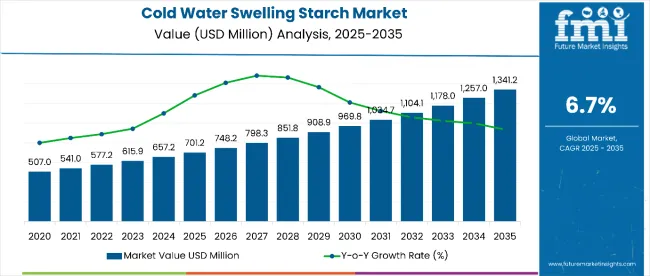

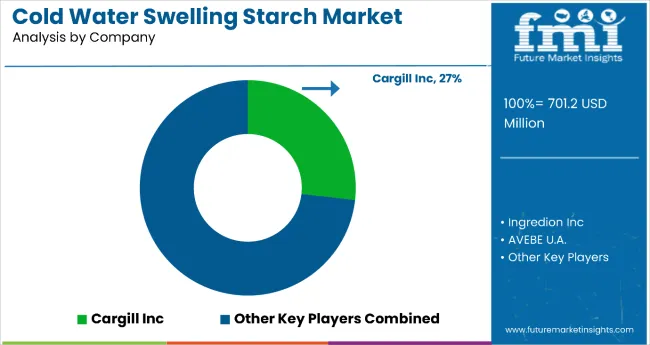

The global cold water swelling starch market is valued at USD 701.2 million in 2025 and is slated to reach approximately USD 1,341.2 million by 2035, recording an absolute increase of USD 640.0 million over the forecast period. This translates into a total growth of 91.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.7% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.91X during the same period, supported by increasing demand for biodegradable ingredients, rising adoption of clean-label food products, and growing focus on energy-efficient processing technologies.

Cold Water Swelling Starch Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 701.2 million |

| Forecast Value in (2035F) | USD 1,341.2 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

Between 2025 and 2030, the cold water swelling starch market is projected to expand from USD 701.2 million to USD 998.7 million, resulting in a value increase of USD 297.5 million, which represents 46.5% of the total forecast growth for the decade.

This phase of growth will be shaped by rising consumer demand for instant-use products, increasing adoption of sustainable processing methods, and growing penetration of convenience food products in emerging markets. Food processing companies are expanding their cold water swelling starch product portfolios to address the growing demand for multifunctional ingredient solutions.

From 2030 to 2035, the market is forecast to grow from USD 998.7 million to USD 1,341.2 million, adding another USD 342.5 million, which constitutes 53.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of sustainable sourcing practices, integration of advanced processing technologies, and development of specialized formulations for industrial applications. The growing adoption of biodegradable materials and clean-label ingredients will drive demand for premium cold water swelling starch with enhanced functionality and environmental compatibility.

Between 2020 and 2025, the cold water swelling starch market experienced steady expansion, driven by increasing consumer focus on convenience foods and growing awareness of energy-efficient processing methods. The market developed as food manufacturers recognized the need for instant-use ingredients to meet demand for ready-to-eat products and reduced processing costs. Industrial applications began emphasizing the importance of cold water swelling starch in textile sizing and adhesive manufacturing for maintaining production efficiency.

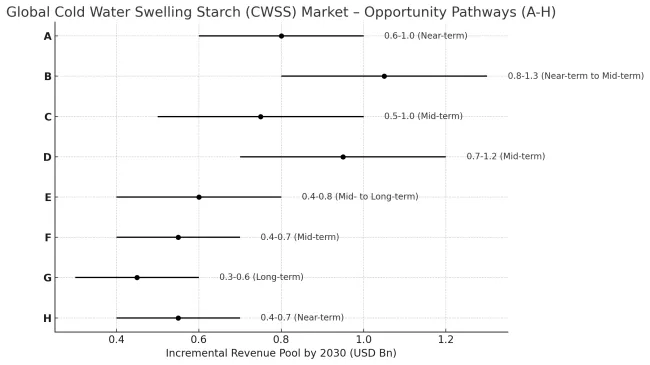

The coming years are transformative for cold water swelling starch. Manufacturers, food formulators, and industrial users are converging on one theme: functional, clean, and energy-efficient ingredients. As consumers demand instant-use, minimally processed, clean-label products, and industries seek sustainable formulations with lower heat / energy demand, CWSS becomes a key enabler. Innovations in source, modification, and regionally localized production further amplify opportunity. Altogether, these eight pathways may unlock around USD 3.5-6.0 billion in incremental revenue by 2033-35.

Market expansion is being supported by the increasing demand for biodegradable and energy-efficient processing solutions across food and industrial applications. Modern manufacturers are increasingly focused on cost-effective ingredients that can reduce energy consumption during production while maintaining product quality and functionality. Cold water swelling starch's proven efficacy in eliminating heat treatment requirements and supporting instant product preparation makes it a preferred ingredient in convenience food formulations.

The growing emphasis on clean-label and sustainable ingredients is driving demand for cold water swelling starch derived from natural sources such as potato, corn, and cassava. Consumer preference for instant and ready-to-eat products that combine convenience with natural ingredient profiles is creating opportunities for innovative formulations. The rising adoption of sustainable manufacturing practices and environmental regulations is also contributing to increased product adoption across food processing and industrial applications.

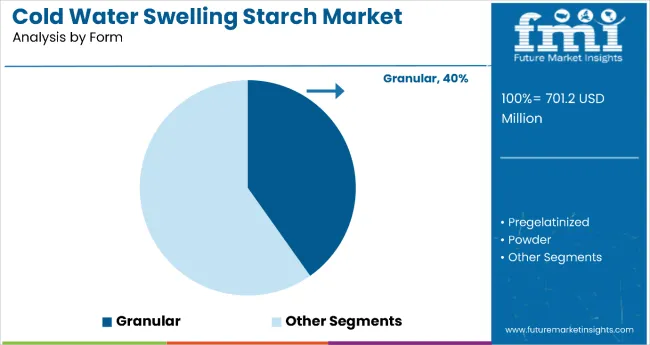

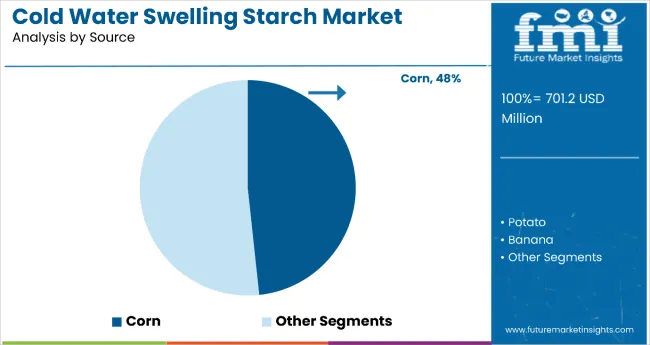

The market is segmented by form, source, application, process, and region. By form, the market is divided into granular, pregelatinized, and powder. Based on source, the market is categorized into banana starch, chickpeas starch, potato starch, corn starch, cassava starch, tapioca starch, rice starch, wheat starch, and other sources. In terms of application, the market is segmented into food, clinical nursing homes to thicken foods, dairy, bakery, convenience, ready-to-eat or instant dessert, snacks, edible fillings, pharmaceutical, textile sizing, adhesive making, and other applications. By process, the market is classified into spray cooking and drum-dried. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The granular form is projected to account for 40% of the cold water swelling starch market in 2025, reaffirming its position as the category's preferred format. Consumers and manufacturers increasingly understand the benefits of granular starch, including superior dispersibility, excellent texturizing properties, and streamlined processing without heat treatment requirements. Granular cold water swelling starch directly addresses processing efficiency concerns by providing immediate functionality upon mixing with cold water.

This form represents the foundation of most industrial applications, as it offers the most versatile and cost-effective solution for manufacturers seeking instant functionality. The granular segment is projected to grow at a CAGR of 7.4% through 2035, driven by its compatibility with automated processing systems and ability to maintain product stability. With manufacturing processes demanding greater efficiency and reduced energy consumption, granular form aligns with both operational and sustainability goals, making it the central growth driver of cold water swelling starch demand.

Corn starch is projected to represent 48% of cold water swelling starch demand in 2025, underscoring its role as the dominant raw material source for instant starch production. Manufacturers gravitate toward corn-based starch for its wide availability, cost-effectiveness, and neutral taste profile that works across diverse food applications. Positioned as a reliable and scalable ingredient, corn starch offers both functional benefits, such as excellent thickening properties, and economic advantages, including established supply chains and consistent quality.

The segment is supported by corn's superior processing characteristics and compatibility with various modification processes. Additionally, manufacturers are increasingly combining corn-based cold water swelling starch with other functional ingredients to enhance performance in specific applications like instant desserts and convenience foods. As ingredient-conscious manufacturers prioritize reliability and cost-efficiency, corn-based cold water swelling starch will continue to dominate supply chains, reinforcing its leadership position within the global starch ingredients market.

The cold water swelling starch market is advancing rapidly due to increasing demand for energy-efficient processing solutions and growing adoption of convenience food products. However, the market faces challenges including limited raw material availability in certain regions, competition from conventional heat-processed starches, and fluctuating agricultural commodity prices. Innovation in sustainable sourcing practices and specialized formulation development continue to influence product advancement and market expansion patterns.

Expansion of Clean-Label and Natural Ingredient Trends

The growing consumer preference for clean-label products is driving demand for cold water swelling starch derived from natural sources. Manufacturers are responding by developing transparent ingredient profiles and sustainable sourcing practices. This trend is particularly strong in food applications where consumers seek recognizable ingredients with minimal processing. Clean-label positioning also supports premium pricing strategies and brand differentiation in competitive markets.

Integration of Sustainable Processing Technologies and Cost Optimization

Modern cold water swelling starch manufacturers are adopting sustainable processing methods that reduce energy consumption and waste generation during production. These technologies improve operational efficiency while meeting environmental sustainability goals. Advanced processing techniques also enable the development of specialized formulations for specific industrial applications, enhancing product performance and expanding market opportunities across food, textile, and adhesive industries.

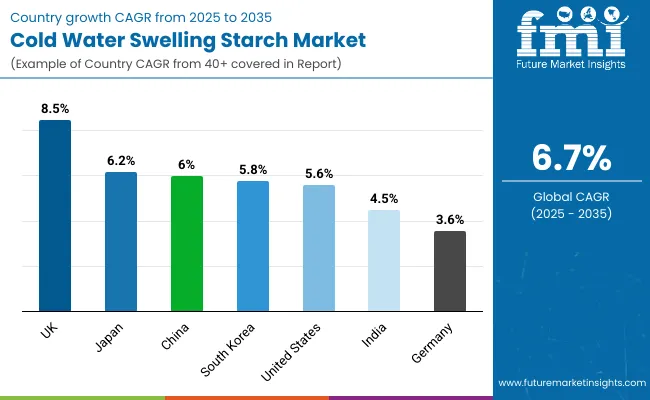

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.5% |

| Japan | 6.2% |

| China | 6.0% |

| South Korea | 5.8% |

| United States | 5.6% |

| India | 4.5% |

| Germany | 3.6% |

The cold water swelling starch market is experiencing robust growth globally, with the United Kingdom leading at an 8.5% CAGR through 2035, driven by rising adoption of clean-label ingredients, expanding convenience food sector, and growing emphasis on energy-efficient processing technologies. Japan follows with 6.2% growth, supported by advanced food processing infrastructure and consumer preference for instant food products.

China shows steady growth at 6.0%, driven by expanding food processing industry and increasing demand for cost-effective ingredient solutions. South Korea records 5.8% growth, focusing on innovative food applications and technological advancement in processing methods. The United States exhibits 5.6% growth, emphasizing sustainable processing and biodegradable ingredient solutions.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from cold water swelling starch in the United Kingdom is projected to exhibit strong growth with a CAGR of 8.5% through 2035, driven by surging adoption of clean-label food ingredients and innovative processed food products. The country's advanced food processing sector and consumer preference for sustainable ingredients are creating significant demand for energy-efficient starch solutions. Major food manufacturers are establishing comprehensive supply chains to serve the growing population of convenience-focused consumers across urban markets.

Revenue from cold water swelling starch in Japan is expanding at a CAGR of 6.2%, supported by advanced food processing infrastructure, consumer preference for convenience products, and growing adoption of energy-efficient manufacturing practices. The country's sophisticated food industry and focus on quality formulations are driving demand for specialized cold water swelling starch solutions. Japanese manufacturers are establishing innovative production methods to serve the demand for instant food products.

Demand for cold water swelling starch in China is projected to grow at a CAGR of 6.0%, supported by expanding food processing industry, cost-effective manufacturing practices, and growing adoption of instant food products. Chinese manufacturers are increasingly focused on scalable production methods and supply chain optimization. The market is characterized by strong demand for affordable formulations that combine functionality with economic advantages.

Revenue from cold water swelling starch in South Korea is projected to grow at a CAGR of 5.8% through 2035, driven by the country's focus on food technology innovation, premium product development, and consumer preference for convenient food solutions. Korean manufacturers consistently invest in advanced processing methods that deliver superior functionality while maintaining cost efficiency.

Revenue from cold water swelling starch in the United States is projected to grow at a CAGR of 5.6% through 2035, supported by advanced food processing infrastructure, emphasis on sustainable manufacturing, and growing demand for biodegradable ingredients. American manufacturers value processing efficiency, environmental responsibility, and proven performance, positioning cold water swelling starch as a core component of sustainable food production.

Revenue from cold water swelling starch in India is projected to grow at a CAGR of 4.5% through 2035, supported by expanding food processing sector, increasing urbanization, and growing demand for convenient food products. Indian manufacturers are focusing on cost-effective solutions and scalable production methods to serve the large domestic market.

Revenue from cold water swelling starch in Germany is projected to grow at a CAGR of 3.6% through 2035, supported by the country's emphasis on quality manufacturing, sustainable processing practices, and established food industry infrastructure. German manufacturers prioritize product quality, environmental compliance, and technical innovation, making cold water swelling starch a trusted component in premium food applications.

The cold water swelling starch market in Europe is projected to grow from USD 105.2 million in 2025 to USD 201.2 million by 2035, registering a CAGR of 6.7% over the forecast period. The United Kingdom is expected to strengthen its position, rising from 24.0% market share in 2025 to 28.0% by 2035, supported by accelerating clean-label ingredient adoption and strong innovation in instant/ready-to-eat food formulations. Germany follows with 21.0% in 2025, moderating to 19.0% by 2035 as growth there remains steady but below the UK’s pace due to more mature manufacturing adoption.

France accounts for 15.0% in 2025, easing slightly to 14.0% by 2035 as market expansion is steady but incremental. Italy holds 10.0% in 2025, moving to 9.0% by 2035, with growth concentrated in convenience food and specialty industrial applications. Spain represents 8.0% in 2025, declining modestly to 7.0% by 2035 as neighboring markets attract incremental investment.

The Rest of Europe (including Nordic countries, Eastern Europe, BENELUX, and other markets) collectively contributes 22.0% in 2025, expanding to 23.0% by 2035, driven by rising adoption in emerging processing hubs and increasing demand from textile, paper & packaging applications.

The cold water swelling starch market is characterized by competition among established ingredient suppliers, specialty starch manufacturers, and emerging sustainable processing companies. Companies are investing in advanced processing technologies, sustainable sourcing practices, innovative formulations, and market expansion strategies to deliver effective, reliable, and cost-efficient starch solutions. Product quality, supply chain optimization, and application development are central to strengthening product portfolios and market presence.

Cargill Inc., USA-based, leads the market with significant global presence, offering comprehensive cold water swelling starch solutions with focus on food applications and industrial uses. Ingredion Inc., USA, provides innovative starch formulations with emphasis on functionality and processing efficiency. AVEBE U.A., Netherlands, delivers specialized potato-based starch products with focus on natural sourcing and sustainability. Tate & Lyle, UK, focuses on high-performance ingredients that combine functionality with clean-label positioning.

ADM Co. and KMC, operating globally, provide comprehensive starch product ranges across multiple applications and processing methods. Roquette, France, emphasizes natural ingredient solutions and sustainable processing practices. Grain Processing Corporation, USA, offers specialized formulations with focus on specific industrial applications and customized solutions for diverse manufacturing requirements.

The success of cold water swelling starches, driven by convenience food demand, clean-label requirements, and cost-efficient processing, will not only enhance food and beverage functionality but also strengthen supply chain resilience. It will consolidate emerging markets as hubs for modified and functional starch production while aligning advanced economies with sustainable, high-performance food ingredients. This calls for a concerted effort by all stakeholders: governments, industry bodies, suppliers, OEMs, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 701.2 Million |

| Form | Granular, Pregelatinized, Powder |

| Source | Banana Starch, Chickpeas Starch, Potato Starch, Corn Starch, Cassava Starch, Tapioca Starch, Rice Starch, Wheat Starch, Other Sources |

| Application | Food, Clinical Nursing Homes to Thicken Foods, Dairy, Bakery, Convenience, Ready-to-eat or Instant Dessert, Snacks, Edible Fillings, Pharmaceutical, Textile Sizing, Adhesive Making, Other Applications |

| Process | Spray cooking, Drum-Dried |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, India, China, South Korea, Japan, Canada, France, Italy, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Cargill Inc., Ingredion Inc., AVEBE U.A., Tate & Lyle, ADM Co., KMC, Roquette, and Grain Processing Corporation |

| Additional Attributes | Product innovation by processing method, regional supply chain dynamics, competitive landscape analysis, sustainability initiatives in sourcing, integration with clean-label positioning, innovations in energy-efficient processing, and sustainable agricultural sourcing practices |

The market is projected to grow at a CAGR of 6.7% from 2025 to 2035, rising from USD 701.2 million in 2025 to USD 1,341.2 million by 2035.

The United States is the largest consumer, driven by its advanced food processing industry, strong adoption of instant starches, and emphasis on clean-label and biodegradable ingredients.

Potato starch offers superior cold-water solubility, high yield, and cost-efficiency. It holds the largest share among sources, contributing 56.5% of the market in 2025, and is projected to grow at a CAGR of 7.2%.

Drum-dried starch provides high uniformity, fast solubility, and is cost-effective at scale. It is ideal for use in instant food mixes, adhesives, and coatings, with a projected CAGR of 7.1%, making it the fastest-growing process segment.

Ready-to-eat/instant desserts are expected to lead, with strong demand for convenience and cold-processed foods. The segment is projected to grow at a CAGR of 7.3%, reaching USD 353.1 million by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA