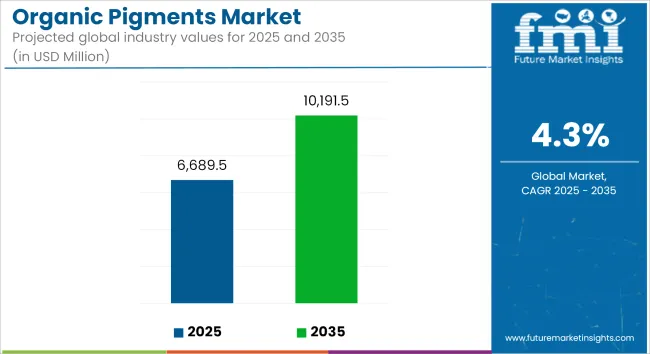

The global organic pigments market is estimated to be valued at USD 6,689.51 million in 2025 and is forecast to grow to USD 10,191.49 million by 2035, advancing at a CAGR of 4.3% during the forecast period. Growth is primarily driven by increasing demand for sustainable and eco-friendly colorants in paints & coatings, printing inks, textiles, and plastics across Europe and Asia-Pacific. Regulatory pressures and rising consumer preference for low-VOC, heavy-metal-free pigments are accelerating the adoption of organic alternatives.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 6,689.51 million |

| Projected Market Size in 2035 | USD 10,191.49 million |

| CAGR (2025 to 2035) | 4.3% |

The global organic pigments market is experiencing consistent demand growth due to tightening environmental regulations, particularly in the European Union and North America. Agencies such as the European Chemicals Agency (ECHA) and the USA Environmental Protection Agency (EPA) have placed restrictions on heavy metals and VOC emissions, prompting manufacturers to shift toward organic pigments that comply with REACH and other regulatory standards. These pigments do not contain heavy metals such as lead, chromium, or cadmium, which are found in many inorganic colorants, making them preferable in regulated industries such as packaging and consumer goods.

In the packaging sector, demand for organic pigments is supported by increasing use of eco-certified printing inks. For instance, food packaging manufacturers in the EU must meet specific colorant migration limits to ensure safety for human contact. Organic pigments used in water-based inks provide the necessary color stability while meeting these thresholds. Major printing companies like HP and Epson have adopted organic pigment-based ink technologies to meet regulatory and sustainability goals, especially in digital textile printing and personalized packaging.

In the construction and automotive industries, manufacturers are integrating organic pigments into architectural coatings and vehicle paints due to regulatory pressures to reduce emissions during application. These coatings also meet indoor air quality certifications such as LEED and GREENGUARD, required in commercial and residential projects in North America and parts of Europe. While inorganic pigments such as titanium dioxide offer high opacity, they fall short in compliance with emerging green chemistry frameworks when compared to organic alternatives.

Asia-Pacific markets, particularly China and India, are witnessing accelerated adoption due to rapid infrastructure development, growing middle-class demand for printed packaging, and government-led sustainability campaigns. For example, India’s Bureau of Indian Standards (BIS) has revised norms encouraging use of lead-free pigments in decorative paints. Similarly, China’s Ministry of Ecology and Environment is promoting low-VOC coatings in urban development projects.

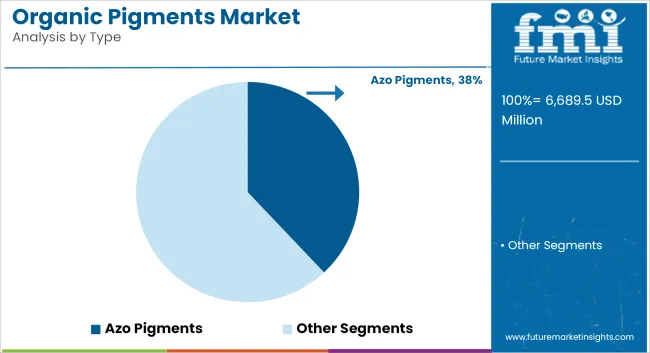

Azo pigments are projected to account for 38% of the global organic pigments market in 2025, and are forecast to expand at a CAGR of 4.5% through 2035. These pigments are widely valued for their bright, high-tint strength shades ranging from yellow to red, making them ideal for use in paints, coatings, plastics, and printing inks.

Their cost-effectiveness and strong lightfastness have made them the most commercially viable class of organic pigments. With growing regulatory restrictions on heavy metal-based colorants, demand for azo pigments is accelerating in packaging, decorative paints, and textile printing.

Technological improvements in pigment dispersion and surface treatment have enhanced their stability, weather resistance, and application across water-based and solvent-based systems. The ability to tailor color shades and comply with stringent environmental standards, particularly in Europe and North America, further strengthens the segment’s long-term outlook. Their versatility ensures continued preference in both industrial and consumer product manufacturing.

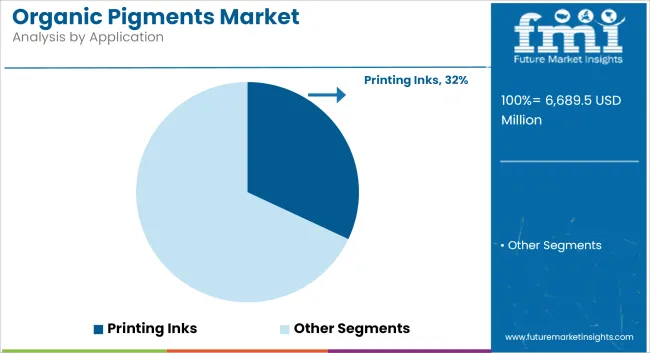

Printing inks are expected to hold 32% of the global organic pigments market in 2025, growing at a CAGR of 4.8% through 2035. This dominance is driven by increasing demand for vibrant, eco-friendly inks in packaging, publication, textiles, and labels. Organic pigments offer excellent dispersion, gloss retention, and heat resistance, making them ideal for offset, flexographic, gravure, and digital ink formulations.

With rapid expansion in e-commerce and sustainable packaging across food, beverage, and personal care sectors, pigment usage in high-resolution, low-VOC inks is increasing. Government regulations promoting low-toxicity printing materials-especially in food-contact packaging-further support the shift toward organic pigments.

Additionally, advancements in inkjet technology and water-based systems are pushing demand for pigments with enhanced flow, color strength, and compatibility with bio-based solvents. Asia-Pacific remains the leading region for printing ink consumption due to high-volume commercial printing, while Europe leads in regulatory-driven sustainable ink adoption, further reinforcing this segment's growth.

Volatile Raw Material Prices

Organic pigments depend on petrochemical derivatives and natural raw materials, both of which experience high volatility in their prices. When costs fluctuate, that can make it challenging to keep profit margins stable. Additionally, disruptions in the supply chain contribute to pricing volatility, prompting manufacturers to explore alternative sourcing strategies.

Stringent Environmental Regulations

With the global awareness of environmental safety further highlighting, stringent regulations about the production and disposal of organic pigments have been stipulated. Meeting REACH, EPA, and similar regimes involves prohibitively expensive reformulations and investments in clean manufacturing technologies. These evolving environmental standards can be particularly challenging for smaller players to meet.

Rising Demand for Eco-Friendly Pigments

Increasing consumer awareness regarding sustainability and eco-friendly pigments and non-toxic pigments is boosting industries. Eco-Friendly Inks and Substrates Water-based inks, biodegradable coatings and natural fabric dyes are now the norm, opening the door for manufacturers to innovate and align with the green economy. Eco-compliance certifications are also enhancing brand value.

Expansion in Emerging Markets

Increased demand for paints, coatings, plastics, and printing inks walking key users of organic pigments is driven by fast industrialization and urbanization in countries of Asia-pacific, Latin America, and Africa. Localized production facilities and strategic partnerships in these areas give businesses access to high-growth markets with lower operational expenses.

In the United States, the organic pigments market is recovering at a steady growth, supported by the development of paints, coatings, and printing ink industries. The rising demand for green and sustainable colorants is driving manufacturers to invent new and introduce bio-based pigments.

In addition, the growth of building and the development of packaging solutions are accelerating the usages of pigments. There is also an upward trend in the USA towards pigments that are non-toxic and free from heavy metals, further maintaining its market share in the world of organic pigments.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

According to the UK organic pigments market analyzers, as industries transition to sustainable practices in production along with stringent regulation standards for products to make a green revolution. The high-performance organic pigments are consumed chiefly in the country's packaging, automotive, and architectural coatings industries, which are experiencing great growth.

In addition, rising consumer demand for eco-labeling and green certifications have urged businesses to switch towards the organic pigment alternative. Over the forecast period, investments to improve pigment durability, light fastness, and versatility are expected to drive more growth in the UK

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The vast European Union cosmetics market is also driving growth of the organic pigments market owing to environmental regulations that have banned heavy metal-based pigments. Sustainable pigment alternatives of Argentine bio technology industries are gaining greater acceptance in Germany, France, Italy and Spain.

The growing use of pigments in various applications, a rising demand for pigments from the automotive coatings sector in Europe, plastics and textiles sectors are also contributing to the demand for pigments. Growing investments in bio-derived pigment manufacturing and green technologies are also bolstering the stronghold of the region on the global market, and thus making it a significant contributor.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

Japan accounted a consistent share for organic pigments market, owing to the advanced manufacturing sectors in the country such as electronics, automotive coatings and specialty printing. Japanese-making aspects prioritize a high purity degree, durability, and environmental harmony for several high-tech applications.

Furthermore, the land's sustainability initiatives and reduced carbon footprint targets are driving pigment producers to adopt eco-friendly production processes. The chemical industry modernization initiatives being strengthened by the Japanese government are also positively impacting the organic pigments market outlook in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Some of the key factors during the forecast period identified in South Korea organic pigments market are increase in industrialization, strong electronics manufacturing base and increasing demand from construction and packaging. Key drivers are rising investments for eco-friendly product development and an increase in urban infrastructure projects.

With support from the government related to green manufacturing initiatives and a rise in the popularity of customized pigments for digital printing, the market has been witnessing new traction. A bastion of pigment production is developing in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

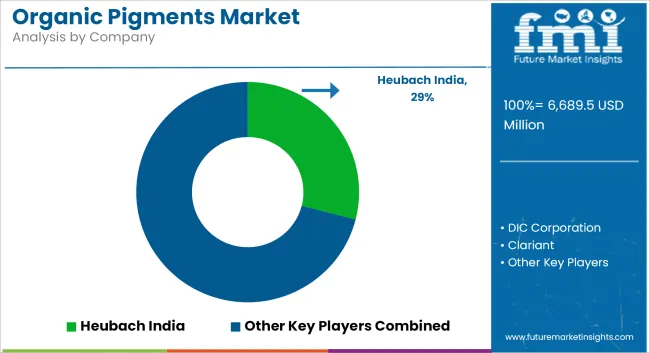

The organic pigments market is moderately fragmented, with key players such as DIC Corporation, Clariant AG, Heubach Group, and Sudarshan Chemical Industries Ltd. leading global supply. These companies are focusing on expanding their environmentally compliant pigment portfolios in response to REACH and FDA regulations, particularly in the EU and North America.

R&D investments are concentrated on high-performance pigments suitable for packaging, automotive coatings, and textile applications, with an emphasis on improved lightfastness and dispersion stability.

Strategic mergers-such as the recent Heubach and Clariant pigment business integration-are reshaping the competitive landscape by combining technology and geographic reach. Asian manufacturers, particularly in India and China, are scaling up production to serve both domestic demand and global exports, offering cost-competitive solutions that meet rising quality standards. Sustainability, recyclability in packaging, and compliance with eco-labels such as Blue Angel and Nordic Swan are increasingly central to competitive positioning and product development.

The overall market size for organic pigments market was USD 6,689.51 million in 2025.

The organic pigments market expected to reach USD 10,191.49 million in 2035.

Rising demand for eco-friendly colorants, growth in packaging and textile industries, and strict environmental regulations will drive demand.

The top 5 countries which drives the development of cargo bike tire market are USA, UK, Europe Union, Japan and South Korea.

Synthetic source segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA