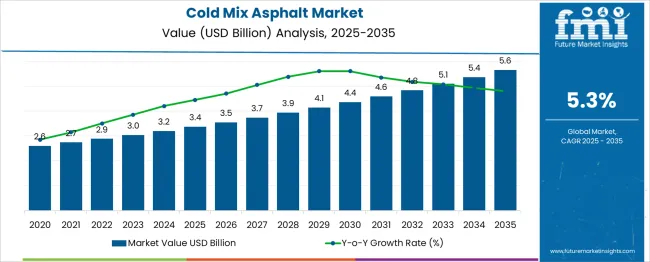

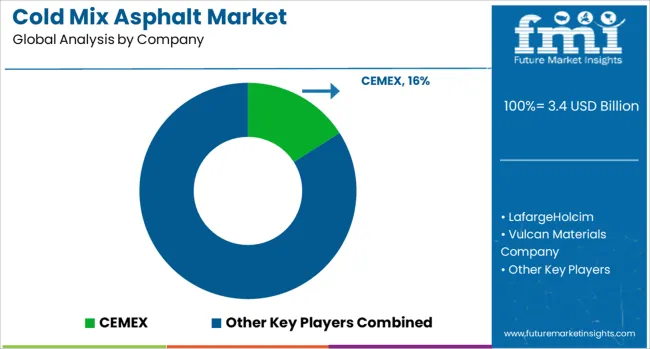

The Cold Mix Asphalt Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. This steady increase is driven by expanding infrastructure development and a growing preference for environmentally friendly and energy-efficient road construction methods.

The market’s upward trajectory highlights increasing adoption of cold mix asphalt as a sustainable alternative in both emerging and established markets. Over the 15-year forecast period, the market will nearly double in value, showcasing a favorable environment for manufacturers, suppliers, and contractors to capitalize on evolving industry trends.

Rising government investments in road maintenance and expanding urbanization are key factors supporting this growth. As the market continues to mature, innovations in cold mix asphalt technology and improved application techniques are expected to boost demand and adoption further worldwide.

| Metric | Value |

|---|---|

| Cold Mix Asphalt Market Estimated Value in (2025 E) | USD 3.4 billion |

| Cold Mix Asphalt Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The Cold Mix Asphalt market is experiencing a steady upward trajectory due to its practical applicability in environments where hot mix asphalt is not feasible. The use of cold mix solutions is gaining momentum owing to their ability to be stored, transported, and applied without the need for heating, thereby reducing energy consumption and greenhouse gas emissions.

This market is further supported by government initiatives focused on sustainable road construction, especially in regions experiencing fluctuating climates and urgent repair needs. Advancements in emulsion chemistry and mix designs have made cold mix asphalt more durable and suitable for a variety of road conditions.

Additionally, the emphasis on rapid, low-cost maintenance techniques for deteriorating road infrastructure is expanding its use across urban and rural areas. The shift toward low-disruption pavement technologies and the growing demand for efficient road repair systems are expected to continue propelling the market forward, making cold mix asphalt a preferred solution for both temporary and semi-permanent surfacing applications..

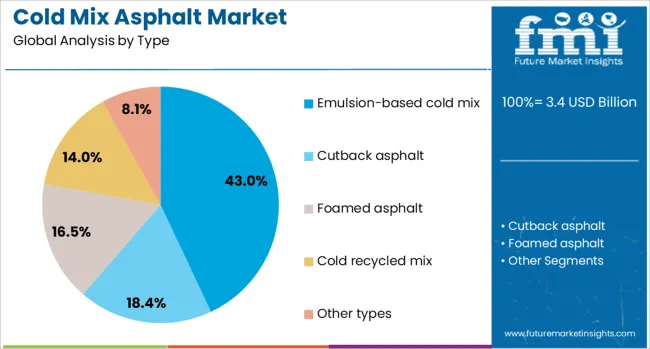

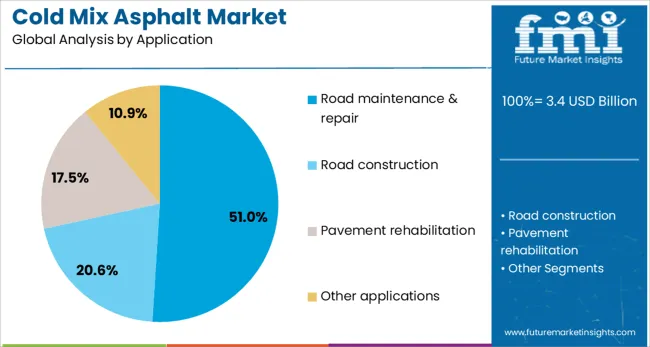

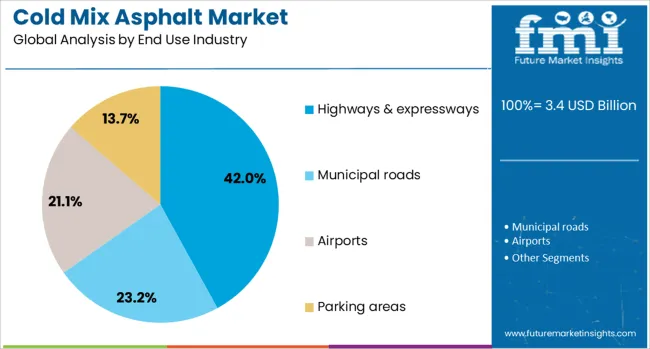

The cold mix asphalt market is segmented by type, application, end-use industry, aggregate type, and geographic regions. The cold mix asphalt market is divided into Emulsion-based cold mix, Cutback asphalt, Foamed asphalt, Cold recycled mix, and other types. In terms of application, the cold mix asphalt market is classified into Road maintenance & repair, Road construction, Pavement rehabilitation, and other applications. Based on end-use industry, the cold mix asphalt market is segmented into Highways & expressways, Municipal roads, Airports, Parking areas, and others.

The cold mix asphalt market is segmented into Natural aggregates, Recycled aggregates, and Synthetic aggregates. Regionally, the cold mix asphalt industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The emulsion-based cold mix segment is expected to account for 43% of the Cold Mix Asphalt market revenue share in 2025, establishing itself as the leading type. This dominance has been achieved due to the improved stability, workability, and environmental advantages offered by emulsion-based formulations. These mixes have been preferred for their ability to be applied at ambient temperatures, which eliminates the need for heating and reduces fuel usage.

Enhanced shelf life and ease of transportation have made them highly practical for use in remote locations and during emergency roadworks. Their ability to bond effectively to existing pavements and provide long-lasting surface repairs has strengthened their appeal among contractors and public road authorities.

Moreover, lower emissions during application and compliance with sustainability standards have contributed to wider adoption in regions focused on green infrastructure. As governments and municipalities aim to modernize road maintenance practices while minimizing environmental impact, the demand for emulsion-based cold mix is expected to remain strong.

The road maintenance and repair segment is projected to hold 51% of the Cold Mix Asphalt market revenue share in 2025, reflecting its position as the primary application. This segment’s leadership is rooted in the rising urgency to address aging infrastructure and deteriorating road networks without causing extended traffic disruptions. The practicality of cold mix asphalt for patching potholes, repairing cracks, and resurfacing worn areas under varying weather conditions has supported its widespread use.

Unlike traditional hot mix, cold mix can be applied quickly without heavy machinery, enabling fast reopenings of affected roads. Public agencies have increasingly relied on this method for emergency repairs due to its cost-efficiency and time-saving benefits.

The versatility of cold mix asphalt has further expanded its use across rural, urban, and suburban zones. With limited budgets and growing traffic volumes, municipalities are prioritizing technologies that allow for frequent, low-disruption maintenance cycles, thereby reinforcing the demand for cold mix asphalt in this application segment..

The highways and expressways segment is anticipated to represent 42% of the Cold Mix Asphalt market revenue share in 2025, emerging as the leading end-use industry. This dominance is attributed to the continuous need for preventive and corrective maintenance across long-distance transport corridors. Cold mix asphalt has been increasingly utilized in highway projects due to its compatibility with short-term interventions and shoulder repairs that require immediate response.

The ability to conduct maintenance without interrupting peak traffic flows or deploying extensive equipment has made cold mix solutions especially relevant for high-capacity roads. Furthermore, the durability of advanced cold mix formulations and their performance under varied traffic loads have supported their inclusion in regular maintenance schedules.

National highway authorities have been adopting cold mix asphalt for cost-effective and environmentally compliant road rehabilitation programs. As the focus on safety, ride quality, and infrastructure longevity intensifies, the use of cold mix asphalt in highways and expressways is expected to retain a significant portion of the market..

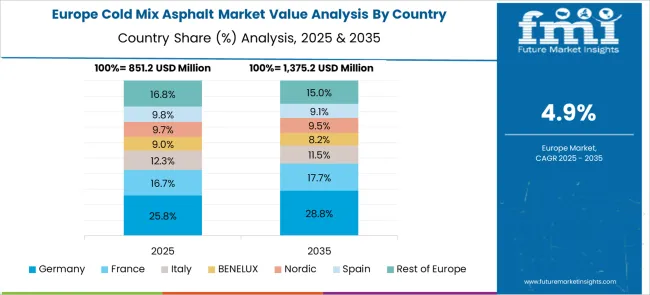

The cold mix asphalt market is growing as infrastructure projects and road maintenance programs seek cost-effective, easy-to-apply paving solutions with reduced environmental impact. Cold mix asphalt offers advantages such as lower energy consumption during production, simplified application without heating, and suitability for patching and small-scale repairs. Rising government investments in road infrastructure and repair, especially in developing regions, support market expansion. North America and Europe lead in adoption, while Asia-Pacific presents significant growth potential due to increasing urbanization and road network development.

Cold mix asphalt varies by binder type, aggregate quality, and emulsifier content, affecting its setting time, durability, and load-bearing capacity. Some formulations prioritize quick curing for rapid repairs, while others focus on long-term stability under heavy traffic. The choice of additives and aggregate gradation influences resistance to water damage and temperature fluctuations. Inconsistent raw material sourcing and mixing practices can lead to variability in product performance. Manufacturers investing in standardized formulations and quality testing ensure reliable outcomes and wider acceptance by contractors and municipalities.

Advances in application methods, including specialized spreading machines and rollers, enhance efficiency and compaction quality of cold mix asphalt on-site. Portable mixing units allow batch preparation near repair locations, reducing transportation challenges. Use of tack coats and primers improves adhesion to existing pavement, extending repair lifespan. Training programs for contractors on best practices promote proper installation, minimizing premature failures. These improvements support broader adoption in patching, pothole repair, and temporary paving, especially in climates where seasonal constraints limit hot mix asphalt use.

Growing road networks and aging infrastructure drive consistent demand for repair solutions that minimize traffic disruptions and lower maintenance costs. Cold mix asphalt’s ability to be applied without traffic lane closures or specialized heating equipment suits urban and rural environments alike. Municipalities prioritize preventive maintenance programs that use cold mix for rapid pothole repairs to enhance road safety and extend pavement life. Expansion of public-private partnerships and government stimulus packages in infrastructure rehabilitation accelerates procurement of cold mix asphalt products, particularly in regions facing harsh weather conditions affecting pavement durability.

Compliance with environmental and quality standards, such as limits on volatile organic compounds (VOCs) and particulate emissions during production and application, shapes product development and acceptance. Regional variations in standards may require tailored formulations or certifications. Although cold mix asphalt offers savings in energy and equipment costs, higher material costs compared to traditional hot mix asphalt can be a barrier in budget-sensitive projects. Logistics challenges in supply chain management, including seasonal raw material availability and storage stability, impact pricing and delivery schedules. Producers offering consistent quality, technical support, and cost-effective solutions achieve stronger market positions.

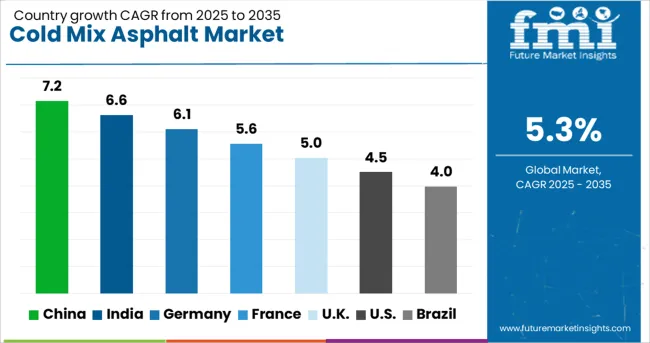

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global cold mix asphalt market is expanding at a 5.3% CAGR, supported by growing infrastructure repair and maintenance activities. Among BRICS nations, China leads with 7.2% growth, driven by large-scale road construction projects and material production capacity. India follows at 6.6%, fueled by government initiatives for road rehabilitation and urban development. In the OECD region, Germany records 6.1% growth, reflecting strict quality standards and demand for durable road materials. The United Kingdom grows at 5.0%, supported by infrastructure refurbishment efforts. The United States, a mature market, shows 4.5% growth, shaped by highway maintenance programs and regulatory compliance. These countries collectively influence market dynamics through production capabilities, regulatory frameworks, and infrastructure demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the cold mix asphalt market with a 7.2% growth rate, driven by rapid infrastructure expansion and increased road maintenance activities. The demand for cost-effective and durable paving solutions encourages adoption of cold mix asphalt, especially in urban and rural road repair projects. Compared to India, China benefits from government initiatives focusing on sustainable construction materials and longer-lasting pavement technologies. Domestic manufacturers are enhancing product quality while expanding distribution through large construction firms. Rising focus on reducing construction downtime supports market growth in China’s vast infrastructure landscape.

India’s cold mix asphalt market grows at 6.6%, supported by expanding road networks and the need for efficient repair solutions. Compared to Germany, India faces unique climate challenges requiring durable asphalt mixtures suited for monsoon seasons. Increasing government spending on highway and rural road improvements promotes cold mix adoption. Local manufacturers are focusing on affordable yet high-performance asphalt products. The rise of small and medium construction companies also fuels demand. Expanding awareness about quick and sustainable road maintenance solutions accelerates market growth.

Germany’s cold mix asphalt market advances at 6.1%, supported by stringent quality standards and a mature construction sector. Compared to the UK, Germany places higher emphasis on environmentally friendly materials and recycled asphalt mixtures. The demand for rapid repair solutions during colder months increases cold mix usage. Infrastructure maintenance budgets prioritize long-lasting and cost-effective pavement options. Local manufacturers innovate with low-emission production technologies. High-quality standards and regulated distribution channels maintain market reliability and steady growth in Germany.

The United Kingdom cold mix asphalt market grows at 5.0%, driven by urban maintenance and infrastructure refurbishment projects. Compared to the USA, the UK market emphasizes ease of use and fast-setting properties in cold mix products. Increased investment in public infrastructure supports demand. Manufacturers focus on user-friendly packaging and improved storage stability. Road repair contractors prefer cold mix asphalt to reduce traffic disruption. Regulatory support for sustainable construction materials encourages innovation and adoption.

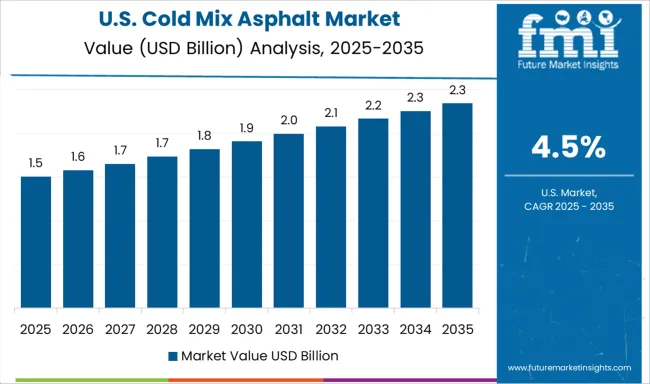

The United States cold mix asphalt market expands at 4.5%, influenced by increasing road maintenance requirements and budget constraints. Compared to China, the USA market has slower growth but benefits from widespread use in patching and minor repairs. Demand is driven by local government contracts and seasonal repair windows. Manufacturers emphasize product consistency and easy application. Online procurement and supply chain improvements support broader market reach. Rising awareness of extended pavement life encourages adoption despite competitive alternatives.

The cold mix asphalt market is dominated by major construction material companies and specialized asphalt technology providers that prioritize sustainable, cost-effective paving solutions. CEMEX and LafargeHolcim are global leaders, leveraging extensive supply chains and innovation in cold mix formulations that reduce energy consumption and extend paving season capabilities.

Vulcan Materials Company and Colas Group bring strong regional expertise, offering tailored cold mix asphalt products that address varying climate and traffic demands, ensuring durability and ease of application. Heidelberg Materials emphasizes research-driven product development, integrating polymers and additives to enhance cold mix performance in challenging environments.

The Dow Chemical Company supports the market with advanced chemical additives that improve binder flexibility and adhesion, increasing the lifespan of cold mix pavements. Road Science LLC and EZ Street Company specialize in proprietary cold mix technologies that offer rapid curing and high early strength, catering to quick repair and maintenance needs in urban infrastructure.

Competition centers on innovation in binder technology, environmental impact reduction, and adaptability to diverse project scales. These companies continuously refine cold mix asphalt formulations to meet growing demands for sustainable infrastructure development while maintaining cost efficiency and performance under fluctuating weather conditions.

As mentioned in Shrieve’s official announcement, Shrieve launched its PROGILINE® ECO-T range of organic asphalt additives in Europe in early 2024. This product line features 100% organic, solvent-free additives designed to improve asphalt performance sustainably, supporting lower-temperature mixing and eco-friendly cold mix applications, meeting the growing demand for greener construction materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Type | Emulsion-based cold mix, Cutback asphalt, Foamed asphalt, Cold recycled mix, and Other types |

| Application | Road maintenance & repair, Road construction, Pavement rehabilitation, and Other applications |

| End Use Industry | Highways & expressways, Municipal roads, Airports, Parking areas, and Others |

| Aggregate Type | Natural aggregates, Recycled aggregates, and Synthetic aggregates |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CEMEX, LafargeHolcim, Vulcan Materials Company, Colas Group, Heidelberg Materials, The Dow Chemical Company, Road Science LLC, and EZ Street Company |

| Additional Attributes | Dollar sales in the Cold Mix Asphalt Market vary by product type (emulsified asphalt, cutback asphalt), application (road repair, maintenance, pothole filling), and form (ready-mix, bagged). Growth is driven by increasing infrastructure repair needs, cost-effectiveness, and environmental benefits. Regional demand is strong in North America, Europe, and Asia-Pacific. |

The global cold mix asphalt market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the cold mix asphalt market is projected to reach USD 5.6 billion by 2035.

The cold mix asphalt market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in cold mix asphalt market are emulsion-based cold mix, _cationic emulsion cold mix, _anionic emulsion cold mix, _non-ionic emulsion cold mix, cutback asphalt, _rapid curing (rc) cutback, _medium curing (mc) cutback, _slow curing (sc) cutback, foamed asphalt, cold recycled mix, _place cold recycling, _central plant cold recycling, other types, _polymer modified cold mix, _fiber reinforced cold mix and _additive enhanced cold mix.

In terms of application, road maintenance & repair segment to command 51.0% share in the cold mix asphalt market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Mixed Reality Navigation Platforms Market Forecast and Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mixed Signal IC Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA