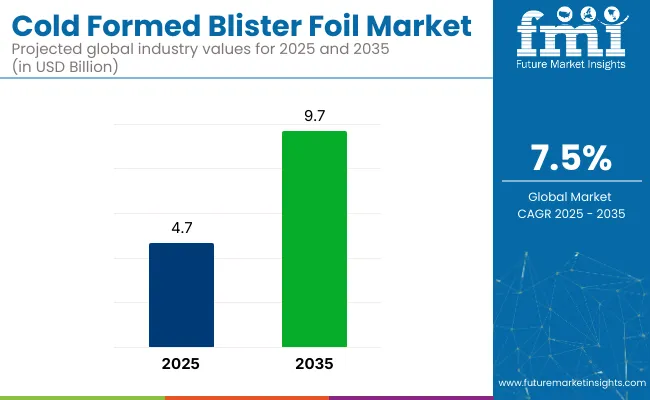

The global cold formed blister foil market is projected to grow from USD 4.7 billion in 2025 to USD 9.7 billion by 2035, registering a CAGR of 7.5% during the forecast period. Sales in 2024 were recorded at USD 4,391.3 million. This growth is primarily driven by the rising demand for tamper-evident and moisture-resistant packaging in the pharmaceutical industry.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 4.7 billion |

| Projected Value (2035F) | USD 9.7 billion |

| CAGR (2025 to 2035) | 7.5% |

Cold formed blister foil, offering excellent protection against light, moisture, and oxygen, is increasingly used to package tablets, capsules, and sensitive drugs. Its compatibility with regulatory requirements and ability to extend product shelf life make it a preferred material among pharmaceutical manufacturers worldwide.

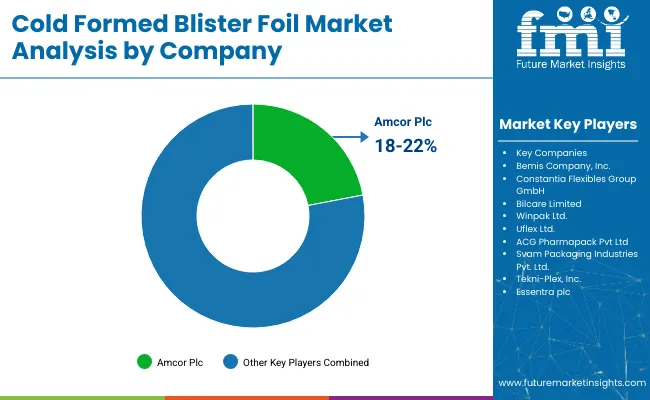

In 2023, Amcor, a global leader in packaging solutions, announced a USD 35 million investment to expand its cold formed foil capacity at its facility in Sligo, Ireland. This expansion includes new high-performance forming lines and aims to meet growing European demand for pharmaceutical blister packs.

“The additional capabilities in our Sligo site allow us to provide customers with even more differentiated and efficient solutions to meet their healthcare packaging needs. With our global scale and innovation capabilities, Amcor is uniquely positioned to capture growing demand for both medical and pharmaceutical packaging products globally.”- Peter Konieczny, Chief Commercial Officer at Amcor

Recent innovations in the pharmaceutical packaging market, particularly in blister and strip packaging, include the development of multi-layer aluminum-based laminates that significantly improve barrier protection while using less material. These advanced laminates offer superior resistance to moisture, light, and oxygen, making them ideal for extending the shelf life of sensitive drug formulations.

At the same time, manufacturers are introducing recyclable polymer layers to align with evolving regulatory and environmental mandates, ensuring performance without compromising on recyclability. Technological advancements such as enhanced sealing systems and improved thermoformability have led to more precise packaging for a wide variety of pharmaceutical products, including tablets, capsules, and powder-based formulations. These improvements contribute to both operational efficiency and dosage integrity, which are critical in high-throughput production environments.

The Asia-Pacific region is poised to see significant market growth, driven by a surge in generic drug manufacturing and expanding pharmaceutical exports, especially from countries like India and China. These nations are rapidly strengthening their manufacturing infrastructure to cater to global supply chains, leading companies to invest heavily in localized production units, digitally enabled printing technologies, and compliant sourcing of packaging materials.

Meeting strict international regulatory standards such as USA FDA, EMA, and WHO guidelines has become a priority, particularly as demand rises for high-volume, cost-effective, and reliable pharmaceutical packaging. As global demand for affordable medications increases, the region is expected to play a central role in scaling up capacity while maintaining quality and traceability in packaging solutions.

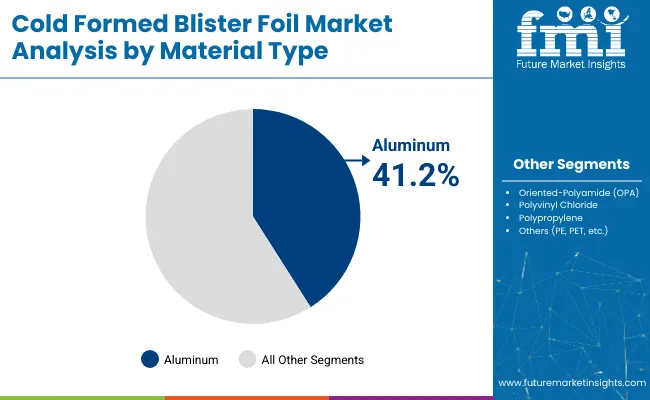

The market has been segmented based on material type, application, and region. By material type, oriented-polyamide (OPA), aluminum, polyvinyl chloride, polypropylene, and other polymers such as PE and PET are used to achieve optimal barrier properties, mechanical strength, and thermal resistance for blister packaging.

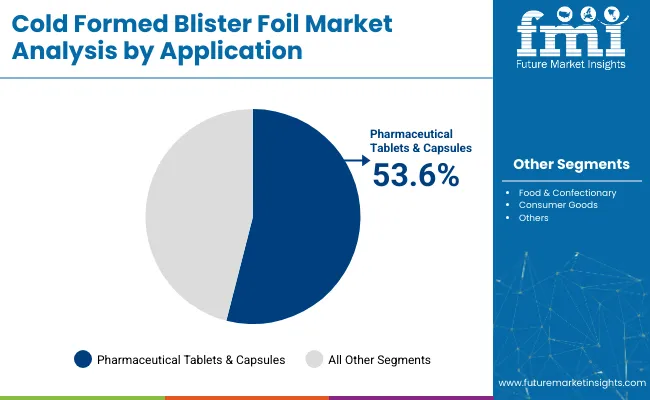

Applications are divided into pharmaceuticals including tablets & capsules, inhalants, and other formulations like veterinary solutions to reflect the primary end-use dominance. Additionally, food & confectionery and other industrial applications capture the growing adoption of cold-formed foil in non-pharma sectors for product preservation and tamper resistance.

Regional segmentation includes North America, Latin America, Europe, APAC, and MEA to address variations in pharmaceutical manufacturing trends, regulatory frameworks, and consumer safety standards across global packaging markets.

The aluminum segment is projected to hold the largest share 41.2% of the cold formed blister foil market by 2025, driven by its unmatched barrier properties, malleability, and dominant role in pharmaceutical and healthcare packaging. Aluminum serves as a highly effective shield against moisture, oxygen, light, and external contaminants, all of which are critical factors in maintaining the stability, potency, and shelf life of sensitive drug formulations.

Its mechanical strength and excellent formability allow for deep-draw cavities in cold-forming applications without compromising the foil’s structural integrity. This makes it especially suited for moisture-sensitive solid dosage forms such as tablets and capsules, which are widely used in chronic and preventive care. Post-pandemic, this demand has increased further with the surge in generic drug production and global supply chain expansion in the pharmaceutical sector.

Aluminum’s widespread use is also supported by its compatibility with multilayer laminates, particularly when combined with materials like polyamide and PVC, enhancing its thermal resistance and expanding its functional scope across various drug types. Regulatory pressure from authorities such as the USA FDA and European Medicines Agency (EMA) continues to emphasize high-barrier, compliant packaging, positioning aluminum-based cold formed foil as the industry’s benchmark.

Additionally, innovations in ultra-thin foil grades and ongoing efforts to improve recyclability are adding value, making aluminum not only a performance-driven choice but also a progressively sustainable one. These factors collectively ensure that the aluminum segment will remain the most preferred material in cold formed blister packaging applications through the forecast period.

The pharmaceutical tablets and capsules segment is projected to lead the application category with a commanding 53.6% share in 2025, driven by the growing need for secure, tamper-evident, and unit-dose packaging in the global pharmaceutical landscape.

Cold formed blister packs have become the standard packaging solution for oral solid dosage forms, offering superior protection against contamination, moisture, and oxygen factors crucial for maintaining drug efficacy and shelf life. Their design allows for individual pill dispensing, which is essential in ensuring dosing accuracy, preventing misuse, and reducing waste.

The demand for such packaging is rising in parallel with the increased prevalence of chronic illnesses, expansion of generic drug production, and the aging global population, which heavily depends on long-term medication therapies.

In healthcare settings such as hospitals, clinical trials, and retail pharmacies, cold formed blister packs play a critical role in product traceability, clear labeling, and medication adherence, particularly for complex dosing regimens. The segment also benefits from the growing emphasis on child-resistant and senior-friendly packaging, which cold-formed solutions are well-suited to deliver.

Moreover, the increasing implementation of serialization and anti-counterfeiting regulations in regulated markets like North America, Europe, and parts of Asia has further solidified the segment’s importance. Manufacturers are tailoring blister designs adjusting cavity shapes, foil gauges, and laminate compositions to accommodate specific drug types, climatic conditions, and distribution requirements. As regulatory scrutiny intensifies and demand for safe, efficient packaging solutions continues to rise, this segment will remain the primary driver of growth in the cold formed blister foil market.

High Material Costs and Sustainability Concerns

The durability of aluminum-based packaging materials is facing challenges in the cold-formed blister foil industry, ensuring limited recyclability. Cold-formed foil (CFF) offers excellent moisture, light, and oxygen barrier properties, yet its high weight and non-biodegradable nature pose problems in waste management. Then, there are strict pharmaceutical packaging regulations where compliance with global safety standards must be maintained at all times, which is a huge barrier for smaller manufacturers to enter the market.

Growth in Pharmaceutical Packaging and Sustainable Foil Alternatives

Growing need from the unit-dose pharmaceutical packaging industry is driving market growth, where cold-formed blister foil is used to provide optimal protection of moisture-sensitive drugs. Technological advancements, such as lightweight, recyclable, and hybrid foil laminates, also underpin sustainability innovations. The addition of intelligent/ smart packaging solutions, track-and-trace technologies, and biodegradability barrier coatings will further improve product differentiation and regulatory compliance.

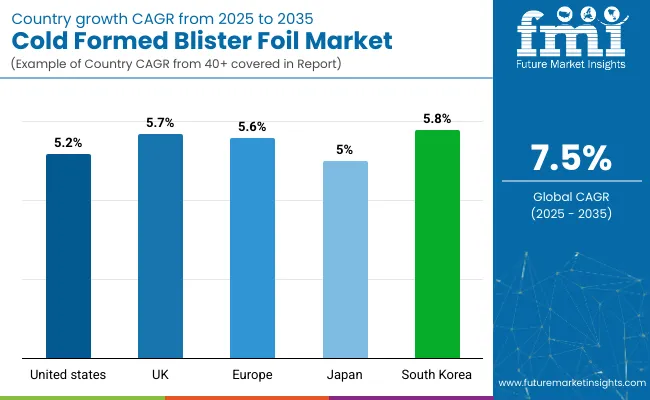

The cold-formed blister foil market in the United States is growing rapidly, supported by the growing pharmaceutical industry and the increasing need for high-barrier packaging solutions. An increase in demand for tamper-evident and moisture-resistant packaging for solid-dose drugs is prop-directing market growth.

Strict FDA regulations on pharmaceutical packaging and serialization requirements for drug traceability are also driving the demand for cold formed blister foils. In addition, with the growing penetration of child-proof and adult-friendly packaging solutions, the United States is supporting product innovation.

Market growth is also being driven by the presence of leading pharmaceutical companies and packaging manufacturers, as well as growing investments in sustainable packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

Increasing pharmaceutical production and rising high-barrier packaging demand to extend the shelf life of drugs driving the UK Cold Formed Blister Foil Market. In the United Kingdom, a stringent regulatory framework and the regulatory authority, the Medicines and Healthcare products Regulatory Agency (MHRA), are contributing to the increased demand for drug safety and compliance, and thus expect growth of the cold formed blister foil market.

Furthermore, the rising consumer inclination towards sustainable and recyclable packaging material is motivating innovations in sustainable blister foil packaging. This trend is further complemented by the boom in contract manufacturing organizations (CMOs) dedicated to pharmaceutical packaging, which bolsters the market growth.

The growth of personalized medicine and biologics requiring complex packaging solutions is also driving the increase in demand for advanced blister foil production technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The pharmaceutical packaging market is regulated strictly according to government regulations such as the EU Falsified Medicines Directive (FMD), which demands secure and traceable drug packaging, which is expected to propel the EU Cold Formed Blister Foil Market.

Germany, France, and Italy are significant countries in this region, with strong pharmaceutical industries that are investing in advanced-performance packaging that provides optimal medicine protection. Rising acceptance of cold-formed blister foil in over-the-counter (OTC) medications and dietary supplements is expected to boost demand.

Also, the EU's move for sustainable and less plastic waste is encouraging research for recyclable and biodegradable alternatives to pharmaceutical packaging. Market trends are further being influenced by the rising demand for child-resistant and anti-counterfeiting packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.6% |

The Japanese cold-formed blister foil market is driven largely by strict pharmaceutical packaging regulations and increasing emphasis on the implementation of advanced packaging technologies. Market growth is propelled by the increasing need for packaging solutions with an extended shelf life for prescription drugs and nutraceuticals.

High-barrier cold-formed blister foils are in high demand owing to the presence of major pharmaceutical companies with innovative drug formulations. Moreover, the increasing patient safety efforts in Japan, such as QR-coded and RFID-enabled blister packaging, have been accelerating the adoption of smart packaging solutions.

Another significant factor aiding market growth is the growing geriatric population and the rising propensity for unit-dose drug packaging to ensure medication adherence.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The cold-formed blister foil market in South Korea is flourishing owing to the booming pharmaceutical and nutraceuticals industry. Moreover, the country’s investments in advanced pharmaceutical packaging technologies along with regulatory supervision by the ministry of food and drug safety (mfds) is positively impacting the market growth.

Investments in high-barrier cold-formed blister foil are being driven by the rising need for export-quality packaging solutions that comply with international standards. Furthermore, market growth is being propelled by the increasing adoption of smart packaging solutions, such as tamper-evident and patient-friendly blister packs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The global market for cold-formed blister foil is expanding rapidly, owing to rising high-barrier pharmaceutical packaging demand fueled by the growth in world-based pharmaceutical production, strict regulatory requirements, and an increase in unit dose medication packaging unit dose medication packaging.

Cold-formed blister foils offer excellent protection against moisture, oxygen, and light, making them ideal for sensitive drugs, high-potency formulation, and biologics. The increasing emphasis on counterfeiting prevention and child-resistant packaging solutions is further supporting market growth.

The overall market size for cold formed blister foil market was USD 4.7 billion in 2025.

The cold formed blister foil market is expected to reach USD 9.7 billion in 2035.

The growth of the cold formed blister foil market will be driven by increasing demand for pharmaceutical packaging, advancements in barrier protection technologies, and rising regulatory compliance for enhanced drug safety and shelf life extension.

The top 5 countries which drives the development of cold formed blister foil market are USA, European Union, Japan, South Korea and UK.

Electronics Sector to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA