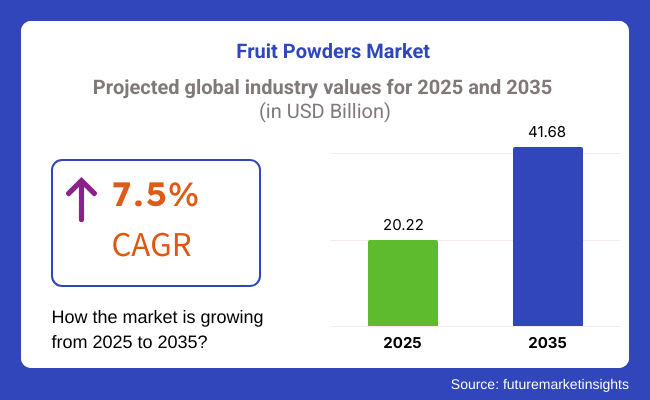

The global fruit powders market is predicted to increase from USD 20.22 billion in 2025 to USD 41.68 billion by 2035, at a compound annual growth rate of 7.5% during the forecast period.

Increasing consumer demand for natural, minimally processed ingredients is having a major impact on these market dynamics, and fruit powders are preferred as a natural substitute for synthetic flavoring agents and preservatives in the food and beverage industry.

Across industries as diverse as confectionery, snacks, dairy products, and nutraceuticals, manufacturers are ramping up production capabilities to meet surging demand for fruit powders. In the process of transforming fruits into fruit powder, firms are adopting advanced drying technologies like spray-drying and freeze-drying, which help the company achieve better nutrient retention and shelf life.

This position of fruit powders has been bolstered by their ability to deliver natural taste, color, and nutritional benefits without requiring artificial additives. The competitive dynamics are reshaping due to consumer demand for clean-label products.

Fruits have been quickly integrated into food and beverages and have become popular in the healthy food category, as health-conscious consumers are looking for fruit-based products without synthetic preservatives, which is expected to boost the demand for both organic and non-GMO fruit powders. Manufacturers are meeting demand with organic-certified fruit powders and partnerships with sustainable farming initiatives for ethical sourcing.

Some regional players are gaining momentum by selling local fruit powders that cater to Indigenous taste profiles and eating habits. Global manufacturers, however, are developing exotic fruit powder blends as well as functional formulations, as well as fortified variants that contain the addition of probiotics or collagen. Rising acceptance of fruit powders, especially in plant-based and vegan formulations, is further promoting market growth.

It is a crucial part of the competition with brands that highlight green packaging, waste in fruit processing, and cases of surplus or ugly fruit being used to make quality powders. Companies that invest in innovation, sustainability, and clean-label formulations will most likely continue to dominate the industry as consumer preferences change.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global fruit powders industry. This analysis highlights key shifts in performance and revenue realization patterns, offering stakeholders a clearer understanding of the growth trajectory.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.1% |

| H2 (2024 to 2034) | 7.5% |

| H1 (2025 to 2035) | 7.2% |

| H2 (2025 to 2035) | 7.7% |

The first half of the year, H1, spans from January to June, while the second half, H2, includes the months from July to December. During the first half of the decade (2025 to 2035), the industry is expected to grow at a CAGR of 7.1%, followed by an increase to 7.5% in the second half.

As the period progresses, the industry is projected to exhibit a CAGR of 7.2% in H1 and maintain a steady growth rate of 4.4% in H2. This growth pattern reflects an overall increase of 10 BPS in H1, while H2 records an additional 20 BPS, indicating a stable expansion of the industry.

| Segment | Value Share (2025) |

|---|---|

| Blueberry Powder (By Product Type) | 20% |

In terms of the powder produced from tropical fruits like mango in the paprika powder market, the global fruit powder market is divided into strawberry, blackberry, black currant, raspberry, blueberry, peach, apple, pear, apricot, plum, and others, where nutritional benefits and flavour preferences drive the flavour across food and beverages applications.

Blueberry powder now represents over 20% of the global market, driven by its superfood status. It is used in nutraceuticals, functional foods, and beverages, as it is rich in antioxidants, polyphenols, and vitamins C & K. Common applications include dietary supplements, smoothies, protein bars, health drinks, and baked goods.

These processes, freeze-drying, and spray-drying, help to preserve its nutrient profile and boost shelf stability. Demand is driven by North American and European markets, led by the clean-label and organic food movement. Top suppliers such as Kanegrade, FutureCeuticals, and NutraDry supply blueberry powder and offer organic and conventional versions.

The peach powder has started to gain a foothold as it is naturally sweet and nutrient-rich, and it provides vitamins A & C, fiber, and antioxidants to consumers' bodies for immunity and digestive health. This has fuelled its adoption in instant drink mixes, dairy alternatives, confectionery, and baby food.

Functional drinks and bakery products are becoming more popular in the southern market, including Asia-Pacific and Europe. The segment is primarily driven by players such as Paradise Fruits, BATA Food, Van Drunen Farms, etc., who are catering to "premium" peach powder. Freezing and spray-drying blueberry powder, like several others, helps to retain as much flavour and nutrients as possible, which makes it a popular product among health-savvy buyers.

| Segment | Value Share (2025) |

|---|---|

| Freeze-Dried Fruit Powder (By Processing Technology) | 35% |

Based on the processing technology, the global fruit powder market can be classified into (i) freeze-dried, (ii) spray-dried, (iii) vacuum-dried, and (iv) drum-dried. Freeze-drying dominates the market, contributing more than 35% to total sales, owing to its better nutrient retention and its application in premium products.

Freeze-drying is the method of choice for high-value applications (e.g., dietary supplements, baby food, functional beverages), as it retains up to 97% of nutrients, like vitamin C, polyphenols, and antioxidants. This process is often prevalent in health-oriented and clean-label markets, particularly popular in North America and Europe, where demand for organic and minimally modified components is soaring.

"To meet the rising demand," says the firm, "leading manufacturers including Paradise Fruits, Chaucer Foods, and European Freeze Dry are ramping up production, especially for superfruit powders like acai, goji, and elderberry."

An economical alternative is spray-drying, already widely used, for example, in mass-market products like instant beverages, confectionery, and dairy applications. However, the process subjects fruit to heat, so some heat-sensitive nutrients are lost. The bulk production of essential low-price segments is tilted heavily by businesses like Van Drunen Farms, Dohler, and Aarkay Food Products.

Freeze-dried offers a premium positioning appeal for organic products; however, spray-dried powder is used primarily in the food and beverage large-scale manufacturing process when it comes to large volumes, particularly in emerging markets such as Asia-Pacific, where the key focus is on cost optimization.

According to the fruit powders industry, which is going through an immense growth curve, the rise in demand for natural, plant-based ingredients by companies of all ilk has led to its expansion.

The food and beverage sector appears to be at the forefront of this trend, with fruit powders being used for flavor enhancement, natural coloring, and nutritional enrichment, and the demand for organic and clean-label products is high. These powders, typically consumed in functional foods and supplements, are popular in the nutraceutical sector, and vitamins and antioxidants are abundant in these foods.

Fruit powders are considered natural skin-care products and provide hydration and antioxidants, making them a valuable addition to cosmetics and personal care items. Home appliance settings, on the other hand, are experiencing a shift in consumer preferences as convenient and long-lasting fruit-based products for easy popularity in smoothies, baking, and meal prep among molders are now being rolled out in the form of powder products.

The innovations in the spray-drying and freeze-drying processes caused these fruit powders to become better products, with their quality, shelf life, and usability being mentioned, thus propelling sales further.

The fruit powders industry is facing different types of risks, such as price volatility of raw materials, disruptions in the supply chain, and regulatory challenges. Extreme climate change and irregular weather lead to variances in fruit harvests, resulting in scarcity and price hikes.

Another big problem is quality control. Contamination from pesticides and improper drying or storage conditions inevitably come with health problems and product recalls. This adds a level of compliance due to strict food safety regulations and certifications that must be met. Noncompliance may result in damage to a company's brand image and lawsuits.

And the volatility of consumer preferences and competition adds an extra level of risk. The demand for clean-label products and organic products is rising; hence, it will be necessary for the companies to accept change and offer only additive-free and organic natural powders. Otherwise, sooner or later, the share is going to be lost to competitors who innovate new products, such as functional and fortified fruit powders.

There are also logistics and distribution risks that affect steadiness. Industry instability is also due to product quality, which includes temperature-sensitive temperature and transportation, as well as product quality if the product sacrifices quality in order to supply big raw materials, and also depending on the global supply chain, such as trade restrictions or a rise in fuel costs, which can increase operating costs and reduce profit margins.

| Countries | CAGR (2020 to 2035) |

|---|---|

| The USA | 3.7% |

| Japan | 3.3% |

| China | 1.5% |

| Germany | 7.0% |

| Australia | 9.8% |

FMI is of the opinion that the USA industry is slated to grow at 3.7% CAGR during the study period. Growth is propelled by the demand for natural and convenient food, which is induced by consumers' increasing health awareness and a well-established food processing industry in the country.

Mass food producers add powders to soft beverages, baked goods, and dietary supplements to address the growing trend toward clean-label products. The trend toward plant-based eating and organic foods adds to the demand.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Health-conscious consumers | Customers opt for natural ingredients and shy away from artificial additives, thereby fueling demand. |

| Powerful food processing industry | The USA boasts a developed food sector and extensive use and innovation in fruit powder use. |

| Clean-label movement | Consumers favor less processed and labeled products, increasing the use of fruit powder. |

| Greater intake of functional foods | Companies utilize these powders in functional food items like energy drinks and health supplements. |

FMI is of the opinion that the Japanese industry is slated to grow at 3.3% CAGR during the study period. Consumers look for functional and health-oriented foods extensively, and thus, the market has incorporated these powders in health beverages, confectionery, and nutraceuticals.

Older people need easy and nutrient-dense foods, thereby driving the demand for these powders as the ideal ingredient. Japanese firms concentrate on product innovation, using rare powders in conventional sweets and drinks.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Functional food demand | Japanese consumers are looking for food with improved health benefits, thus increasing demand. |

| Demographic trend: aging population | Seniors are looking for convenient, healthy options and are increasing their consumption of these powders in supplements. |

| Product development innovation | Companies launch new uses of these powders in conventional and innovative foods. |

| High-quality food standards | Japan's rigorous food safety laws promote the use of high-quality powders. |

FMI is of the opinion that the Chinese industry is slated to grow at 1.5% CAGR during the study period. Urbanization and increasing disposable income have transformed food trends, with increased consumption of healthy and convenient foods.

There is a cultural practice of preferring the use of fruits for their health benefits and favoring the addition of fruit powder to functional foods and nutraceuticals. The growing consumer industry of the middle class and increasing demand for food safety also encourage more use of fruit powders in foods and beverages.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Urbanization and lifestyles | Urban residents need healthy and quick food, which increases the sales. |

| Impact of traditional medicine | Consumption of fruit for health is promoted by traditional Chinese medicine, thereby facilitating the consumption. |

| Emerging middle class | More people can afford to buy good-quality food products, which results in more demand for fruit powder. |

| Food safety awareness | More concern about the quality of food raises demand for good-quality, natural powders. |

FMI is of the opinion that the industry is slated to grow at 7.0% CAGR during the study period. German consumers are looking for organic and green products, and hence, the demand for natural powders is high.

Germany's industry for organic foods is highly developed and is enthusiastically involved in adding powders to snacks, drinks, and dietary supplements. Increasing veganism and plant-based lifestyles also favors growth.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| High demand for organic foods | German consumers favor naturally and sustainably processed powders. |

| Growing vegan and plant-based food | These powders are crucial in plant-based food innovation. |

| Food technology industry | Companies utilize new processing methods to improve the quality of these powders. |

| High expenditure by consumers on healthy foods | German consumers spend money on high-quality dietary supplements and natural foodstuffs. |

FMI is of the opinion that the Australian industry is slated to grow at 9.8% CAGR during the study period. Australia possesses a successful health and well-being sector, fueling robust demand for organic food products, smoothies, and supplements.

Demand is also spurred by consumers' active uptake of clean-label and plant-based options. Additionally, Australia's successful agribusiness sector guarantees a secure supply of quality, locally sourced powders.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Growth in the health and wellness market | Healthy food solutions are popular with consumers, supporting the sale of fruit powder. |

| Plant-based diet trend | Australians prefer plant-based and clean-label offerings, supporting industry growth. |

| Robust agricultural industry | Local production of quality fruits meets the domestic fruit powder market. |

| Growing premium food market | Consumers are looking for premium, organic, and functional food, which propels innovation in fruit powders. |

Kanegrade Ltd (15-18%)

The leading company produces very good fruit powders to make bespoke blends and organic products.

Döhler Group (12-16%)

Strong focus on naturalness and sustainability with varied applications in food and beverage.

Paradise Fruits (10-14%)

The innovator in freeze-dried fruit powders for over 20 years to cater to premium and functional food markets.

Chaucer Foods Ltd (8-12%)

Specialize in dehydrated fruit powders for bakery, snacks, and confectionery applications.

Saipro Biotech Pvt Ltd (7-10%)

Organic fruit powders, as a niche claiming their merit in the nutraceutical domain, are the prime focus, having optimized applications spreading with biotech interventions.

Other Key Players (35-45% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 20.22 billion |

| Projected Market Size (2035) | USD 41.68 billion |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion |

| By Product Type | Strawberry, Blackberry, Black Currant, Raspberry, Blueberry, Peach, Apple, Pear, Apricot, and Plum |

| By Nature | Organic and Conventional |

| By End Use | Fruit Processing, Beverage Processing, Dietary Supplements, Pharmaceuticals, Cosmetics and Personal Care |

| By Technology | Freeze Dried, Spray Dried, Vacuum Dried, and Drum Dried |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Kanegrade Ltd, Döhler Group, Paradise Fruits, Chaucer Foods Ltd, Saipro Biotech Pvt Ltd, Baobab Foods Inc., NutraDry, FutureCeuticals, Van Drunen Farms, and Milne MicroDried |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

The market is segmented into strawberry, blackberry, black currant, raspberry, blueberry, peach, apple, pear, apricot, and plum, with demand driven by nutritional benefits and flavor preferences.

The market is divided into organic and conventional fruit powders, with organic variants gaining traction due to rising consumer preference for chemical-free and sustainable products.

The fruit powders market is categorized into fruit processing, beverage processing, dietary supplements, pharmaceuticals, and cosmetics and personal care, with increasing applications in functional foods and wellness products.

The market includes freeze-dried, spray-dried, vacuum-dried, and drum-dried fruit powders, with freeze-drying leading due to its superior nutrient retention and premium product applications.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The global fruit powders market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by increasing demand for natural ingredients and functional food applications.

By 2035, the global fruit powders market is expected to reach a significant valuation, fueled by rising consumer preference for clean-label products and advanced processing technologies.

The freeze-dried fruit powder segment is anticipated to grow the fastest due to its superior nutrient retention, extended shelf life, and increasing use in dietary supplements, functional beverages, and premium food applications.

Key growth drivers include rising health awareness, increasing demand for natural and organic ingredients, expanding applications in nutraceuticals and cosmetics, and advancements in drying technologies that enhance product stability and nutrient content.

Some of the dominant players in the global fruit powders market include Kanegrade Ltd, Döhler Group, Paradise Fruits, Chaucer Foods Ltd, FutureCeuticals, and Milne MicroDried, focusing on innovation, sustainability, and expanding their product portfolios.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 10: Global Market Volume (MT) Forecast by Technology, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 18: North America Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 20: North America Market Volume (MT) Forecast by Technology, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 28: Latin America Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Technology, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 36: Europe Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 38: Europe Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 40: Europe Market Volume (MT) Forecast by Technology, 2017 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 48: East Asia Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Technology, 2017 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 58: South Asia Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Technology, 2017 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2017 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 68: Oceania Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Technology, 2017 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 72: MEA Market Volume (MT) Forecast by Country, 2017 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 74: MEA Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 76: MEA Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 78: MEA Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 80: MEA Market Volume (MT) Forecast by Technology, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 15: Global Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 19: Global Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 23: Global Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Nature, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Technology, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 45: North America Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 49: North America Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 53: North America Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Nature, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Technology, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 109: Europe Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 118: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 148: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 172: South Asia Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 173: South Asia Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Nature, 2023 to 2033

Figure 178: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Nature, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Nature, 2023 to 2033

Figure 208: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 217: MEA Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 221: MEA Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 225: MEA Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 228: MEA Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 229: MEA Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 233: MEA Market Volume (MT) Analysis by Technology, 2017 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 236: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 238: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 239: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Fruit Powders in EU Size and Share Forecast Outlook 2025 to 2035

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Kernel Products Market

Fruit Seed Waste Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA