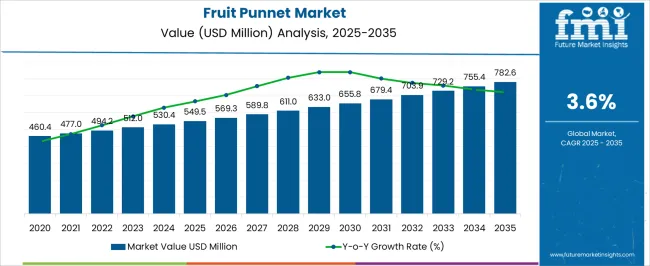

The Fruit Punnet Market is estimated to be valued at USD 549.5 million in 2025 and is projected to reach USD 782.6 million by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

The Fruit Punnet market is experiencing steady growth driven by the increasing demand for sustainable and convenient packaging solutions in the food and retail sectors. The market outlook is shaped by rising consumer awareness about eco-friendly packaging and the shift from plastic-based containers to paper-based alternatives. Growing preference for lightweight, recyclable, and biodegradable packaging has enhanced the adoption of paper punnets.

Additionally, the expansion of organized retail and supermarket chains is fueling the need for standardized packaging that ensures product protection, freshness, and easy handling. Investments in innovative packaging designs that improve shelf visibility and reduce food wastage are further supporting market growth.

The trend toward ready-to-use and pre-packaged fruits, especially in urban regions with busy lifestyles, is expected to continue driving demand Coupled with increasing export activities and stringent regulatory policies promoting sustainable materials, the Fruit Punnet market is projected to witness consistent expansion across both developed and emerging markets over the forecast period.

| Metric | Value |

|---|---|

| Fruit Punnet Market Estimated Value in (2025 E) | USD 549.5 million |

| Fruit Punnet Market Forecast Value in (2035 F) | USD 782.6 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

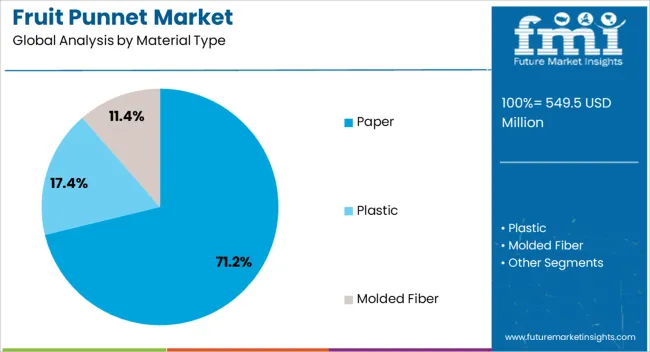

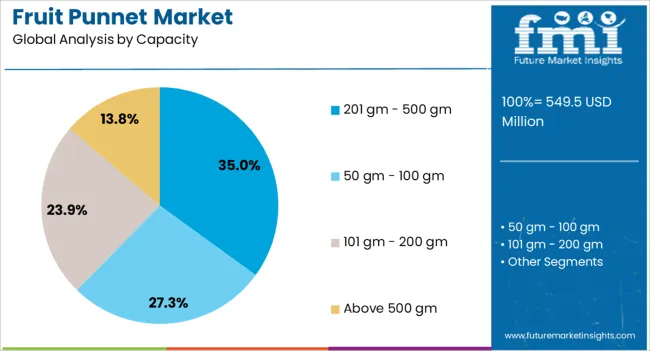

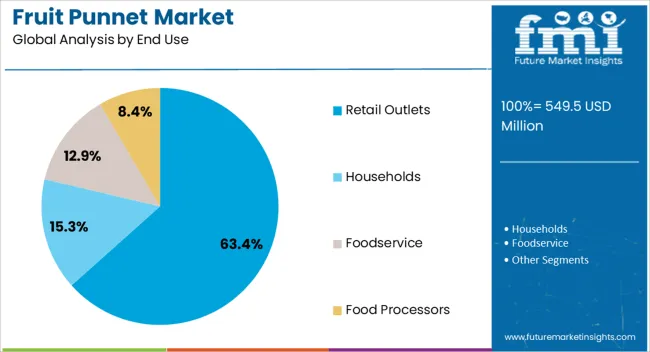

The market is segmented by Material Type, Capacity, and End Use and region. By Material Type, the market is divided into Paper, Plastic, and Molded Fiber. In terms of Capacity, the market is classified into 201 gm - 500 gm, 50 gm - 100 gm, 101 gm - 200 gm, and Above 500 gm. Based on End Use, the market is segmented into Retail Outlets, Households, Foodservice, and Food Processors. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper material type is projected to hold 71.20% of the Fruit Punnet market revenue share in 2025, making it the leading material segment. This dominance is attributed to the biodegradability, recyclability, and eco-friendly nature of paper, which aligns with increasing environmental concerns and government regulations on single-use plastics.

Paper punnets are also preferred for their lightweight structure and ability to provide adequate protection to fruits during transport and storage. The segment has benefited from innovations in coated and molded paper designs that enhance moisture resistance and durability while maintaining sustainability.

Furthermore, the cost-effectiveness of paper-based packaging compared to alternative materials has strengthened its adoption across large-scale retail chains and small businesses alike The widespread availability of paper packaging solutions and growing consumer preference for green packaging have solidified its position as the leading material type in the Fruit Punnet market.

The 201 gm - 500 gm capacity segment is expected to account for 35.00% of the Fruit Punnet market revenue share in 2025, establishing it as the leading capacity range. This segment’s growth is driven by the increasing demand for small to medium-sized fruit packs that cater to individual households and small families.

The portion size provides convenience, reduces wastage, and aligns with changing consumption patterns focused on health and portion control. Retailers and suppliers prefer this capacity as it balances cost-effectiveness and customer appeal, while maintaining freshness and protection during transportation.

The versatility of this range allows it to be used across a variety of fruit types, making it suitable for organized retail, grocery stores, and convenience outlets Rising urbanization, busy lifestyles, and demand for ready-to-eat packaged fruits are expected to sustain the growth of this capacity segment in the coming years.

The retail outlets end-use segment is anticipated to hold 63.40% of the Fruit Punnet market revenue in 2025, making it the leading end-use category. The segment’s prominence is driven by the expansion of supermarkets, hypermarkets, and organized retail chains that prefer standardized packaging solutions for efficient display and handling.

Retail outlets benefit from punnets that ensure product protection, maintain freshness, and enhance visual appeal, which directly impacts consumer purchasing behavior. Additionally, the adoption of paper punnets in retail settings aligns with sustainability initiatives, improving brand reputation and compliance with eco-friendly regulations.

The convenience offered to consumers in selecting pre-packaged fruits, combined with the growing preference for hygienic and ready-to-buy products, has reinforced the adoption of punnets in retail channels As retail infrastructure continues to expand globally, the commercial demand for packaged fruit solutions is expected to maintain a strong growth trajectory.

Sustainable Alternatives Replacing Plastic Fruit Punnets

Bans on plastic packaging solutions are being initiated across the globe. North American and European countries are also taking significant steps in this direction, reflected in their latest guidelines that restrict the use of plastic.

Further, the industry for environmentally friendly packaging is accelerating to fill the emerging demand for plastic alternatives. Players are thus developing smart, sustainable punnet packaging to meet consumer demand.

Smart Packaging Technology Gains Traction in the Market

Users are increasingly adopting smart packaging technology like RFID tags to monitor and track the quality as well as the freshness of fruits. Moreover, the preference for attractive and transparent punnets for display purposes, while offering convenience in storage and handling, is also increasing. This trend indicates a shift toward more visually appealing and technologically advanced packaging solutions in the fruit punnet

Europe to Witness Business Expansion Prospects for Fruits in Europe

Several countries export fruits and vegetables to countries in Europe due to growing demand for exotic fruits and vegetables in the region. This includes passion fruit, lychees, pitahaya, fresh lychees, and carambola. Imports of these exotic fruits into the region are expected to fuel demand for fruit punnets to ensure safety during transit.

Global fruit punnet sales rose at a CAGR of 3% from 2020 to 2025. Over the forecast period, the industry is projected to expand at a 3.6% CAGR. Demand for punnet packaging is linked to the expansion of the horticulture sector. Growing popularity of healthy snacking is also contributing to the demand for fruits, which are usually packed in punnets.

The use of fruit containers is increasing due to the growing demand for packaging solutions that reduce the chances of fruit damage during transit.

Supermarkets and grocery stores are significant end users of fruit containers, which they use to pack and sell individual portions of fruits like grapes, strawberries, or cherries. Their demand is also rising as they offer a protective and hygienic packaging option for the safety and convenience of the consumers.

The demand for reusable fruit punnet solutions is predicted to surge as consumers are becoming aware of their environmental impact. Surging demand for plastic punnet alternatives like fiber and paper punnets is also increasing as consumers become environmentally conscious. Growth in online sales of fruits on eCommerce websites is fueling the demand for fruit punnet packaging.

From the following table, the growth potential of key markets can be learned. Manufacturers are expected to find more expansion opportunities in China, India, and Thailand, than in the United States and the United Kingdom. Vast populations residing in Asian countries, fuel the demand for nourishing fruits. Thus, impacting the sales rate of packaging solutions like fruit punnet.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United States | 2.9% |

| The United Kingdom | 2.7% |

| China | 5.2% |

| India | 5.9% |

| Thailand | 4.8% |

The United Kingdom is projected to rise at a 2.7% CAGR through 2035. Sales of fruit punnets are expected to remain sluggish in the projected period, due to new alternatives emerging in the market. Less consumers to eat fruits, as opposed to the massive consumer population in Asian countries is also a key aspect behind this.

Many greener innovations, changing the composition of fruit punnets have marked the trends in the country. Recently, Asda, a popular supermarket in the United Kingdom, introduced a fully recyclable blueberry punnet and film lid. The brand later announced a trial on other fresh punnets, such as tomatoes and grapes.

The United States is projected to expand at a 2.9% CAGR over the estimated period. Stable revenues in the country are driven by the establishment of retail chains that sell fresh vegetables in see-through punnet solutions. Safe delivery of fruits is another propeller for the sales of fruit punnets.

Growing demand for 100% recyclable punnets, made from a renewable resource, is fueling the sales of biodegradable punnet packaging. Fruit containers are also being developed to meet the physical requirements of the supply chain so that the fruit comes in optimal condition. The solution is supplied stacked or flat to optimize storage space and reduce transport costs.

The demand for fruit punnets is increasing at an average of 5.9% over the forecast period. The expanding food and beverage industry is increasing the application of fruit punnets. Growing emphasis on packaged fruits and vegetables is predicted to fuel is also a key driver.

Players providing fruit containers in the country are now offering paper-based punnets, baskets, and trays as an alternative to plastic or polystyrene trays. Responsiveness of fruit punnet makers to the latest consumer concerns is the catalyst for this change.

The sales are also increasing as manufacturers develop high-quality printed punnets that can be customized with trending graphics and suitable colors to attract consumer attention.

The section below offers key insights into the top-performing segments in the fruit punnet market. Plastic material is projected to hold a dominant share of the fruit punnet market. The segment is estimated to gain 71.2% in 2025. Similarly, retail outlets acquire a massive value share of 63.4% in 2025.

| Segment | Plastic (Material) |

|---|---|

| Value Share (2025) | 71.2% |

Based on material, plastic is projected to be a leading contender in the global industry. Plastic holds 71.2% in 2025. Commonly used plastics in fruit punnets are polypropylene and PET.

They are effective in designing punnets. Plastic solutions offer a comprehensive choice of punnets for different sizes for medium, light, and heavy-duty use. They are being increasingly used to pack soft fruits and vegetables like berries, grapes, mushrooms, cherries, etc.

| Segment | Retail Outlet (End Use) |

|---|---|

| Value Share (2025) | 63.4% |

The retail outlet segment is expected to acquire a share of 63.4% in 2025. Retailers use punnets for branding and differentiating purposes. To increase their brand recognition, retailers employ personalized punnets with color schemes, logos, or distinctive designs, to draw in customers seeking certain brands or product options.

Key players in the fruit punnet industry are introducing high-quality full-color options for fruit punnets to increase their attractiveness among fruit vendors. Leading participants are introducing the latest technologies for brand modification, unparalleled logos, and marketing for their clients.

Players are further introducing innovations in biodegradable fruit punnets to gain resonance among eco-conscious consumers. New features like a unique snap lock function are also being introduced by manufacturers for easier handling and superior protection. Companies are consistently upgrading their product offerings to make them more effective and functional.

Participants gain more profits on the sales of premium fruit punnet packaging. As a result, they are focusing on design innovation in this product category to amplify their annual revenue and gain an edge over other contenders.

Industry Updates

Based on material type, the industry is divided into paper, plastic, and molded fiber.

By capacity, the market is segregated into 50 gm - 100 gm, 101 gm - 200 gm, 201 gm - 500 gm, and above 500 gm.

Different end uses of fruit containers are retail outlets, households, foodservice, and food processors.

The fruit punnets are sold across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global fruit punnet market is estimated to be valued at USD 549.5 million in 2025.

The market size for the fruit punnet market is projected to reach USD 782.6 million by 2035.

The fruit punnet market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in fruit punnet market are paper, plastic and molded fiber.

In terms of capacity, 201 gm - 500 gm segment to command 35.0% share in the fruit punnet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Punnet Market Analysis – Growth & Demand 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Kernel Products Market

Fruit Seed Waste Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA