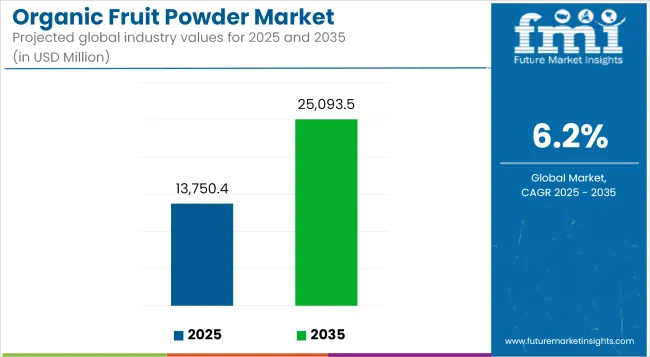

Between 2025 and 2035, the global market for organic fruit powder is expected to witness accelerated growth, increasing from USD 13,750.4 million to USD 25,093.5 million at a CAGR of 6.2%. The industry has been shaped by escalating consumer preferences for organic, natural, and additive-free ingredients in daily consumption. Organic fruit powders, widely perceived as a clean-label, shelf-stable alternative to fresh fruit, have gained popularity in both household and industrial formulations.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 13,750.4 million |

| Projected Value (2035F) | USD 25,093.5 million |

| Value-based CAGR (2025 to 2035) | 6.2% |

Market momentum has been sustained by shifting dietary patterns, increased demand for vegan and non-GMO ingredients, and growing awareness around micronutrient deficiencies. Brands have been seen adopting advanced drying technologies such as freeze-drying and vacuum-drying to preserve flavor and nutrient integrity.

However, volatility in organic raw material availability and higher price points compared to conventional alternatives have been observed as constraints for mass adoption, especially across emerging markets. An evident trend toward transparent labeling and traceable sourcing has further reinforced trust and preference among urban consumers.

Food and beverage manufacturers are gradually repositioning their product lines around clean-label claims, using organic fruit powders to achieve natural sweetness, color, and flavor. Meanwhile, functional applications in sports nutrition, infant formulations, and health-focused snacks are being prioritized to capture the premium segment.

In the coming decade, product innovation and cross-category formulation will likely reshape the competitive landscape. By 2025, banana, apple, and acai-based powders are expected to dominate due to their high adaptability across applications. By 2035, more exotic fruits like dragon fruit and baobab are projected to gain traction owing to their antioxidant content and unique appeal in premium segments.

The beverages category is anticipated to retain its dominance, supported by demand for instant health mixes, protein smoothies, and energy blends. With technology integration in processing and a rising preference for natural immunity-boosting ingredients, the market is poised to remain dynamic, with a consistent tilt toward functionality, purity, and sustainability.

The table below is a comparative analysis of the change in Cipher26 over the last six months, the base year (2024), and the current year (2025) for the global organic fruit powder market. Such an assessment is very important, as it brings to light key performance shifts and revenue realization trends, facilitating the stakeholders to easily track market growth. The first half (H1), which covers January to June, is followed by the second half (H2), which covers July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.9% |

| H2 (2024 to 2034) | 6.3% |

| H1 (2025 to 2035) | 6.0% |

| H2 (2025 to 2035) | 6.4% |

The first half (H1) of the period from 2025 to 2035 is projected to experience a 6.1% growth in CAGR, while the second half (H2) would record a slightly higher 6.3% growth. The projection of the CAGR will be kept at a stable increase in the time from the period of H1 2025 to H2 2035. The market experienced an increase of 10 BPS in H1, while H2 recorded a marginal increase of 10 BPS.

In 2025, blended organic fruit powders account for an estimated 14.3% of the market share. Their role is expanding as brands increasingly shift to multifunctional ingredient systems that deliver flavor, color, nutrition, and clean-label appeal in a single formulation. These blends often combine two or more fruit sources to create optimized nutrient profiles and tailored flavor experiences.

They have proven especially useful in high-growth categories such as functional beverages, dairy alternatives, and fortified snacks. Leading manufacturers like Nutradry and DMH Ingredients are developing proprietary fruit blends incorporating superfruits (e.g., acai, goji) with base powders (banana, apple) to balance cost and performance. According to USDA Organic certification data, such blends are compliant with clean-label norms and offer supply chain flexibility.

These formulations are favored in Asia-Pacific and North America for children's health beverages, probiotic-rich yogurts, and energy mix sachets. With rising demand for natural sugar substitutes and immunity boosters, blend-based solutions are being positioned as ideal for holistic nutrition.

Regulatory clarity around permitted ingredient combinations is expected to support further innovation. The functional value addition of these blends enables them to outperform single-origin powders in terms of application versatility and consumer acceptance, especially in premium-priced health-positioned offerings.

As of 2025, the cosmetics and personal care segment comprises nearly 7.8% of total market demand for organic fruit powders. This share, though smaller than food and beverage, is steadily rising due to the increasing application of fruit powders in face masks, scrubs, shampoos, and organic skin-care formulations.

Organic papaya, blueberry, and acerola powders are particularly favored for their antioxidant, brightening, and anti-inflammatory properties. The European Commission’s COSMOS standard supports the inclusion of fruit-derived bioactive powders in certified natural cosmetics, encouraging R&D across bio-based ingredient portfolios.

Brands such as Naissance and NOW Foods have expanded their personal care SKUs using organic powders, enhancing product narratives around sustainability and skin safety. The shift away from synthetic exfoliants and chemical actives has driven demand for such powders in rinse-off and leave-on products. Furthermore, innovations in fine-milling and encapsulation technologies have improved solubility and shelf life for topical use.

While the segment faces formulation challenges due to particle size and pH sensitivity, the growing consumer preference for natural and edible-grade cosmetic ingredients is expected to push adoption. This segment is poised to witness strong CAGR growth across Western Europe and East Asia, aligning with holistic beauty trends.

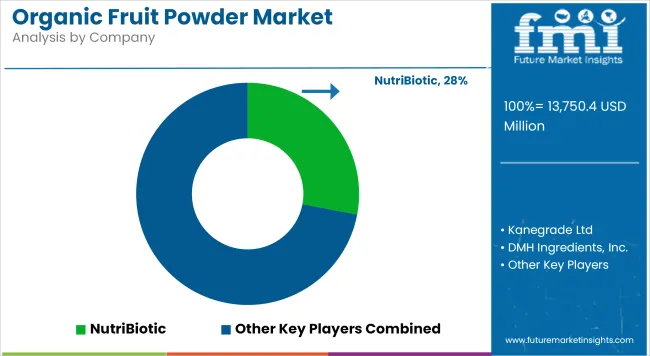

The global organic fruit powder market structure stays moderately fragmented, where regional players play in most of the shares, partnering up with both multinational corporations (MNCs) and Chinese manufacturers. While MNCs are leading in the premium product categories and managing large-scale B2B supply chains, regional players have managed to capture sustained different market segments via local sourcing, customization, and affordable production.

Regional manufacturers are an integral part of the organic fruit powder market, particularly in North America, Europe, and Latin America. These companies, in particular, work with community organic farms, thus assuring a constancy of the supply chain, while they at the same time promote the idea of farm-to-table. In key markets such as Germany, France, and the United States, regional brands focus on clean-label and functional blends, which are more and more backed by the consumer desire for organic, traceable ingredients.

The growth of organic fruit powder through fermentation, said the Chinese manufacturers who play a prominent role in the freeze-dried and spray-dried product categories. These companies are benefitting from economies of scale and thus can position themselves as bulk suppliers of the goods.

Unfortunately, the situation is made difficult for them because of the pesticide residues and organic certification-related issues, which have moved many international buyers to prefer suppliers that deal with them more strictly, chiefly coming from North America and Europe.

The MNC presence increases competition and improves the sector as they bring new technology into processing and product formulation. The MNCs are heavy spenders on innovations like new drying processes aimed at product nutrient retention and solubility improvement, targeting the food and beverage companies globally.

Nevertheless, regional players remain in the game by providing localized formulations, flexible packaging, and DTC distribution tactics, which keep them relevant in the ever-changing organic fruit powder market.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Population (millions) | 3,742.9 |

| Estimated Per Capita Spending (USD) | 6.0% |

| Country | Germany |

|---|---|

| Population (millions) | 1,526.3 |

| Estimated Per Capita Spending (USD) | 5.8% |

| Country | China |

|---|---|

| Population (millions) | 1,215 |

| Estimated Per Capita Spending (USD) | 6.5% |

| Country | Japan |

|---|---|

| Population (millions) | 953 |

| Estimated Per Capita Spending (USD) | 3.7% |

| Country | India |

|---|---|

| Population (millions) | 754 |

| Estimated Per Capita Spending (USD) | 6.0% |

In 2025, the United States is set to keep its top position in the world organic fruit powder market with an estimated market volume of USD 3,742.9 million. This success is attributed to newly adopted health and wellness products being prioritized by a strong consumer base. Natural and additive-free food is a dream that most health-oriented individuals have, which is also the reason for the increased demand for organic fruit powders.

The supply chain in the USA is established and works well, which is one of the reasons for the high-quality products that are delivered to the customers quickly and efficiently. Furthermore, the presence of main players in the market through their product innovations continuously is responsible for market growth. The clean-label products trend and the use of organic fruit powders in functional foods and drinks will push the market forward in the coming years.

Germany is supposed to account for a decent portion of the European organic fruit powder market, with a volume of around USD 1,526.3 million in 2025. The strong competitiveness of the country in the market is a result of the increased consumer shift toward organic, natural foodstuff. More and more German citizens are committed to health and environmental issues, which, in turn, has caused a great deal of demand for organic fruit powders.

Nevertheless, the market gets additional support from the required quality standards and certifications, which, in turn, increase customer trust and sales. Above this, due to its favourable geographic position in Europe, Germany can also offer efficient distribution channels throughout the continent and maintain its strong market share.

China has become the country with the fastest-growing fruit powder market, anticipating USD 1,215 million in sales by the year 2025. The growth of this market is largely attributed to the increasing health awareness among Chinese people, which, in turn, has resulted in the demand for more natural and organic food. The increase of the middle class with better purchasing power is also a factor in the purchase of high-quality goods such as organic fruit powders.

The domestic producers are now using flexible formulas and advanced production methods to produce goods for local and foreign markets and, at the same time, apply for international certifications. The internet of retail is one of the main distribution channels that assist people in accessing online organic fruit powders through e-commerce platforms.

The organic fruit powder market is booming due to the increasing consumer demand for natural and clean-label foods. The pressure is growing and is forcing businesses to compete, such as as Northwest Wild Foods, Wildly Organic, Saipro Biotech, NutraDry, and KAREN'S NATURALS. Enterprises are emphasizing product development, scaling up production, and engaging in strategic partnerships to bolster their market shares.

The global organic fruit powder market is projected to expand at a CAGR of 6.2% from 2025 to 2035.

By 2035, the global organic fruit powder market is estimated to reach approximately USD 25,093.5 million.

The freeze-dried organic fruit powder segment is expected to grow the fastest due to superior nutrient retention, extended shelf life, and increasing application in functional foods and beverages.

Rising consumer preference for clean-label and natural ingredients, increasing demand for functional foods, expanding applications in nutraceuticals, and advancements in drying technologies are key growth drivers.

Some of the leading players in the market include Kanegrade, European Freeze Dry, NutraDry, Saipro Biotech, Van Drunen Farms, and KAREN'S NATURALS.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Organic Tea Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA