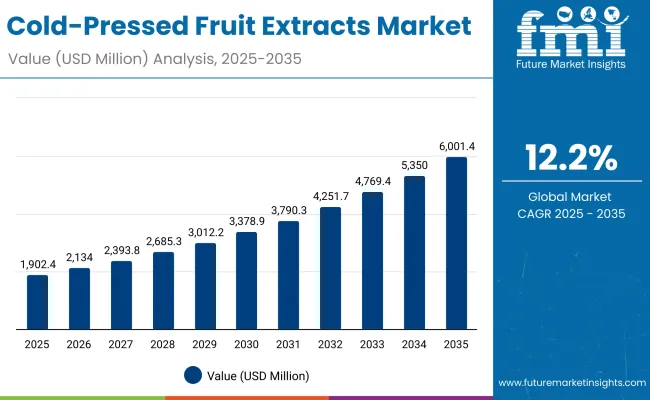

The Global Cold-Pressed Fruit Extracts Market is expected to record a valuation of USD 1,902.4 million in 2025 and USD 6,001.4 million in 2035, with an increase of USD 4,099.0 million, which equals a growth of over 215% during the forecast period. The overall expansion represents a CAGR of 12.2% and more than a 3X increase in market size.

Global Cold-Pressed Fruit Extracts Market Key Takeaways

| Metric | Value |

|---|---|

| Global Cold-Pressed Fruit Extracts Market Estimated Value in (2025E) | USD 1,902.4 million |

| Global Cold-Pressed Fruit Extracts Market Forecast Value in (2035F) | USD 6,001.4 million |

| Forecast CAGR (2025 to 2035) | 12.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,902.4 million to USD 3,378.9 million, adding USD 1,476.5 million, which accounts for 36% of the total decade growth. This phase records strong adoption of cold-pressed fruit-based skincare, particularly antioxidant/repair formulations, which align with global anti-aging trends.

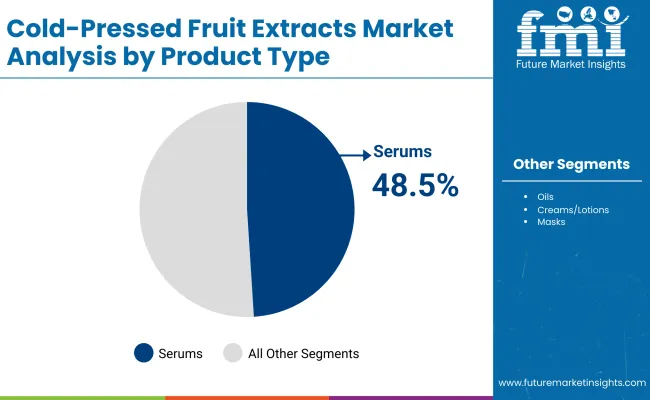

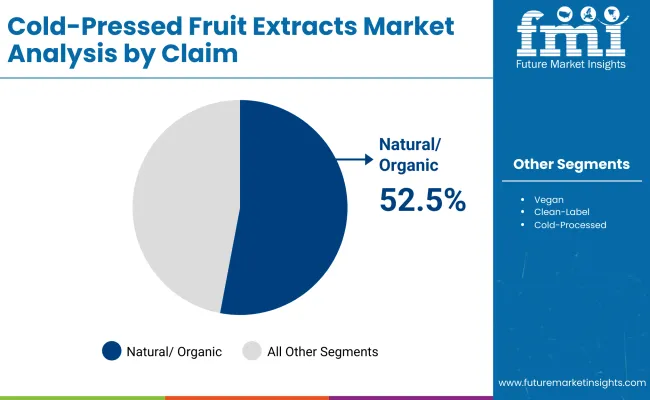

Serums dominate this period, catering to over 48% of consumer applications as high-concentration extracts are increasingly used in daily skincare. The popularity of natural/organic claims also accelerates early growth, accounting for 52.5% market share in 2025, reflecting consumer preference for clean-label and vegan-friendly products.

The second half from 2030 to 2035 contributes USD 2,622.5 million, equal to 64% of total growth, as the market jumps from USD 3,378.9 million to USD 6,001.4 million. This acceleration is powered by innovations in cold-processing technologies, increased premiumization in Asia-Pacific markets, and rising awareness of sustainability in product sourcing.

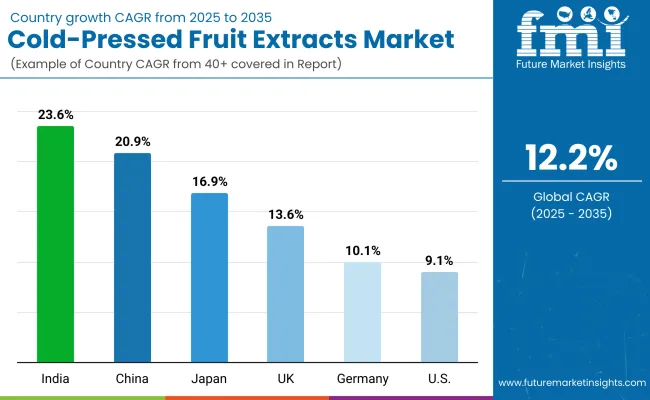

Markets such as China (20.9% CAGR), India (23.6% CAGR), and Japan (16.9% CAGR) outpace growth in mature economies, shifting global share dynamics. By the end of the decade, natural/organic and vegan claims consolidate as mainstream categories, while e-commerce becomes the leading distribution channel for these products.

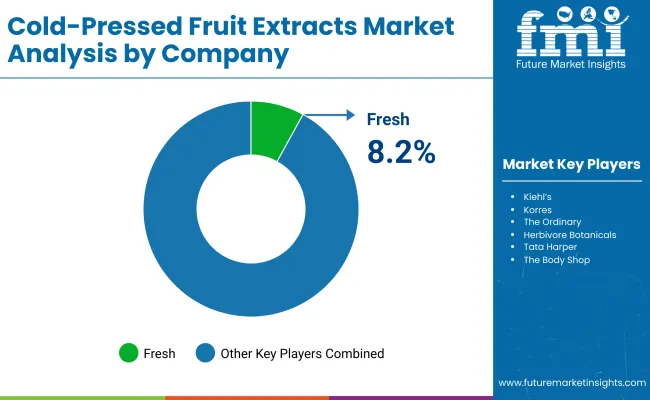

From 2020 to 2024, the Global Cold-Pressed Fruit Extracts Market grew steadily, laying the foundation for clean-label skincare adoption. During this period, the competitive landscape was fragmented, with top-tier players like Fresh holding only 8.2% global share in 2025, while over 90% of market value was distributed among smaller and niche natural skincare brands.

Differentiation relied on authenticity, sourcing transparency, and product purity. Hardware-like dominance, as seen in technology markets, is absent hereinstead, value was driven by claims such as natural/organic, vegan, and cold-processed, with brands leveraging e-commerce and specialty stores to expand outreach.

Demand for cold-pressed fruit extracts will expand to USD 1,902.4 million in 2025, and the revenue mix will shift significantly as serums and oils grow faster than traditional creams and lotions.

Established natural beauty brands face rising competition from digital-first players offering direct-to-consumer (D2C) subscription models, personalized formulations, and AI-driven skin diagnostics to pair consumers with optimal products.

Major players are pivoting toward hybrid models that combine eco-friendly sourcing, advanced cold-processing technology, and sustainability certifications to retain consumer trust. Emerging entrants from Asia and clean beauty innovators in the U.S. and Europe are gaining share rapidly.

The competitive advantage is moving away from traditional branding alone toward ecosystem strength, transparency, and product authenticity.

Advances in cold-pressing technologies have enhanced nutrient preservation, enabling extracts to retain higher antioxidant and hydration properties compared to conventional processing. This makes them highly attractive for skincare categories focusing on repair, barrier support, and hydration.

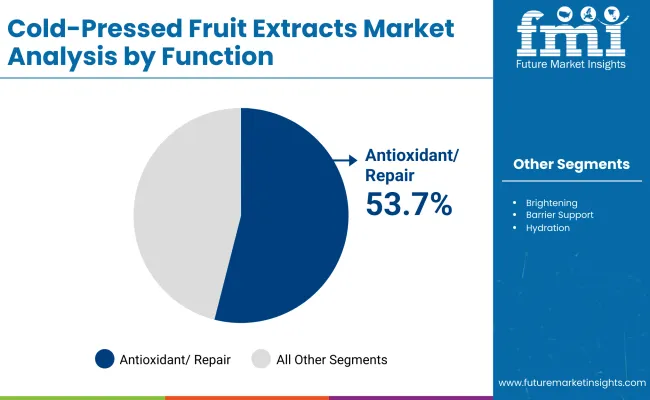

The surge in antioxidant/repair formulations, capturing over 53.7% of global value in 2025, is directly linked to rising consumer demand for anti-aging, pollution-protection, and repair-oriented products. Serums, with their concentrated delivery systems, are leading adoption, capturing nearly 48.5% share in 2025.

Expansion of clean-label and natural/organic claims has fueled growth, as over half of global consumers in 2025 are projected to choose products with these labels. Innovations in vegan and cold-processed claims are opening new application areas across serums, oils, and face masks.

Segment growth is expected to be led by serums and oils, while regional expansion will be driven by Asia-Pacific, where countries like India and China demonstrate double-digit CAGRs due to growing middle-class spending and digital adoption of skincare. The USA remains the single-largest country market, but relative share declines slightly as Asian markets accelerate, reflecting the shift in consumer demand toward sustainable and innovation-driven beauty ecosystems.

The market is segmented by Source, Function, Product Type, Channel, and Claim, highlighting the diversity of consumer-driven preferences. Sources include pomegranate, acai/berry blends, citrus, and sea buckthorn, each bringing unique functional benefits such as antioxidant protection or hydration. Functions span antioxidant/repair, brightening, barrier support, and hydration, with antioxidant/repair being the leading contributor.

Product types cover serums, oils, creams/lotions, and masks, with serums dominating early adoption. Channels include e-commerce, natural/organic beauty stores, pharmacies, and mass retail, reflecting the omillionichannel distribution strategy of leading brands.

Claims range from natural/organic and vegan to clean-label and cold-processed, underscoring how product positioning strongly influences purchase intent. Regionally, the market scope spans North America, Europe, Asia-Pacific, and emerging markets in Latin America and the Middle East, with Asia-Pacific delivering the highest growth trajectory led by China, India, and Japan.

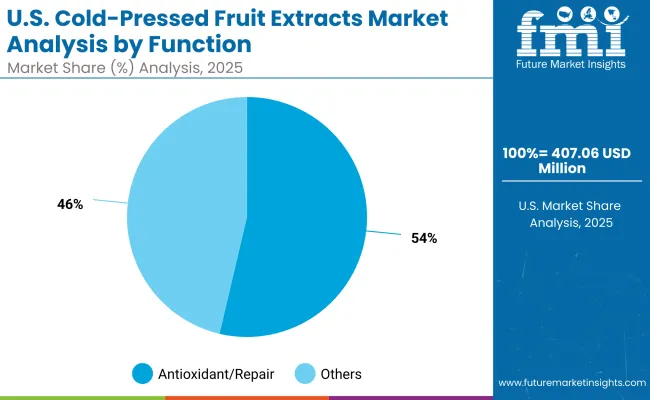

| Function | Value Share % 2025 |

|---|---|

| Antioxidant/repair | 53.7% |

| Others | 46.3% |

The antioxidant/repair segment is projected to contribute 53.7% of the Global Cold-Pressed Fruit Extracts Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by rising consumer demand for products that combat oxidative stress, premature aging, and pollution-related skin damage. Antioxidant-rich extracts, such as pomegranate and acai blends, have become core ingredients due to their proven ability to repair and rejuvenate skin at the cellular level.

The segment’s growth is also supported by the global rise of anti-aging skincare, where antioxidant-focused serums and oils are positioned as premium offerings. As clean beauty trends continue to shape purchasing behavior, antioxidant/repair products are marketed not only for efficacy but also for their natural and organic sourcing. With strong endorsements from dermatologists and influencers alike, this segment is expected to retain its position as the backbone of cold-pressed fruit extract applications.

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 48.5% |

| Others | 51.5% |

The serums segment is forecasted to hold 48.5% of the market share in 2025, led by its application in delivering concentrated doses of antioxidants, vitamins, and hydration directly to the skin. Serums are favored for their high absorption rates, lightweight formulations, and ability to target specific skincare concerns, such as fine lines, hyperpigmentation, and barrier repair. Their appeal extends to both mass-market consumers and premium skincare buyers seeking maximum effectiveness in minimal application.

Their compact design, dropper-based precision use, and compatibility with multi-step routines have facilitated widespread adoption across age groups. The segment’s growth is bolstered by innovations in cold-processing technology that preserve the potency of delicate fruit extracts, ensuring better performance than conventionally processed alternatives. As skincare routines become more specialized, serums are expected to continue their dominance in the global cold-pressed fruit extracts market.

| Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 52.5% |

| Others | 47.5% |

The natural/organic claim segment is projected to account for 52.5% of the Global Cold-Pressed Fruit Extracts Market revenue in 2025, establishing it as the leading claim type. This category is favored for its alignment with consumer preferences for chemical-free, eco-friendly, and ethically sourced skincare products.

The appeal of “organic” certifications and “natural origin” labels has made these products highly desirable, particularly among millennials and Gen Z consumers who associate clean-label beauty with health and sustainability.

Its suitability across diverse product typesserums, oils, creams, and maskshas amplified its presence in both premium and mass-market categories. Developments in cold-processed extraction methods support this trend by preserving the natural bioactive compounds without synthetic additives, reinforcing the authenticity of “natural” positioning. Given its strong balance between efficacy and sustainability, the natural/organic claim segment is expected to maintain its leading role in shaping the future of the global cold-pressed fruit extracts market.

Rising Demand for Antioxidant/Repair Skincare Formulations

In 2025, antioxidant/repair products already account for 53.7% of the market share (USD 998 million), making this the single largest functional category. The driver behind this dominance is the increasing global concern over environmental stressors such as urban pollution and UV radiation, which accelerate skin aging.

Consumers are actively seeking products that not only hydrate but also repair oxidative damage, making pomegranate, acai, and citrus-based extracts highly valuable. The adoption is further amplified by dermatological endorsements and clinical claims that validate the efficacy of antioxidants in skin rejuvenation. This driver is not only expanding the premium skincare space but also encouraging mass-market players to include antioxidant-led formulations in their product lines.

Premiumization and Accelerated Growth in Asia-Pacific Markets

Markets such as India (23.6% CAGR), China (20.9% CAGR), and Japan (16.9% CAGR) are fueling a new wave of premium skincare adoption. Rising disposable incomes, rapid digital penetration, and aspirational lifestyles have shifted consumer preferences toward premium cold-pressed extracts marketed as natural, vegan, and clean-label.

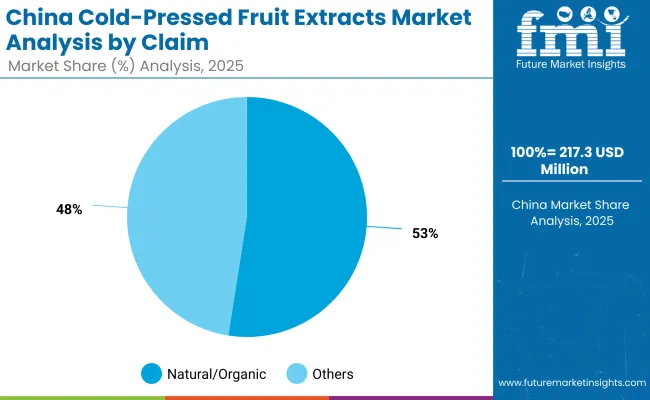

In China, for example, the natural/organic claim segment already represents 52.5% share in 2025, reflecting heightened awareness of product authenticity. This driver is particularly important because it demonstrates how emerging markets are not only consuming but reshaping global growth trajectories. Asia-Pacific is rapidly becoming the epicenter of clean-beauty innovation, forcing global players to tailor product portfolios specifically for younger, urban consumers.

High Cost of Cold-Processing Technology and Raw Materials

Cold-pressed extraction retains nutritional potency but is significantly more resource-intensive than conventional processing. Maintaining controlled temperatures, ensuring sustainability certifications, and sourcing exotic fruits such as sea buckthorn or acai contribute to higher production costs.

This elevates end-product prices, restricting accessibility in price-sensitive regions. While premium segments in Europe and Asia-Pacific can absorb the cost, emerging markets with limited consumer spending power face barriers to widespread adoption. The lack of large-scale economies of scale further intensifies this restraint, as small and mid-sized brands struggle to maintain profitability while adhering to “clean” and “cold-processed” claims.

Regulatory Challenges in Labeling and Standardization

The natural, organic, and clean-label claims are central to this market, but inconsistent regulatory frameworks across regions are creating trust deficits. For instance, Europe has stricter guidelines on organic certification compared to the USA, while Asian markets vary in enforcement. This inconsistency allows some brands to make broad or misleading claims, leading to consumer skepticism.

The absence of global harmonization in organic and clean beauty standards restrains brand credibility and complicates cross-border product launches. In the long term, companies will need to invest more in third-party certifications, compliance audits, and transparent sourcing documentation, which add cost and time burdens.

Surge in E-Commerce and Direct-to-Consumer (D2C) Channels

E-commerce is rapidly emerging as the most influential sales channel for cold-pressed fruit extracts. Digital-native brands are leveraging social commerce, influencer partnerships, and subscription models to expand reach.

Consumers increasingly prefer purchasing serums, oils, and masks directly from official websites or online marketplaces due to access to reviews, transparency in sourcing, and convenience of personalized recommendations. This trend is particularly visible in the USA and Asia-Pacific, where beauty platforms are integrating AI skin diagnostics and virtual try-ons, creating an experiential buying journey that builds consumer trust.

Cold-Processed and Vegan Claims Becoming Premium Differentiators

While natural/organic holds the largest share in 2025 at 52.5%, the emergence of vegan and cold-processed claims is transforming into a premium positioning strategy. Consumers are beginning to value “cold-processed” not only as a technical process but also as a symbol of product purity and authenticity.

Similarly, vegan-certified extracts appeal to ethically conscious consumers who prioritize cruelty-free and plant-based lifestyles. Together, these claims are reshaping competitive dynamics, with established players like Fresh and Juice Beauty emphasizing sustainability narratives while indie brands innovate with niche formulations that highlight lesser-known fruits like sea buckthorn or exotic berry blends.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.9% |

| USA | 9.1% |

| India | 23.6% |

| UK | 13.6% |

| Germany | 10.1% |

| Japan | 16.9% |

The Global Cold-Pressed Fruit Extracts Market is characterized by a stark contrast in growth rates across developed and emerging economies. India (23.6% CAGR) and China (20.9% CAGR) are expected to be the fastest-growing markets from 2025 to 2035, fueled by rising disposable incomes, urbanization, and increasing consumer awareness of clean-label and natural skincare solutions.

These countries are experiencing a rapid shift toward premium and organic formulations, particularly among younger demographics who value vegan and cold-processed claims. Japan (16.9% CAGR) also reflects strong momentum, supported by the country’s deep-rooted culture of skincare rituals, technological innovation in beauty, and growing demand for antioxidant-rich products like serums and oils. Together, these three Asian markets are reshaping the global demand curve, making Asia-Pacific the primary growth engine for this industry.

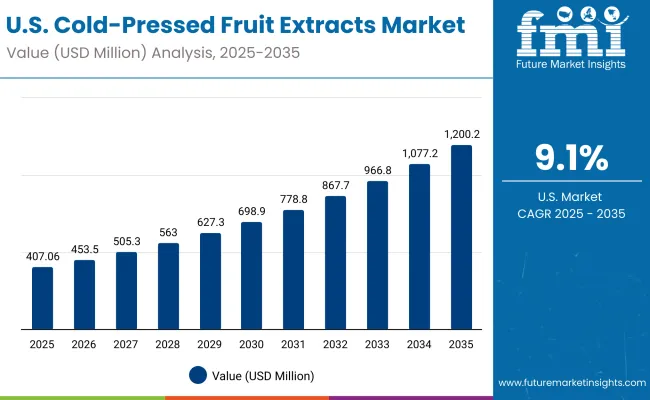

In contrast, growth in mature markets is relatively modest, though still stable and significant. The USA, the single-largest market by absolute size, is projected to grow at 9.1% CAGR, showing strong but steady expansion as antioxidant/repair formulations dominate and e-commerce channels become mainstream.

Germany (10.1% CAGR) and the UK (13.6% CAGR) represent Europe’s contribution, where clean-label, natural/organic claims are already well established. However, market saturation and higher regulatory barriers result in slower growth compared to Asia.

Despite these differences, Western markets remain critical for premium brand positioning and innovation, while Asia drives volume expansion and market acceleration. This divergence indicates that global players must balance steady demand in mature economies with aggressive growth opportunities in emerging Asian markets.

| Year | USA Cold-Pressed Fruit Extracts Market (USD Million) |

|---|---|

| 2025 | 407.06 |

| 2026 | 453.55 |

| 2027 | 505.34 |

| 2028 | 563.05 |

| 2029 | 627.35 |

| 2030 | 698.99 |

| 2031 | 778.81 |

| 2032 | 867.75 |

| 2033 | 966.85 |

| 2034 | 1,077.26 |

| 2035 | 1,200.28 |

The Cold-Pressed Fruit Extracts Market in the United States is projected to grow at a CAGR of 9.1%, led by strong demand for antioxidant/repair formulations which account for 53.7% of value in 2025 (USD 218.7 Million). Skincare consumers are prioritizing anti-aging, barrier repair, and hydration, creating consistent demand across premium and mid-range categories.

Serums remain the leading product type, while e-commerce and specialty organic beauty stores are driving accessibility. Clean-label and vegan positioning are critical in this market, where transparency and ethical sourcing influence purchasing decisions.

The Cold-Pressed Fruit Extracts Market in the UK is expected to grow at a CAGR of 13.6%, supported by strong consumer affinity for clean-label beauty. British consumers are highly responsive to natural/organic claims, with growing interest in fruit-based brightening and hydration solutions.

Premium brands dominate distribution through pharmacies, natural beauty retailers, and increasingly, online platforms. Regulatory oversight in the EU/UK region ensures higher standards of organic certification, which enhances consumer confidence and brand loyalty.

India is witnessing the fastest growth globally, with the Cold-Pressed Fruit Extracts Market forecast to expand at a CAGR of 23.6% through 2035. Rising middle-class spending, digital adoption of beauty platforms, and increasing consumer awareness of antioxidant and hydration benefits are fueling expansion.

Tier-2 and Tier-3 cities are becoming important markets as e-commerce penetration rises and affordable product launches reach a broader consumer base. Ayurvedic influences are blending with cold-pressed innovations, further boosting acceptance of natural skincare formulations.

The Cold-Pressed Fruit Extracts Market in China is expected to grow at a CAGR of 20.9%, among the highest globally. The market is driven by natural/organic claims, which already hold 52.5% of value share in 2025 (USD 114.1 Million).

Urban millennials and Gen Z are particularly attracted to vegan and cold-processed positioning, seeing them as hallmarks of premium skincare. Cross-border e-commerce, social commerce platforms, and local beauty-tech firms are accelerating product accessibility. Competitive domestic players are rapidly innovating with exotic fruit blends and affordable cold-processed options.

| USA by Function | Value Share % 2025 |

|---|---|

| Antioxidant/repair | 53.7% |

| Others | 46.3% |

The United States market is valued at USD 407.06 million in 2025, with antioxidant/repair leading at 53.7% (≈ USD 218.7 million). Dominance of repair-led formulations stems from high consumer focus on anti-aging, pollution defense, and barrier support, where cold-pressed pomegranate, citrus, and acai extracts deliver clinically resonant antioxidant benefits.

Strong dermatologist retail channels, robust e-commerce penetration, and preference for serums (the top product format globally) reinforce premium adoption. Portability of dropper formats, layering with retinoids/niacinamide, and compatibility with sensitive-skin routines further enhance uptake across age cohorts.

This advantage positions antioxidant/repair as the core opportunity space for line extensions (e.g., booster serums, treatment oils, repair masks) and clean-label/vegan claim stacking. Hydration and barrier-support SKUs broaden daily-use frequency, raising basket sizes on D2C and specialty-organic sites. As ingredient transparency and sustainability gain traction, verified cold-processed claims will command price premiums.

| China by Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 52.5% |

| Others | 47.5% |

The China market is valued at ~USD 217.33 million in 2025 (implied from natural/organic at USD 114.1 million = 52.5% share), with natural/organic claims leading consumer choice. Momentum is powered by urban millennial and Gen Z cohorts that equate vegan, clean-label, and cold-processed with premium safety and efficacy.

Social commerce ecosystems and cross-border platforms accelerate the discovery of serums and oils emphasizing antioxidant/brightening benefits from acai blends, pomegranate, and citrus. Local beauty-tech and indie naturals are innovating with exotic berry mixes and sea buckthorn to differentiate.

This claim leadership creates an outsized opportunity for certified organic lines, eco-sourcing storytelling, and skin-diagnostic-led personalization. As regulatory scrutiny on claims tightens, brands with auditable supply chains and third-party certifications will scale faster across T1-T3 cities.

| Company | Global Value Share 2025 |

|---|---|

| Fresh | 8.2% |

| Others | 91.8% |

The market is moderately to highly fragmented, with a long tail of clean beauty and indie naturals competing alongside established names. Fresh leads globally, while peers such as Kiehl’s, Korres, The Ordinary, Herbivore Botanicals, Juice Beauty, Tata Harper, Biossance, The Body Shop, and Drunk Elephant shape positioning around natural/organic, vegan, and cold-processed narratives.

Differentiation is shifting from simple ingredient lists to integrated ecosystems: verified sustainable sourcing, cold-processing transparency, and D2C personalization (AI skin diagnostics, subscription replenishment, routine builders).

Mid-sized innovators are scaling through serum-first roadmaps, clinically framed antioxidant claims (repair/brightening), and green packaging. Retail execution pairs e-commerce, specialty-organic beauty stores, and pharmacies to balance reach with credibility.

Winning playbooks emphasize certifications (organic/vegan), traceable supply chains, and content-rich education that links fruit source, extraction method, and skin outcome. As consumers demand proof, brands that combine lab-backed efficacy with authentic sustainability will capture premium share while the fragmented tail continues to drive experimentation and niche growth.

Key Developments in Global Cold-Pressed Fruit Extracts Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,902.4 million |

| Sources | Pomegranate; Acai/berry blends; Citrus; Sea buckthorn |

| Functions | Antioxidant/repair; Brightening; Barrier support; Hydration |

| Product Types | Serums; Oils; Creams/lotions; Masks |

| Channels | E-commerce; Natural/organic beauty stores; Pharmacies; Mass retail |

| Claims | Natural/organic; Vegan; Clean-label; Cold-processed |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fresh; Kiehl’s ; Korres ; The Ordinary; Herbivore Botanicals; Juice Beauty; Tata Harper; Biossance ; The Body Shop; Drunk Elephant |

| Additional Attributes | Global dollar sales by product type and function; adoption trends in antioxidant/repair, hydration, and brightening use-cases; rising demand for serums and oils; growth of clean-label, vegan, and cold-processed claims; channel splits across e-commerce, specialty natural stores, pharmacies, and mass retail; regional growth hotspots (China, India, Japan) vs. scale markets (USA, Western Europe); sourcing transparency and sustainability certifications; innovations in cold-press extraction and potency preservation; competitive fragmentation with long-tail indie naturals; price-premium dynamics for certified organic SKUs. |

The global market is estimated at USD 1,902.4 million in 2025.

The market is projected to reach USD 6,001.4 million by 2035.

It is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types are Serums, Oils, Creams/lotions, and Masks.

Antioxidant/repair, leading with 53.7% value share (≈ USD 998.0 million).

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Seed Waste Market

Fruit Kernel Products Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA