The fruit beverages market is projected to grow from USD 50 billion in 2025 to USD 74 billion by 2035, expanding at a CAGR of 4.0% during the forecast period. The United States is expected to be the most lucrative market for fruit beverages, owing to its mature yet evolving demand for low-calorie, vitamin-enriched juices and blends.

Meanwhile, India is anticipated to register the fastest growth from 2025 to 2035, driven by rising disposable income, a shift toward healthier beverage choices, and expanding organized retail penetration across Tier 2 and Tier 3 cities.

The fruit beverages market is undergoing a steady transformation, with consumers increasingly shifting away from carbonated soft drinks toward natural, health-forward alternatives. Juice blends fortified with antioxidants, probiotics, and functional ingredients like turmeric or collagen are gaining popularity.

While premiumization and wellness-driven innovations continue to fuel growth in urban segments, rural and price-sensitive markets remain dominated by traditional, pulp-rich mango and mixed fruit variants.

However, growth is restrained by seasonal raw material availability, regulatory scrutiny around sugar content, and high packaging and cold chain costs. To address these challenges, manufacturers are investing in aseptic filling technology, cold-pressed processing, and no-added-sugar formulations that appeal to health-conscious consumers and align with clean label trends.

Looking ahead from 2025 to 2035, the fruit beverages marketis expected to evolve toward greater functional differentiation and sustainability. Demand for organic-certified, traceable, and plant-based beverages will accelerate, especially in Europe and East Asia.

Digital D2C models, recyclable PET packaging, and on-the-go mini formats are poised to redefine distribution and packaging strategies. Innovations in tropical and exotic fruit sourcing, AI-based flavor profiling, and gut-health claims will continue to influence new product development.

As a result, the market will likely witness gradual consolidation among Tier 1 beverage conglomerates and regional juice specialists seeking to diversify and scale in emerging economies.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 50 billion |

| Projected Value (2035F) | USD 74 billion |

| Value-based CAGR (2025-2035) | 4.00% |

The fruit beverages market is segmented by packaging into canned and fresh, non-carbonated drinks, and frozen juices; by distribution channel into hypermarkets/supermarkets, convenience stores, and online; by product type into 100% fruit juice, juice concentrates, fruit punch/blends, nectars, and fruit-based smoothies; by fruit type into citrus (orange, lemon, grapefruit), tropical (mango, pineapple, guava), berries (strawberry, blueberry, raspberry), apple, and mixed fruits; by category into organic and conventional; by consumer demographic into kids, adults, and elderly; by claim/positioning into no added sugar, fortified with vitamins/minerals, probiotic/functional, cold-pressed/natural, and low-calorie; and by region into North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, and the Middle East & Africa.

Within the fruit beverages market, packaging plays a critical role in product appeal, shelf stability, and distribution efficiency. Non-carbonated drinks, including tetra packs, PET bottles, and pouch-based juices, account for the largest market share and are expected to post the highest CAGR through 2035 due to rising demand for convenience, health-conscious choices, and longer shelf life.

Canned and fresh juices are popular in vending channels and institutional settings but face volume limitations due to higher costs and perishability. Frozen juices, although niche, maintain relevance in foodservice and institutional catering but are constrained by cold chain dependency and limited household adoption.

Overall, non-carbonated fruit beverages will dominate innovation and shelf presence as they align best with evolving urban consumer needs and global retail formats.

| Packaging Type | CAGR (2025 to 2035) |

|---|---|

| Non-Carbonated Drinks | 4.80% |

The distribution landscape of the fruit beverages market is evolving rapidly as consumer behavior shifts toward digital and convenience-driven purchases. Hypermarkets and supermarkets remain the dominant sales channel in 2025, benefiting from bulk purchasing trends, wide assortment, and in-store promotions.

Convenience stores play a significant role in driving impulse buys and single-serve pack sales, particularly in urban areas and developing markets. However, the online channel is projected to witness the fastest growth through 2035, fueled by rising eCommerce penetration, doorstep delivery models, and growing preference for subscription-based fruit juice services especially for premium, organic, or functional beverages.

As digital discovery, personalized recommendations, and quick reordering gain traction, online platforms will increasingly reshape how fruit beverages are marketed and consumed.

| Distribution Channel | CAGR (2025 to 2035) |

|---|---|

| Online | 5.60% |

The fruit beverages market offers a diverse range of product types catering to different consumer needs and consumption occasions. 100% fruit juices dominate current volume sales due to their clean-label positioning and long-established presence in retail.

Juice concentrates and fruit punch/blends remain popular in foodservice and family-oriented markets due to their affordability and flavor variety. Nectars, with their moderate fruit content and sweetened profiles, appeal to younger demographics in emerging economies.

However, fruit-based smoothies are projected to register the highest CAGR through 2035, driven by the demand for functional nutrition, satiety, and convenience in health-conscious urban consumers. Their ability to integrate superfruits, protein, probiotics, and fiber makes them a favored meal-replacement and wellness beverage.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Fruit-Based Smoothies | 6.20% |

Fruit selection plays a pivotal role in consumer preference and flavor innovation across the fruit beverages market. Citrus fruits, especially orange, remain a staple, accounting for a significant share of traditional juice consumption globally.

Apple-based beverages also maintain steady demand due to their year-round availability and broad appeal. Berry-based drinks, including strawberry and blueberry, are popular in blends and smoothies but tend to carry a premium price tag. However, tropical fruits such as mango, pineapple, and guava are projected to witness the fastest growth through 2035.

Their unique flavor profiles, growing global familiarity, and alignment with exotic, health-forward branding are pushing tropical fruit beverages to the forefront of product development, particularly in Asia-Pacific, Latin America, and increasingly, Western markets.

| Fruit Type | CAGR (2025 to 2035) |

|---|---|

| Tropical Fruits | 5.90% |

In the fruit beverages market, consumer preference is increasingly shaped by awareness of clean-label, ethical sourcing, and health credentials. Conventional fruit beverages continue to dominate due to their affordability, wide availability, and long-standing brand recognition.

However, organic fruit beverages are projected to experience the fastest growth through 2035. The surge in demand is driven by rising concerns over pesticide residues, demand for transparency, and expanding organic certification frameworks across the USA, EU, and parts of Asia.

As consumers become more ingredient-conscious, especially in premium and family segments, manufacturers are scaling up organic portfolios with cold-pressed, no-additive, and preservative-free claims that align with evolving wellness trends.

| Category | CAGR (2025 to 2035) |

|---|---|

| Organic | 6.50% |

The fruit beverages market serves a wide range of consumer demographics, each with unique consumption patterns and product preferences. In 2025, the adults segment holds the largest share, driven by health-conscious consumption of juices, fortified blends, and on-the-go smoothies as meal supplements or energy boosters.

The elderly population represents a niche but growing segment, particularly for low-sugar, fiber-rich, and immunity-supporting juices. However, the kids segment is projected to witness the fastest growth through 2035. Increasing parental focus on healthier drink alternatives to carbonated soft drinks, combined with school-based juice programs and the launch of fun, nutrient-enriched, single-serve packaging, are accelerating demand.

Brands are innovating with flavors, functional claims, and cartoon-branded packs to engage younger consumers.

| Consumer Segment | CAGR (2025 to 2035) |

|---|---|

| Kids | 6.10% |

In a competitive and health-aware environment, branding and positioning are key to differentiation in the fruit beverages market. No added sugar products continue to gain traction among diabetic and weight-conscious consumers, while vitamin- and mineral-fortified drinks are widely adopted across age groups for their perceived immune and energy benefits.

Cold-pressed/natural beverages appeal to premium consumers seeking unprocessed and fresh alternatives, and low-calorie options are growing steadily in calorie-conscious segments. However, probiotic and functional fruit beverages are expected to be the fastest-growing category through 2035, fueled by growing awareness around gut health, digestive wellness, and the microbiome.

As clinical validation around functional ingredients improves, brands are launching immunity-boosting and digestion-support drinks with fruit bases to cater to this demand surge.

| Positioning/Claim | CAGR (2025 to 2035) |

|---|---|

| Probiotic/Functional Drinks | 6.80% |

The United States remains a mature yet dynamic market for fruit beverages, with demand steadily shifting from conventional juices to organic, low-sugar, and functional formats.

Major beverage companies are innovating around clean-label claims and expanding their cold-pressed and fortified product lines. Additionally, the rise of D2C and subscription models for wellness beverages has created new pathways for consumer engagement.

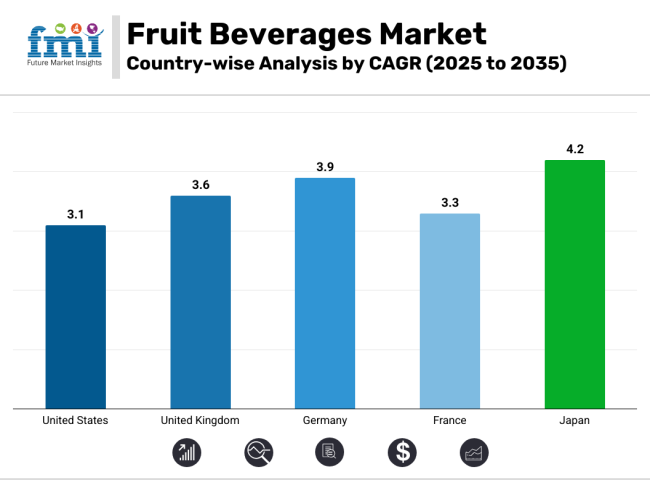

Despite saturation in traditional retail, health-centric positioning and convenience packaging are sustaining steady momentum. The USA. fruit beverages market is projected to expand at a CAGR of 3.1% between 2025 and 2035.

In the United Kingdom, evolving consumer expectations for health, sustainability, and transparency are driving notable shifts in the fruit beverages landscape.

The market is seeing strong uptake of no-added-sugar juices and plant-based smoothies, particularly among younger demographics. Local players are capitalizing on seasonal fruits and recyclable packaging formats, supported by favorable government policies promoting sugar reduction. The UK market is projected to grow at a CAGR of 3.6% during the forecast period.

Germany stands out as a key market in Europe with high consumer preference for organic, cold-pressed, and functional beverages. Demand is particularly strong for locally sourced fruit juices and probiotic-enriched blends that support digestive and immune health.

Strict labeling laws and eco-conscious consumers are pushing manufacturers to focus on sustainability and traceability. Germany’s fruit beverages market is forecast to grow at a CAGR of 3.9% from 2025 to 2035.

France is witnessing moderate yet stable demand for fruit beverages, led by premium juice blends and low-calorie options. Consumer loyalty to traditional flavors such as orange, apple, and mixed berries remains high, but niche categories like tropical blends and functional drinks are gaining ground.

Regulatory emphasis on sugar content and eco-friendly packaging is also influencing product innovation. France’s market is expected to grow at a CAGR of 3.3% over the next decade.

Japan’s fruit beverages market is being reshaped by aging demographics and heightened focus on health and convenience. Consumers are gravitating toward vitamin-fortified, low-sugar, and fiber-rich fruit drinks that align with preventive healthcare.

Convenience store penetration, compact packaging formats, and locally developed flavors are supporting consistent growth. Japan is expected to record a CAGR of 4.2% between 2025 and 2035.

| Attribute | Description |

|---|---|

| Market Name | Fruit Beverages Market |

| Base Year | 2024 |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Units | Value (USD Billion) |

| Segments Covered | By Packaging, Distribution Channel, Product Type, Fruit Type, Categor y, Consumer Demographic, Claim/ P ositoning |

| By Distribution Channel | Hypermarkets/Supermarkets, Convenience Stores, Online |

| By Product Type | 100% Fruit Juice, Juice Concentrates, Fruit Punch/Blends, Nectars, Fruit-Based Smoothies |

| By Fruit Type | Citrus, Tropical, Berries, Apple, Mixed Fruits |

| By Category | Organic, Conventional |

| By Consumer Demographic | Kids, Adults, Elderly |

| By Claim/Positioning | No Added Sugar, Fortified with Vitamins/Minerals, Probiotic/Functional, Cold-Pressed/Natural, Low-Calorie |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Italy, Spain, Japan, India, China, Brazil, South Korea, and more |

| Key Players Covered | PepsiCo Inc., The Coca-Cola Company, Nestlé S.A., Del Monte Foods, Dabur Ltd., Ocean Spray, Patanjali Ayurved, Parle Agro, Welch’s |

| Report Coverage | Market size (2025E & 2035F), CAGR (2025-2035), segment-wise analysis, country-level insights, competitive landscape, key trends |

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Kernel Products Market

Fruit Seed Waste Market

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA