: Europe Market Value Share, by Application (2023 E)

Figure 81: Europe Market Value Share, by Technology (2023 E)

Figure 82: Europe Market Value Share, by End User (2023 E)

Figure 83: Europe Market Value Share, by Country (2023 E)

Figure 84: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 85: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 86: Europe Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 87: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 88: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 89: The United Kingdom Market Value Proportion Analysis, 2022

Figure 90: Global Vs. The United Kingdom Growth Comparison

Figure 91: The United Kingdom Market Share Analysis (%) by Product, 2022 to 2033

Figure 92: The United Kingdom Market Share Analysis (%) by Application, 2022 to 2033

Figure 93: The United Kingdom Market Share Analysis (%) by Technology, 2022 to 2033

Figure 94: The United Kingdom Market Share Analysis (%) by End User, 2022 to 2033

Figure 95: Germany Market Value Proportion Analysis, 2022

Figure 96: Global Vs. Germany Growth Comparison

Figure 97: Germany Market Share Analysis (%) by Product, 2022 to 2033

Figure 98: Germany Market Share Analysis (%) by Application, 2022 to 2033

Figure 99: Germany Market Share Analysis (%) by Technology, 2022 to 2033

Figure 100: Germany Market Share Analysis (%) by End User, 2022 to 2033

Figure 101: Italy Market Value Proportion Analysis, 2022

Figure 102: Global Vs. Italy Growth Comparison

Figure 103: Italy Market Share Analysis (%) by Product, 2022 to 2033

Figure 104: Italy Market Share Analysis (%) by Application, 2022 to 2033

Figure 105: Italy Market Share Analysis (%) by Technology, 2022 to 2033

Figure 106: Italy Market Share Analysis (%) by End User, 2022 to 2033

Figure 107: France Market Value Proportion Analysis, 2022

Figure 108: Global Vs France Growth Comparison

Figure 109: France Market Share Analysis (%) by Product, 2022 to 2033

Figure 110: France Market Share Analysis (%) by Application, 2022 to 2033

Figure 111: France Market Share Analysis (%) by Technology, 2022 to 2033

Figure 112: France Market Share Analysis (%) by End User, 2022 to 2033

Figure 113: Spain Market Value Proportion Analysis, 2022

Figure 114: Global Vs Spain Growth Comparison

Figure 115: Spain Market Share Analysis (%) by Product, 2022 to 2033

Figure 116: Spain Market Share Analysis (%) by Application, 2022 to 2033

Figure 117: Spain Market Share Analysis (%) by Technology, 2022 to 2033

Figure 118: Spain Market Share Analysis (%) by End User, 2022 to 2033

Figure 119: Russia Market Value Proportion Analysis, 2022

Figure 120: Global Vs Russia Growth Comparison

Figure 121: Russia Market Share Analysis (%) by Product, 2022 to 2033

Figure 122: Russia Market Share Analysis (%) by Application, 2022 to 2033

Figure 123: Russia Market Share Analysis (%) by Technology, 2022 to 2033

Figure 124: Russia Market Share Analysis (%) by End User, 2022 to 2033

Figure 125: BENELUX Market Value Proportion Analysis, 2022

Figure 126: Global Vs BENELUX Growth Comparison

Figure 127: BENELUX Market Share Analysis (%) by Product, 2022 to 2033

Figure 128: BENELUX Market Share Analysis (%) by Application, 2022 to 2033

Figure 129: BENELUX Market Share Analysis (%) by Technology, 2022 to 2033

Figure 130: BENELUX Market Share Analysis (%) by End User, 2022 to 2033

Figure 131: East Asia Market Value (US$ million) Analysis, 2016 to 2022

Figure 132: East Asia Market Value (US$ million) Forecast, 2023 to 2033

Figure 133: East Asia Market Value Share, by Product (2023 E)

Figure 134: East Asia Market Value Share, by Application (2023 E)

Figure 135: East Asia Market Value Share, by Technology (2023 E)

Figure 136: East Asia Market Value Share, by End User (2023 E)

Figure 137: East Asia Market Value Share, by Country (2023 E)

Figure 138: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 139: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 140: East Asia Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 141: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 142: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 143: China Market Value Proportion Analysis, 2022

Figure 144: Global Vs. China Growth Comparison

Figure 145: China Market Share Analysis (%) by Product, 2022 to 2033

Figure 146: China Market Share Analysis (%) by Application, 2022 to 2033

Figure 147: China Market Share Analysis (%) by Technology, 2022 to 2033

Figure 148: China Market Share Analysis (%) by End User, 2022 to 2033

Figure 149: Japan Market Value Proportion Analysis, 2022

Figure 150: Global Vs. Japan Growth Comparison

Figure 151: Japan Market Share Analysis (%) by Product, 2022 to 2033

Figure 152: Japan Market Share Analysis (%) by Application, 2022 to 2033

Figure 153: Japan Market Share Analysis (%) by Technology, 2022 to 2033

Figure 154: Japan Market Share Analysis (%) by End User, 2022 to 2033

Figure 155: South Korea Market Value Proportion Analysis, 2022

Figure 156: Global Vs South Korea Growth Comparison

Figure 157: South Korea Market Share Analysis (%) by Product, 2022 to 2033

Figure 158: South Korea Market Share Analysis (%) by Application, 2022 to 2033

Figure 159: South Korea Market Share Analysis (%) by Technology, 2022 to 2033

Figure 160: South Korea Market Share Analysis (%) by End User, 2022 to 2033

Figure 161: South Asia Market Value (US$ million) Analysis, 2016 to 2022

Figure 162: South Asia Market Value (US$ million) Forecast, 2023 to 2033

Figure 163: South Asia Market Value Share, by Product (2023 E)

Figure 164: South Asia Market Value Share, by Application (2023 E)

Figure 165: South Asia Market Value Share, by Technology (2023 E)

Figure 166: South Asia Market Value Share, by End User (2023 E)

Figure 167: South Asia Market Value Share, by Country (2023 E)

Figure 168: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 169: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 170: South Asia Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 171: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 172: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 173: India Market Value Proportion Analysis, 2022

Figure 174: Global Vs. India Growth Comparison

Figure 175: India Market Share Analysis (%) by Product, 2022 to 2033

Figure 176: India Market Share Analysis (%) by Application, 2022 to 2033

Figure 177: India Market Share Analysis (%) by Technology, 2022 to 2033

Figure 178: India Market Share Analysis (%) by End User, 2022 to 2033

Figure 179: Indonesia Market Value Proportion Analysis, 2022

Figure 180: Global Vs. Indonesia Growth Comparison

Figure 181: Indonesia Market Share Analysis (%) by Product, 2022 to 2033

Figure 182: Indonesia Market Share Analysis (%) by Application, 2022 to 2033

Figure 183: Indonesia Market Share Analysis (%) by Technology, 2022 to 2033

Figure 184: Indonesia Market Share Analysis (%) by End User, 2022 to 2033

Figure 185: Malaysia Market Value Proportion Analysis, 2022

Figure 186: Global Vs. Malaysia Growth Comparison

Figure 187: Malaysia Market Share Analysis (%) by Product, 2022 to 2033

Figure 188: Malaysia Market Share Analysis (%) by Application, 2022 to 2033

Figure 189: Malaysia Market Share Analysis (%) by Technology, 2022 to 2033

Figure 190: Malaysia Market Share Analysis (%) by End User, 2022 to 2033

Figure 191: Thailand Market Value Proportion Analysis, 2022

Figure 192: Global Vs. Thailand Growth Comparison

Figure 193: Thailand Market Share Analysis (%) by Product, 2022 to 2033

Figure 194: Thailand Market Share Analysis (%) by Application, 2022 to 2033

Figure 195: Thailand Market Share Analysis (%) by Technology, 2022 to 2033

Figure 196: Thailand Market Share Analysis (%) by End User, 2022 to 2033

Figure 197: Oceania Market Value (US$ million) Analysis, 2016 to 2022

Figure 198: Oceania Market Value (US$ million) Forecast, 2023 to 2033

Figure 199: Oceania Market Value Share, by Product (2023 E)

Figure 200: Oceania Market Value Share, by Application (2023 E)

Figure 201: Oceania Market Value Share, by Technology (2023 E)

Figure 202: Oceania Market Value Share, by End User (2023 E)

Figure 203: Oceania Market Value Share, by Country (2023 E)

Figure 204: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 205: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 207: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 208: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 209: Australia Market Value Proportion Analysis, 2022

Figure 210: Global Vs. Australia Growth Comparison

Figure 211: Australia Market Share Analysis (%) by Product, 2022 to 2033

Figure 212: Australia Market Share Analysis (%) by Application, 2022 to 2033

Figure 213: Australia Market Share Analysis (%) by Technology, 2022 to 2033

Figure 214: Australia Market Share Analysis (%) by End User, 2022 to 2033

Figure 215: New Zealand Market Value Proportion Analysis, 2022

Figure 216: Global Vs New Zealand Growth Comparison

Figure 217: New Zealand Market Share Analysis (%) by Product, 2022 to 2033

Figure 218: New Zealand Market Share Analysis (%) by Application, 2022 to 2033

Figure 219: New Zealand Market Share Analysis (%) by Technology, 2022 to 2033

Figure 220: New Zealand Market Share Analysis (%) by End User, 2022 to 2033

Figure 221: Middle East & Africa Market Value (US$ million) Analysis, 2016 to 2022

Figure 222: Middle East & Africa Market Value (US$ million) Forecast, 2023 to 2033

Figure 223: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 224: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 225: Middle East & Africa Market Value Share, by Technology (2023 E)

Figure 226: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 227: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 228: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 229: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 230: Middle East & Africa Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 231: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 232: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 233: GCC Countries Market Value Proportion Analysis, 2022

Figure 234: Global Vs GCC Countries Growth Comparison

Figure 235: GCC Countries Market Share Analysis (%) by Product, 2022 to 2033

Figure 236: GCC Countries Market Share Analysis (%) by Application, 2022 to 2033

Figure 237: GCC Countries Market Share Analysis (%) by Technology, 2022 to 2033

Figure 238: GCC Countries Market Share Analysis (%) by End User, 2022 to 2033

Figure 239: Turkey Market Value Proportion Analysis, 2022

Figure 240: Global Vs. Turkey Growth Comparison

Figure 241: Turkey Market Share Analysis (%) by Product, 2022 to 2033

Figure 242: Turkey Market Share Analysis (%) by Application, 2022 to 2033

Figure 243: Turkey Market Share Analysis (%) by Technology, 2022 to 2033

Figure 244: Turkey Market Share Analysis (%) by End User, 2022 to 2033

Figure 245: South Africa Market Value Proportion Analysis, 2022

Figure 246: Global Vs. South Africa Growth Comparison

Figure 247: South Africa Market Share Analysis (%) by Product, 2022 to 2033

Figure 248: South Africa Market Share Analysis (%) by Application, 2022 to 2033

Figure 249: South Africa Market Share Analysis (%) by Technology, 2022 to 2033

Figure 250: South Africa Market Share Analysis (%) by End User, 2022 to 2033

Figure 251: North Africa Market Value Proportion Analysis, 2022

Figure 252: Global Vs North Africa Growth Comparison

Figure 253: North Africa Market Share Analysis (%) by Product, 2022 to 2033

Figure 254: North Africa Market Share Analysis (%) by Application, 2022 to 2033

Figure 255: North Africa Market Share Analysis (%) by Technology, 2022 to 2033

Figure 256: North Africa Market Share Analysis (%) by End User, 2022 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cold Laser Therapy Market Report – Size, Share & Innovations 2025-2035

Japan Cold Laser Therapy Market Insights – Demand, Size & Industry Trends 2025-2035

Germany Cold Laser Therapy Market Outlook – Share, Growth & Forecast 2025-2035

United States Cold Laser Therapy Market Outlook – Trends, Demand & Forecast 2025-2035

Australia and New Zealand Cold Laser Therapy Market Report – Trends & Innovations 2025-2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Hot and Cold Therapy Market Trends – Size, Share & Forecast 2025-2035

Endovenous Laser Therapy Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Laser Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Laser Frequency Splitting and Mode Competition Teaching Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Component Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Laser-Assisted Smart Lathes Market Size and Share Forecast Outlook 2025 to 2035

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA